The financial markets are volatile, unpredictable, and often driven by emotion. For traders seeking stability in this chaos, Candle Power EA V1.0 MT4 introduces a refined, disciplined approach to algorithmic trading. Built for MetaTrader 4, this Expert Advisor merges market psychology with advanced candle-pattern analysis to create a multi-layered mean-reversion strategy that adapts to various trading environments.

Rather than chasing trends or relying on risky martingale systems, Candle Power EA focuses on statistical balance. Its logic revolves around identifying extreme price deviations and positioning itself for the natural correction that follows — a method proven to deliver long-term consistency.

This EA is not just another trading robot. It’s a systematic framework that combines multiple independent strategies within one executable file, making it powerful, flexible, and ideal for traders who demand control over every trade outcome.

Introduction: The Concept Behind Candle Power EA

Candle Power EA V1.0 MT4 was designed for traders who value data-driven execution and controlled exposure. It is based on the mean-reversion principle, which assumes that prices eventually return to their equilibrium after moving too far from it.

The EA uses price exhaustion signals, volatility filters, and custom candle metrics to detect overbought and oversold zones. When market momentum slows and reverses, the algorithm executes trades that aim to profit from these retracements.

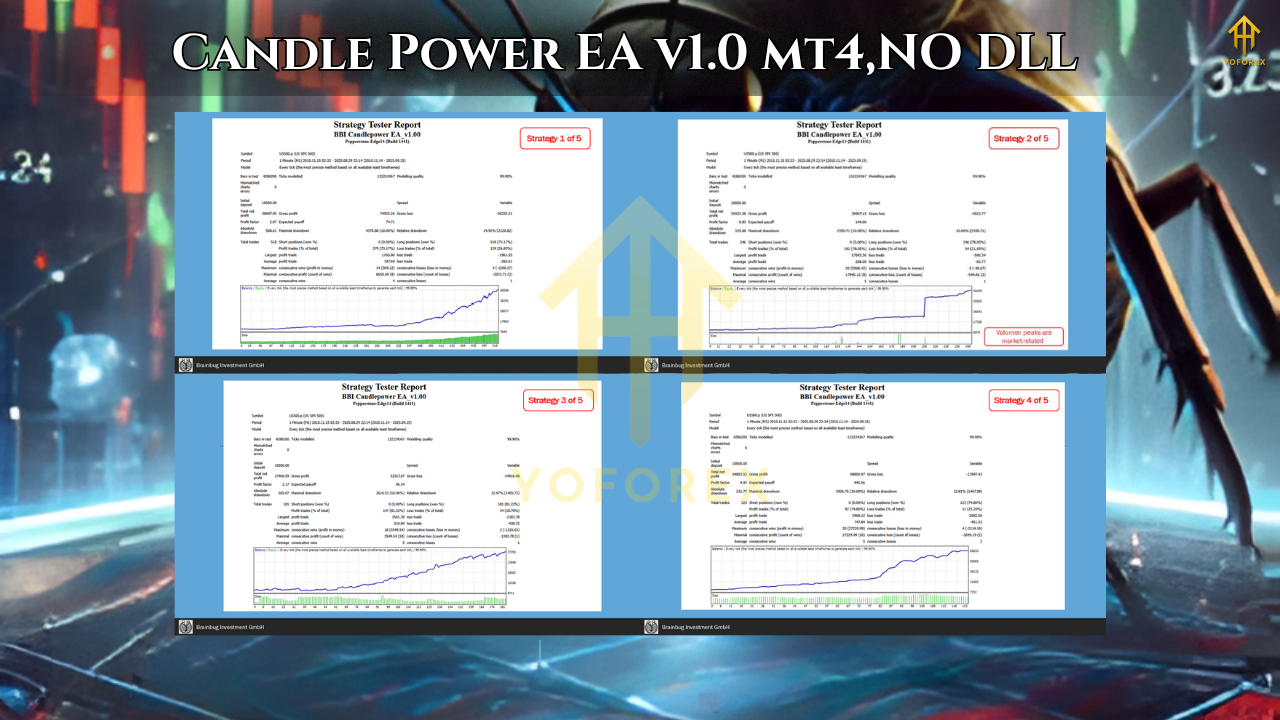

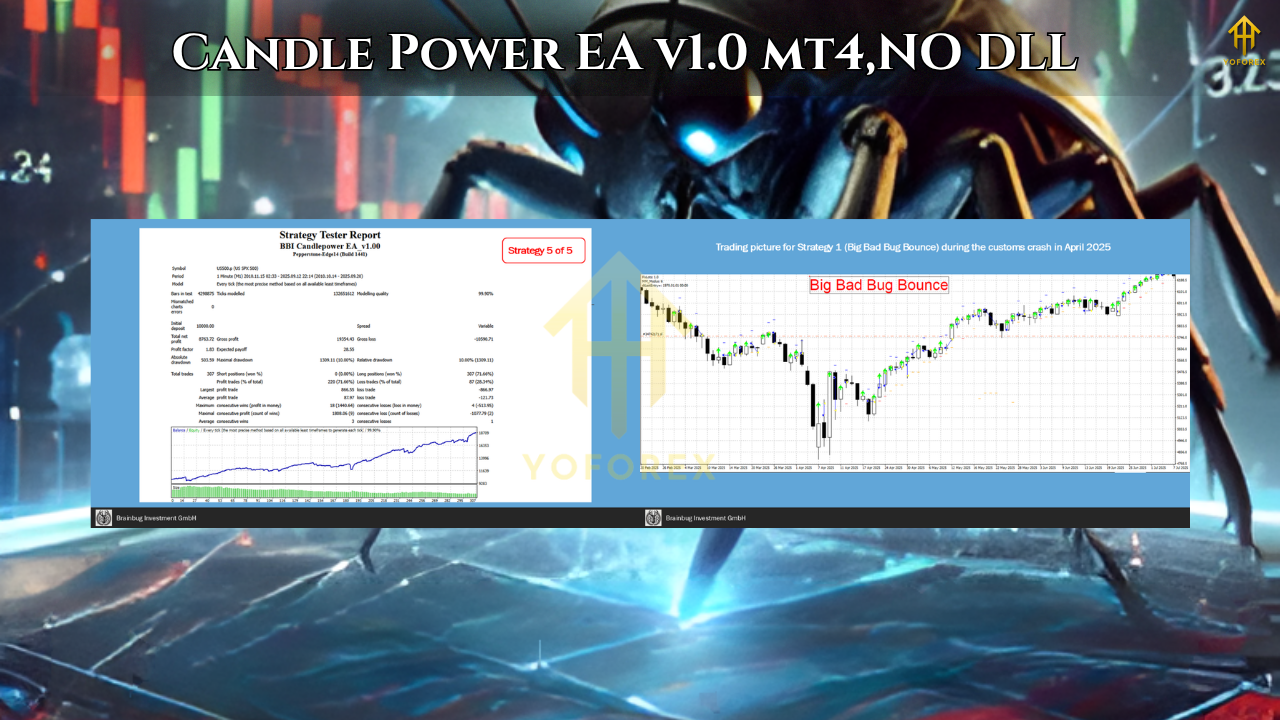

