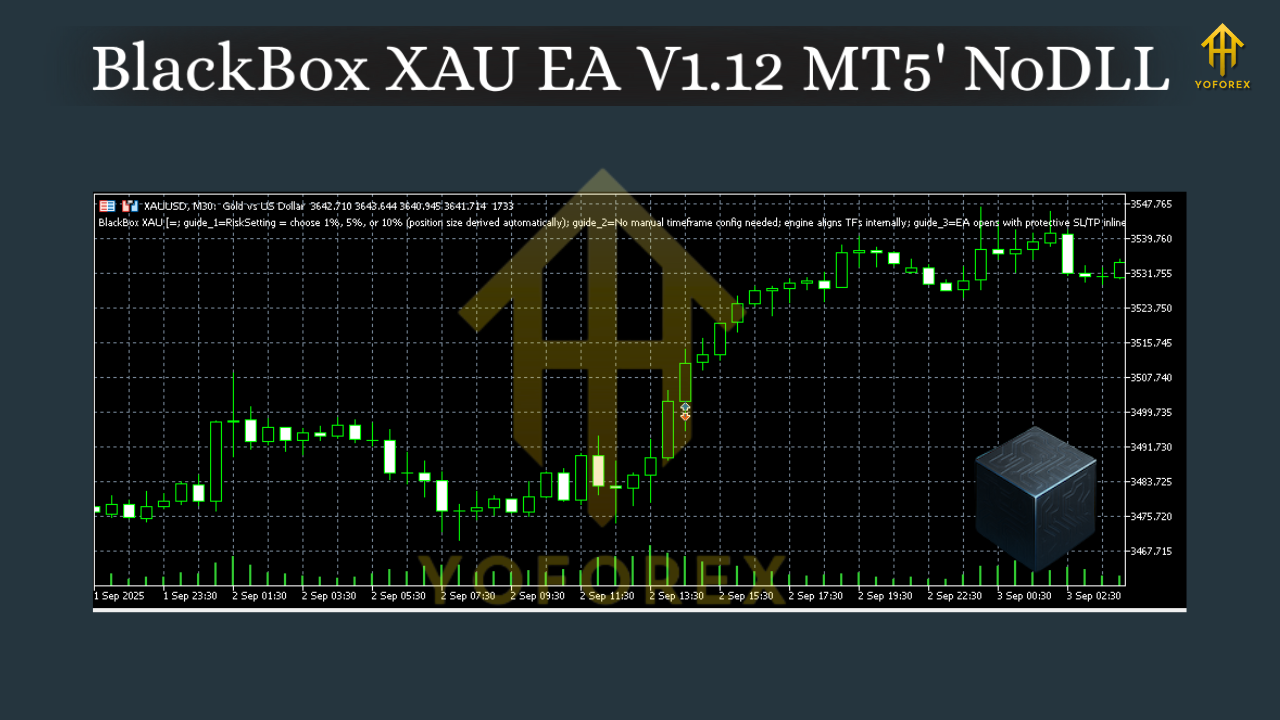

BlackBox XAU EA V1.12 MT5: Rules-Based Gold Trading With Controlled Drawdown

If you’ve ever felt like Gold can be a wild beast—fast spikes, fake breakouts, sudden reversals—you’re not wrong. BlackBox XAU EA V1.12 for MT5 is built specifically to tame that volatility without chasing every candle. It waits for structure, validates momentum, filters noise, and steps in only when risk-to-reward looks decisively in your favor. The promise is simple: consistent, rules-based execution with strict drawdown control, so you can focus on account growth rather than firefighting bad trades.

Instrument: XAUUSD (Gold)

Minimum Deposit: $500

What is BlackBox XAU EA V1.12?

BlackBox XAU is a purpose-built Expert Advisor for MetaTrader 5 that trades Gold with a disciplined decision tree. Instead of reacting to every micro move, it reads the market’s context—volatility regime, intraday trend alignment, liquidity pockets—and executes only when there’s a clear statistical edge. The engine blends momentum confirmation with dynamic risk management so losses stay small, while winners are allowed to develop with smart trailing logic.

A key design choice is control over exposure. You won’t find martingale, grid averaging, or hedging gambits here. The EA runs one clean idea at a time, factoring in spread, slippage, and session dynamics. If the environment isn’t favorable, it simply doesn’t trade. That restraint is exactly what many Gold traders have been missing.

