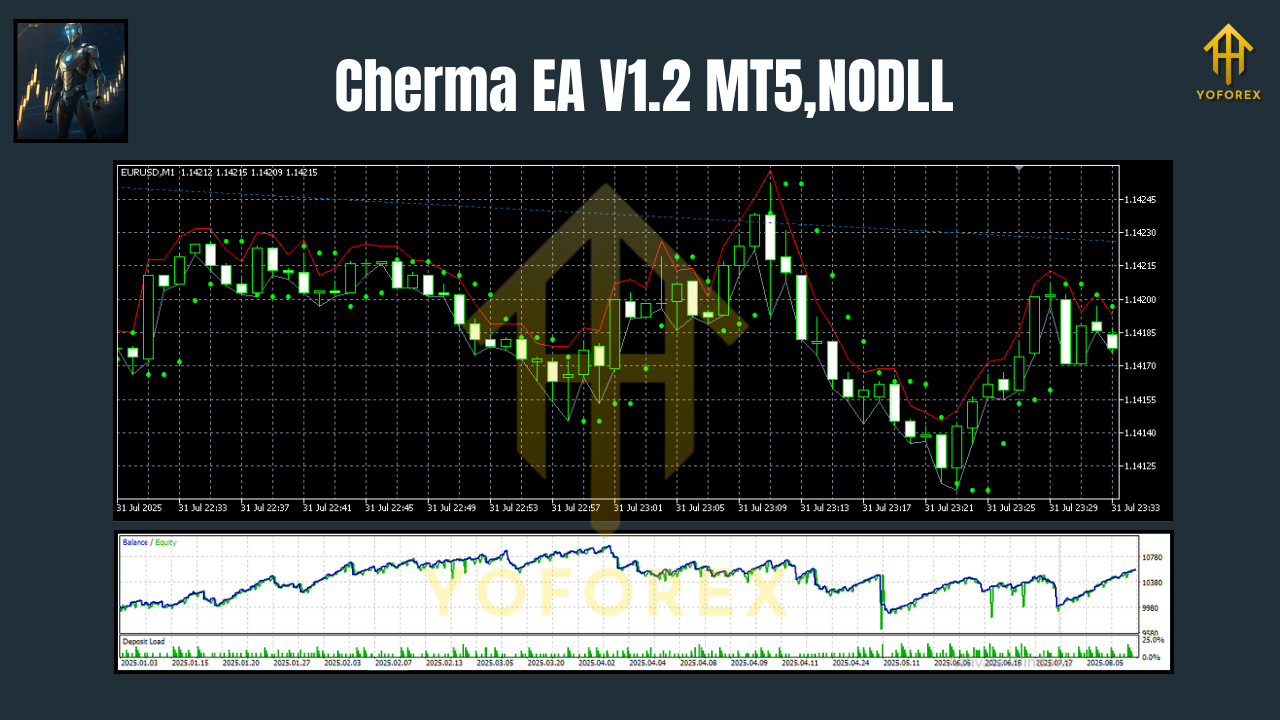

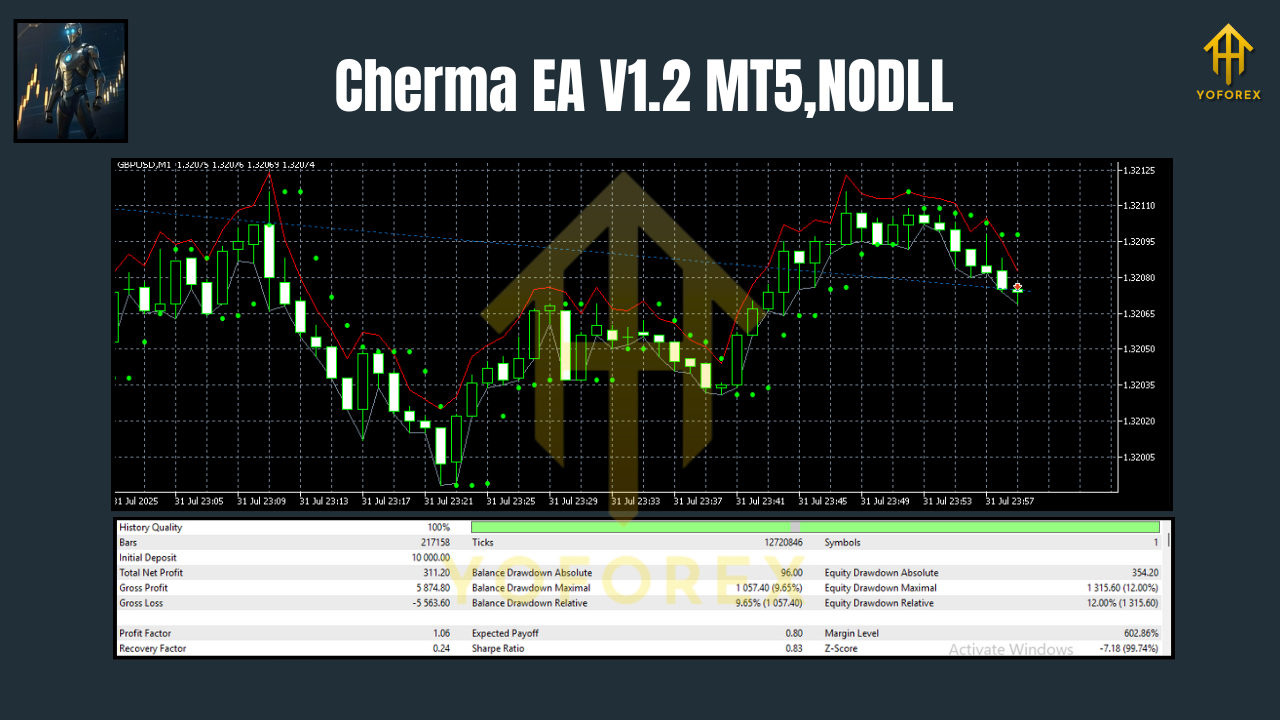

Cherma EA V1.2 MT5: High-Frequency Scalping for XAUUSD, EURUSD & GBPUSD

If you’ve ever stared at the screen wishing your manual clicks were just… faster, you’re not alone. Scalping on M1 and M5 is equal parts discipline and speed, and that’s exactly where Cherma EA V1.2 MT5 steps in. Built for XAUUSD (Gold), EURUSD, and GBPUSD, this Expert Advisor targets short, repeatable moves with a rules-based approach, aiming to squeeze pips from micro-trends and volatility bursts while keeping risk front and center. Whether you’re a full-time trader or someone who can’t babysit charts all day, Cherma’s automation helps you systematize entries, exits, and risk—without the constant drag of decision fatigue.

Below, you’ll find a practical overview of how the EA works, the features that matter in real trading, and a step-by-step setup guide so you can go from download to deployment with confidence.

What Is Cherma EA V1.2 MT5?

Cherma EA V1.2 is a high-frequency scalper designed for M1 and M5 charts on three of the market’s most traded symbols—XAUUSD, EURUSD, and GBPUSD. The EA uses a signal engine that evaluates short-term momentum, micro-structure shifts, and spread/volatility conditions before triggering trades. An execution layer then places and manages orders using predefined risk parameters (fixed lot or dynamic risk %) and a set of trade management tools such as stop-loss, take-profit, and optional partial close/trailed exits.

