If you’ve been hunting (pun intended) for a reliable MT5 expert advisor that doesn’t blow up accounts or demand a PhD to configure, Black Wolf EA V2.16 MT5 is worth a serious look. It’s built to adapt—quiet in low-volatility sessions, aggressive when momentum kicks up, and conservative when spreads expand. In short, it behaves like a disciplined trader who actually sticks to the plan. Below, I’ll walk you through the strategy logic, recommended setup, risk controls, backtesting workflow, and practical tips so you can deploy it confidently on a live or prop-firm account.

What Black Wolf EA V2.16 Actually Does (Overview)

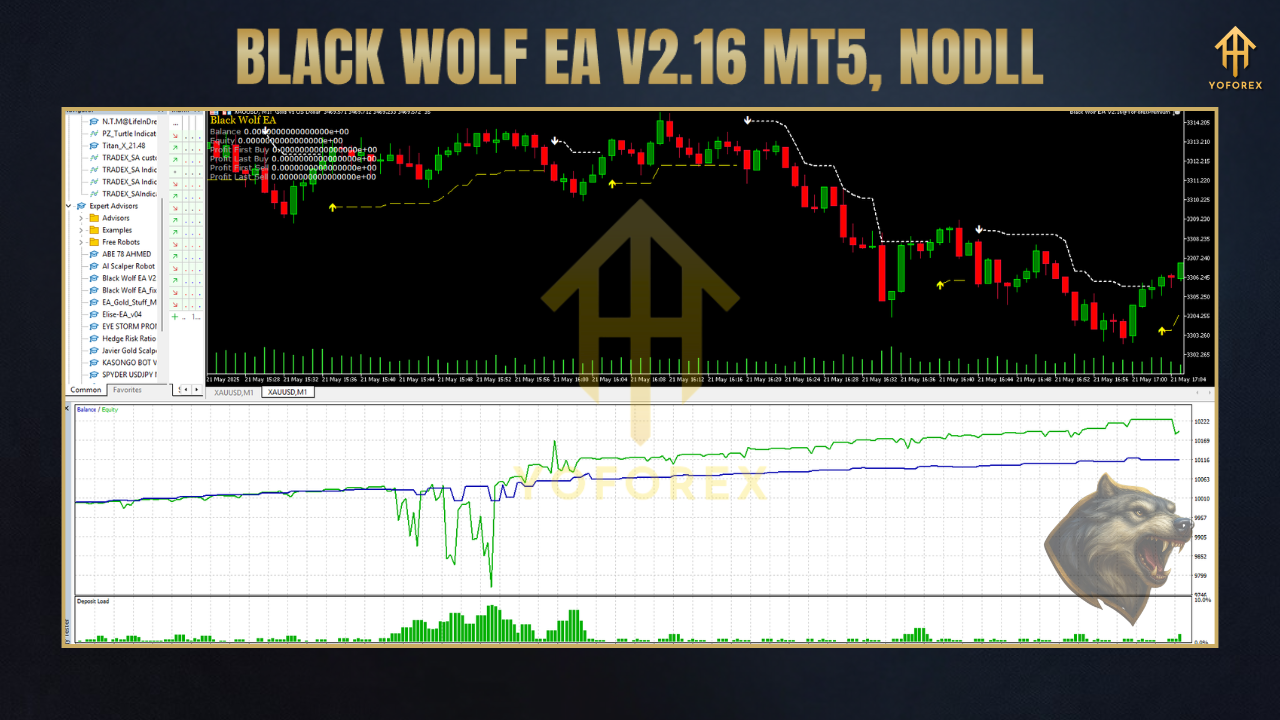

Black Wolf EA V2.16 MT5 is an algorithmic trading system for MetaTrader 5 designed to automate both short-term scalps and medium-term swings. Under the hood, it blends a trend-bias filter with precise entry logic that looks at recent volatility, candle structure, and spread/latency gates before it pulls the trigger. The outcome is a bot that tries to trade the right moments—not all moments.

