Introduction to Atlas Quant EA V1.0 MT4

Atlas Quant EA V1.0 MT4 is a fully automated trading system designed to operate 24/5 on the MetaTrader 4 platform. It uses a combination of quantitative price analysis, volatility modeling, and trend detection to generate trade decisions. Rather than using high-risk methods such as martingale, averaging, or dual-sided hedge stacking, the EA focuses on clean and selective entries based on price behavior, momentum alignment, and trend continuation.

The EA was built for traders who want an automated assistant capable of analyzing market strength, identifying high-probability directions, and managing trades without requiring constant intervention. Because version 1.0 is optimized for modern price volatility (2023–2025), Atlas Quant tends to behave more intelligently than many older EAs struggling with expanded market spikes and sharp intraday swings.

Atlas Quant EA V1.0 works on both currency pairs and gold (XAUUSD), but it shows its strongest results on trending instruments where volatility provides clean momentum. This makes it appealing for traders who want a smooth and structured approach to automated forex trading.

Core Features of Atlas Quant EA V1.0 MT4

1. Clean Quantitative Trend Model

The EA evaluates trend direction using a combination of momentum slope, volatility expansion, and price displacement. This prevents false signals during consolidations and allows the EA to capture moves with stronger probability.

2. No Martingale or High-Risk Positioning

Atlas Quant does not stack orders or multiply lot sizes after losses. This helps control risk more effectively, making the EA safer for smaller accounts compared to grid-based robots.

3. Adaptive Stop-Loss and Trade Management

The EA automatically adjusts stop-loss values depending on market volatility. During quiet sessions, the EA maintains tight risk, whereas during higher volatility periods, it widens SL slightly to avoid premature exit.

4. Multi-Currency Support

Atlas Quant can trade:

- EURUSD

- GBPUSD

- USDJPY

- XAUUSD

- AUDUSD

- USDCHF

Although it works across many markets, it performs best on pairs that follow structured trends rather than flat market cycles.

5. Stable Execution Logic

Atlas Quant EA uses lightweight code, allowing the bot to execute trades quickly without freezing or lagging the MT4 terminal. This makes it VPS-friendly and suitable for traders running multiple EAs simultaneously.

6. Fully Automated 24/5 Trading

Once configured, the EA handles everything—from market scanning to trade execution and risk management. Traders who prefer a hands-off approach will find this convenient and practical.

How Atlas Quant EA V1.0 MT4 Works – Strategy Explained

The EA uses a combination of analytical tools rather than relying on a single indicator. Its execution model can be broken down into several stages:

1. Market Structure Analysis

Atlas Quant identifies whether the market is trending or ranging. If the market is flat, it waits. If a trend is forming, it starts analyzing volatility layers.

2. Volatility-Based Confirmation

The EA tracks volatility expansion, which often signals the beginning of a continuation move. Trades are entered only when price momentum aligns with directional volatility.

3. Entry Trigger Logic

When both trend and volatility properties align:

- The EA enters a buy if price confirms positive momentum

- The EA enters a sell if price confirms downward strength

4. Smart Risk Control

The EA manages trades through:

- Predefined stop-loss

- Break-even shifting

- Trailing stop based on momentum strength

- Partial exit logic in some conditions

5. Exit Logic

The EA closes trades based on:

- Reversal in volatility

- Trend exhaustion

- Reaching take-profit

- Breakeven triggered during sudden reversals

By avoiding unnecessary re-entries or multiple trades in a single direction, Atlas Quant emphasizes account safety and long-term performance consistency.

Recommended Settings & Requirements

While Atlas Quant EA V1.0 is flexible, traders should follow these base recommendations for optimal performance:

Minimum Deposit

- $200 for currency pairs

- $500+ for XAUUSD

Recommended Leverage

- 1:500 preferred

- Minimum acceptable leverage: 1:200

Best Timeframes

- M30

- H1

- H4 for ultra-stable, low-frequency trading

Best Trading Pairs

- EURUSD

- GBPUSD

- XAUUSD

- USDJPY

Broker Requirements

- ECN preferred

- Low-spread environment

- Fast order execution

VPS Requirement

While not mandatory, a VPS ensures continuous execution without interruption. Traders using multiple EAs should always use a VPS for reliability.