Who it’s for:

- Traders who prefer short, frequent trades and quick feedback loops.

- Anyone tired of overtrading emotionally and wants a repeatable, rules-driven process.

- Traders who can run MT5 on a VPS with low spreads/latency (ECN brokers recommended).

Core idea:

Focus on quality micro-setups in liquid pairs where spreads are tight and fills are reliable, then manage risk ruthlessly.

Key Features (What Actually Helps in Live Trading)

- M1 & M5 Scalping Engine: Tuned for ultra-short-term setups in XAUUSD, EURUSD, and GBPUSD.

- Spread & Slippage Filters: Block entries when trading costs spike, reducing poor fills during news or illiquid moments.

- Session Controls: Limit trading to London/NY overlaps or your preferred hours to match volatility with your strategy.

- Adaptive Risk Options: Choose fixed lots or dynamic position sizing via risk-percentage per trade.

- Stop-Loss/Take-Profit + Trailing: Predefined exits with optional trailing stops to protect open profits.

- Break-Even Logic: Auto-lock at break-even after a configurable profit threshold.

- Max Trades & Cooldown: Caps frequency and forces “breathing space” between entries to avoid overtrading.

- News-Aware Blocking (Optional): Pause trading around major releases with your own calendar process or external filter.

- Magic Number & Commenting: Clean trade tracking across multiple charts or instances.

- Robust Logging: Clear diagnostics for optimization and troubleshooting.