Its greatest strength lies in its modular structure — five autonomous strategy blocks, each using unique filters and risk models. These modules trade independently, which not only diversifies performance but also prevents over-concentration of risk in one specific setup.

Core Logic and Working Mechanism

Candle Power EA V1.0 MT4 integrates multiple candle-based decision layers to confirm every entry. It doesn’t take impulsive trades; instead, it looks for precise technical confluences such as candle exhaustion, RSI divergence, and volatility contraction.

Each of the five internal modules has its own “personality”:

- Some identify strong reversals after panic drops.

- Others detect small mean corrections in quiet markets.

- A few focus on session-based reversions after specific daily patterns.

Together, these modules create a balanced portfolio that performs across different volatility conditions — a critical element for sustained results in algorithmic trading.

Exit management is equally refined. The EA uses multiple types of exit triggers:

- Take profit based on dynamic volatility zones.

- Trailing stop-loss that locks profit as momentum fades.

- Time-based exits for overextended trades.

This comprehensive trade lifecycle ensures that performance is steady and exposure is limited.

Features That Distinguish Candle Power EA V1.0 MT4

1. Modular Strategy Engine

Candle Power EA integrates five different mean-reversion models. Each module uses independent magic numbers and logic paths, enabling traders to analyse them individually or run all simultaneously for maximum diversification.

