If you have been searching for an MT4 Expert Advisor that values discipline over drama, AI MEDUSA EA V2.95 MT4 deserves a place on your shortlist. The core idea is simple and serious: operate on the H1 timeframe, avoid risky position-doubling tactics, enforce hard stops and realistic targets, and let a rule-driven engine manage trades across a curated basket of pairs. Instead of obsessing over backtest curves, the focus here is forward behavior in live market conditions—execution, spreads, slippage, and the way trades breathe when volatility changes. This review is designed for readers who prefer robust processes, not shortcuts: we cover setup, risk design, portfolio selection, forward-testing, and day-to-day operating routines that help you get consistent results without losing sight of risk.

Why H1—and Why It Matters for Real Accounts

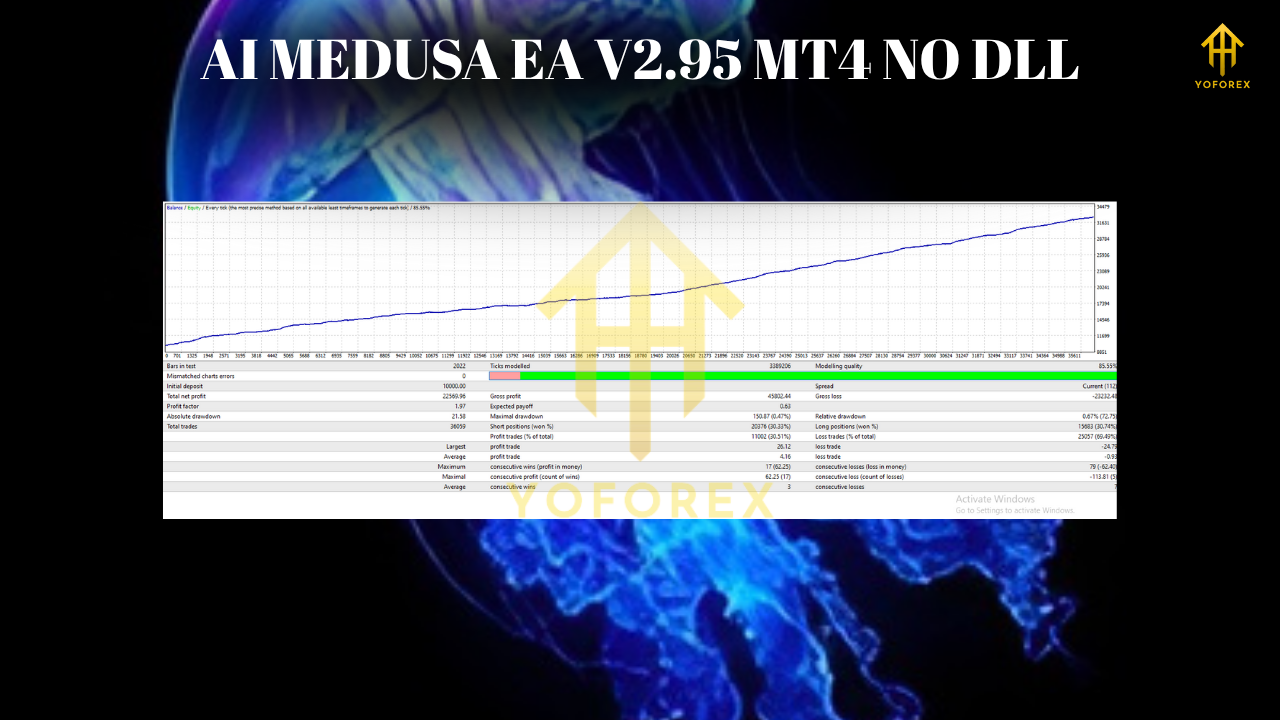

The H1 timeframe sits in a sweet spot. It filters a large portion of intraday noise while still offering enough opportunities across multiple symbols to keep your equity curve moving. That matters because execution costs (spread, commission, slippage) have a smaller proportional impact than on ultra-fast scalping. When you anchor a system like AI MEDUSA on H1, stop loss placement becomes more meaningful, and breakeven or trailing logic can operate with less random whipsaw. The result is a trade profile that is easier to analyze week by week using metrics that matter: profit factor, average win vs. average loss, and maximum drawdown.

Non-Grid, Non-Martingale by Design

Too many robots look great until they double down into a major loss. AI MEDUSA takes the opposite path. Each position stands on its own merit with a hard stop loss and a defined take profit. The EA can move to breakeven once price progresses, protecting open equity and reducing the chance that a strong move turns into a full reversal loss. This style does not guarantee profits, but it limits the damage from bad entries and forces the system to win by selection quality instead of balance-sheet leverage.

