Belkaglazer EA V2.282 MT4 — Transparent Automation for Traders Who Want Control

If you’re hunting for an MT4 expert advisor that’s flexible enough to fit your style—scalping, swing, or trend-following—Belkaglazer EA V2.282 is worth a serious look. It’s built for clean execution and sustainable risk management, steering clear of high-risk gimmicks like martingale or grid stacking. The result? A professional, rules-first trading workflow you can actually understand, adjust, and trust over the long haul.

What Makes Belkaglazer EA Different?

Belkaglazer EA V2.282 is a professional algorithmic trading system designed for MetaTrader 4. Unlike “black box” robots that hide logic or rely on hedging/multipliers to claw back losses, Belkaglazer emphasizes clarity and control. You get well-labeled inputs, sensible defaults, and room to adapt parameters to the way you trade.

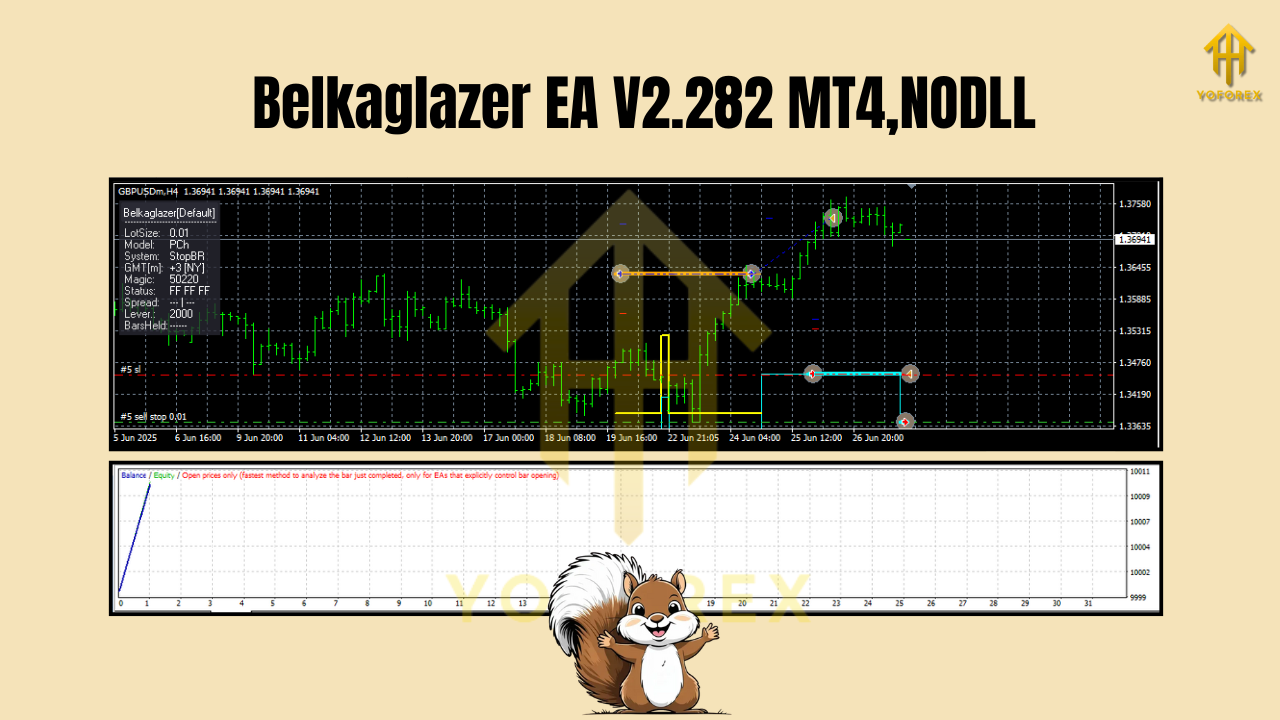

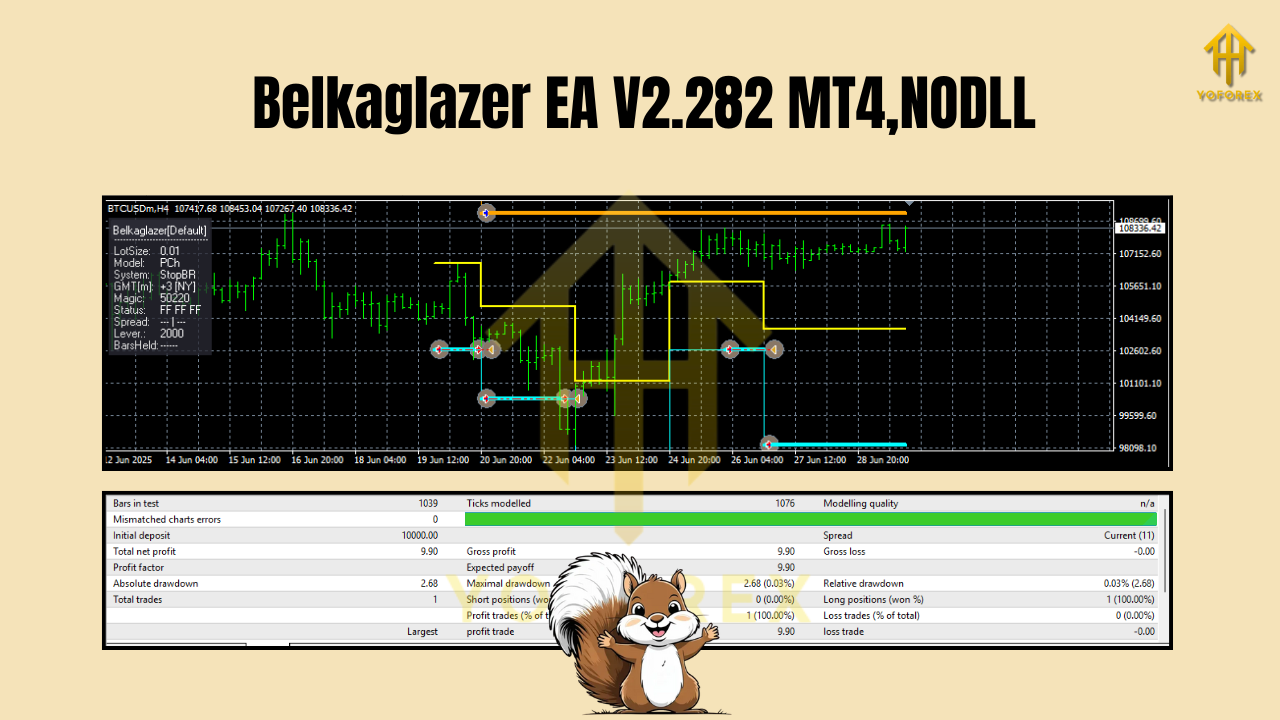

- Markets covered: Major Forex pairs (e.g., GBPUSD, EURUSD, etc.) and crypto CFDs like BTCUSD and ETHUSD

- Time frames supported: M5, M15, M30, H1, H4

- Minimum deposit: $500 (with sensible risk; more if you run multiple symbols or higher lot steps)

- Philosophy: No martingale, no grid, no nonsense—just robust signals, strict risk, and clean positions.

Who’s it for? Traders who want a serious MT4 expert advisor with transparent logic, good documentation, and the ability to tweak risk per trade, filters, and signal conditions without turning the account into a science experiment.

Key Features (At a Glance)

- No Martingale or Grids: Zero compounding of losses; risk stays capped by design.

- Multiple Strategy Modes: Configure for scalping, swing, or trend-following behaviors.

- Robust Risk Controls: Fixed fractional risk, hard stop-loss and take-profit, optional trailing.

- Clean Execution: Focus on precision entries and conservative exposure; no “revenge trading.”

- Multi-Asset Ready: Works on major FX pairs and crypto CFDs (BTCUSD, ETHUSD).

- Time Frame Flexibility: From M5 for nimble entries to H4 for broader swings.

- News-Aware Trading (Optional): Pause or reduce exposure around high-impact events (if you enable such filters).

- Session Filters: Trade only London/NY overlap, or keep it running 24/5—your call.

- Parameter Transparency: Every key component is adjustable; no hidden “secret sauce.”

- Backtest-Friendly: Consistent logic enables reliable historical testing and forward testing.