2. Realistic Risk Control

Instead of increasing position size after losses, this EA uses fixed or proportional lot sizes through eight different money management modes. Drawdown remains within controlled parameters even in adverse market phases.

3. Adaptive to Market Stress

The EA thrives during sharp volatility bursts, often seen during panic selling or sudden market recoveries. It detects exaggerated moves and systematically trades the correction.

4. Transparent Strategy Design

Every trade is triggered by measurable candle data, ensuring clarity in decision-making. There are no hidden filters or repainting indicators — what you see is what drives the trade.

5. Backtested and Optimised

Candle Power EA has been tested across more than 15 years of market data, validating its adaptability and long-term potential.

6. Designed for Index and Volatility Assets

While optimised for the S&P 500 index, the logic can be applied to other correlated instruments like NASDAQ, US30, and global equity indices after parameter tuning.

How to Set Up and Run Candle Power EA on MT4

- Install and Load the EA

- Copy the EA file into your MetaTrader 4 “Experts” directory.

- Restart MT4 and attach Candle Power EA to your S&P 500 chart (symbol names may vary depending on your broker).

- Choose the Recommended Timeframe

- Use the H1 timeframe for balanced accuracy and performance.

- Set Risk Parameters

- Define your lot size or risk percentage.

- Start with small risk allocations during the first test period.

- Run a Demo or Backtest

- Test the EA over historical data to analyse how each module behaves in different market regimes.

- Deploy Live on VPS

- Use a Virtual Private Server for continuous 24/7 operation to prevent connection interruptions.

- Monitor and Adjust

- Review monthly performance.

- Enable or disable specific modules if needed based on volatility changes.

Strategic Advantages of Candle Power EA

1. Portfolio Diversity Inside One EA

Instead of buying multiple robots, traders get five complementary systems inside a single EA. Each follows its own risk pattern, which helps distribute exposure and create smoother equity growth.

2. Focus on Market Correction Instead of Prediction

The EA doesn’t attempt to forecast large trends. It profits from the predictable behavior of price normalization, a method proven to hold statistical strength across time.

3. No Emotional Trading

Candle Power EA’s algorithmic logic eliminates hesitation, greed, and fear — the three emotional triggers that cause most manual traders to fail.

4. Stable During Volatility Surges

Most bots fail when volatility spikes. Candle Power EA is designed to trade those periods strategically, identifying exhausted moves and executing contrarian trades at calculated levels.

5. Consistent Performance Over the Long Term

With disciplined position sizing and no compounding exposure, this EA is ideal for traders who want steady month-over-month performance rather than aggressive spikes.

Ideal Traders for Candle Power EA V1.0 MT4

This Expert Advisor is suited for:

- Professional traders seeking diversified algorithmic exposure.

- Prop-firm participants who need strategies that comply with risk rules and avoid martingale.

- Newer traders learning about algorithmic logic and capital management.

- Investors who want automated exposure to major indices without constant manual intervention.

However, traders looking for high-frequency or ultra-scalping EAs may find Candle Power slower-paced, as it prioritises quality setups over quantity.

Performance and Long-Term Outlook

Candle Power EA’s real strength lies in its ability to function effectively through both bullish and bearish market cycles.

- In strong uptrends, it captures pullbacks toward the mean.

- In market crashes, it identifies recovery points from oversold extremes.

- During consolidations, it exploits range-bound oscillations efficiently.

Its consistent framework, data transparency, and detailed reporting make it a serious contender for traders looking to replace speculative EAs with structured trading logic.

The system’s architecture also allows expansion — additional presets for Gold, Oil, and volatility indices are expected to be released, which could make it a complete multi-asset trading suite in the future.

Conclusion

Candle Power EA V1.0 MT4 is a complete evolution of the mean-reversion concept. It brings together candle analytics, volatility interpretation, and disciplined position control into one intelligent package.

This EA’s appeal lies not in marketing gimmicks but in engineering precision — it’s transparent, modular, and optimised for long-term portfolio integration. Traders who value sustainable results over flashy promises will find Candle Power EA to be a valuable tool.

Before deploying live, traders should always backtest and demo-test extensively, adjusting parameters to align with their capital and broker environment. With disciplined use, Candle Power EA can become a cornerstone in any algorithmic trading system.

Comments

Leave a Comment