How the Strategy Thinks (in Plain English)

While the exact recipe is proprietary, the workflow looks like this:

- Context first: Identify whether Gold is trending or ranging using higher-timeframe bias and local structure.

- Volatility filter: Measure current ATR/true range to size stops and targets sensibly; avoid thin or erratic conditions.

- Signal quality gate: Confirm short-term impulse aligns with the background bias; skip low-probability setups.

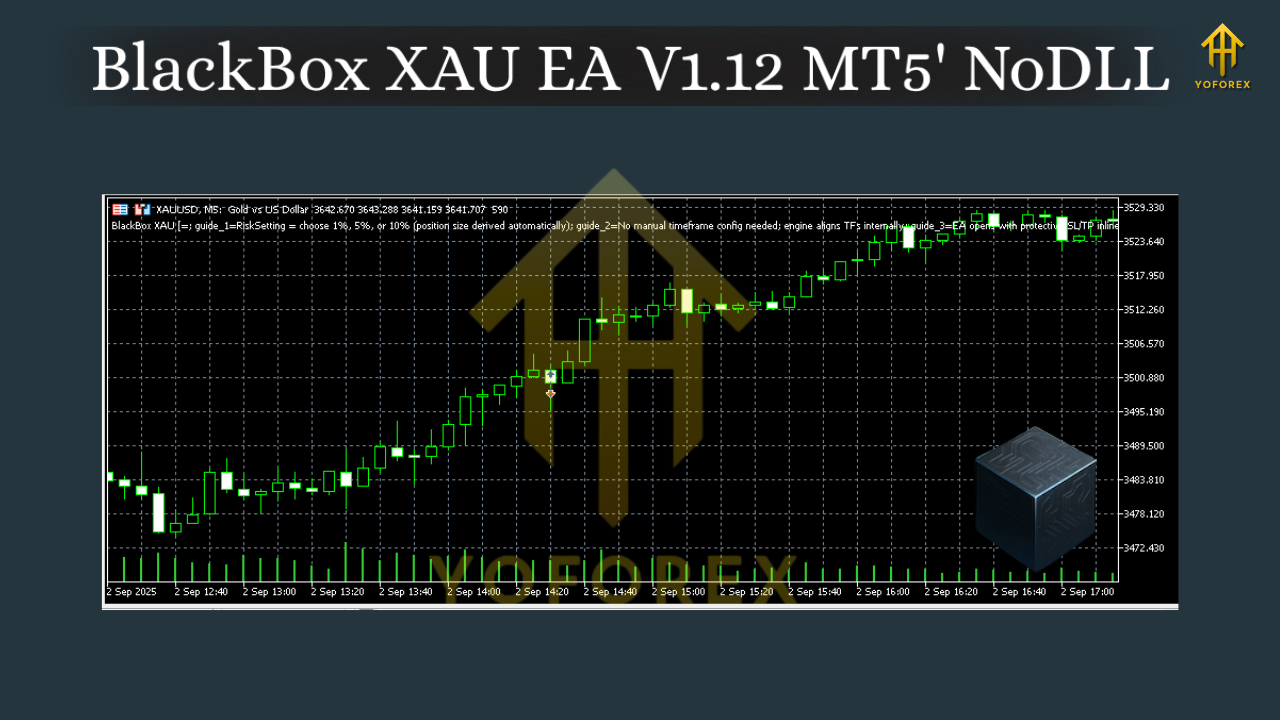

- Precision entries: Use micro-pullback or breakout confirmation to avoid early entries; reduce noise-triggered trades.

- Adaptive protection: Every position has a hard stop; the trailing logic tightens as the trade matures or volatility spikes.

- Capital discipline: Position size is computed from risk percent per trade, not “hope.” No adding to losers. Ever.

Why Traders Like It (Key Features)

- Rules-based execution: No impulsive entries; every trade must pass multiple filters.

- Low drawdown design: Risk is capped per position; no grid, no martingale.

- Volatility-aware stops/targets: Dynamic ATR logic adapts to Gold’s changing tempo.

- Session intelligence: Prioritizes liquid sessions (London/NY overlap) to reduce slippage and improve fills.

- Spread & slippage control: Built-in checks; skips entries if conditions are unfavorable.

- Smart trailing & partials: Locks in gains as momentum extends; optional partial profit at predefined R multiples.

- News-aware workflow (optional): Pause trading around major USD- or Gold-sensitive events if you enable it.

- Prop-firm friendly: One-trade logic, fixed risk, and no exotic money management.

- Clear logs: Every decision leaves a trail, so you can audit what happened and why.

