Tired of EAs that look great in screenshots but melt down the moment markets get messy? Same. That’s exactly why Apex G EA V1.25 for MT4 is designed with one core promise: consistent, controlled execution that respects risk first and seeks quality trades over noise. No wild martingale pyramids, no hidden “grid gone crazy” logic. Just a practical, rules-driven Expert Advisor you can actually live with day after day.

This guide walks you through what Apex G EA does, how it thinks, setup steps on MT4, recommended presets, risk notes, and a few FAQs. I’ll keep it human (coz real traders are reading this), and I’ll flag exactly where you can tweak things for prop firms or live accounts. Let’s dive.

What Is Apex G EA V1.25 (MT4)?

At its core, Apex G EA V1.25 is a rule-based, multi-filter trading system built for MetaTrader 4. It focuses on liquid symbols (major FX pairs and gold), avoids aggressive position-doubling, and uses confluence—trend context + volatility + momentum + session filters—to decide when to engage.

Who it’s for:

- Traders who prefer non-martingale, non-grid logic.

- Prop-firm seekers who need measured daily risk and equity protection.

- Beginners who want an install-and-run workflow (with sensible defaults).

- Intermediate users who can tune parameters for different brokers/conditions.

What it’s not:

- A “get rich this weekend” robot.

- A set-and-forget unicorn that never needs risk management.

- A curve-fit backtest showpiece that collapses forward.

Why Traders Like This EA

- Saner risk: fixed-fraction or fixed-lot sizing; optional equity guards.

- Market-adaptive: can throttle entries during high-impact news or low-liquidity.

- Clean logic: prefers a single, quality entry over rapid-fire scalps when spreads are wide.

- Prop-firm minded: daily loss guardrails and max concurrent trades limiters.

Key Features (What You Actually Get)

- • Non-Martingale, Non-Grid — No pyramiding disasters hiding inside.

- • Multi-Filter Confluence — Trend (MA/structure), momentum (RSI/MA slope), volatility (ATR), and time-session filters.

- • Risk Controls — Per-trade risk %, daily loss cap, equity stop, and max trades per symbol/day.

- • Spread & Slippage Aware — Auto-skip if spreads exceed a threshold you define.

- • News Pause (Optional) — Pause entries around red-flag releases (manual schedule or external filter).

- • Smart TP/SL Logic — ATR-linked stops and dynamic partial exits when moves decelerate.

- • Break-Even & Trailing — Lock gains early and trail only when structure confirms (not blindly).

- • Session Filters — Focus on London/NY overlap or avoid dead Asian hours… you choose.

- • Symbol-Agnostic Defaults — Works on majors and XAUUSD; tune per symbol for best results.

- • Prop-Firm Preset — Conservative template for daily DD and consistency targets.

- • VPS-Ready — Lightweight, minimal CPU—ideal for 24/5.

- • Clear Logs — Execution notes help you audit entries/exits (handy for prop reviews).