Strategy Modes Explained

1) Scalping Mode (M5–M15)

If you prefer quick-hit trades and tight risk, use lower time frames like M5 or M15. You’ll want:

- Conservative spread filters (avoid widening spreads)

- Hard SL and modest TP; consider a trailing stop only if the pair trends smoothly

- Avoid running during thin liquidity (late Friday, rollover, major news spikes)

2) Swing Trading (M30–H1)

This is a great balance of signal quality and trade frequency:

- Aim for risk per trade between 0.5%–1.5%

- Use ATR-based stops for volatility-aware placement

- Consider partial exits or a break-even shift after price moves in your favor

3) Trend-Following (H1–H4)

When you want to capture larger directional moves:

- Wider stops; fewer but higher-quality signals

- Consider pyramiding only if your risk plan allows it (never martingale)

- Let winners run with trailing logic; accept smaller win rates but bigger average winners

Recommended Pairs, Time Frames & Capital

- Forex pairs: GBPUSD, EURUSD, and other majors with consistent liquidity

- Crypto pairs: BTCUSD and ETHUSD (expect higher volatility; reduce per-trade risk)

- Time frames: M5, M15, M30, H1, H4 (pick based on your mode and personality)

- Minimum deposit: $500 is the practical floor for single-symbol trading with small lot sizes. If you’ll run multiple pairs or crypto, start higher so your risk per trade stays tiny.

Tip: More capital ≠ more risk. Keep your risk % per trade small and consistent.

Installation & Setup (MT4)

- Add the EA to MT4

- Open MT4 → File → Open Data Folder

- Go to MQL4 → Experts and copy the Belkaglazer EA file there

- Restart MT4 or refresh Navigator (right-click → Refresh)

2. Attach to Chart

- Open a chart (e.g., GBPUSD H1)

- Drag Belkaglazer EA from Navigator → Expert Advisors onto the chart

- Allow Algo Trading and check DLL if the EA requires it (most don’t)

3. Configure Inputs

- Set Risk Percent (start low: 0.5%–1%)

- Choose your mode (scalp/swing/trend) and time frame

- Adjust trade sessions, max spread, and slippage

- Optional: enable news filter/session filters

4. Run on Demo First

- Observe entries, stops, and exits for at least 2–4 weeks

- Only go live when behavior matches your expectations

Backtesting & Optimization Tips

- Data Quality: Use high-quality tick data where possible; spread simulation matters.

- Sample Size: Run multi-year tests for FX; multiple regimes for crypto.

- Walk-Forward Logic: Avoid overfitting. Do segmented tests across different periods.

- Robustness Checks: Shake inputs by ±10–20% and make sure performance doesn’t collapse.

- Forward Test: After a solid backtest, forward test on demo/VPS to confirm live execution.

Goal: You’re not chasing the “perfect” parameter set—just a stable, sensible one.

Risk & Money Management

- Keep risk small: 0.25%–1.5% per trade is a reasonable envelope

- Daily loss guard: Consider stopping for the day after 2–3 losses

- Symbol limits: Limit concurrent trades or use a global max risk cap

- Crypto caution: Use tighter lot sizing due to volatility, and widen stops logically

Best Practices for Live Trading

- Low-spread, fast-execution broker (ECN/Razor-style accounts help)

- Reliable VPS near your broker’s server to reduce latency

- Consistent conditions: Don’t keep switching time frames and pairs every other day

- Stay news-aware: Big releases can temporarily distort spreads and fills

- Log everything: MT4 journal + screenshots help spot issues quickly

Pros & Cons

Pros

- Flexible strategy modes (scalp, swing, trend)

- No martingale or grid exposure

- Transparent parameters and logic

- Works on majors and crypto CFDs

- Backtest- and forward-test-friendly

Cons

- Requires discipline; not a “plug-and-pray” bot

- Crypto symbols demand stricter risk control

- Over-optimization can still happen if you push it too far

Final Verdict

Belkaglazer EA V2.282 MT4 is a capable, transparent MT4 expert advisor that respects risk and gives you control. Whether you favor M5 scalps or H4 swings, its no-martingale, no-grid design aims for stability over spectacle. Start on demo, dial in your mode and filters, and only then move to live with conservative risk. If you want a flexible EA that you can actually understand and tune—without betting the farm—this one should be on your shortlist.

Comments

проститутки астрахань трусовский район зрелые проститутки астрахани

Leave a Comment