Portfolio Mindset: Multi-Pair Coverage, One Brain

One of AI MEDUSA’s practical advantages is portfolio operation. You attach it to the recommended chart and let it monitor a basket of pairs that you’ve added to Market Watch. This allows you to spread risk across instruments that do not all react the same way to a single headline or macro impulse. It’s not about chasing dozens of charts; it’s about curating a handful that complement each other. For example, pairing a dollar major with a yen cross and a commodity-linked pair can reduce correlated drawdowns and smooth the equity line. Always remember that diversification does not eliminate risk; it manages the rhythm of your wins and losses.

Step-By-Step Setup for MT4

- Install the EA in the Experts directory and restart the platform.

- Attach it to the recommended H1 chart. Confirm that Algo Trading is enabled.

- Add your intended symbols to Market Watch so the EA can see their ticks.

- Review risk settings before the first session: per-trade risk, maximum concurrent positions, breakeven trigger and offset, and any trade filters you plan to use.

- Run a quick platform health check—no missing price history, no custom suffix issues, and your VPS (if used) stays stable during market hours.

The Trade Lifecycle in Plain English

- Pre-trade scan: The EA watches for structured price behaviour and momentum quality on H1, rejecting thin or erratic conditions.

- Risk calculation: Position size is computed from your account balance or equity, respecting your per-trade cap.

- Entry: The EA opens a trade with a hard stop placed beyond a reasonable invalidation level, and a target aligned to recent volatility.

- Management: If price progresses, the system can advance the stop to reduce risk or to breakeven. If conditions deteriorate, the stop is allowed to do its protective job.

- Exit: Positions close by reaching the target, hitting stop, or a managed condition when the trade thesis weakens.

Risk Architecture That Scales

A robust EA still needs a robust plan. Consider the following baseline and adapt to your account size and temperament:

- Per-trade risk: 0.25%–0.75% when trading multiple pairs; you may go slightly higher for single-pair focus, but never so high that two losses ruin your day.

- Daily stop: Set a daily loss cap (e.g., 2R or a fixed percentage). If you hit it, stop for the day. Protecting mental capital is as important as protecting account equity.

- Exposure rules: Limit total concurrent risk. If two symbols are highly correlated, either skip the second trade or halve the size.

- Weekly scorecard: Log win rate, average win vs. average loss, profit factor, and maximum drawdown every Friday. These four numbers will tell you if the system is behaving.

Broker and VPS: Execution Is Part of the Edge

The better your execution, the more accurately your EA logic translates into results. Aim for consistent tight spreads and a robust trade server connection. A VPS near your broker’s servers can reduce latency and slippage, improve the responsiveness of breakeven or trailing actions, and minimize disconnections during active sessions. Keep your terminal updated, schedule maintenance outside liquid hours, and avoid heavy resource usage on the VPS that could delay order handling.

Session Timing and News Awareness

H1 entries are durable enough to handle ordinary noise, but high-impact events can still distort spreads or produce gaps. If you are new to the system, reduce risk around major releases until you have forward-tested behaviour with your broker’s liquidity. The London session and the London–New York overlap generally provide healthier follow-through; late session trades may stall and require more patience.

Prop-Firm Evaluations Without Surprises

AI MEDUSA’s rule-first behaviour fits evaluation rules if you configure it carefully. Reduce simultaneous positions, use conservative risk per trade, and set a daily hard stop that sits comfortably under the firm’s daily limit. Evaluation breaches are costly and usually avoidable with tighter controls.

Troubleshooting: Common Issues and Practical Fixes

- Few or no trades: Check that symbols are in Market Watch, that H1 is selected, and that filters are not overly restrictive for current volatility.

- Frequent breakeven stopouts: Consider a slightly wider breakeven offset or require more distance before moving the stop.

- Clustered losses on correlated pairs: Cap the number of trades that rely on the same currency’s direction, or cut the second position size.

- Flat equity over weeks: Prune a weak pair, nudge position size within your risk cap, or bias participation to the most liquid hours.

Operating Principles to Keep You Consistent

- Be patient with H1: Let trades develop. Interference often degrades results.

- Respect your stop: The stop is the cost of the idea; paying it quickly is cheaper than negotiating with the market.

- Review weekly, not trade-by-trade: One or two outcomes never define a strategy; trends emerge across dozens of trades.

- Scale gradually: If metrics look good, increase risk in small steps and re-measure. Consistency beats leaps.

Final Verdict

AI MEDUSA EA V2.95 MT4 is built for traders who value structure, safety, and steady decision-making on the H1 timeframe. Its non-martingale, non-grid approach, use of hard stops and measured targets, and portfolio orientation make it suitable for accounts that prefer a calm, rules-driven style over high-frequency improvisation. To get the best from it, operate with professional habits: a clean VPS, a reliable broker connection, a written risk plan, and a weekly scorecard. Combined, those habits turn a capable EA into a repeatable trading process. If disciplined forward-testing, modest scaling, and tight risk governance describe your approach, this system fits naturally into your toolkit.

Comments

Leave a Comment