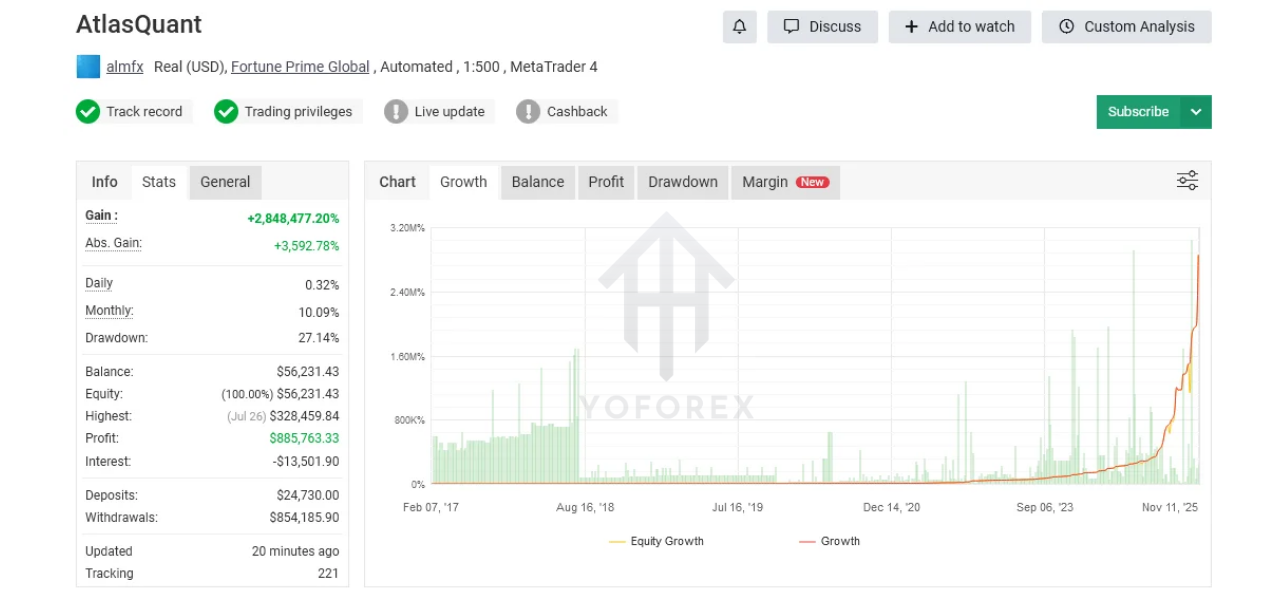

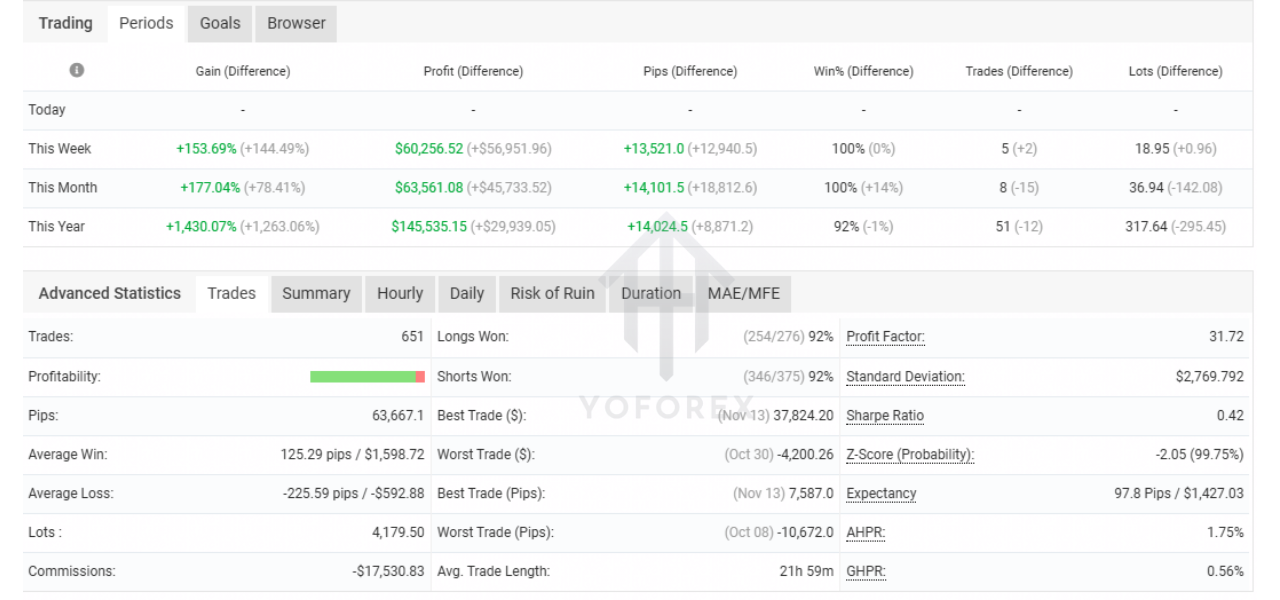

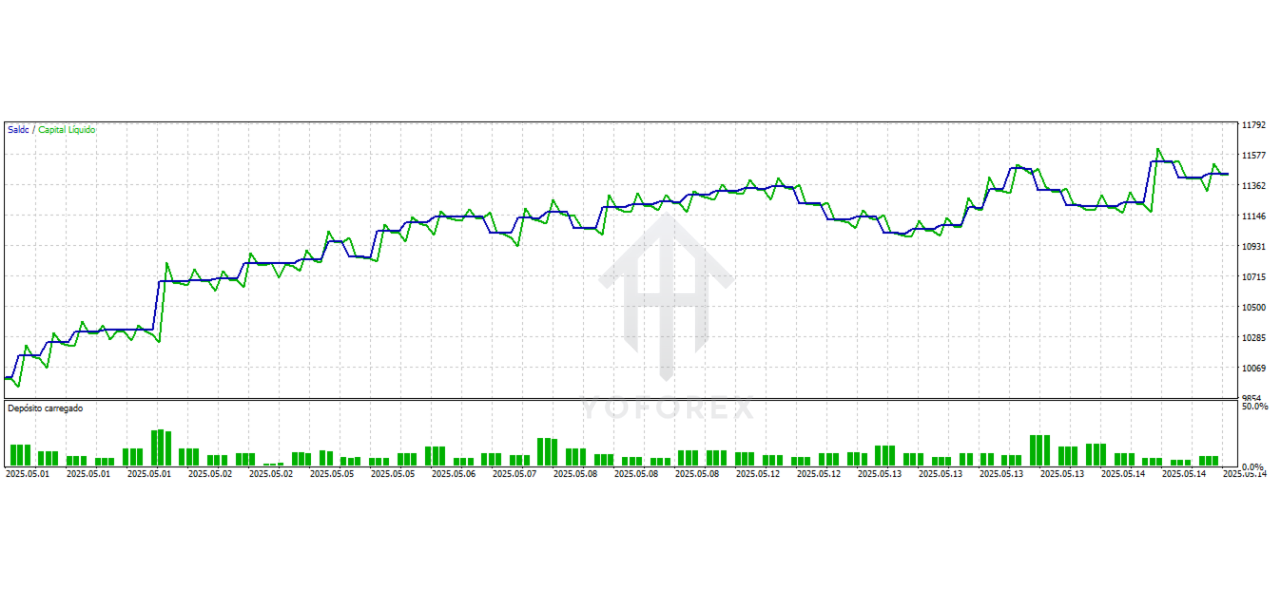

Performance Analysis & Realistic Expectations

Atlas Quant EA V1.0 performs best in structured markets where trend formation occurs steadily throughout the week. Backtesting and early testing feedback indicate that the EA:

- Excels during medium-to-high trend phases

- Performs consistently on EURUSD and XAUUSD

- Maintains moderate drawdown due to clean entries

- Avoids forced trading, improving long-term stability

However, traders should maintain realistic expectations:

- During low-volatility periods, the EA may produce fewer trades

- Sideways markets can reduce performance

- Slippage and spread variation may impact results on poor brokers

Like any EA, the system should be tested on demo before running live to ensure compatibility with your broker environment.

Installation Guide for Atlas Quant EA V1.0 MT4

Follow these steps to install and run the EA:

Step 1: Download the EA File

Save the file in .ex4 format.

Step 2: Open MT4 → File → Open Data Folder

Step 3: Go to MQL4 → Experts

Paste the EA file into this folder.

Step 4: Restart the MT4 Terminal

Step 5: Enable Automated Trading

Click the AutoTrading button so it turns green.

Step 6: Drag Atlas Quant EA Onto a Chart

Choose the pair you want to trade and attach the EA.

Step 7: Configure Inputs

Set:

- Lot size or risk percentage

- SL/TP preferences

- Maximum spread

- Trading time filters (optional)

Step 8: Run on VPS

