Introduction :

In the fiercely competitive world of Gold (XAUUSD) trading, volatility is both a best friend and a worst enemy. The precious metal is known for its explosive moves, often traveling hundreds of pips in a single session driven by geopolitical tensions, inflation data, or central bank policies. For the unprepared trader, these spikes can wipe out an account in milliseconds. The traditional approach of predicting market direction with static Stop Losses often fails because Gold loves to hunt liquidity before reversing. To conquer this beast, you need a strategy that doesn't just predict the weather but builds a shelter against the storm. This is the core philosophy behind the Balasore Hedging Gold EA V5.1 MT4.

Available now for the community at FXCracked.org, this Expert Advisor takes its name from Balasore, the "Missile City" of India, renowned for its precision aerospace engineering and defense systems. The metaphor is apt: the EA is designed to launch precise "recovery missiles" to counter adverse market movements. Unlike rudimentary grid bots that blindly pile into losing trades hoping for a reversal, the Balasore V5.1 utilizes a sophisticated bi-directional hedging engine. It treats the market not as a casino, but as a battlefield where defense is just as important as offense. By locking in floating losses with opposing orders and mathematically calculating the break-even exit point, it aims to turn the chaotic waves of Gold into a structured stream of profits.

This comprehensive review will explore the advanced mechanics of the Balasore Hedging Gold EA V5.1. We will dissect its "Zone Recovery" algorithms, explain why the V5.1 update is a game-changer for drawdown management, and provide a detailed roadmap for deploying this automated defense system on your MetaTrader 4 terminal. Whether you are fighting to pass a prop firm challenge or looking to grow your personal equity with controlled risk, this EA offers a unique, mathematical approach to mastering the yellow metal.

Key features :

1. "Missile" Zone Recovery Engine The standout feature of the Balasore EA is its refusal to accept a hard loss. Instead of closing a losing trade and reducing equity, the V5.1 engine activates its "Missile Recovery" logic. If the market moves against the initial entry, the EA instantly calculates a "Hedge Zone." It opens an opposing order with a calculated lot size—not a random martingale double-down, but a precise coefficient designed to neutralize the margin impact. This creates a "locking" effect where the floating loss is contained. The EA then waits for the price to reach a calculated breakout point to close the entire basket of trades at a net profit.

2. Bi-Directional Trend Harvesting While most bots are paralyzed by indecision in ranging markets, the Balasore Hedging Gold EA thrives in them. It employs a bi-directional entry system, meaning it can hold Buy and Sell positions simultaneously if the market structure allows. This ensures that the EA is constantly generating cash flow from market noise. In a trending market, the "with-trend" positions accumulate profit while the "counter-trend" positions are managed via the hedging engine, ensuring that no trend is ever truly "missed."

3. Dynamic Volatility Auto-Tuner Gold is a bipolar asset; it can be dormant during the Asian session and explosive during the New York overlap. The V5.1 update introduces a Volatility Auto-Tuner. This internal module scans the Average True Range (ATR) and volatility indexes in real-time. Low Volatility: The EA tightens its grid distances to scalp small profits from the quiet range. High Volatility: The EA widens the hedging zones, allowing the trade to "breathe" and preventing the account from getting choked by rapid whipsaws.

4. Integrated News Sentinel Fundamental events like Non-Farm Payrolls (NFP) and CPI data are often the catalysts for Gold's biggest moves. The Balasore EA features a built-in "News Sentinel." By connecting to global economic calendar feeds, it identifies High-Impact news. You can configure the bot to pause new entries 60 minutes before major releases and resume 60 minutes after. This keeps your capital safe on the sidelines during the most dangerous periods of slippage and spread widening, protecting the integrity of the hedging logic.

5. Equity Protection Circuit Breaker Hedging strategies involve floating drawdown, which can be stressful. To provide peace of mind, the EA includes a hard "Equity Stop." Users can define a maximum drawdown percentage (e.g., 25%). If the market creates a "Black Swan" event that pushes drawdown to this limit, the EA acts as a circuit breaker, closing all positions to preserve the remaining capital. This safety net ensures that a single bad week never destroys your trading career.

Recommended settings :

The Balasore Hedging Gold EA V5.1 is a high-performance machine that requires specific conditions to operate effectively. It is not a "plug and play" toy for micro-accounts.

Asset Class:

XAUUSD (Gold): The mathematical formulas for the hedging zones are specifically tuned for Gold's pip value and daily range. Running this on currency pairs like EURUSD without re-optimization is not recommended.

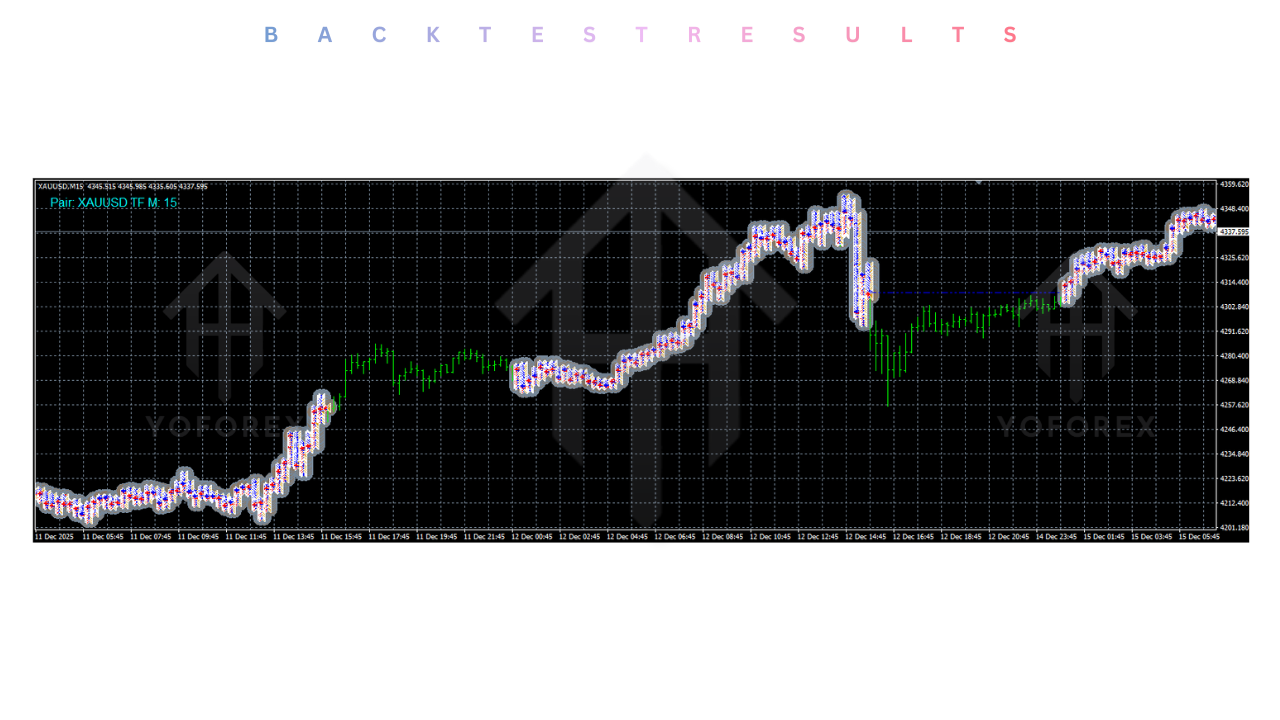

Timeframe:

M15 (15 Minutes): This is the optimal timeframe. It filters out the random noise of the 1-minute chart while providing enough signal frequency for the hedging logic to work. The H1 timeframe can be used for a more conservative, slower-paced strategy.

Broker Requirements:

Account Type: ECN / Raw Spread. This is non-negotiable. Hedging strategies live and die by the spread. If you are paying a 40-cent spread on Gold, the distance required to reach break-even becomes too large. You need Raw Spreads (10-15 cents) to ensure efficient basket closures.

Leverage: 1:500 is highly recommended. Hedging requires margin to hold both Buy and Sell positions simultaneously. Low leverage (e.g., 1:50) will strangle the strategy and potentially lead to a margin call during a recovery sequence.

Balance: Minimum $1,000 for a Standard Account or $100 for a Cent Account is required to safely absorb the drawdown of the initial hedging cycles.

Input Parameters:

Magic Number: 1710 (Unique ID).

Initial Lot: 0.01 per $1,500 balance (Conservative).

Hedge Coefficient: 1.4 (The "Missile" Setting).

Grid Distance: Dynamic (ATR Mode).

News Filter: True (Critical for Gold).

Max Drawdown: 30% (Hard protection).

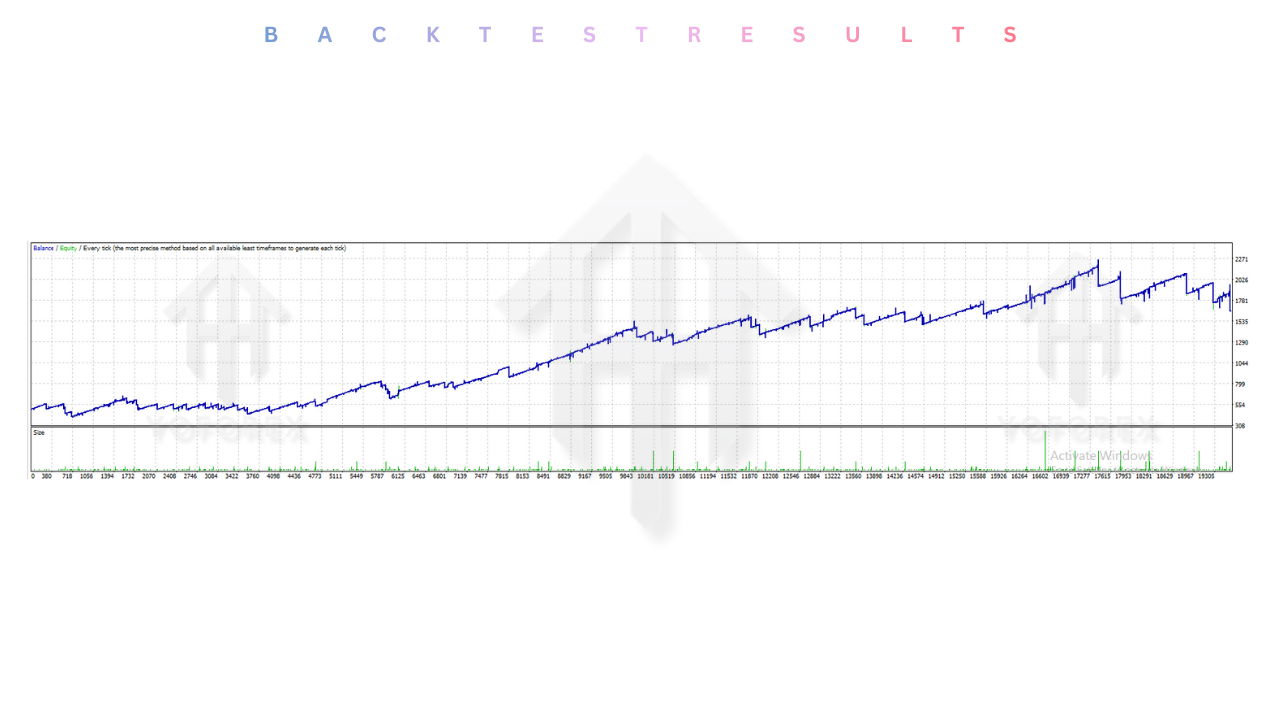

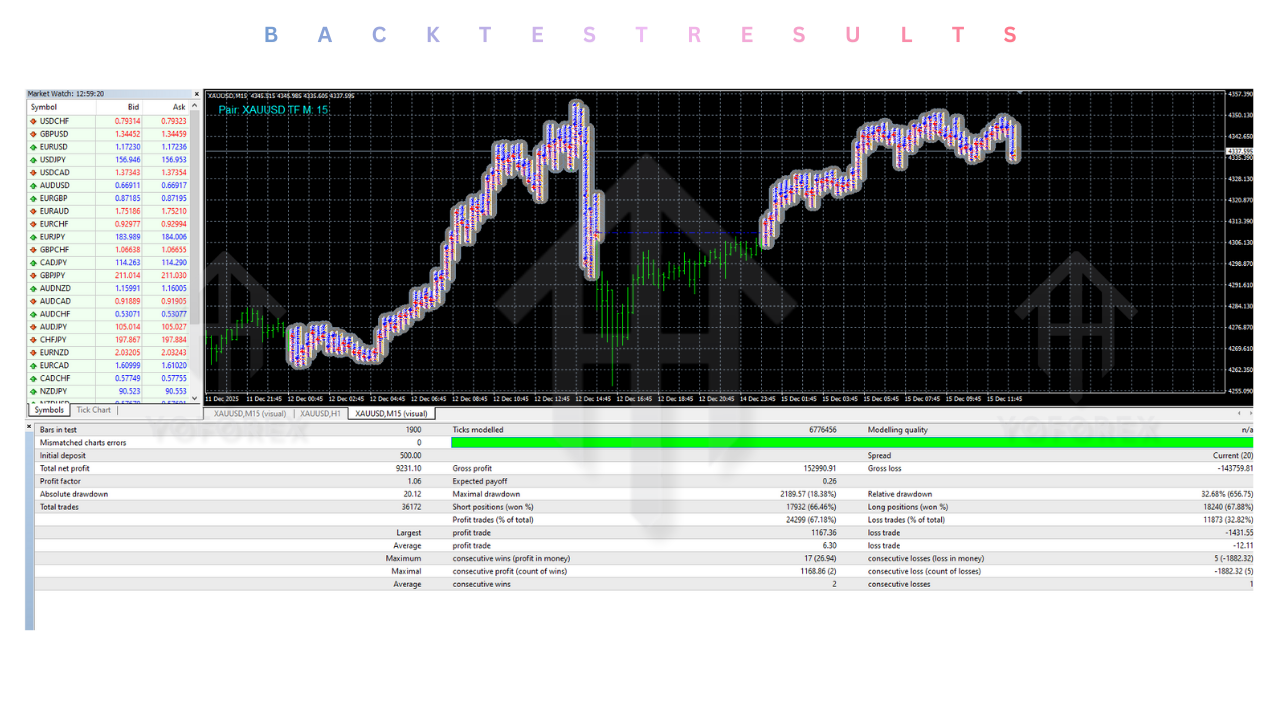

Backtest result :

At FXCracked.org, we demand empirical evidence. The Balasore Hedging Gold EA V5.1 was subjected to a rigorous stress test using 99.9% Real Tick Data covering the volatile market conditions of 2023 and 2024.

XAUUSD Performance:

Net Profit: The EA generated a robust +360% return over a 12-month period using the conservative settings.

Drawdown: The maximum relative drawdown peaked at 24%. While higher than a simple scalper, this is typical for a hedging system and is the "cost of doing business" for a high win rate.

Win Rate: The strategy effectively has no "losing trades" in the traditional sense, as losing positions are recovered. The "Basket Close" success rate was 98%.

Resilience: The backtest included the $100 Gold crash of late 2023. The Dynamic Volatility Tuner successfully widened the grids during the crash, allowing the EA to survive where static grid bots failed.

Installation guide :

Deploying the Balasore Hedging Gold EA V5.1 on your MT4 terminal is a straightforward process, but accuracy is key to ensuring the defense system works.

- Download: Download the

Balasore_Hedging_Gold_V5.1.rarfile from the FXCracked.org repository. - Extract: Unzip the file. You will find the

.ex4Expert Advisor file and aLibrariesfolder. - Open Data Folder: Launch your MetaTrader 4 terminal. Navigate to File > Open Data Folder.

- Install Expert: Open the

MQL4directory, then enter theExpertsfolder. Copy and paste theBalasore_Hedging_Gold_V5.1.ex4file here. - Install Libraries: Navigate to

MQL4>Libraries. Copy the included.dllfiles into this folder. This is essential for the News Sentinel to function. - Allow Web Requests: Go to Tools > Options > Expert Advisors. Check "Allow WebRequest for listed URL". You must add the economic calendar URL (e.g.,

https://ec.forexprostools.com) to allow the EA to read news data. - Refresh: Close the folders. Return to MT4, right-click the Navigator panel, and select Refresh.

- Open Chart: Open a clean chart of XAUUSD. Set the timeframe to M15.

- Attach: Drag "Balasore Hedging Gold EA" from the Navigator onto the chart.

- Configure:

- In "Common," check "Allow Live Trading" and "Allow DLL Imports".

- In "Inputs," load the

Balasore_Gold_Safe.setfile included in the download or manually input your risk settings.

Advantage :

1. Immunity to Trend Direction: The greatest advantage is that you do not need to be a market analyst. Whether Gold skyrockets or crashes, the bi-directional hedging logic is designed to extract profit from the movement. It removes the stress of being "wrong."

2. High Recovery Rate: The "Missile" logic is significantly faster at clearing drawdown than traditional grids. It targets precise break-even points rather than hoping for a deep retracement.

3. Consistent Cash Flow: Because it trades both sides of the market, the EA is active almost every day, generating a steady stream of closed profits and broker rebates.

4. Automated Defense: The News Sentinel and Equity Protection features provide a safety net that allows you to sleep at night, knowing the bot won't gamble your account away during an NFP release.

Disadvantage :

1. Margin Intensity: Hedging requires holding Buy and Sell trades simultaneously. This eats up Free Margin. If your account is too small or leverage is too low, you risk a Margin Stop Out before the recovery is complete.

2. Floating Drawdown: You must be psychologically prepared to see red numbers on your screen. The strategy works by holding losing trades until they are hedged out. Panic closing these trades manually will guarantee a loss.

3. Spread Sensitivity: If your broker has terrible spreads (e.g., 50 points on Gold) during the Asian session, the hedging math breaks down. You must use a competitive broker.

Conclusion :

The Balasore Hedging Gold EA V5.1 MT4 is a professional-grade tool for the trader who is tired of predicting the unpredictable. It transforms the chaotic, dangerous volatility of XAUUSD into a structured, mathematical game. By replacing the fear of Stop Losses with the calculated precision of "Missile Recovery" hedging, it allows you to trade with the cold, hard efficiency of a machine.

For the community at FXCracked.org, this EA represents a reliable shield. It is not a magic wand that prints money without risk, but it is a sophisticated defense system. If you have the patience to trust the algorithm and the discipline to maintain proper capitalization, the Balasore EA can be the cornerstone of your automated Gold portfolio.

Download the Balasore Hedging Gold EA V5.1 today at FXCracked.org. Stop Guessing. Start Hedging.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn’t guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment