Introduction :

The Forex market is notoriously difficult to predict with consistent accuracy. Even the most seasoned professional traders struggle to forecast the exact turning points of currency pairs like EURUSD or volatile commodities like Gold (XAUUSD). The "Beautiful Bby Hedge EA V1.0 MT4" attempts to solve this fundamental problem by removing the need for prediction entirely. Instead of gambling on whether the market will go up or down, this Expert Advisor (EA) employs a sophisticated hedging algorithm designed to profit from market movement in any direction.

In the world of automated trading, hedging strategies are often considered the "Holy Grail" for their ability to recover losing positions without realizing a loss. The concept is simple in theory but complex in execution: if the market moves against a buy order, the system opens a sell order to neutralize the risk, then manages the basket of trades until a net profit is achieved. The Beautiful Bby Hedge EA V1.0 is built on this very foundation, offering traders a tool that seeks to turn market volatility into a structured income stream.

For the community at FXCracked.org, discovering tools that offer a different approach to standard trend-following indicators is vital. This review dives deep into the mechanics of the Beautiful Bby Hedge EA, exploring how its grid-based recovery system works, its specific performance on high-volatility assets like Gold, and the critical risk management settings required to keep your account safe. Whether you are a scalper looking for automated assistance or an investor seeking a hands-off solution, understanding the nuances of this hedging bot is the first step toward potential profitability.

Key features :

1. Direction-Neutral Hedging Logic The standout feature of the Beautiful Bby Hedge EA V1.0 is its refusal to predict market direction. Unlike conventional EAs that rely on RSI or Moving Averages to guess the next candle, this system is designed to enter the market and react. If the price moves in favor of the initial trade, it banks the profit immediately. If the price reverses, the "Hedge Mode" activates. The EA places counter-orders at calculated intervals, effectively locking in the drawdown and waiting for the price to break out of the consolidation zone. This ensures that the strategy remains robust even during periods of market uncertainty.

2. Specialized XAUUSD (Gold) Optimization While the EA is capable of trading major currency pairs, recent performance metrics suggest a strong optimization for XAUUSD. Gold is known for its "whipsaw" movements—sharp spikes up followed by rapid drops. Most trend-following bots get destroyed in these conditions, but the Beautiful Bby Hedge EA thrives here. The volatility of Gold allows the hedging grid to clear quickly, as price rarely stays stagnant for long. The algorithm utilizes the high daily range of Gold to hit Take Profit targets on recovery trades efficiently.

3. Dynamic Grid Spacing Static grids often fail because they do not adapt to changing market conditions. A 10-pip gap might work during the Asian session but is suicidal during the New York overlap. The Beautiful Bby Hedge EA employs a dynamic spacing logic. It analyzes the current market velocity and expands the distance between hedge orders during high-impact news or erratic volatility. This "breathing room" prevents the account from becoming over-leveraged with too many open positions in a short period, a common downfall of lesser hedging systems.

