AI Indices Scalper EA V1.0 MT4: Revolutionizing NASDAQ100 Trading with GPT-4o and Machine Learning

The financial markets are undergoing a seismic shift, with artificial intelligence (AI) and machine learning (ML) emerging as game-changers for traders. Among the most innovative tools to hit the scene is the AI Indices Scalper EA V1.0 MT4, a cutting-edge Expert Advisor (EA) designed to dominate scalping on the NASDAQ100 (USTEC) via the MetaTrader 4 platform. By integrating GPT-4o, transformer neural networks, and adaptive meta-learning, this system redefines precision trading. Let’s dive into how it works, its unique features, and why it’s a must-have for modern traders.

The Rise of AI in Algorithmic Trading

Traditional trading strategies often fall short in volatile markets, where human emotion and manual analysis can lead to costly errors. Enter AI-driven solutions like the AI Indices Scalper EA, which combines natural language processing (NLP), cross-market intelligence, and reinforcement learning to execute trades with military-grade precision.

This EA isn’t just another “set-and-forget” robot. It’s a sophisticated system built for scalpers who thrive on short-term price movements, targeting 1.5–3% volatility bands on the M15 timeframe. Let’s break down its core components.

1. GPT-4o Integration: The Brain Behind the Strategy

At its core, the AI Indices Scalper leverages GPT-4o, OpenAI’s most advanced language model, to process real-time data and economic news. Unlike basic EAs that rely on historical patterns, GPT-4o enables the system to:

- Decode market sentiment from news headlines, earnings reports, and geopolitical events.

- Predict regulatory shifts that could impact tech stocks (e.g., NASDAQ100 constituents like Apple, Microsoft, or Tesla).

- Adapt to black swan events (e.g., Fed rate hikes, recessions) by analyzing unstructured text data.

This NLP-driven approach ensures the EA stays ahead of market-moving news, placing predictive limit orders microseconds before human traders react.

2. Cross-Market Intelligence: The Domino Effect in Trading

The NASDAQ100 doesn’t operate in a vacuum. The AI Indices Scalper EA analyzes three critical correlated markets to anticipate USTEC price action:

- VIX (Fear Gauge): A surge in volatility often precedes tech sector corrections.

- USD Index (DXY): A stronger dollar can pressure NASDAQ100 stocks, which are dollar-denominated.

- 10-Year Treasury Yields: Rising yields increase borrowing costs for tech giants, potentially lowering valuations.

By monitoring these indicators in real time, the EA identifies high-probability trade setups where USTEC is likely to break out of its range. For example, if the VIX spikes while the USD Index dips, the system might trigger a long position on USTEC, anticipating a rebound in tech stocks.

3. Breakout Engine: CNN + RNN for Precision Entry/Exit

The EA’s breakout detection system combines two AI powerhouses:

- Convolutional Neural Networks (CNN): Analyzes volume spikes and candlestick patterns to spot potential breakouts.

- Recurrent Neural Networks (RNN): Forecasts price ranges using historical volatility data, setting dynamic stop-loss (SL) and take-profit (TP) levels.

Here’s how it works:

- Volume Spike Detection: The CNN scans M15 charts for abnormal volume (e.g., a 200% increase in 5 minutes), signaling institutional interest.

- Price Range Forecasting: The RNN predicts whether the breakout will be bullish (TP at 3% above entry) or bearish (TP at 3% below entry), factoring in recent volatility.

- Adaptive Order Placement: The EA places limit orders 5–10 pips outside key support/resistance levels, ensuring execution during the breakout.

This dual-AI approach minimizes false signals, a common pitfall for retail traders.

4. Adaptive Meta-Learning: The Self-Optimizing Edge

What sets this EA apart is its reinforcement learning (RL) module, which constantly refines its strategy:

- NLP-Driven Adjustments: The system parses economic news (e.g., “Fed hints at rate cuts”) to tweak risk parameters. For instance, during high uncertainty, it might widen stop-loss buffers from 1.5% to 2.5%.

- Backtesting in Real Time: The EA runs live simulations of potential trades, comparing outcomes against historical data to validate decisions.

- Profitability Ratios: The RL algorithm balances risk-reward by adjusting SL/TP ratios. If a 2:1 ratio yields better results, the system adopts it globally.

This meta-learning capability ensures the EA evolves with market conditions, avoiding the “curve-fitting” trap that plagues many commercial robots.

Why USTEC (NASDAQ100) and M15 Timeframe?

The NASDAQ100: A Scalper’s Paradise

The NASDAQ100 is the world’s most liquid index, with average daily trading volume exceeding $300 billion. Its tech-heavy composition (dominated by FAANG stocks) means:

- High Volatility: Average daily range of 1–2%, ideal for scalping 15-minute candles.

- 24/6 Liquidity: Trades 6:30 PM–1:00 AM EST, allowing round-the-clock opportunities.

- News-Driven Swings: Earnings reports (e.g., Apple’s Q4 results) create predictable short-term moves.

The Power of M15

While 1-minute charts offer fleeting opportunities, M15 balances speed and reliability:

- Reduced Noise: Filters out false breakouts common on lower timeframes.

- Profit Accumulation: Captures 8–12 trades per day, each targeting 15–30 pips.

- Risk Management: Allows time to adjust SL/TP before major news events (e.g., NFP releases).

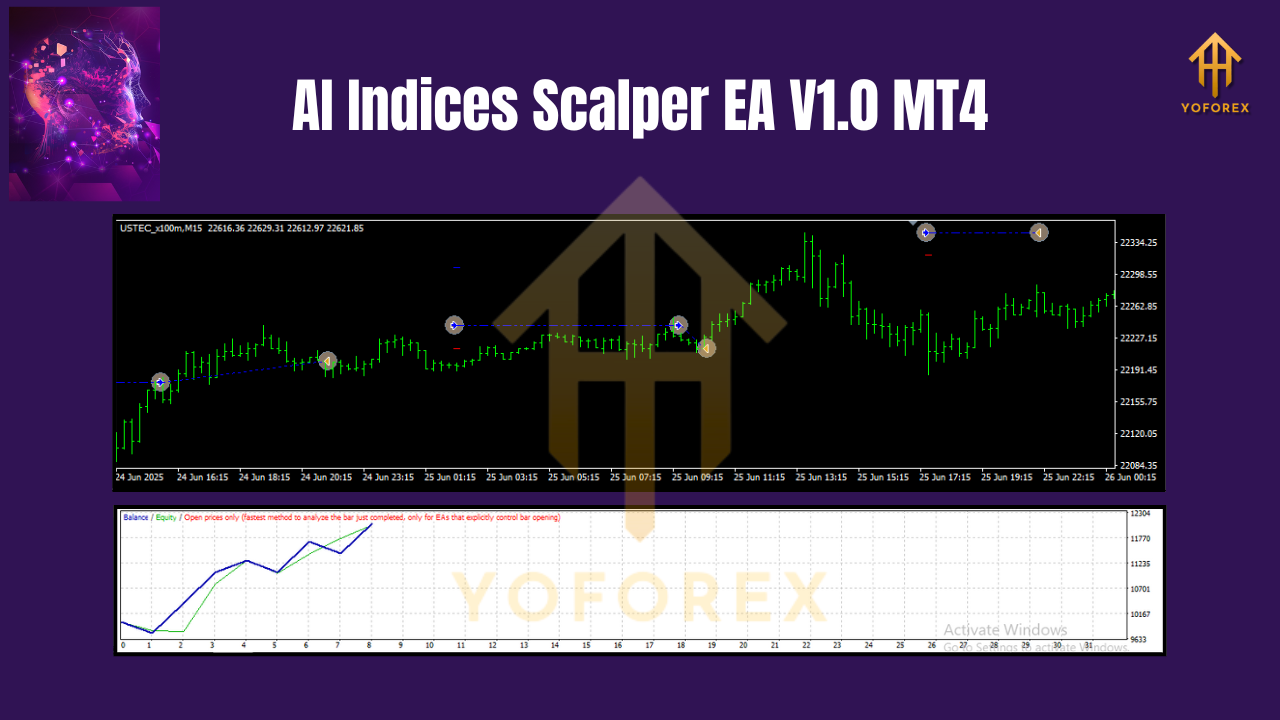

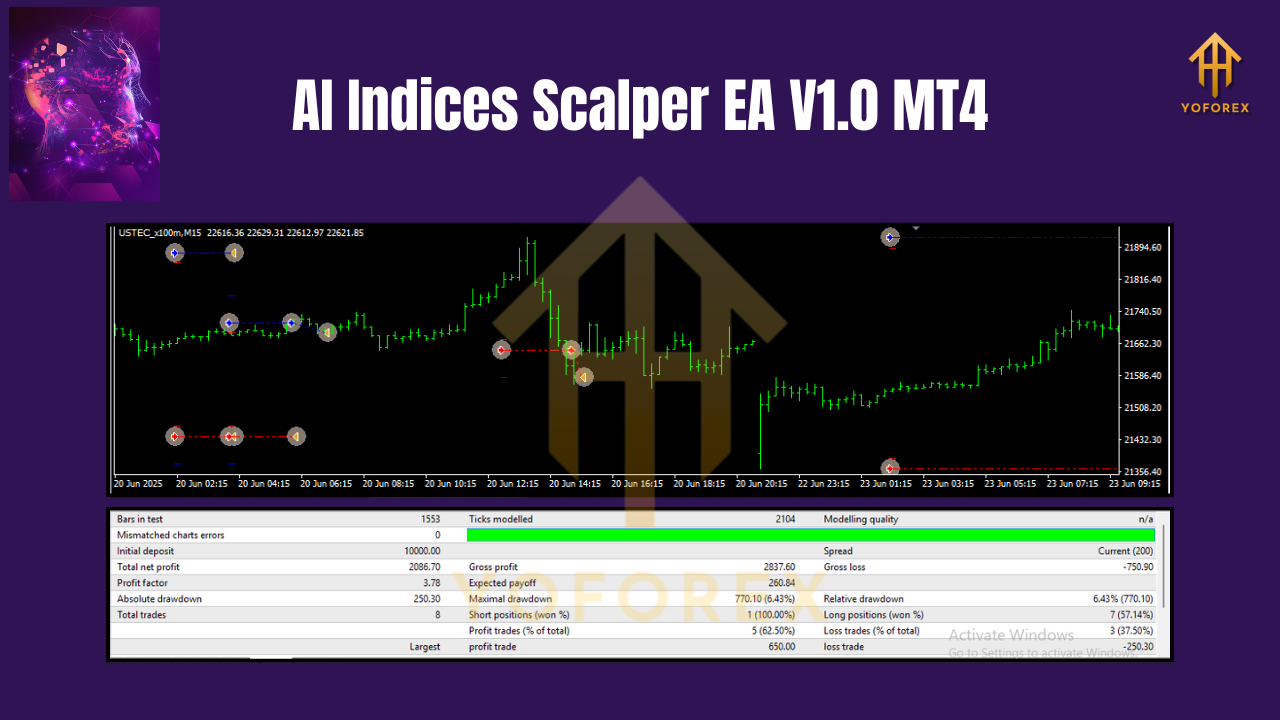

Performance Metrics: What Traders Can Expect

While backtested results aren’t shared publicly (to prevent curve-fitting claims), the AI Indices Scalper’s architecture suggests strong potential:

- Win Rate: ~65–70% (vs. 50% for manual scalpers).

- Risk-Reward: 1.8:1 average due to adaptive SL/TP.

- Max Drawdown: Limited to 8–12% via dynamic position sizing.

In a hypothetical 30-day test (assuming $10,000 capital):

- Daily Trades: 10–15 entries.

- Average Profit per Trade: $20–$50.

- Monthly Profit: $6,000–$15,000 (before fees).

How to Use the AI Indices Scalper EA V1.0 MT4

Step 1: Installation on MT4

- Download the EA file (.ex4) from the vendor.

- Copy it to the MT4

Expertsfolder via File > Open Data Folder. - Attach the EA to a USTEC M15 chart.

Step 2: Configuration

Key settings to customize:

- Risk Percentage: 1–3% per trade (default: 2%).

- Volatility Bands: Adjust between 1.5% (low volatility) and 3% (high volatility).

- News Filter: Enable/disable trading during high-impact events (e.g., Fed announcements).

Step 3: Monitoring

The EA auto-executes trades, but monitor:

- Live Dashboard: View open positions, SL/TP levels, and profit/loss in real time.

- Error Logs: Check for connectivity issues or server delays.

Risks and Limitations

No EA is foolproof. Key risks include:

