Blue Xpert Prime +3.0 EA V1.0 MT5 – A Conservative EURUSD Worker for Steady Growth

If you’re tired of flashy bots promising 10x overnight and then nuking your account, Blue Xpert Prime +3.0 EA V1.0 for MT5 will feel like a breath of fresh air. It’s built for control and consistency rather than fireworks—focused on EURUSD and the M5 timeframe, with a simple, low-risk approach that fits smaller accounts (from just $100) and patient traders who want slow-and-steady equity curves.

What Is Blue Xpert Prime +3.0 EA?

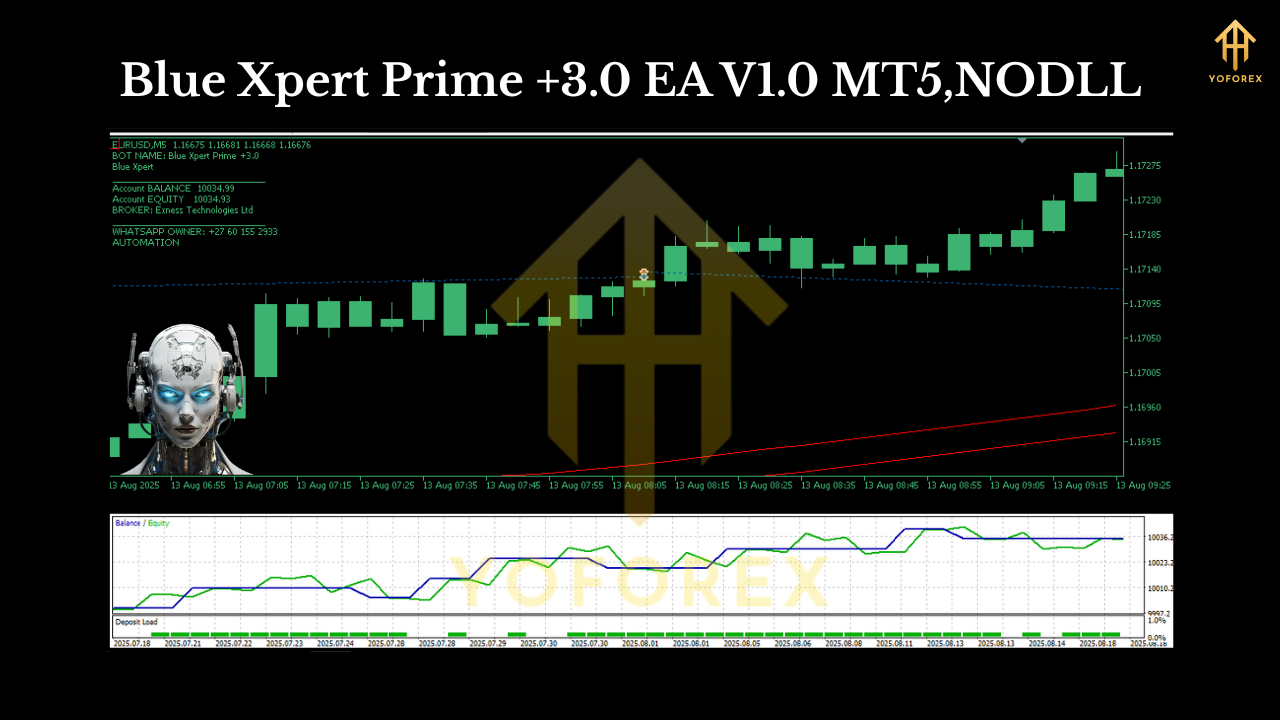

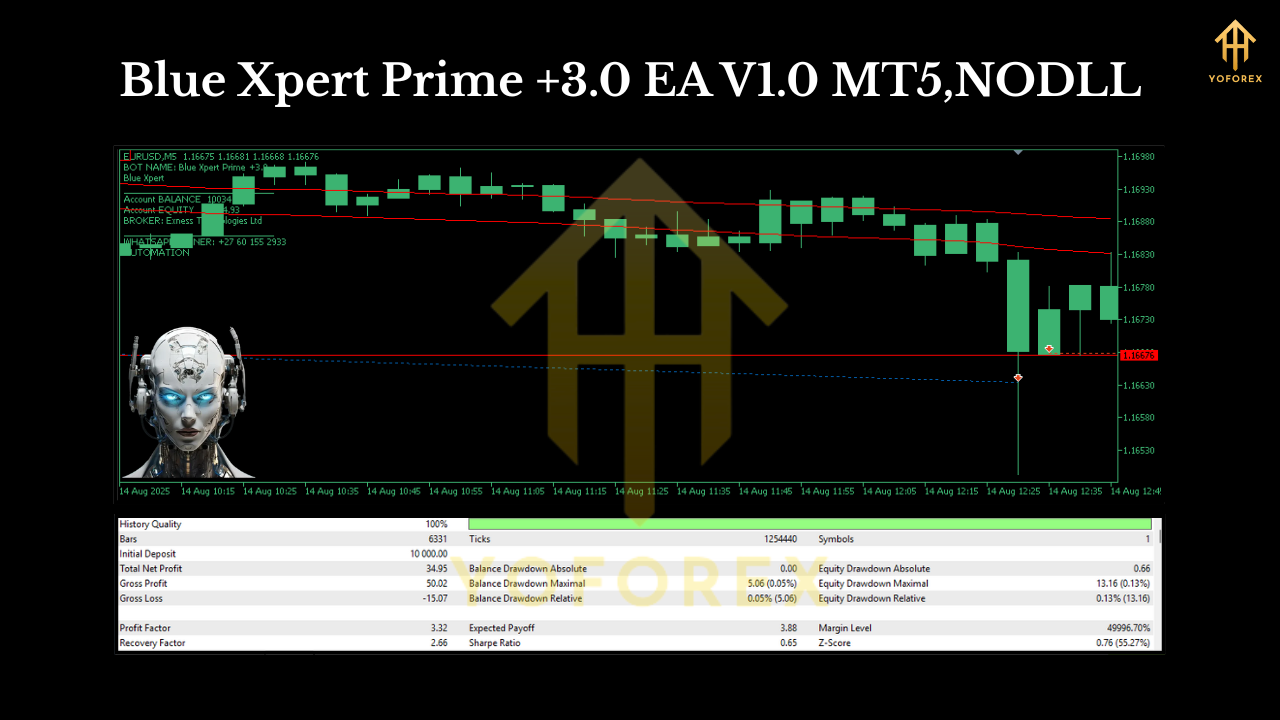

Blue Xpert Prime +3.0 is an automated trading Expert Advisor (EA) for MetaTrader 5, designed specifically for EURUSD on the M5 timeframe. Its philosophy is straightforward: use a clear, rules-based entry and exit model, maintain a balanced risk-to-reward, and avoid aggressive position escalation. The EA aims to capture repeatable intraday opportunities on EURUSD while keeping risk per trade contained, so your drawdowns are more manageable and your equity line can grow without huge emotional swings.

At a glance:

- Platform: MT5

- Pair: EURUSD

- Timeframe: M5

- Minimum/Recommended Deposit: $100

- Profile: Conservative, low-risk, steady growth

Why Traders Like Its “Boring” Approach

The power of Blue Xpert Prime +3.0 isn’t in being flashy; it’s about consistency. Many new traders chase big wins and end up with big losses. This EA tries to do the opposite—filter trades, size them sensibly, and step aside when conditions aren’t right. That means fewer “thrill rides”… and more nights where you can actually sleep.

Who it’s for:

- Traders who prefer controlled risk and long-term growth

- Beginners who want a simple, clear setup without a huge learning curve

- Funded account/prop firm aspirants who value consistency over hype

Key Features

- EURUSD Specialist: Optimized logic for the most liquid FX pair, reducing slippage and weird spread spikes common on exotics.

- M5 Timeframe Logic: Designed for M5 so it can catch intraday moves without the hyper-noise of M1.