- MT5 native: Multi-threaded strategy tester compatibility and smooth VPS operation.

Recommended Setup (So You Start on the Right Foot)

- Timeframe: H1 for signal quality; M15 optional for more frequency once you’re comfortable.

- Account Type: ECN/STP with tight spreads on XAUUSD.

- Leverage: 1:200+ recommended (use responsibly; risk is still based on % per trade).

- Minimum Deposit: $500 (more headroom is always better when learning the EA).

- Risk Per Trade: 0.5%–1.0% for funded/prop rules; up to 1.5% if it’s your own capital and your plan allows.

- VPS: Yes—low latency improves entry quality and trailing precision.

- Broker Settings: Enable hedge accounts if available; confirm stop-level distance so the EA’s SL/TP can place cleanly.

Position Management (Typical)

- Initial SL: ATR-derived, placed beyond the structure that invalidates the setup.

- Take-Profit: Uses a blend of fixed R targets and adaptive trailing; the trailing engages after a predefined profit buffer.

- Break-Even: Optional at +1.0R or session changeover to protect open equity.

- Daily Stop: Consider a daily loss cap (e.g., -2R) to avoid a “bad day spiral.”

Installation & First Run

- Copy the EA: Place

BlackBox_XAU_EA_v1_12.ex5intoMQL5/Experts/in your MT5 data folder. - Restart MT5: Or right-click Experts and hit Refresh.

- Open XAUUSD H1: Clean chart, default template to start.

- Attach the EA: Allow algo trading; check “Allow DLL imports” if your setup requires it.

- Load Preset (optional): Start with the conservative set—risk 0.7% per trade, standard ATR multipliers.

- Run on Demo: Let it handle a full week across London/NY sessions.

- Review Journal/Experts logs: Confirm entries match your expectations; adjust risk only after you trust the flow.

Backtesting & Validation Workflow

Before you go live, validate the EA like a pro:

- Data Quality: Use high-quality tick data with variable spreads. Gold needs realistic spread modeling.

- Windows: Test multiple market regimes—quiet months and wild ones (e.g., CPI/Fed weeks).

- Metrics to Watch: Max drawdown (absolute and relative), profit factor > 1.4 on conservative risk, average R multiple, and consecutive loss streaks.

- Sensitivity Checks: Tweak ATR multiplier ±10–15% and risk 0.5–1.0% to see stability. Robust strategies don’t fall apart with small changes.

- Forward Test: After a solid backtest, run a small-risk demo for at least 10–20 trades. Only then consider live capital.

Daily Operating Plan (So You Don’t Babysit It)

- Pre-Session Check: Server time, spread, VPS, and calendar. Disable around high-impact events if you prefer.

- During Session: Let it run. Avoid manual overrides unless your plan clearly defines them.

- Post-Session Review: Note any unusual slippage or missed trades; keep a tiny trading journal—just bullets—to track context.

Risk Management for Gold (Non-Negotiable)

Gold punishes over-leverage. Respect the plan:

- Cap daily loss: Example: stop after -2R in a single session/day.

- No “revenge tweaks”: Don’t widen stops or double position size after a loss.

- Withdraw profits periodically: Lock in gains to reduce emotional risk.

- Prop rules: If you’re on a challenge, throttle risk to 0.5% and consider disabling during red-flag news.

Who Will Love BlackBox XAU?

- Disciplined swing-intraday traders who prefer a handful of high-quality trades over constant noise.

- Prop-firm candidates who need strict drawdown control and transparent logs.

- Busy traders who want an automated plan that respects risk and session dynamics.

- Gold specialists who understand that patience and precision beat constant engagement.

Common Q&A

Does it hold overnight? It can. The trailing and session logic are designed to manage carry-over risk, but you can force flat by end-session if your rules require.

Can I run it on multiple pairs? It’s engineered for XAUUSD. If you experiment elsewhere, treat it as R&D, not production.

Is there a martingale switch? No. That’s intentional to keep drawdowns contained.

How many trades per day? Varies by volatility; some days zero. That’s by design.

Final Thoughts

BlackBox XAU EA V1.12 isn’t a “trade every candle” bot. It’s a patient, context-aware system that aims to keep your equity curve clean by filtering junk signals and sizing risk properly. If you’ve been burned by over-aggressive Gold EAs, this measured approach may feel refreshingly professional. Start small, validate thoroughly, and let the rules do the heavy lifting.

Comments

Leave a Comment