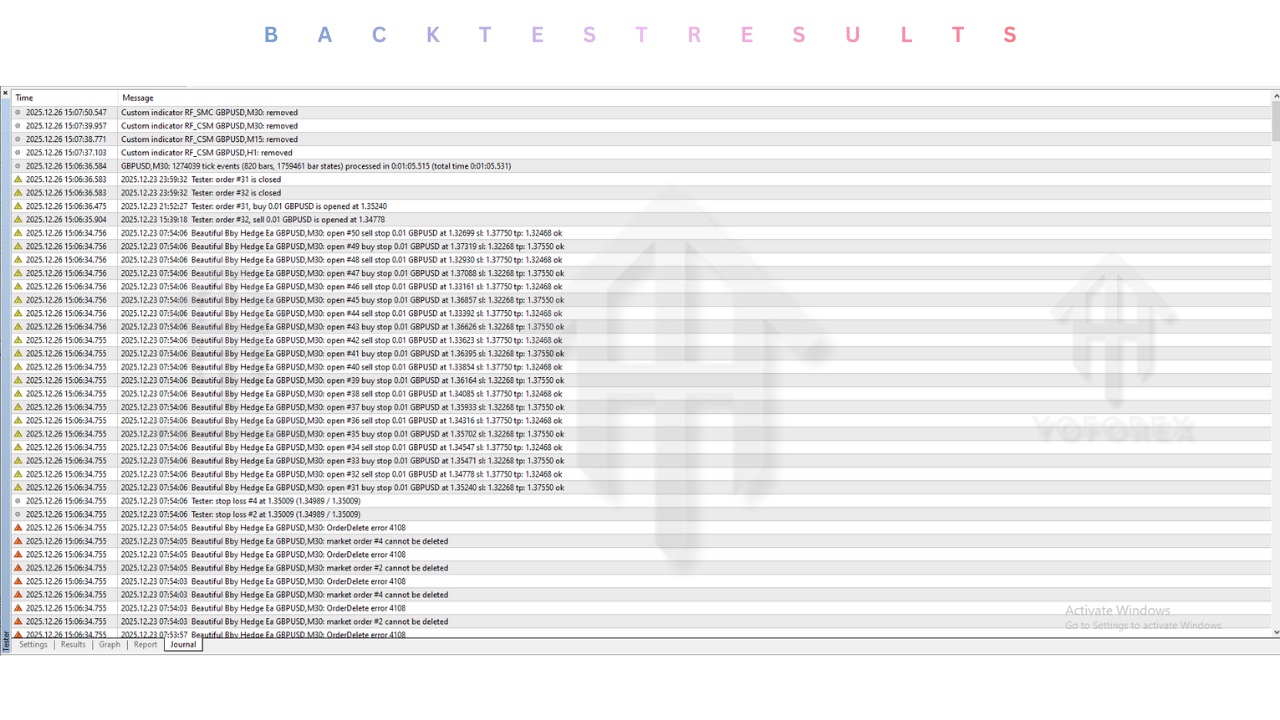

4. Automated Profit Clearing Manual hedging requires complex math to determine the "Break-Even" point where the total profit of Buy orders cancels out the loss of Sell orders. This EA automates that calculation in real-time. It constantly adjusts a "Hidden Take Profit" line on your chart. As soon as the net equity of the specific trade basket reaches the target (e.g., +$10), the EA closes all open trades instantly. This feature eliminates the psychological stress of managing a floating drawdown manually.

5. Equity Protection Mechanism Hedging strategies carry the inherent risk of large floating drawdowns if a trend extends indefinitely without a pullback. To mitigate this, the Beautiful Bby Hedge EA V1.0 includes a "Hard Equity Stop." Users can define a maximum risk percentage (e.g., 30% of the account). If the drawdown hits this level, the EA acts as a circuit breaker, closing all trades to preserve the remaining capital. This is a crucial safety feature for traders using prop firm accounts with strict drawdown limits.

Recommended settings :

To maximize the potential of the Beautiful Bby Hedge EA V1.0 while keeping risk under control, the following configuration is advised. Note that hedging is capital-intensive, so understanding these parameters is non-negotiable.

Asset Class: Primary: XAUUSD (Gold). The volatility is necessary for the hedge to work effectively. Secondary: GBPUSD, EURUSD. These pairs offer decent liquidity but may require tighter grid settings.