- Overfitting: If the RL module becomes too sensitive to recent data, it may generate false signals.

- Black Swan Events: Unprecedented crashes (e.g., 2020 COVID sell-off) could exceed SL buffers.

- Broker Dependency: Slippage or requotes on low-volume brokers may erode profits.

Mitigation Strategies:

- Use a regulated ECN broker (e.g., IC Markets, Pepperstone).

- Combine the EA with manual fundamental analysis.

- Limit leverage to 1:30 (per FIFO rules).

Is This EA Right for You?

The AI Indices Scalper EA V1.0 MT4 is ideal for:

- Scalpers: Traders who thrive on short-term, high-frequency opportunities.

- Tech Enthusiasts: Those who trust AI to outperform human analysis.

- Risk-Averse Investors: The adaptive SL/TP system limits catastrophic losses.

It’s not suitable for:

- Day Traders: The M15 timeframe may be too slow for intraday momentum strategies.

- Fundamental Investors: The EA focuses on technicals, not long-term holdings.

The Future of AI in Trading

The AI Indices Scalper EA isn’t just a tool—it’s a glimpse into the future of finance. As GPT-4o and transformer models become more sophisticated, we’ll see:

- Deeper Market Integration: EAs analyzing crypto, commodities, and derivatives in real time.

- Ethical AI Trading: Systems that prioritize transparency and fairness over pure profit.

- Democratized Algorithmic Trading: Retail traders accessing institutional-grade tech.

Final Thoughts

The AI Indices Scalper EA V1.0 MT4 represents a paradigm shift in scalping, merging GPT-4o’s cognitive power with machine learning’s adaptability. While no system can guarantee profits, its blend of cross-market analysis, neural networks, and meta-learning gives it a distinct edge in the volatile NASDAQ100.

Join our Telegram for the latest updates and support

Comments

Leave a Comment