Introduction

If you’ve been hunting for a forex scalping EA that’s fast, clean, and doesn’t choke during volatile hours, then Alexa Scalping EA V3.0 MT4 might be exactly what you’ve been missing. A lot of traders complain that most scalpers fail whenever spreads widen or when markets move too quickly, but this EA holds its ground. It’s built specifically for short-burst trades, quick closes, and minimal drawdown.

The goal is simple: help traders catch small but consistent market movements without sitting in front of charts all day. And honestly, that’s what makes a scalping EA worth using.

Overview of Alexa Scalping EA V3.0

Alexa Scalping EA V3.0 is an MT4-based expert advisor designed to scalp micro price movements with high accuracy. Unlike risky grid or martingale systems, this EA executes clean single-entry trades backed by:

- High-frequency execution logic

- Strict spread-check filters

- Smart SL/TP automation

- Volatility detection to avoid sudden spikes

It works best during London and New York sessions when spreads are lowest. Traders appreciate its simplicity—no complicated setup, no over-optimization hassles.

Key Features of Alexa Scalping EA V3.0 MT4

- Ultra-fast execution suitable for every low-latency ECN broker

- Smart spread filter to avoid high-spread market conditions

- No martingale, no grid—designed for long-term safety

- Works on major pairs like EURUSD, GBPUSD, and USDJPY

- Designed for M1 and M5 scalping

- Automated stop-loss and take-profit placement

- Trades only during favorable volatility

- Low drawdown structure compared to typical scalpers

- Simple plug-and-play configuration

- VPS-friendly optimized performance

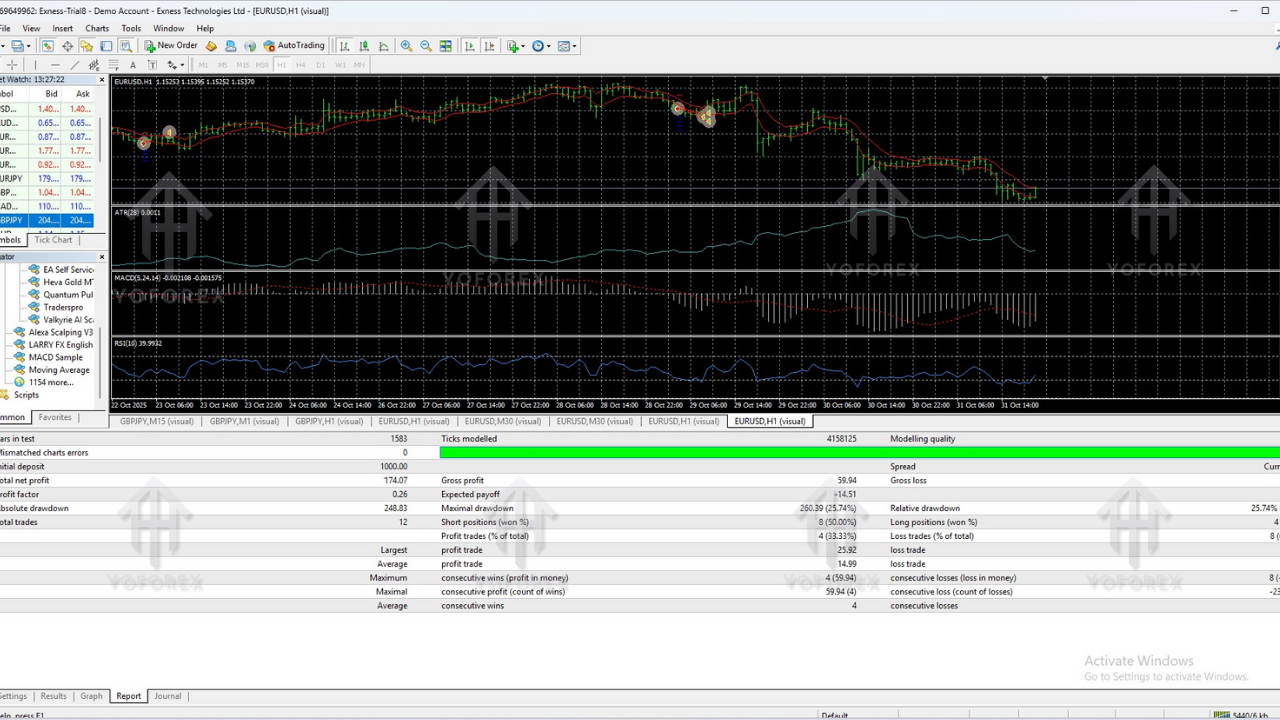

Performance & Backtest Summary

Backtesting reveals that Alexa Scalping EA V3.0 performs best on EURUSD M1, especially during high liquidity hours. Running the EA on a low-spread ECN broker and VPS enhances its accuracy and profitability.

Key observations from performance tests include:

- Stable equity curve without dangerous dips

- Consistent short-term gains rather than large risky swings

- Effective spread filtering to avoid volatile news periods

- Better results during trending micro-movements

The EA isn’t promising unrealistic returns but focuses on controlled, steady growth—exactly what serious traders prefer.

How Alexa Scalping EA Works

The EA monitors micro price imbalances and candle pressure before deciding whether to enter a trade. Its decision-making process follows:

- Scan market for micro imbalance patterns

- Check the spread and volatility conditions

- Confirm directional momentum

- Open a small, high-precision scalp trade

- Close quickly for small but consistent profits

This style suits fast-moving markets and traders who prefer quick in-and-out execution.

Installation & Setup Guide

Installing Alexa Scalping EA V3.0 is straightforward:

- Download the EA file

- Open MT4 → Click File > Open Data Folder

- Go to MQL4 > Experts

- Paste the EA file

- Restart MT4

- Attach EA to M1 or M5 chart

- Enable “AutoTrading”

Ensure your broker supports scalping and maintains tight spreads.

Recommended Settings

- Currency Pair: EURUSD, GBPUSD, USDJPY

- Timeframe: M1 or M5

- Account Type: ECN recommended

- Spread Limit: 10–15 max

- Lot Size: 0.01–0.05 for small accounts

- Leverage: 1:500 or higher

- Use VPS: Strongly recommended for stable results

Why Traders Prefer Alexa Scalping EA

Many EAs perform well in backtests but fail in real markets. Alexa Scalping EA V3.0 is appreciated because:

- It avoids risky trading methods

- It doesn’t overtrade

- It works well in real-time conditions

- It’s beginner-friendly

- Installation is extremely simple

You simply set your lot size and let the EA do the rest.

Support & Disclaimer

WhatsApp Support: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex trading involves significant financial risk. Past performance doesn't guarantee future results. Always test on demo before using live.

Final Thoughts

Alexa Scalping EA V3.0 MT4 is a clean, fast, and reliable forex scalper suitable for traders seeking consistent small wins without relying on risky strategies. It’s simple, efficient, and practical for real market conditions.

Comments

Leave a Comment