You’ll get three practical modes right out of the box:

- Scalper Mode for M5/M15 on low-spread brokers during active sessions;

- Intraday Mode for M15/M30 in steady trends with measured volatility;

- Swing Mode for H1/H4 when you want fewer but higher-quality setups.

The EA aims to protect equity with strict position sizing and a clear stop-loss/TP framework. It does not require martingale or dangerous grid stacking. Instead, it lets you choose between fixed lots or percent-risk per trade, with optional features like partial close and breakeven to lock gains and reduce tail risk. Throw in a built-in equity guard and spread/slippage filters, and you’ve got a bot that’s watchful as a wolf pack leader—entering only when the odds look decent.

Who it’s for: traders who prefer rules, consistency, and fewer surprises. If you’re tired of “all-gas-no-brakes” martingale bots, this EA gives you the brake pedal and a working seatbelt.

Key Features You’ll Actually Use

- Multi-Mode Engine: Scalper (M5/M15), Intraday (M15/M30), and Swing (H1/H4) presets.

- Trend + Volatility Filter: Trades with bias; avoids chop when volatility is abnormally low.

- Smart Risk Control: Fixed lot or risk-percent with ATR-aware stops and realistic targets.

- No Forced Martingale: Averaging is off by default. If you enable it, you can cap steps and distance.

- Equity Protection: Daily loss guard and global drawdown cut-off to keep you in the game.

- Spread & Slippage Gate: Sits out when the market’s too expensive to trade (news spikes, rollovers).

- Breakeven + Partial Close: Secure early gains; trail or scale out at logical milestones.

- Magic Number Isolation: Run multiple pairs on one account without position conflicts.

- Auto Comment & Logging: Clear order tags and readable logs for audits and prop reviews.

- News-Sensitive Option: If your build includes a news filter, you can pause around high-impact events.

- Time Window Control: Trade only during your preferred sessions (e.g., London/New York overlap).

- Preset Packs: Ready-made .set files for scalping and swing—ideal starting points you can tweak.

Recommended Pairs, Timeframes & Risk

Pairs: Start with the majors—EURUSD, GBPUSD, USDJPY—for tight spreads and cleaner structure. Once you’re comfortable, you can test XAUUSD (Gold) in Swing Mode on H1/H4 with conservative risk.

Timeframes:

- Scalper: M5 or M15 (only on a raw-spread ECN account)

- Intraday: M15/M30

- Swing: H1/H4

Minimum Deposit & Leverage:

- Minimum: ~$100 (a cent account helps if you’re learning)

- Recommended: ~$300–$500+ for stable sizing

- Leverage: 1:200 or higher is fine; always size risk, don’t rely on leverage.

Position Sizing (starting point):

- Fixed lot: 0.01 per $200–$300 equity (Scalper)

- Risk %: 0.5%–1.5% per trade (most prop firms stay under 1%)

Adjust these based on your max daily loss rules and drawdown tolerance.

VPS & Broker:

- VPS latency: <10–20ms to your broker if you scalp

- Broker: ECN, raw spread, fast execution, reliable fills

- Trading hours: Disable during rollover (5 minutes before/after) and major news if you scalp

Strategy Logic (Plain-English)

Black Wolf EA first checks if the trend bias and volatility regime align (e.g., momentum not exhausted, no micro-range chop). If conditions pass the spread/slippage gates, it watches for a clean trigger—often a candle-pattern confirmation with a volatility-aware buffer to avoid fakeouts. It places a trade with a predefined stop and target (or dynamic trailing). If price accelerates quickly in your favor, breakeven snaps to protect capital; on sluggish runs, partial take-profit can de-risk the position.

The Swing template trades fewer signals but aims for better R-multiples. Scalper mode goes for high-probability micro-moves—but only when costs (spread + slippage) are low enough to keep the math in your favor.

How To Install & Configure (Step-By-Step)

- Copy the EA: Place

Black Wolf EA V2.16.ex5into MQL5/Experts in your MT5 data folder. - Restart MT5: Or right-click Experts in Navigator → Refresh.

