Looking for an MT4 expert advisor that isn’t just another “RSI cross + hope” script? AGI X2 EA V1.0 MT4 blends two complementary engines—an adaptive trend model and a mean-reversion filter—to hunt higher-quality entries in both steady trends and pullback phases. It’s built to be practical: strict risk controls, session awareness, spread/latency gates, and clean presets you can tweak in minutes. No forced martingale. No grid spam. Just rules.

Below you’ll get the full rundown: what AGI X2 does, how it thinks, recommended pairs & timeframes, install steps, backtest workflow, prop-friendly settings, common pitfalls, and a boxed-up metadata set you can paste straight into your CMS.

What Is AGI X2 EA V1.0 MT4? (Overview)

- X-Trend module — finds directional bias using multi-TF momentum + structure checks (avoids counter-trend chop).

- X-Revert module — waits for stretched moves to mean-revert into the trend or fade short-term extremes when the data say the odds are better.

These modules vote. If both agree, entries are allowed; if they conflict, the EA stands down. That’s the whole point: fewer, better trades that respect the market’s current regime rather than yesterday’s.

Who it’s for: traders who want a composed, rules-driven MT4 EA that you can run during London/NY sessions, pass prop evaluations with, and scale without drama.

Key Features (At a Glance)

- Dual-Engine Logic (X-Trend + X-Revert): Trades only when directional bias and reversion context align.

- Session Awareness: Limit entries to London, NY, or your custom windows to avoid dead zones.

- Strict Risk Controls: Fixed lot or %-risk per trade, ATR-aware stops, and realistic R targets.

- No Forced Martingale/Grid: Averaging is off by default; you can enable capped safety adds if you insist.

- Spread/Slippage Gate: Sits out when costs are “too expensive” (rollover spikes, major news bursts).

- Breakeven & Partial Close: Bank early gains, reduce tail risk on slow follow-throughs.

- Equity Protection: Daily loss guard & global DD cut-off (prop-friendly).

- Magic Number Isolation: Safely run multiple pairs/timeframes from a single account.

- Clean Comments & Logs: Clear audit trail for journaling and prop reviews.

- Preset Packs (.set): Ready to load for Scalper (M5/M15), Intraday (M15/M30), Swing (H1).

Supported Pairs, Timeframes & Capital

Pairs (start here): EURUSD, GBPUSD, USDJPY. Once stable, add XAUUSD (Gold) on H1 with conservative risk.

Timeframes:

- Scalper: M5/M15 (requires tight spreads & low latency)

- Intraday: M15/M30 (balanced frequency vs cost)

- Swing: H1 (fewer, cleaner signals; less execution stress)

Minimum / Recommended Deposit:

- Minimum: ~$100 (a cent account is handy while learning)

- Comfortable start: $300–$500+

Leverage: 1:200 or higher is fine—always size the risk, not the dream.

Environment: ECN broker with tight spreads & transparent commissions. For scalping, a VPS with <20ms latency is ideal.

How AGI X2 “Thinks” (Plain English)

- Session & Cost Check: Only within your trading window and only if spread/slippage are acceptable.

- Bias: X-Trend scans higher-TF structure + momentum to avoid fighting dominant direction.

- Opportunity: X-Revert measures distance from fair value (ATR/volatility context) to spot quality pullbacks or fading edges.

- Trigger: A simple price-action confirmation with volatility buffers—no micro-noise, fewer fakeouts.

- Risk & Targets: ATR-aware stops, fixed-R targets or a modest trailing for trends that run.

- Management: Breakeven and optional partials after defined progress.

- Account Safety: Equity guard halts new entries when your line in the sand is reached.

Installation & First-Run Setup

- Copy the EA: Put

AGI_X2_EA_V1.0.ex4into MQL4/Experts. - Restart MT4 / Refresh: Right-click Experts → Refresh (or restart MT4).

- Enable AutoTrading: Ensure the green “AutoTrading” button is on.

- Attach to Chart: Start with EURUSD M15 (Intraday) or M5 (Scalper) or H1 (Swing).

- Load a Preset:

AGI_X2_Scalp_M15.set,AGI_X2_Intraday_M15.set, orAGI_X2_Swing_H1.set(if provided).

Risk Settings:

- Risk % per trade: begin at 0.5%–1.0%.

- Fixed lot: ~0.01 per $200–$300 equity for scalping.

- Session Hours: Choose London/NY or your custom window; avoid 5–10 mins around rollover.

- Filters: Keep spread/slippage gates strict; loosen only if your broker is consistently clean.

- Magic Numbers: Unique per chart/pair to avoid conflicts.

- VPS: For scalping, deploy on a VPS close to your broker.

Prop-Firm-Friendly Baselines

- Daily loss guard (EA): 3%–4% (keep under most firms’ 5% daily).

- Risk per trade: 0.5%–0.8% during scalping windows.

- Max concurrent trades: Start with 1–2 to reduce correlation shocks.

- News Windows: Pause new entries 15–30 minutes pre/post top-tier releases (CPI, NFP, FOMC).