Note: Cherma EA V1.2 does not require martingale or grid to operate. Run it as a straightforward scalar; keep compounding controlled via lot size and risk %.

Recommended Setup & Requirements

- Platform: MetaTrader 5 (MT5)

- Symbols: XAUUSD, EURUSD, GBPUSD

- Timeframes: M1 or M5 (start with M5 if you’re new to scalping)

- Broker: True ECN/RAW spreads, fast execution; NY4/LD4 data centers are a plus

- VPS: Ping ideally < 20 ms to your broker for best fills

- Leverage: 1:100 to 1:500 (use responsibly)

- Minimum Capital: From $200–$500+ per symbol instance; scale up conservatively

- Sessions: London, NY, or overlap (avoid minutes right around high-impact news)

How to Install & Configure Cherma EA (Step-by-Step)

- Download & Copy: Place the EA file into MT5 → File → Open Data Folder → MQL5 → Experts.

- Restart MT5: Or refresh the Navigator so MT5 loads the EA.

- Attach to Chart: Open M1 or M5 chart for XAUUSD/EURUSD/GBPUSD, drag the EA onto the chart.

- Enable Algo Trading: Check “Allow algo trading” in both MT5 and the EA settings.

- Broker Filters: Set max spread (e.g., 10–20 points on majors; looser for Gold if needed).

- Risk Settings:

- Fixed Lot (e.g., 0.01 per $500–$1000 to start), or

- Risk % per trade (e.g., 0.25%–0.5% conservative; 1% aggressive).

7. Stops & Targets: Start with modest SL/TP tuned to pair volatility (e.g., majors 5–15 pips; gold requires wider).

8. Trade Frequency Caps: Set max concurrent trades and a cooldown (e.g., 3–5 minutes) to avoid bunching entries.

9. Session Control: Restrict to liquid hours and avoid the first/last minutes of each hour if your fills suffer.

10. Save a Template: Store your settings for each pair/timeframe; consistency helps analysis and scaling.

Three Risk Profiles You Can Copy

1) Conservative (account protection first)

- Risk per trade: 0.25%–0.5%

- Lot size: 0.01 per $1000 (majors); adjust higher only after stable results

- Session: London/NY overlap only

- Goal: Learn the EA’s rhythm with minimal drawdown

2) Balanced (steady growth)

- Risk per trade: 0.5%–0.75%

- Lot size: 0.01–0.02 per $1000–$1500

- Session: London + first half of NY

- Goal: Compounded returns with controlled heat

3) Aggressive (experienced traders only)

- Risk per trade: 1%

- Lot size: 0.02+ per $1000 (symbol-dependent)

- Session: Highly active windows; strict spread filter

- Goal: Faster growth, higher variance; expect larger swings

Backtesting & Forward Testing Tips

- Use Realistic Spreads: Don’t backtest on near-zero spreads if your live costs are higher—your equity curve will lie.

- Model Quality: Use tick-based data where possible; M1 scalping needs granular simulation.

- News Windows: Consider blocking trades 5–10 minutes before/after high-impact releases during tests to mirror live behavior.

- Walk-Forward: Optimize on one period, forward-validate on another; it helps avoid overfitting to a single regime.

- Start on Demo/VPS: Run at least 2–4 weeks on demo or micro-live; confirm fills and slippage before sizing up.

Pro Tips for Day-to-Day Use

- One Pair, One Chart: Run separate instances per symbol/timeframe with unique Magic Numbers.

- Latency Matters: If ping > 30 ms, consider a different VPS region or broker server.

- Costs Kill Scalpers: Prioritize commission + spread over flashy marketing; the tightest costs usually win.

- Avoid Choppy Midnight: If your broker’s rollover causes spreads to explode, disable trading around daily reset.

- Journal Everything: Screenshot odd fills, track slippage, and adjust your spread/volatility filters accordingly.

Final Word & Disclaimer

Cherma EA V1.2 MT5 is built for traders who want fast, repeatable execution on M1/M5 without the emotional overhead of manual scalping. It won’t “print money” magically (nothing does), but with the right broker conditions, realistic risk, and disciplined sessions, it can add a structured, high-frequency edge to your toolbox.

Call to Action:

Ready to put your scalping on autopilot? Set up Cherma EA V1.2 MT5 on a demo account today, fine-tune your filters, and then go live with sensible risk once you’re comfortable with the fills and behavior. Consistency beats intensity—especially on M1 and M5.

Comments

Leave a Comment