- Conservative Risk Framework: Keeps risk per trade modest; aligns with small accounts and gradual compounding.

- Clear Risk-to-Reward: A simple take-profit and stop-loss model to avoid over-engineering.

- Session & Filter Controls: Optional filters help sidestep choppy, low-quality windows.

- News Awareness (Manual Option): You can pause around major news if your plan is to avoid volatility spikes.

- Broker-Agnostic Setup: Works on any reliable MT5 broker with decent spreads and execution.

- Beginner-Friendly: Clean inputs and sensible defaults; you don’t need to be a quant to run it.

- VPS-Ready: Runs smoothly on a basic VPS so you don’t need your home PC on 24/7.

- No Over-intervention Required: Fully automated once configured; adjust risk and let it work.

How It Works (In Plain English)

Blue Xpert Prime +3.0 looks for repeatable intraday momentum and mean-reversion cues on EURUSD M5, then places trades with predefined stop-loss and take-profit distances. It aims for setups where the probability of follow-through is higher than random noise, and it tries to avoid entries during messy, low-liquidity conditions. You won’t see it shotgun 20 trades an hour; it’s selective on purpose.

Installation & Quick Start (MT5)

- Download & Copy Files:

- Place the EA file into

MQL5/Experts/inside your MT5 data folder (File → Open Data Folder).

2. Restart MT5:

- Close and reopen MT5 so the EA loads in the Navigator panel.

3. Attach to EURUSD (M5):

- Open a EURUSD chart, switch the timeframe to M5, and drag Blue Xpert Prime +3.0 onto the chart.

4. Allow Algo Trading:

- Tick “Allow Algo Trading” in the EA’s Common tab and enable algo trading globally on MT5.

5. Set Risk Parameters:

- Choose fixed lot or a modest % risk (e.g., 0.5%–1% per trade for small accounts).

6. Optional Filters:

- Configure any session filters or time windows you prefer. Conservative users often avoid major news minutes.

7. Run on a VPS (Recommended):

- For 24/5 execution and fewer disconnects, consider a low-latency VPS near your broker.

Recommended Settings & Best Practices

- Account Size: Starts from $100, but if you can, more cushion is always better (e.g., $200–$500+) so you can survive a normal variance cycle.

- Risk per Trade: Keep it small. 0.5%–1% risk is a sensible baseline for conservative growth.

- Broker: ECN/STP with tight spreads on EURUSD; fast execution helps, especially around London/NY overlap.

- VPS: Yes—keeps the EA online even if your laptop is off.

- Avoid Over-Tinkering: Resist the urge to change settings daily. Give a configuration a fair sample size.

- Journal Everything: Track weekly results and note news periods, spreads, and any anomalies.

Performance Philosophy (What to Expect)

This EA’s goal is not to double accounts every week—that’s not realistic and usually ends badly. Expect moderate trade frequency and incremental gains in favorable weeks, with occasional small losing streaks (that’s normal in trading). The real edge is discipline: smaller drawdowns, controlled risk, and consistency you can stick with for months, not days.

Reality check:

- You will have losing days.

- You’ll see flat periods where the EA sits on its hands (that’s a feature, not a bug).

- Over a broader sample (think hundreds of trades), the aim is a gently rising curve—not a rollercoaster.

Pros & Cons

Pros

- Conservative, beginner-friendly approach

- Clear EURUSD/M5 focus

- Sensible risk control and simple R:R

- Easy to install and run on MT5

- Works with small accounts (from $100)

Cons

- Not a high-frequency “action” bot

- Patience required; no moonshots

- Performance can vary across brokers/spreads and during event-heavy weeks

Final Thoughts

Blue Xpert Prime +3.0 EA V1.0 MT5 is for traders who value capital preservation and steady progress over adrenaline. It’s focused, minimalist, and transparent—no gimmicks, just a consistent EURUSD M5 plan that can help you grow a small account without overexposing it. If you’ve been burned by aggressive bots before, this “slow and sane” approach may be exactly what you’ve been looking for.

Comments

Leave a Comment