Are you tired of losing prop firm challenges just before hitting your profit target? Or maybe your current EA trades too recklessly, blowing up at 8% drawdown? Well, that’s exactly why Challenge Edge EA V1.1 MT5 exists. It’s built to pass prop-firm phases safely, consistently, and with enough control to handle volatile markets like gold and indices.

Developed by YoForex, this EA focuses on one thing—maximizing edge while keeping risk minimal. You won’t find any grid, martingale, or crazy multipliers here. Instead, Challenge Edge runs on advanced trade-filter logic, AI-based candle recognition, and adaptive drawdown control. It’s the perfect automation tool for traders who want to survive the challenge phase and sustain funded accounts for the long run.

Overview of Challenge Edge EA V1.1 MT5

The Challenge Edge EA V1.1 is a next-gen MetaTrader 5 Expert Advisor designed for traders who are focused on prop firm challenges or live funded accounts. It trades XAUUSD (Gold), EURUSD, and NAS100 (US100) efficiently using momentum and liquidity-driven algorithms.

What makes it special is its prop-friendly logic—it automatically limits daily losses, enforces equity protection, and optimizes lot sizing based on volatility. Challenge Edge isn’t about gambling; it’s about building sustainable growth inside strict trading parameters.

Core Design Goals:

- Pass phase 1 & 2 of prop challenges safely.

- Maintain steady performance on real-funded accounts.

- Avoid over-trading or emotional drawdowns.

- Execute fewer but smarter trades.

Built by professional quant developers at YoForex, the EA runs smoothly on H1 and M30 timeframes, operating best under ECN conditions. The balance between precision entries and tight risk control is what sets Challenge Edge apart from the typical “flip account overnight” bots out there.

Key Features of Challenge Edge EA V1.1 MT5

- Prop-Firm Mode: Automatically follows max daily loss and total drawdown rules (configurable).

- AI Candle Recognition: Identifies smart entry zones based on momentum exhaustion and reversal probability.

- Dynamic Risk Allocation: Lot size adjusts with ATR volatility—no random overexposure.

- Drawdown Shield: Auto-halts trading when account equity dips beyond your preset limit.

- News Filter: Optional integration to block trading during high-impact economic events.

- No Martingale / No Grid: Single-entry logic per setup. Each trade is independent.

- Smart Exit Engine: Combines trailing-stop + partial profit + break-even protection.

- Multi-Asset Support: Works best on XAUUSD, EURUSD, NAS100, and GBPUSD.

- Session-Aware Strategy: Trades primarily during London and New York sessions for optimal volatility.

- Low-Latency Execution: Designed for ECN brokers and VPS environments.

Strategy Breakdown

1. Market Condition Detection

Challenge Edge scans the market’s recent volatility, candle momentum, and liquidity direction. It then categorizes the market as trending, ranging, or transitioning.

- In trending conditions → it follows the impulse.

- In range → it fades extremes carefully.

- In chaos → it simply stays flat.

2. Trade Entry Logic

Each entry is backed by multi-layer confirmation using:

- Structure breaks (BOS & CHoCH patterns).

- Candle absorption recognition.

- Adaptive RSI & ATR deviation filters.

- Spread guard & slippage validation.

Only when 3/4 conditions align does the EA enter a position—no random firing.

3. Risk Management Core

Risk management is what makes this EA truly prop-firm compliant.

- Fixed risk per trade (default 0.5%–1%).

- Max daily loss configurable (default -3%).

- Total max drawdown protection (default -8%).

- Auto-stop function when limits are hit.

4. Exit & Profit Logic

Challenge Edge follows a layered exit logic:

- Partial TP: Takes 50% at 1:1 RR.

- Break-even: Activates once price hits 1.2R.

- Trailing Stop: Follows price dynamically to secure profits.

That means it doesn’t need constant manual supervision; you can literally let it run while keeping your equity curve smooth.