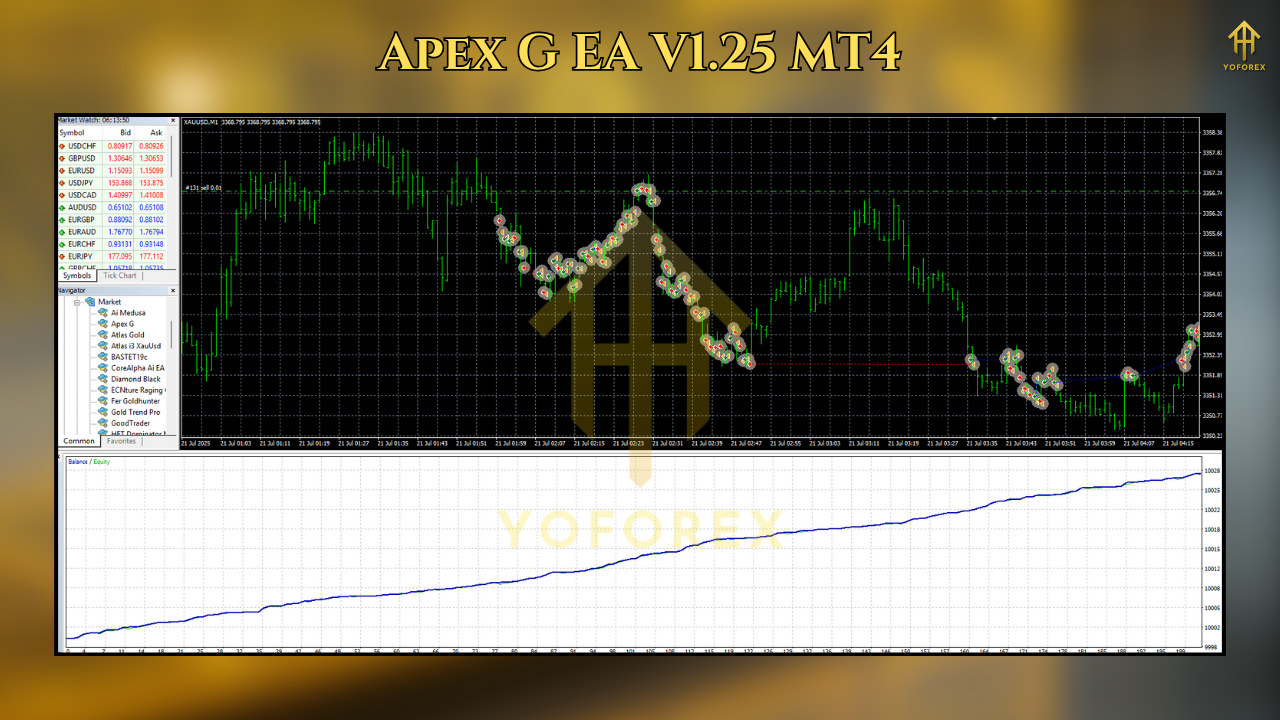

How Apex G EA Enters & Exits (The “Brain” in Plain English)

Apex G EA is trend-biased with momentum confirmation. Think of it like this:

- Context: It checks if price is generally trending (structure/MA slope).

- Volatility Check: Is the move tradable or is the market cramped? ATR filters help avoid chop.

- Entry Timing: Looks for momentum confirmation (e.g., pullback into dynamic support/resistance with renewed push).

- Guardrails: If spread is too wide or slippage spikes, it will pass.

- Exit Logic: Uses a mix of hard SL/TP, break-even once price advances, and optional trailing based on volatility compression or minor structure breaks.

No exotic black-box claims. Just layered, sensible conditions that reduce “random click” behavior.

Installation & Quick Setup (MT4)

- Download & Unzip the EA file.

- Open MT4 → File → Open Data Folder.

- Navigate to

MQL4/Experts/and paste the EA file there. - Restart MT4 or right-click Navigator → Refresh.

- Enable Algo Trading (top toolbar).

- Drag Apex G EA V1.25 onto your chart (start with a major pair or XAUUSD).

- In the Inputs tab, choose your Risk Mode (fixed lot or risk %), Max Trades, Daily Loss Limit, and Spread Filter.

- Allow live trading (common tab) and click OK.

Recommended Presets (Pick What Fits You)

1) Prop-Firm Conservative (A+)

- Timeframe: M15 or H1

- Risk per trade: 0.25% – 0.5%

- Max trades/day: 2–3 across all symbols

- Daily loss limit: 1.5% – 2% (EA disables new entries if hit)

- Spread filter: Tight (e.g., ≤ 20 points on majors; ≤ 150 points on gold depending on broker)

- Trailing: Conservative, move to BE fast once +1R

2) Balanced Swing-Intraday

- Timeframe: M30/H1

- Risk per trade: 0.5% – 1%

- Max trades/day: 3–5

- Daily loss limit: 3%

- Trailing: Moderate, enable partials at 1.5R–2R

3) Aggressive (Test on Demo First, pls)