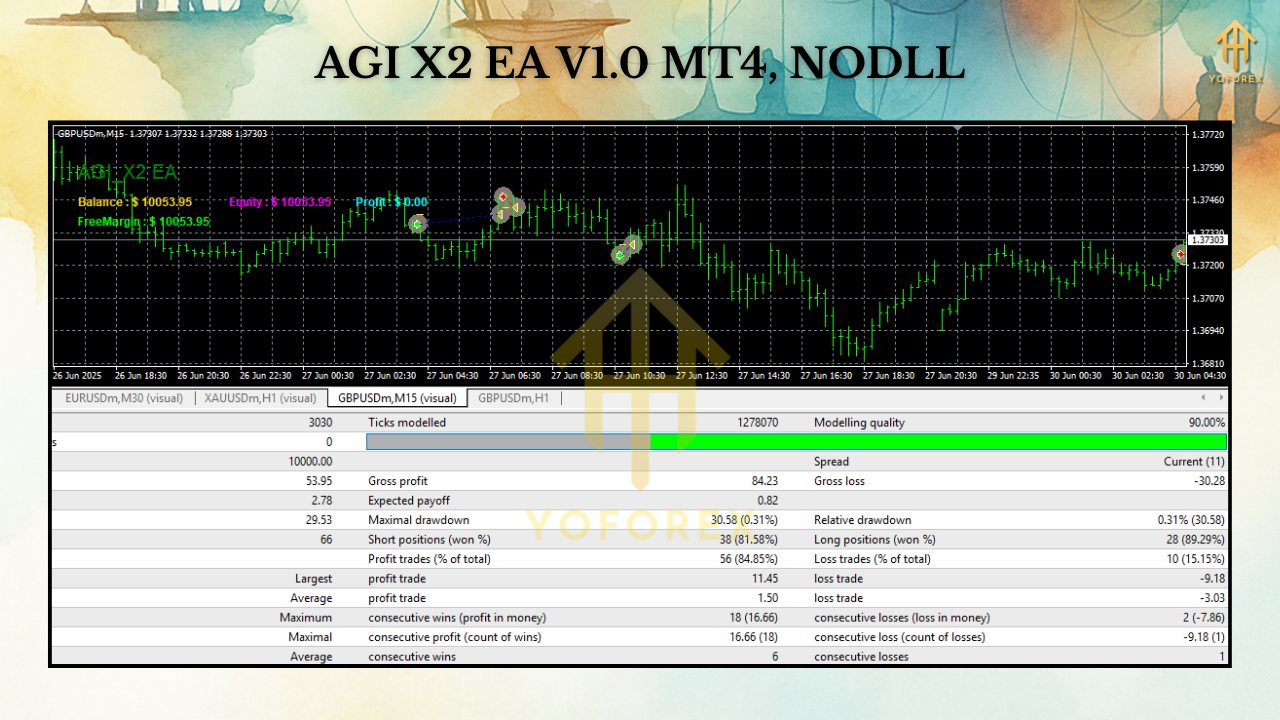

Backtest & Forward-Test Workflow

Backtest right or don’t bother:

- Data: Tick data with variable spread + realistic commissions.

- Period: 12–24 months spanning both trends and messy ranges.

- Session Match: Test the exact session(s) you’ll trade live.

- Risk Constant: Fix 1% per trade to compare pairs & timeframes fairly.

- Costs Honest: Use your broker’s typical spread & commission; don’t sugarcoat.

Metrics to watch:

- Max Drawdown (relative) and consecutive losses (psychology check).

- Profit Factor > 1.3 on realistic costs is a workable baseline.

- Expectancy/trade and time in market (lower exposure often = less tail risk).

- Robustness: Nudge stops/targets; robust logic shouldn’t implode on small tweaks.

Forward test 2–3 weeks on micro lots or a small live account to confirm live spreads/slippage. If live costs degrade results, tighten gates or shift to Intraday/Swing.

Troubleshooting (Quick Wins)

- “No trades today?” Check session window, spread/vol filters, and volatility regime; skipping bad conditions is a feature.

- “Lots of scratches?” Delay BE activation or use partial TP; widen stop modestly if justified.

- “News whipsaws?” Expand pre/post-news pause for scalper templates.

- “Conflicts between EAs?” Use unique Magic Numbers and, if needed, comment filters.

- “Daily guard hit?” Lower per-trade risk and reduce concurrent exposure.

FAQ

Does AGI X2 use martingale or grid?

No by default. Any averaging is optional and strictly capped—most users keep it off.

Does it work on Gold?

Yes—prefer H1 Swing with wider stops and conservative risk. Test first.

VPS necessary?

Highly recommended for scalping; still helpful for stability on intraday/swing.

Plug-and-play?

Presets make it close, but broker conditions vary. Backtest → forward-test → scale.

Risk Disclaimer

Trading Forex/CFDs involves substantial risk. Past performance is not a guarantee of future results. Only trade capital you can afford to lose. Always validate settings on demo or a small live account first.

Call to Action

Ready to move from guessy entries to a calmer, data-driven flow? Download AGI X2 EA V1.0 MT4, load a preset that fits your style (Scalper/Intraday/Swing), and run disciplined tests for a couple of weeks. Keep risk tight, review results, then scale responsibly. That’s how you get durable compounding—no Hail Marys, just process.

Download: (Insert your fxcracked.org download link here—match the slug below for clean SEO.)

Support: Drop questions in the post comments or reach out via your usual channel.

Comments

Leave a Comment