The rise of Expert Advisors has changed how retail traders approach the forex and metals markets. Among the recent EAs gaining attention is Axonshift EA V1.3 MT5, a system created specifically for trading gold (XAUUSD). Unlike generic robots that promise to work across multiple symbols and timeframes, Axonshift is focused on a single instrument and timeframe, making it a specialized option for traders who prefer clarity and consistency.

What Is Axonshift EA V1.3 MT5?

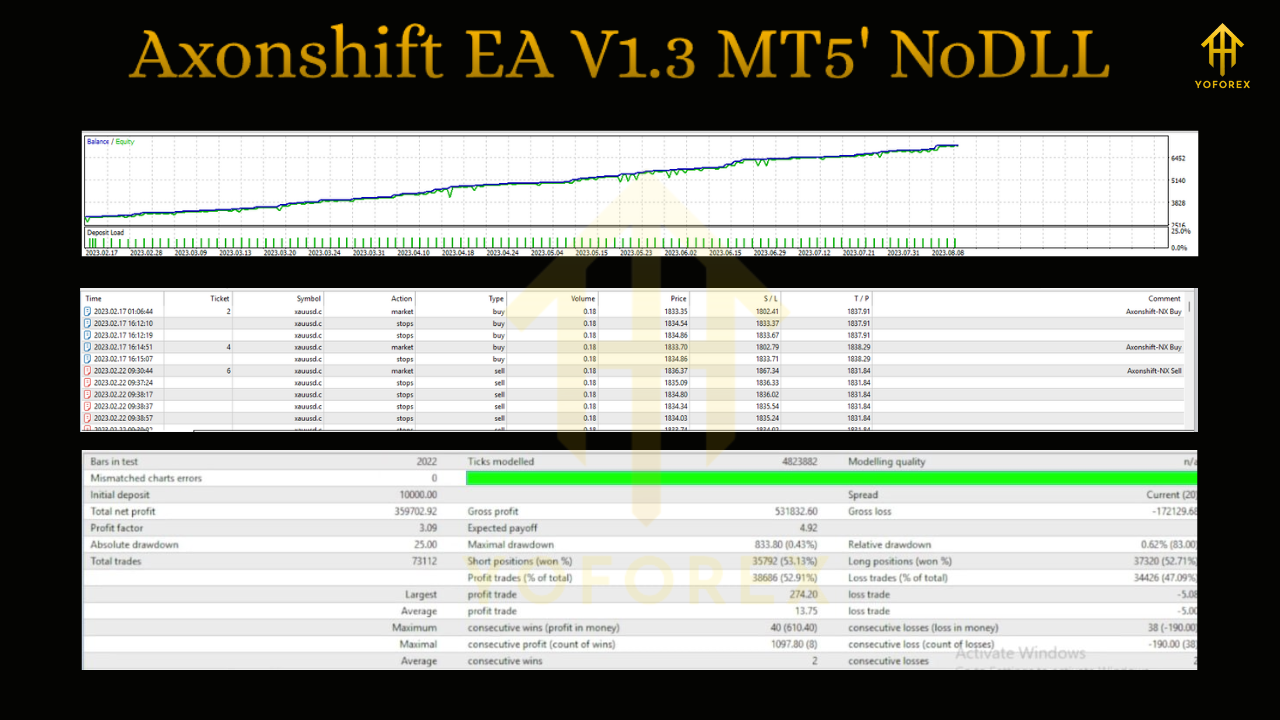

Axonshift EA is an automated trading system designed for MetaTrader 5. It was built to handle the gold market, especially on the H1 chart, where price dynamics and volatility often create structured trade opportunities. The V1.3 release represents the latest refinement of the system, offering improved stability and more robust risk management settings compared to earlier versions.

This Expert Advisor does not rely on martingale or grid methods. Instead, it works with fixed stop loss and take profit levels, ensuring that each position is managed within a clear risk framework. By avoiding dangerous recovery strategies, it reduces the chance of unexpected account blowouts, making it more appealing to cautious traders.

Key Features That Stand Out

Axonshift EA V1.3 MT5 comes with several features that differentiate it from many automated trading systems:

- Specialized Focus on XAUUSD H1: It is tuned specifically for gold on the one-hour timeframe, which means its entry and exit logic is tailored for the unique behavior of this market.

- Defined Risk per Trade: Fixed SL and TP ensure every trade has a known risk level, with no hidden exposure.

- No Overtrading: The EA filters trades based on internal conditions, waiting for high-probability setups instead of constantly opening positions.

- Continuous Development: The release of version 1.3 demonstrates ongoing improvement and adaptation, ensuring the EA remains relevant.

Why Traders Are Talking About It

Gold remains one of the most actively traded assets in forex and CFD markets. Its volatility can deliver strong opportunities, but it also demands precise management. Traders are drawn to Axonshift EA V1.3 because it claims to offer a structured way of handling that volatility. Instead of relying on discretionary decisions or emotional reactions, the EA calculates entries based on consistent rules and closes trades at pre-defined levels.

Another reason for interest is the rise of prop firm challenges. Traders who want to pass evaluations often need tools that limit drawdowns while still producing steady returns. An EA that avoids risky strategies while focusing on a single instrument fits into this demand.

Limitations and Risks

Despite the strong marketing points, traders should not overlook the limitations:

- Restricted to One Pair and One Timeframe: It cannot be easily adapted to other symbols or intervals.

- Broker Sensitivity: Spreads, execution speed, and slippage on gold can vary widely. Results may differ depending on the broker.

- Market Dependence: Like all EAs, it performs best under certain conditions. Periods of unexpected volatility or sudden global events can disrupt performance.

- Cost Factor: It is a premium EA, so the investment required to purchase it may be significant relative to smaller accounts.

Best Practices for Using Axonshift EA V1.3

If you are considering adding this EA to your trading setup, here are a few guidelines:

- Start with Demo Testing: Always test new systems on demo before committing live capital. This helps you understand its behavior under your broker’s conditions.

- Use a VPS: Running the EA on a reliable virtual server ensures stability and reduces downtime risks.

- Risk Management First: Even with built-in SL/TP, set your own account-wide rules, such as maximum drawdown limits.

- Keep Expectations Realistic: This EA aims for consistency, not explosive growth. Avoid raising risk just to accelerate returns.

Long-Term Potential

The real strength of Axonshift EA V1.3 is its conservative design. By staying away from grids, hedging, and martingale strategies, it positions itself as a safer alternative for traders who prefer steady growth over high-risk gambling. While it may not suit those chasing fast profits, it does appeal to traders who want to build accounts sustainably over the long term.

The update to version 1.3 shows the developer’s commitment to refinement. With better risk controls and tuned entry logic, it reflects the importance of adaptation in algorithmic trading. Traders who respect its limitations and apply it responsibly may find it a valuable addition to their toolbox.

Final Thoughts

Axonshift EA V1.3 MT5 is a specialized tool for gold traders looking to automate their strategies without exposing themselves to excessive risk. Its strength lies in discipline, consistency, and structured decision-making. While not a universal solution, it may deliver real benefits to those willing to trade within its intended scope. Like all EAs, it should be treated as an assistant, not a guarantee. By combining it with sound money management and patience, traders can maximize its potential.

Comments

Leave a Comment