- Timeframe: M15

- Risk per trade: 1% – 1.5%

- Max trades/day: 5–7

- Daily loss limit: 4%

- Trailing: Faster, allow re-entries with stricter spread cap

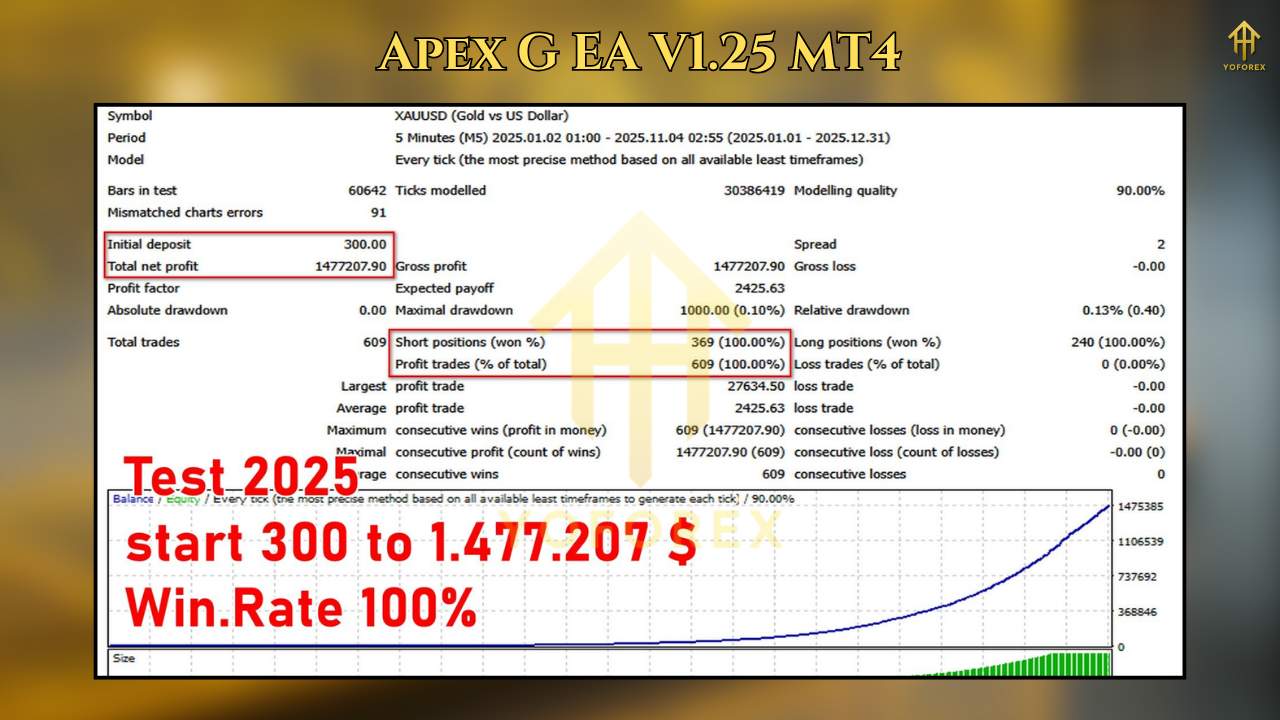

Performance Approach (How to Judge It Properly)

- Backtest windows: At least 3–5 years on each symbol you plan to run.

- Walk-Forward: Split periods (e.g., 2019–2022 optimize, 2023–2024 forward).

- Symbol Basket: Start with 1–2 symbols you know well (e.g., EURUSD + XAUUSD).

- Forward Demo: 4–8 weeks demo with your broker’s real spreads/commission.

- Prop Mode: Enable daily equity protection before attempting any challenge.

- KPI to watch: Max DD, PF (Profit Factor), avg R:R, % time in trade, win rate under high spread.

Risk & Money Management (Where Most EAs Fail)

- Risk % beats fixed lots for longevity.

- Avoid stacking correlated pairs (EURUSD + GBPUSD + EURGBP can amplify exposure).

- For gold (XAUUSD), widen stops relative to ATR and keep spread filters stricter.

- Never raise risk to “win it back.” The EA isn’t designed for revenge trading (thankfully).

- If your broker’s spreads balloon during rollover, disable entries for that hour.

Troubleshooting (Common “Huh?” Moments)

- “No trades for 2 days!”

Your filters (spread/session/news) might be too strict. Or market was choppy. Consider temporarily easing the spread cap or enabling more sessions. - “Stops feel tight on gold.”

Raise the ATR multiplier for SL or shift to H1. XAUUSD needs room to breathe. - “Why did it skip a nice setup?”

Likely failed one filter—spread spike, momentum not confirmed, or session off. Check the Experts and Journal tabs for a hint. - “Equity protection kicked in early.”

Good. It saved the account from a bad session. Review the daily loss % and maybe lower risk per trade.

Who Should Start With Demo (Most of us, honestly)

- New to EAs or to your broker’s execution conditions.

- Switching from grid/marti bots to conservative systems (psychology adjustment needed).

- Attempting a prop challenge—run this on demo for 2–4 weeks first with challenge-like rules.

FAQs

Q1: Which timeframe is best?

Start with M15 or H1. H1 tends to be calmer; M15 finds more entries but can be noisier.

Q2: Does it martingale or grid?

No. It uses single entries with risk caps, break-even, and optional trailing.

Q3: Can I run multiple pairs?

Yes, but avoid heavy correlation. Start with one or two symbols, then scale.

Q4: What’s the minimum deposit?

Technically it can run small accounts, but to keep risk % sensible and cover commission/spread, $200–$500 is a practical floor (varies by broker).

Q5: Good for prop firms?

Yes—use the Prop-Firm Conservative preset, strict daily loss protection, and keep risk per trade low.

Q6: Do I need a VPS?

Highly recommended for uptime, especially if you’re away from your desktop.

Final Tips (Before You Go Live)

- Broker matters: tight spreads + consistent fills = better EA outcomes.

- Keep one change at a time when optimizing (risk, ATR, session; don’t tweak 8 things at once).

- Record a simple trade journal (symbol, TF, settings, reason for any manual overrides).

- Re-evaluate monthly; markets trend, range, then trend again… Let your presets adapt.

Call to Action

Ready to try it? Install Apex G EA V1.25 MT4, load one of the presets above, and run a 2–4 week demo. If the equity curve behaves itself and the DD stays inside your rules, only then consider switching to live or taking it into a challenge. Patience now saves pain later, promise.

Trade safe, keep risk first, and let the numbers speak.

Disclaimer

Trading Forex, CFDs, indices, and metals involves substantial risk and is not suitable for everyone. Past performance is not indicative of future results. Use demo mode first; only trade capital you can afford to lose.

Comments

Leave a Comment