Continuation EA V1.0 MT4 — Ride Strong Trends on M15 Without Second-Guessing

Tired of catching a great move… then watching it run without you? Or worse, jumping in too late and getting whipsawed? Continuation EA V1.0 MT4 is built for traders who want to surf momentum instead of fighting it. The EA focuses on trend continuation—spotting when price is more likely to keep moving in the current direction—and then executing a structured plan so you don’t have to babysit every candle. You’ll get rule-based entries, risk controls, and exits that aim to let winners breathe while cutting losers early. It’s simple where it should be, and smart where it counts.

This guide walks you through how the EA thinks, the ideal setup on EURUSD, XAUUSD, and US30 at M15, and practical risk settings that keep you in the game. No hype. Just a clear framework to help you trade momentum with a cooler head and a cleaner chart… coz fewer emotional clicks usually equals better outcomes.

What Is Continuation EA V1.0 MT4?

Continuation EA V1.0 MT4 is a rule-driven trend-following robot designed for MetaTrader 4. Its core logic tries to answer a single question: Is the current move likely to continue? To do that, it evaluates:

- Directional bias (Is the market trending up or down?)

- Momentum strength (Is the push strong enough to justify entry?)

- Pullback/Breakout context (Is price resuming after a healthy pause?)

- Volatility windows (Is the market too noisy or just right?)

- Liquidity timing (Sessions where continuation is more reliable)

When conditions align, the EA enters in the direction of the prevailing trend and manages positions with dynamic stops and trailing logic. The goal is simple: capture the “middle” of a move rather than guessing tops or bottoms.

Who Is It For?

- Intraday trend riders who prefer clean, methodical setups.

- Prop-firm aspirants who must respect max drawdown rules.

- Busy traders who want automation to enforce discipline.

- Beginners who need structure without over-optimization.

If you like scalping every micro tick, this isn’t that. If you prefer measured, repeatable momentum trades on a 15-minute canvas, you’ll feel at home.

How the Strategy Thinks (in Plain English)

- Establish Bias:

The EA filters for directional bias using slope, higher-high/lower-low recognition, and momentum bursts. No single indicator “holy grail”—it’s a confluence. - Wait for Pause:

Trends rarely move in straight lines. The EA looks for a modest pullback or a small consolidation—places where continuation often launches from. - Confirmation & Entry:

A fresh impulse (break of minor structure, renewed momentum) triggers entries. This helps avoid chasing exhausted moves. - Risk First, Then Profit:

Initial stop goes behind a logical structure point. From there, a trailing stop or partial take-profit logic kicks in to reduce risk and lock gains. - “No Trade” Is a Trade:

If volatility is erratic or spreads are ugly, the EA steps aside. Sitting out is part of the edge.

Recommended Setup (Fast Start)

- Platform: MetaTrader 4

- Chart: M15

- Pairs/Index: EURUSD, XAUUSD, US30

- Broker: Low spread, stable execution (ECN preferred)

- VPS: Yes (low latency helps), especially for US30 and XAUUSD

- Leverage: Use responsibly; the EA doesn’t need crazy leverage to work

- Spread Filter: Keep a spread cap to auto-avoid bad conditions

Lot sizing: Start small. For many accounts, 0.01–0.05 lots per $1,000 is a sensible sandbox. Adjust after you collect at least a few weeks of stats.

Pair-by-Pair Notes on M15

EURUSD (M15)

- Why it fits: Liquid, relatively clean trends during London/NY overlap.

- Behavior: Continuation often appears after London open surges or pre-NY impulses.

- Tip: Use session filters. Avoid dead Asian hours unless you have data that says otherwise.

XAUUSD / Gold (M15)

- Why it fits: Strong momentum bursts, frequent trend legs.

- Behavior: Volatile around news; continuation is powerful but can fake out if spreads balloon.

- Tip: Add a news filter or widen stop buffers during high-impact events. Keep a strict daily loss cap.

US30 / Dow Jones (M15)

- Why it fits: Index momentum is real, especially 30–90 minutes after NY open.

- Behavior: Whippy opens; continuation builds once initial chop settles.

- Tip: Consider a delayed session start (e.g., skip the first 15–30 min of NY) to avoid early noise.

Entries, Exits, and Risk—What to Expect

- Entries: Triggered when momentum resumes after a pause. The EA prefers structure confirmation over blind chasing.

- Stops: Placed beyond a recent swing or a volatility-based buffer.

- Trailing: Kicks in when price moves in your favor, helping bank progress and reduce give-back.

- Exits: Mix of trailing stops and optional partial profits at logical levels.

- Daily Guardrails: Optional daily loss cap and trade count limit to protect mental and account capital.

Pro tip: If your broker widens spreads at rollover or pre-news, use time-based blocks to keep the EA flat during those windows.

Risk Settings That Make Sense

- Per-Trade Risk: 0.25%–0.75% for most retail accounts; 0.5% is a sweet spot.

- Max Daily Drawdown: 1%–2% to stay prop-firm friendly.

- Max Open Trades: 1–3, depending on account size and pair mix.

- Correlation Check: Avoid stacking EURUSD long with US30 long if your stats show correlated drawdowns.