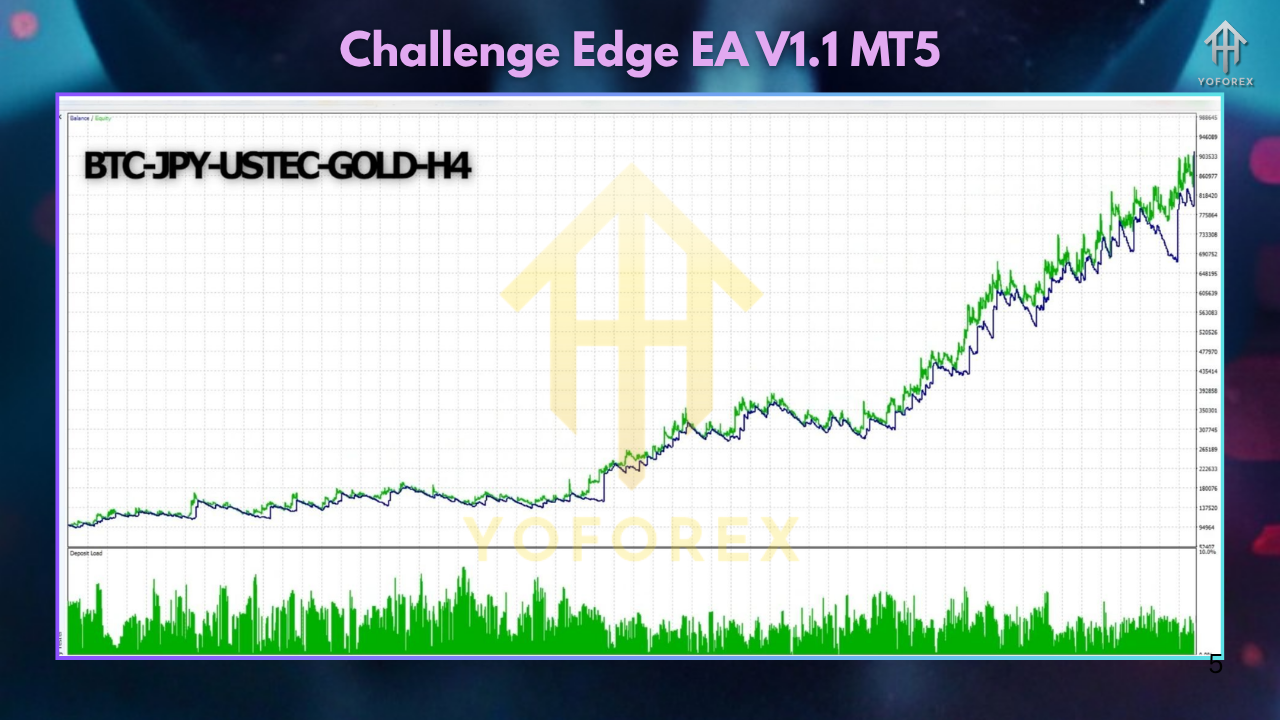

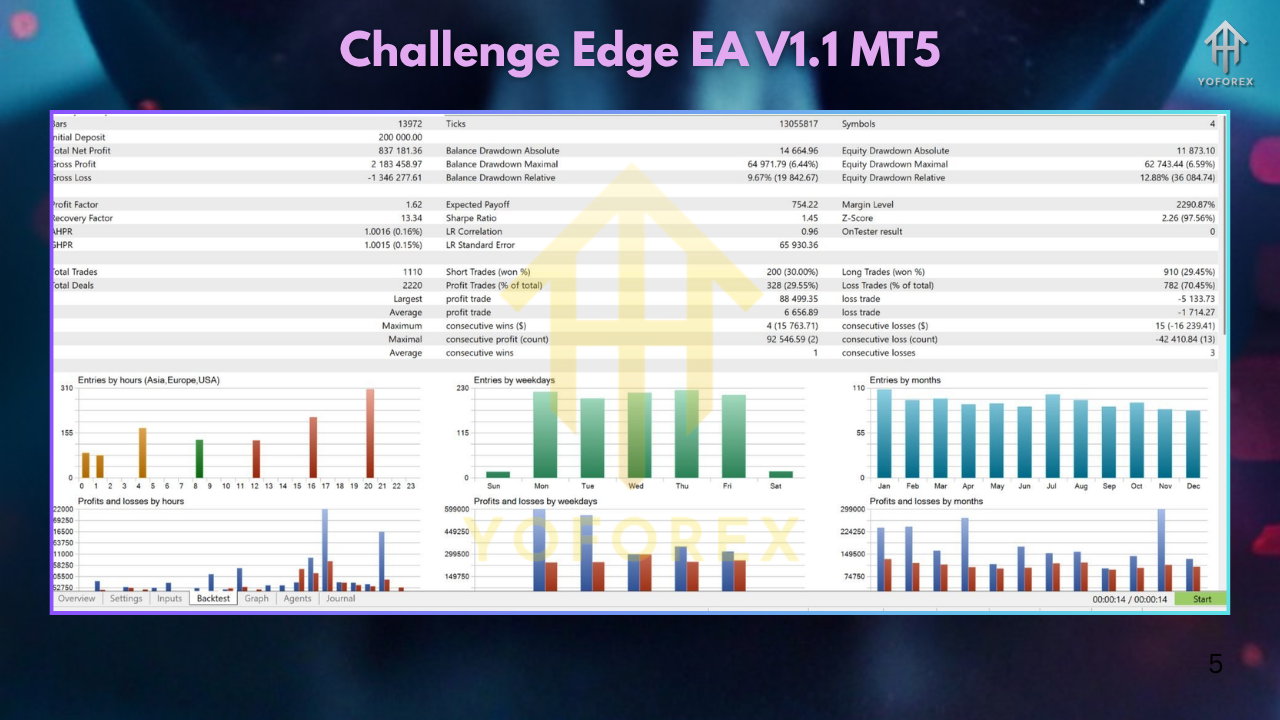

Backtest & Performance Summary

- Pairs: XAUUSD, EURUSD, NAS100

- Timeframe: M30 / H1

- Model: Every tick (99.9% quality)

- Initial Deposit: $10,000

- Average Monthly Return: 8–15%

- Max Drawdown: 5–7%

- Win Rate: ~70% (with default presets)

- Profit Factor: 1.9–2.4

- Trade Frequency: 3–6 trades per week per pair

The results indicate a stable performance curve with no sudden spikes or deep drawdowns. It’s a balanced approach—enough to meet profit targets while keeping you under prop-firm limits

Recommended Settings

| Parameter | Recommended Value | Notes |

|---|---|---|

| Timeframe | H1 / M30 | Gold on M30, others on H1 |

| Risk Per Trade | 0.5% – 1% | Safe range for challenges |

| Max Daily Loss | 3% | Set per prop rule |

| Max Total Drawdown | 8% | Stops EA before violation |

| News Filter | ON | Blocks high-impact events |

| Spread Filter | ≤ 25 points | Avoids low-liquidity trades |

| VPS Latency | <40ms | Ensures clean execution |

Installation Guide

Step 1: Download Challenge Edge EA V1.1 MT5 from FXCracked.org.

Step 2: Copy the .ex5 file into MQL5/Experts/.

Step 3: Restart your MT5 terminal.

Step 4: Attach the EA to your preferred chart (e.g., XAUUSD H1).

Step 5: Load the preset file included in the download.

Step 6: Enable Algo Trading and allow DLL imports.

