In the fast-evolving world of forex trading, finding an automated trading solution that can consistently deliver results is a challenge for many traders. Chinese EA V1.0 MT4 is one such automated Expert Advisor (EA) specifically designed for gold trading on the MetaTrader 4 (MT4) platform. This EA leverages a trend-following grid strategy that focuses on capturing profit from sustained market trends, particularly in the XAUUSD (gold) pair.

Let’s dive into the unique features, performance, and setup of Chinese EA V1.0 MT4 and why it stands out in the crowded market of automated trading tools.

Key Features of Chinese EA V1.0 MT4

1. Trend-Following Grid Strategy

One of the standout features of Chinese EA V1.0 is its trend-following grid system. The EA uses a multi-indicator engine to analyze market conditions, combining moving averages, volatility indicators, and session filters to identify strong market trends. Unlike traditional grid systems that often involve high risks (such as the Martingale method), this EA stays focused on adding positions during trends, ensuring that profits are maximized during favorable market conditions without compounding losses.

- Moving Averages: Used to determine the overall market direction.

- Momentum and Volatility Indicators: Help assess the strength of trends.

- Session Filters: Prevent trades during periods of low market liquidity or high volatility.

2. Non-Martingale Risk Management

The Chinese EA V1.0 avoids the use of the Martingale strategy, which can lead to massive drawdowns by increasing lot sizes after losses. Instead, it uses a non-Martingale grid strategy, where positions are added at fixed intervals or based on ATR (Average True Range). This reduces the risk of large losses during drawdowns and ensures more predictable trading.

3. Comprehensive Risk Management Tools

To safeguard your trading capital, Chinese EA V1.0 MT4 comes equipped with several advanced risk management features. These include:

- Equity Stops: To limit the total loss from all open trades.

- Daily Loss Cap: A cap on the total loss for the day to prevent large drawdowns.

- Maximum Open Orders: Limits the number of simultaneous trades to reduce exposure.

- News Pause Feature: This option allows traders to avoid trading during major economic events, which can cause erratic price movements.

These features allow traders to implement a more controlled and secure trading environment, especially for those who are risk-averse.

4. No DLLs (Dynamic Link Libraries) Required

Chinese EA V1.0 MT4 is designed to run on MetaTrader 4 without the need for any external DLLs. This makes the EA more secure and compatible with a wider range of brokers and MT4 builds. It also eliminates the potential security risks associated with third-party libraries.

5. Pre-configured .SET Files for Easy Setup

Another noteworthy feature is the inclusion of pre-configured .SET files, which are customized to suit different risk levels and trading preferences. These files make it easier for traders to get started quickly without having to manually adjust the settings.

How to Set Up Chinese EA V1.0 MT4

Setting up the Chinese EA V1.0 MT4 is a straightforward process, even for beginners. Here’s a simple guide to get started:

- Download MetaTrader 4: If you haven’t already, download and install the MetaTrader 4 platform from a reliable source.

- Obtain Chinese EA V1.0 MT4: Purchase the EA from a trusted vendor.

- Install the EA: After downloading the EA file, place it into the Experts folder of your MT4 directory (typically located under

C:\Program Files (x86)\MetaTrader 4\MQL4\Experts). - Attach the EA to the XAUUSD Chart: Open the XAUUSD chart and select the H1 timeframe. Drag and drop the EA from the Navigator window onto the chart.

- Load .SET File: Load the preset .SET file based on your risk tolerance and trading preferences.

- Activate and Monitor: Once the EA is activated, it will begin trading automatically. You can monitor the performance and adjust settings if necessary.

Performance and Results

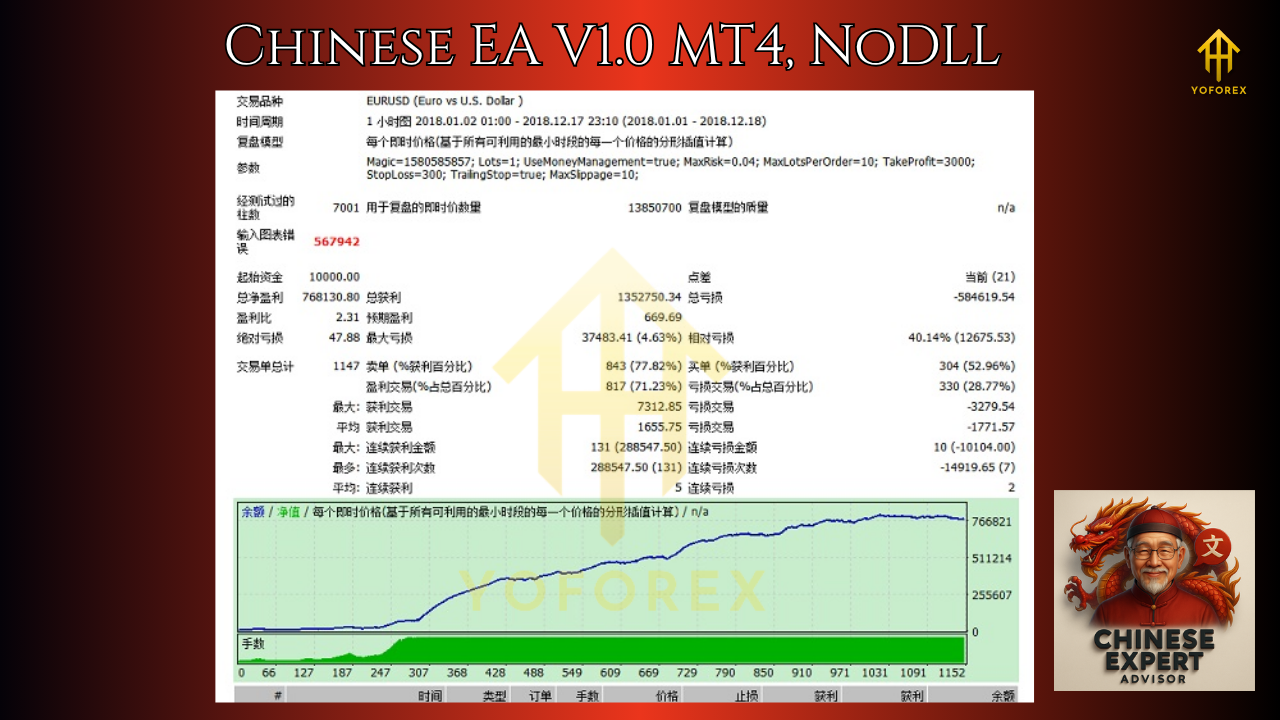

The Chinese EA V1.0 MT4 has shown promising results, particularly in capturing profits from strong gold trends. Many traders report steady and consistent returns with the EA, though actual performance depends on factors like broker conditions, account type, and trading settings.

- Real-Time Performance: The EA is designed for real-time trading, allowing it to adapt to current market conditions and execute trades at optimal entry and exit points.

- Backtesting: Before running the EA on a live account, it’s highly recommended to perform backtesting to assess its suitability for your trading style and risk tolerance. This ensures that you understand its behavior in various market conditions.

Pricing and Availability

Chinese EA V1.0 MT4 is available for purchase at $199, down from its original price of $1,000. This price includes the EA file and the pre-configured .SET files, making it a cost-effective solution for traders looking to automate their gold trading strategies. The EA is compatible with MetaTrader 4 and supports XAUUSD trading on the H1 timeframe.

Why Choose Chinese EA V1.0 MT4?

If you’re looking to automate your trading while managing risk efficiently, Chinese EA V1.0 MT4 provides a powerful solution. Here’s why it might be right for you:

- Trend-Following Focus: The EA’s ability to capture profits during sustained trends makes it a reliable choice for gold traders.

- Non-Martingale Strategy: Unlike many other grid-based EAs, this one avoids risky lot size increases, which helps prevent catastrophic drawdowns.

- Comprehensive Risk Management: With features like equity stops, daily loss caps, and news pause, your capital is better protected.

- Easy Setup and Customization: The EA comes with preset configurations, making it easy for both beginners and experienced traders to use.

Final Thoughts

Chinese EA V1.0 MT4 is a well-rounded automated trading tool that offers a safe and effective way to trade gold using a trend-following grid strategy. Whether you’re a beginner or an experienced trader, this EA provides all the necessary features for consistent and controlled trading.

Before going live, make sure to conduct proper backtesting and run the EA on a demo account to understand its performance and fine-tune settings to fit your needs.

Comments

Leave a Comment