For stable uptime, run MT4 on a VPS.

Who Should Use This EA?

Atlas Quant EA V1.0 MT4 is suitable for:

- Beginner traders needing a structured algo

- Intermediate traders wanting stable automation

- Traders focused on EURUSD or gold

- Users who dislike grid or martingale systems

- Part-time traders who cannot monitor charts all day

The EA is not suitable for traders expecting daily high-frequency trading or extremely aggressive scalping.

Pros and Cons

Pros

- Trend and volatility-driven entry model

- No martingale or grid trading

- Beginner friendly

- Multi-pair support

- Works well with VPS

- Strong risk management logic

Cons

- Limited long-term public performance data due to new release

- Lower trade frequency during consolidation

- Requires proper broker conditions for best results

Final Verdict

Atlas Quant EA V1.0 MT4 is a strong candidate for traders who want a disciplined, stable, and volatility-aligned Expert Advisor without exposure to dangerous trading practices. Its focus on trend continuation, adaptive SL management, and quant-style analysis makes it a reliable tool for those who prefer structured trading. While relatively new, its controlled approach and consistent logic make it well suited for 2025 market volatility.

This EA is recommended for traders who want long-term, rule-based trading rather than hyper-aggressive strategies. When paired with a good broker and VPS, Atlas Quant can be a powerful addition to your automated trading portfolio.

Comments

Leave a Comment