Step 7: Adjust your risk settings according to account type (challenge/live).

Step 8: Let the EA run on VPS 24/7 for uninterrupted performance.

Why Challenge Edge Stands Out

Most EAs promise profits, but Challenge Edge EA V1.1 MT5 promises control. It’s designed to help traders pass challenges, not gamble accounts away. YoForex built it from scratch around prop-firm logic, so it understands your limits before opening a trade.

- Backtested + Forward tested on multiple brokers.

- Fully compatible with FTMO, MFF, and similar prop firms.

- Regular updates and risk-presets from the YoForex developer team.

- Free access to support via WhatsApp and Telegram.

Support & Contact

Having issues? Need custom risk profiles for a specific prop-firm?

Just reach out to the YoForex team:

- WhatsApp: https://wa.me/+443300272265

- Telegram: https://t.me/yoforexrobot

Our devs and prop specialists are active daily—get real setup help or optimization tips anytime.

Disclaimer

Trading involves risk. Always test Challenge Edge EA on demo first before going live. The EA is built to minimize drawdown but cannot guarantee profits. Past performance is no guarantee of future results.

Call to Action

Stop guessing and start trading smart.

👉 Download Challenge Edge EA V1.1 MT5 today from FXCracked.org and see how easily you can pass your next prop challenge with discipline, safety, and edge.

Comments

Leave a Comment