Remember: green weeks beat green hours. Keep risk boring so results can be exciting.

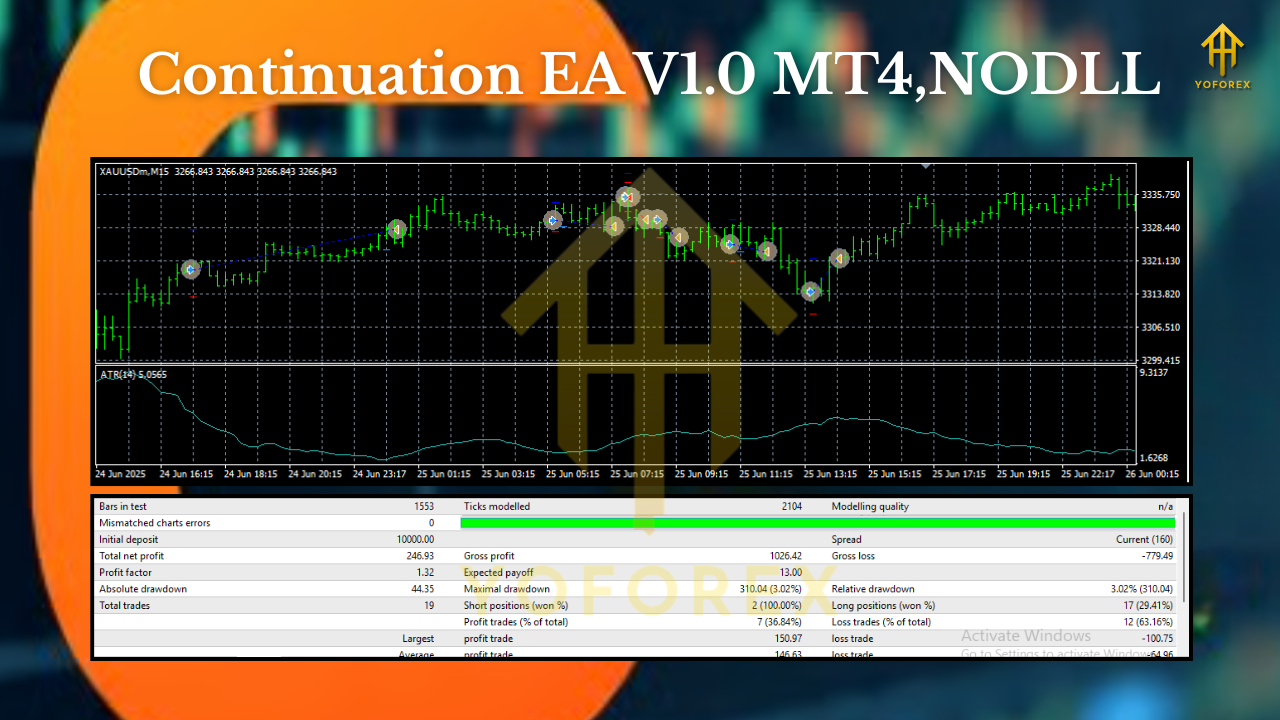

Backtesting & Forward-Testing Tips

- Sample Size: At least 1–2 years per instrument on M15 to capture various regimes.

- Model Quality: 99% tick data if possible; realistic spread and commissions.

- Session Filters: Test session windows (London/NY) vs. full day.

- News Windows: Compare results with and without news avoidance.

- Parameter Discipline: Don’t curve-fit. The edge comes from structure + patience, not perfect numbers.

Forward Test: Run it live on demo for 2–4 weeks. Validate that broker conditions match your backtest assumptions. Then scale with caution.

Installation & Quick Configuration (MT4)

- Copy the EA: Place the

.ex4or.mq4file into MQL4/Experts. - Restart MT4: Or refresh the Navigator panel.

- Attach to Chart: Open M15 on EURUSD, XAUUSD, or US30 and drag the EA on.

- Allow Live Trading: Enable “Algo Trading” globally and in EA settings.

- Basic Inputs:

- Risk mode (fixed lot vs. % risk)

- Spread filter

- Session times (enable London/NY bias)

- Trailing stop behavior and partial-TP on/off

6. Run Demo First: Verify logs, trade behavior, and broker execution before going live.

Best Practices (Hard-Won Little Rules)

- One change at a time. Adjust inputs slowly and record results.

- Respect news. If you must trade through it, reduce risk.

- Use a VPS. Stability matters; random disconnects ruin edges.

- Weekly review. Export history, tag trades by pair/session, and prune what underperforms.

- Stay consistent. The EA needs time in the seat to show its edge—don’t yank it daily.

Final Word & Disclaimer

Continuation EA V1.0 MT4 is about catching the part of the move most traders miss—the continuation. It won’t win every trade (nothing does), but it gives you a structured playbook to lean on. Trade small, iterate, collect stats, then scale what works. Past performance doesn’t guarantee future results. Markets change. Always test on demo first, and never risk money you can’t afford to lose. Simple, steady, and patient—those three words will take you surprisingly far, even if the path feels slow at times… tho slow is usually smooth, and smooth is fast.

Comments

Leave a Comment