- Allow Algo Trading: Enable the “Algo Trading” button in MT5’s top toolbar.

- Attach to Chart: Open EURUSD (for example), set timeframe (M5 for scalping or H1 for swing), and drag the EA onto the chart.

- Load a Preset (.set): Start with a provided preset like

BlackWolf_Scalper_M5.setorBlackWolf_Swing_H1.set(if included).

Configure Risk:

- Choose Fixed Lot or Risk % per trade (start small: 0.5%–1%).

- Set Daily Loss Guard (e.g., 3%–5%) and enable Equity Protection.

- Set Trade Sessions: Limit trading to London/NY overlap for scalper mode; keep swing mode broader.

- Spread/Slippage Filters: Keep defaults strict; widen only if your broker is consistently tight.

- Magic Numbers: Unique per chart/pair to avoid order conflicts.

- Run on a VPS: If you scalp, run 24/5 with low latency.

Backtest Workflow & What To Look For

- Modeling Quality: Use high-quality tick data (variable spread if possible).

- Period: Test at least 12 months that include both trends and ranges.

- Costs: Set realistic spread and commission to match your broker.

- Risk: Fix risk at 1% per trade initially to compare apples-to-apples.

Metrics That Matter:

- Max Drawdown (relative) and consecutive losses—can you stomach them?

- Profit Factor > 1.3 on realistic costs tends to be workable.

- Expectancy and Win Rate—ensure the combo fits your psychology.

- Time in Market—lower is often safer, especially on prop rules.

Equity Curve Character: Gentle stair-steps are better than vertical spikes.

News Windows: For scalper setups, compare results with news disabled vs enabled.

Sensitivity Tests: Slightly vary stops/targets and see if performance holds—robust strategies don’t implode with small tweaks.

Live sanity check: Start with micro lots and verify that live spreads, slippage, and fills don’t ruin the math you saw in backtests. If live costs are worse, tighten filters or shift to Intraday/Swing mode.

Prop-Firm Friendly Use (Practical Notes)

- Daily Loss: Set an EA-level daily loss guard (e.g., 3%) below the prop’s hard rule.

- Max Drawdown: Cap risk per trade and limit concurrent trades to avoid clusters.

- News & Rollover: Disable scalping around high-impact events and daily rollover.

- Scaling: Once you pass phase 1 with conservative risk, don’t double risk out of excitement—keep it boring.

Troubleshooting Quick Wins

- “Few trades today?” Check session filters, volatility conditions, and spread gates—no signals is better than bad signals.

- “BE triggers too early.” Nudge breakeven to activate a bit later or use partial close instead.

- “Too many micro-losses.” Widen stop slightly, demand cleaner triggers, or switch to Intraday/Swing.

- “Big news whipsaws.” Pause trading 15–30 minutes before and after major releases when scalping.

FAQ

Does Black Wolf EA use martingale?

Not by default. You control any averaging behavior; keep it capped or leave it off.

Can I run multiple pairs at once?

Yes—just assign unique Magic Numbers per chart.

Do I need a VPS?

Highly recommended for scalping (latency <20ms). For Swing mode, it’s still nice to have.

Will it work on gold (XAUUSD)?

Yes in Swing Mode (H1/H4) with conservative risk and wider stops—test first.

Is it plug-and-play?

Presets help, but your broker conditions and risk tolerance matter. Backtest, then forward-test before scaling.

Risk Disclaimer

Trading CFDs/Forex involves significant risk. Past performance—backtests or forward tests—does not guarantee future results. Only trade with money you can afford to lose, and always validate settings on a demo or small live account first.

Call to Action

Ready to try it? Download Black Wolf EA V2.16 MT5 and start with the included presets. Run a clean backtest, forward-test for a couple of weeks, and then scale with discipline. If you’re aiming for funded accounts or steady side income, treat risk like a hawk and the bot like a skilled assistant, not a money printer.

Comments

Immerse into the stunning realm of EVE Online. Shape your destiny today. Fight alongside hundreds of thousands of explorers worldwide. Join now

contraseña

where is the password ?

Leave a Comment