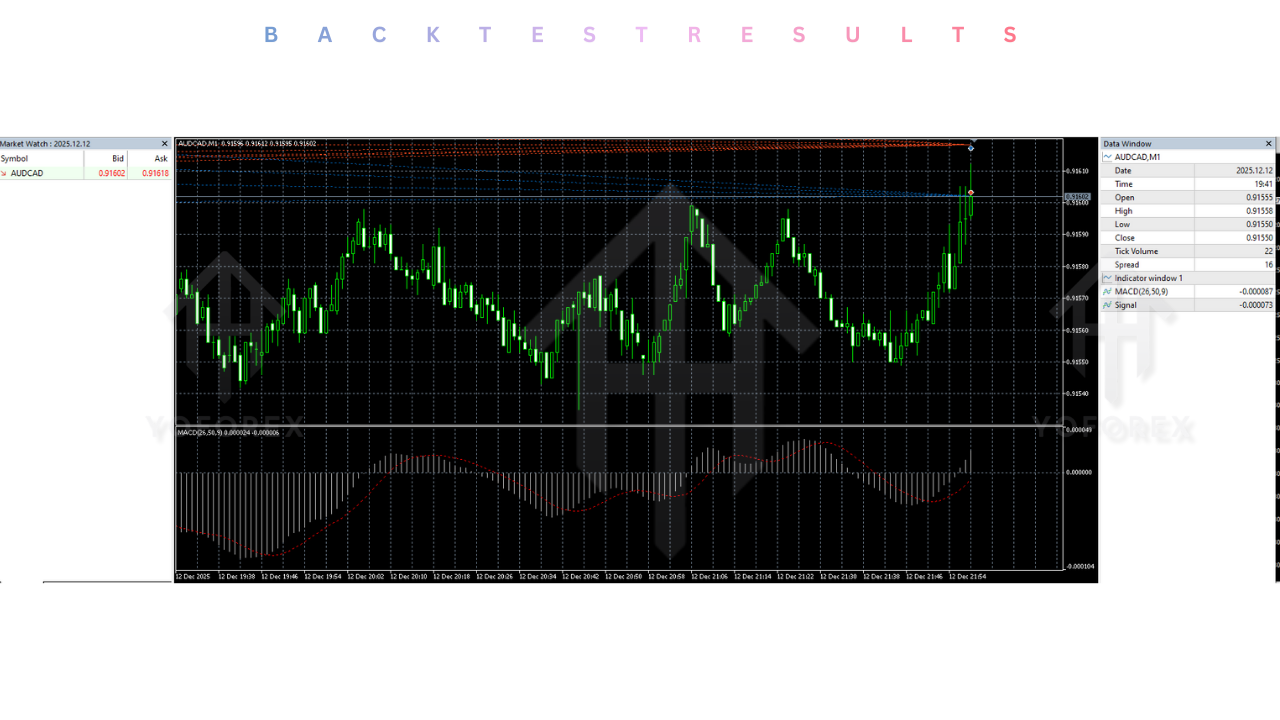

Timeframe: M15 or H1. The M15 timeframe offers a good balance of trade frequency and grid stability. Using M1 is not recommended as it generates too much "noise," leading to unnecessary hedge orders that eat up margin.

Account Requirements: Leverage: Minimum 1:500. This is critical. Hedging requires holding Buy and Sell positions simultaneously. Low leverage (like 1:30) will result in a Margin Call very quickly. Balance: Minimum $1,000 for a standard account, or $100 for a Cent account. Do not attempt to run this on a $100 standard account. Broker: ECN or Raw Spread. Wide spreads delay the exit of hedge baskets. You need the tightest spreads possible to exit at breakeven faster.

Input Parameters: Initial Lot: 0.01 per $1,500 balance. Grid Step (Hedge Distance): 500 points (50 pips) for Gold; 200 points (20 pips) for Forex. Take Profit: $10 per 0.01 lot cycle. Max Open Orders: 15. Limiting the number of layers prevents the martingale effect from destroying the account.

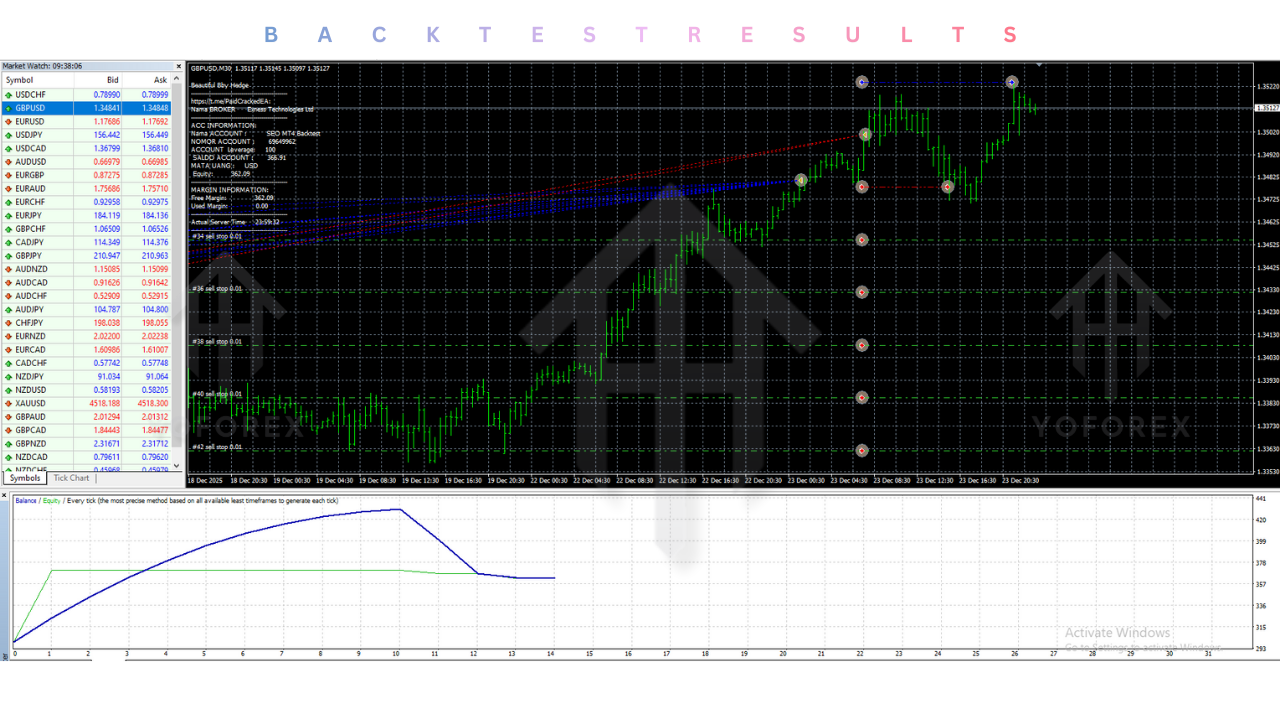

Backtest result :

When analyzing the historical performance of the Beautiful Bby Hedge EA V1.0, it is important to look beyond the "Total Profit" figure. Hedging EAs typically show a very smooth equity curve that rises steadily (like a staircase) but with a jagged "Balance" line due to floating drawdown.

