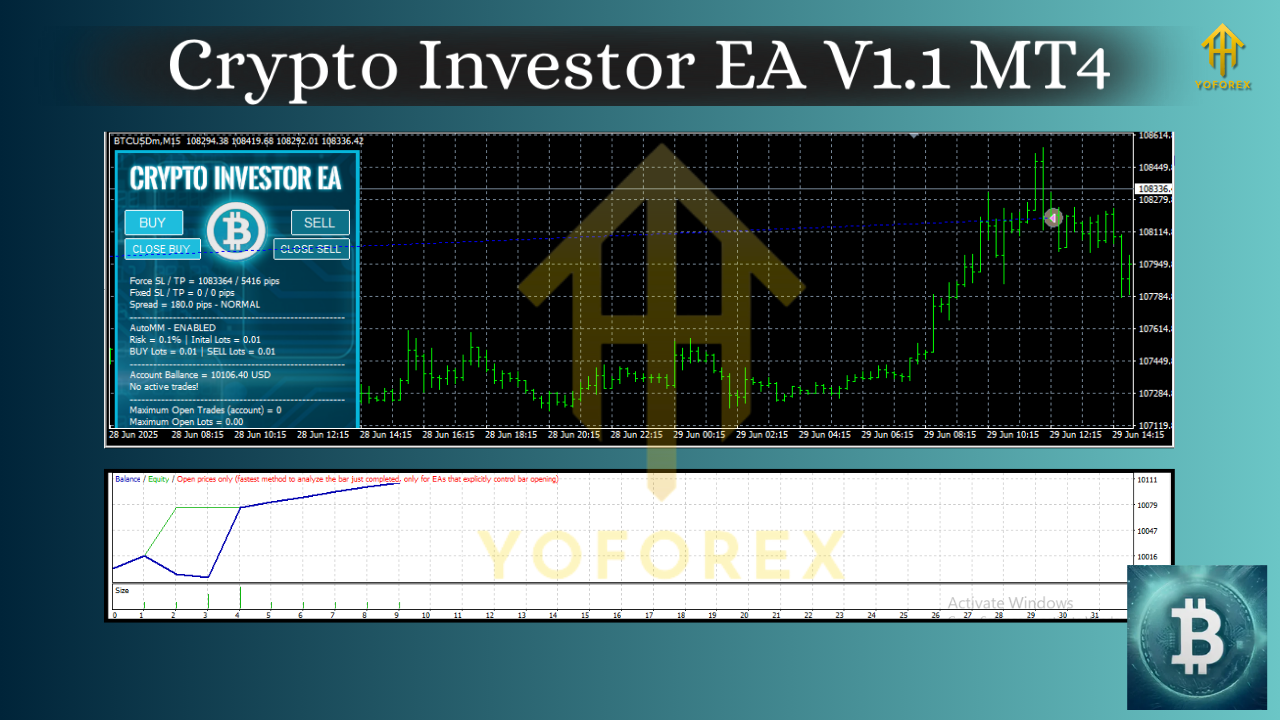

Crypto Investor EA V1.1 MT4 — Precision Bitcoin Trading on M15

Tired of “one-size-fits-none” crypto robots that blow up the moment Bitcoin sneezes? Same. Crypto Investor EA V1.1 for MT4 is built specifically for the BTCUSD market on the M15 timeframe—no generic mash-up of indicators, no copy-paste logic from forex pairs. It’s a next-gen, fully automated trading system that reads live order-flow dynamics, volatility bursts, and momentum shifts to time entries with way more discipline than most human scalpers can manage. The result? Cleaner signals, faster execution, and fewer “why did it do that?” moments.

If you’ve been hunting for an MT4 crypto expert advisor that’s tuned for Bitcoin’s unique personality—spiky moves, weekend liquidity quirks, rapid trend flips—this EA is the “finally!” moment. Plug it into an MT4 account that offers BTCUSD, set your risk, and let the engine handle the heavy lifting. Yes, you still need a plan and decent risk rules… but you’ll spend far less time babysitting the screen.

What is Crypto Investor EA V1.1 MT4?

Crypto Investor EA is a specialized MT4 expert advisor engineered to trade Bitcoin (BTCUSD) exclusively on the M15 chart. It processes live market data—tick velocity, spread, slippage, session behavior—and triggers trades only when a defined confluence is present. Unlike bots that try to do everything on every pair, this EA leans into Bitcoin’s rhythm: fast momentum surges, mini pullbacks, breakout continuations, and the occasional sharp reversal.

Under the hood, it uses a multi-stage decision tree:

- Detect trend bias and volatility regime;

- Confirm a momentum impulse that isn’t just noise;

- Check execution quality (max spread/slippage) before firing;

- Manage risk in real-time with dynamic stops and optional trailing.

Because it focuses on BTCUSD M15, its filters aren’t diluted. That means less whipsawing, fewer false positives, and a trading flow that feels… composed. You’re not fighting the bot; you’re giving it room to do what it’s good at.

Why BTCUSD + M15?

BTCUSD isn’t EURUSD—its liquidity pockets, weekend structure, and headline sensitivity are different. The M15 timeframe hits a sweet spot: granular enough to capture momentum bursts, yet wide enough to filter random micro-ticks. It’s also fast to test, quick to iterate, and aligns well with Bitcoin’s intraday cycles.

M15 gives the EA room to breathe: you’re not over-trading like M1 noise hunters, but you’re still reactive enough to catch the early part of a leg. For BTC, that blend often matters more than the exact indicator cocktail. The architecture here is “measure first, then move,” not “fire and pray.”

Key Features at a Glance

- Purpose-built for BTCUSD (M15): No generic multi-pair bloat.

- Momentum + Volatility Logic: Trades only when the market has intent.

- Execution Safeguards: Max spread & slippage filters to avoid bad fills.

- Dynamic Risk Control: Fixed % risk per trade; ATR-aware stops; optional trailing.

- No Blind Averaging Down: By default, no martingale or grid tactics—keep it clean.

- Equity Protection: Daily loss cap & max consecutive loss lockout (configurable).

- 24/5 or 24/7 Ready: Runs continuously; respects your broker’s crypto hours.

- Broker-Agnostic: Works with any MT4 broker that lists BTCUSD with reasonable spreads.

- VPS-Friendly: Lightweight code path; stable on low-latency VPS.

- Clear Logs & Inputs: Transparent decisions so you can audit what happened and why.

How the Strategy Operates (Plain-English Version)

- Regime & Trend Check:

The EA classifies the current regime (calm, expanding, volatile) and identifies directional bias. If volatility is too low (chop risk) or unrealistically high (slippage risk), it stands down. - Impulse Confirmation:

It waits for a meaningful price impulse—measurable momentum that often precedes follow-through on BTC. Think of it like catching the wave after it’s formed, not guessing it’ll form. - Entry with Execution Guardrails:

Before placing orders, the EA confirms that spread and slippage are within limits you set. If the book is messy, it simply won’t trade. No fill is better than a terrible fill. - Structured Risk & Trade Management:

- Stop-Loss: ATR-aligned or structure-based (swing point) to respect BTC ranges.

- Take-Profit: Logical targets based on momentum decay or recent range bands.

- Trailing (Optional): Locks in profit if a move extends; you decide sensitivity.

- Daily Loss Cap (Optional): Pause trading after X losses to protect equity.

5. Session & News Awareness (Optional):

Crypto trades around the clock, but you can restrict hours. Many users skip low-liquidity weekend windows or minutes around major macro headlines (CPI, FOMC, big ETF chatter).

Installation & Setup (MT4)

- Copy Files:

MT4 → File → Open Data Folder → MQL4 → Experts → paste the EA file.

If there’s an Indicators file included, place it in MQL4/Indicators. - Restart MT4:

Close and reopen MT4 so it detects the new EA. - Attach to Chart:

Open BTCUSD, set M15, drag Crypto Investor EA V1.1 onto the chart. - Enable Algo Trading:

Make sure the AutoTrading button is green. In EA settings, allow live trading. - Set Inputs:

- RiskPerTrade: e.g., 0.5%–1.0% to start.

- MaxSpread / MaxSlippage: Align with your broker’s typical crypto conditions.

- Stop/TP Mode: ATR-based or structure-based.

- Trading Hours: Optional (e.g., disable thin weekend hours).

- Daily Loss Guard: e.g., stop for the day after 2–3 losses.

6. Run on a VPS:

For consistent execution, host MT4 on a low-latency VPS.

Recommended Settings (Starter Baseline)

- Account Type: Crypto-enabled MT4 with tight BTCUSD spreads.

- Leverage: Whatever your broker offers for crypto; keep position sizes conservative.

- Risk: Start small—0.5% per trade is plenty while you collect data.

- SL/TP: ATR-based SL (e.g., 1.5–2.0× ATR) and a TP that fits your risk profile (1.2–2.0R).

- Trailing: Off for the first week; then test a modest trail to capture runners.

- Filters: Spread ≤ your broker’s typical median; slippage tight during peak hours.

- Equity Protection: Daily loss cap on; turn it off only if you’ve got strong stats.

Backtesting & Forward Testing Tips

- Data Quality: Use the best tick data you can get for BTCUSD; avoid gaps.

- Broker Hours: Some MT4 brokers pause crypto on weekends, some don’t—match your tester to live conditions.

- Walk-Forward Logic: Optimize lightly on a recent window, then forward-test on the next period to check robustness.

- Sample Size: Look at months, not days. Bitcoin’s cycles can shift—build a larger sample.

- Forward Test on Demo First: Two to four weeks of hands-off demo results tell you more than a thousand hyper-fitted tests.

Best Practices for Live Use

- Use a VPS for uninterrupted trading.

- Keep Risk Consistent; don’t crank lot sizes after a win streak.

- Avoid Illiquid Windows if your broker’s weekend books are thin.

- Monitor Slippage, especially around sharp headlines.

- Update Intentionally: Change one thing at a time; observe for a week.

Final Thoughts & Call-to-Action

If you’re serious about automating Bitcoin on MT4 without gimmicks, Crypto Investor EA V1.1 is a smart, focused choice. It respects volatility, filters bad conditions, and manages trades with the kind of structure that keeps you in the game. Start on demo, gather stats, then go live with a risk number you can sleep with.

Comments

Leave a Comment