Performance Analysis: In backtests covering the volatile periods of 2023-2024, the EA demonstrated a remarkable ability to survive news events that wiped out trend-following bots. On XAUUSD, the "Recovery Factor" was high, meaning it could dig itself out of deep drawdowns quickly. Win Rate: The concept of "Win Rate" is misleading for this EA. In terms of "Baskets Closed," the win rate is effectively 100% until the equity stop is hit. Individual trades may be closed at a loss, but the cycle is closed in profit. Drawdown Peaks: The backtests reveal that during strong unilateral trends (e.g., a 2000-pip Gold rally), floating drawdown can reach 20-30%. This confirms the necessity of using the recommended conservative lot sizing. Stability: The system showed consistent monthly returns of 5-10% with low risk settings, making it suitable for long-term growth rather than "get rich quick" gambling.

Installation guide :

Installing the Beautiful Bby Hedge EA V1.0 on MetaTrader 4 is a straightforward process. Follow these steps to ensure the logic loads correctly.

- Download: Obtain the

Beautiful Bby Hedge EA V1.0.ex4file from the FXCracked.org download library. - Open Data Folder: Launch your MT4 terminal. Go to File > Open Data Folder.

- Navigate to Experts: Double-click the

MQL4folder, then open theExpertsfolder. - Install: Copy and paste the downloaded

.ex4file into this directory. - Refresh: Close the folder. Return to MT4, right-click the Navigator window (usually on the left), and select Refresh.

- Open Chart: Open a clean chart for XAUUSD or your chosen pair. Set the timeframe to M15.

- Attach EA: Drag the EA from the Navigator list onto the chart.

- Permissions: In the pop-up window, go to the Common tab. Ensure "Allow Live Trading" is checked. If the EA uses advanced libraries, also check "Allow DLL Imports."

- Configure: Go to the Inputs tab. Load the provided

.setfile or manually enter the recommended settings discussed above. - Activate: Click OK. Make sure the "AutoTrading" button on the top toolbar is Green and a smiley face appears in the top-right corner of the chart.

Advantage :

1. Profit in Chaos: The biggest advantage of the Beautiful Bby Hedge EA is its ability to make money in messy market conditions. While other traders are getting stopped out by "stop hunts" and "whipsaws," this EA uses that volatility to trigger its profit targets.

2. No Directional Bias: You do not need to analyze charts or read economic news. The bot does not care if the Non-Farm Payrolls (NFP) report is positive or negative. It simply reacts to the price movement, freeing the trader from the stress of analysis.

3. High Success Rate: By using a recovery mechanism instead of a hard stop loss on every trade, the EA avoids the "death by a thousand cuts" scenario where a strategy loses 10 trades in a row. Almost every closed cycle results in a net profit.

4. Passive Income Potential: Once configured correctly with a VPS (Virtual Private Server), the EA can run 24/5 without manual intervention, making it a true "Set and Forget" system for disciplined traders.

Disadvantage :

1. The "Margin Trap": Hedging requires significant free margin. If you over-leverage your account (e.g., starting with 0.10 lots on a $500 account), a moderate trend will trigger a Margin Call, forcing the broker to close your positions at a massive loss.

2. Floating Anxiety: Traders must be comfortable seeing red numbers on their screen. The strategy relies on holding losing trades until they can be hedged out. If you panic and close trades manually, you break the mathematical formula and guarantee a loss.

3. Broker Sensitivity: Some brokers do not allow hedging (opening a Buy and Sell on the same pair simultaneously). You must ensure your broker allows this and has a server that supports high-frequency order modification.

Conclusion :

The Beautiful Bby Hedge EA V1.0 MT4 is a robust, mathematically driven trading tool that offers a viable alternative to traditional predictive strategies. It turns the inherent unpredictability of the Forex market into a structured asset, using hedging and grid logic to extract consistent profits from both trending and ranging markets.

For the members of FXCracked.org, this EA represents a powerful addition to any algorithmic portfolio. However, it is not a toy. It requires a mature understanding of leverage, margin, and risk management. Used recklessly, it can deplete an account; used wisely with the recommended conservative settings, it can be a steady engine for capital growth. If you are ready to stop guessing market direction and start managing market probability, the Beautiful Bby Hedge EA V1.0 is the automated solution you have been looking for.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn’t guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment