In today’s fast‑evolving forex environment, many traders are turning to automation to gain an edge. One such option is the Currency Curator Ex4 EA v1.0 MT4, an Expert Advisor for the MetaTrader 4 platform designed to trade multiple currency pairs with configurable risk/reward settings. In this article, we will explore how this EA works, its strengths, limitations, and how you can integrate it into your trading setup.

Firstly, what exactly is the Currency Curator EA? At its core, it is a fully automated system—meaning once you configure it and deploy it in MT4, it will monitor market conditions, generate signals, execute trades, and manage those trades according to the rules you define. The “v1.0” version indicates its initial release stage, and “Ex4” is the compiled format for MT4 Expert Advisors.

Features and Capabilities

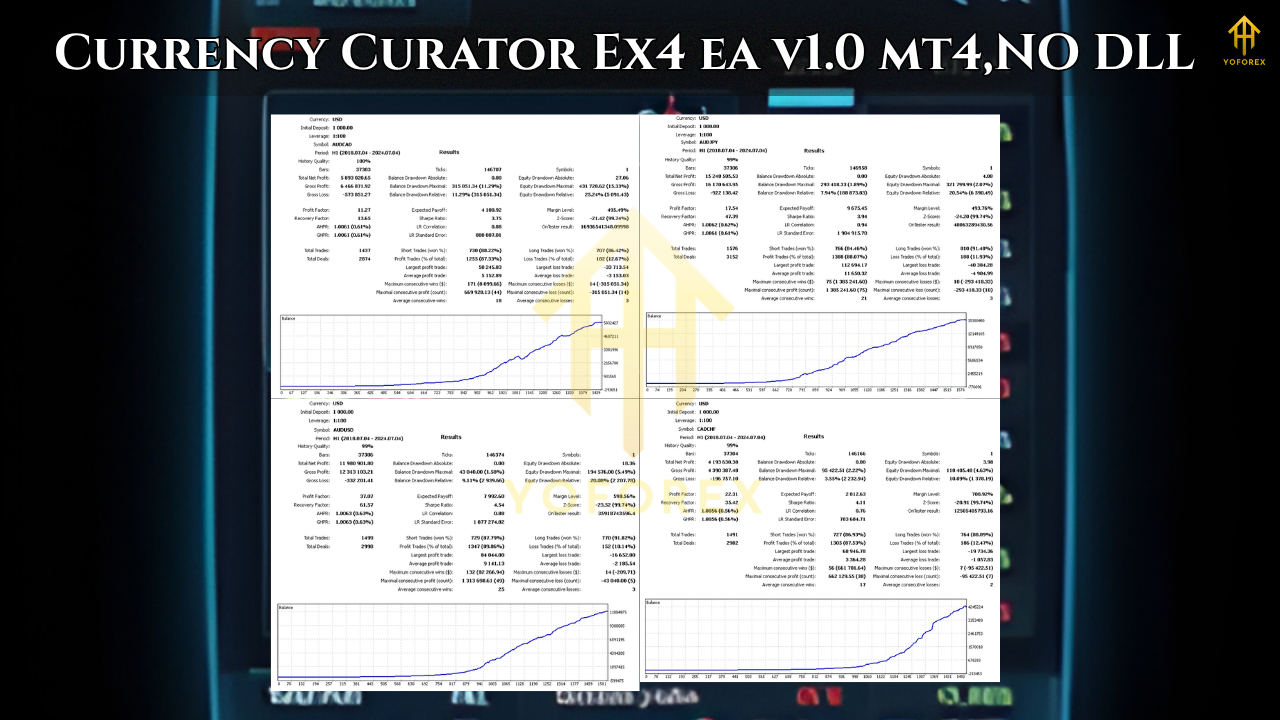

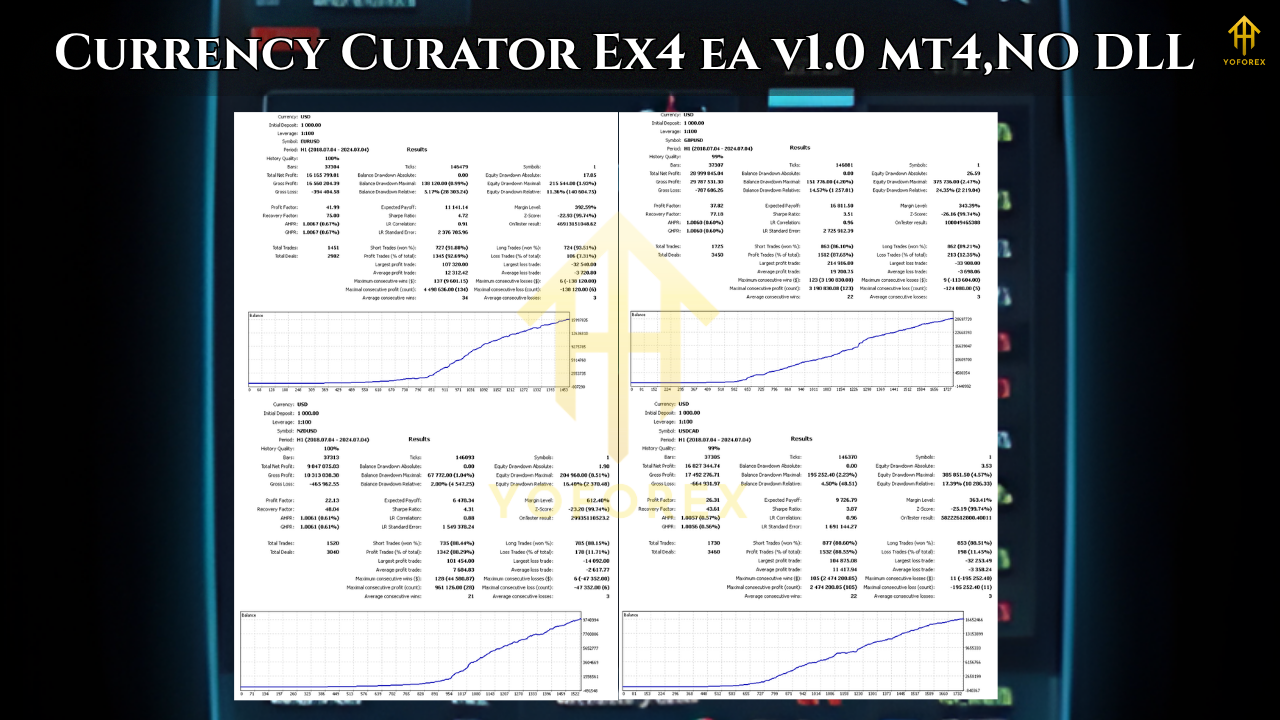

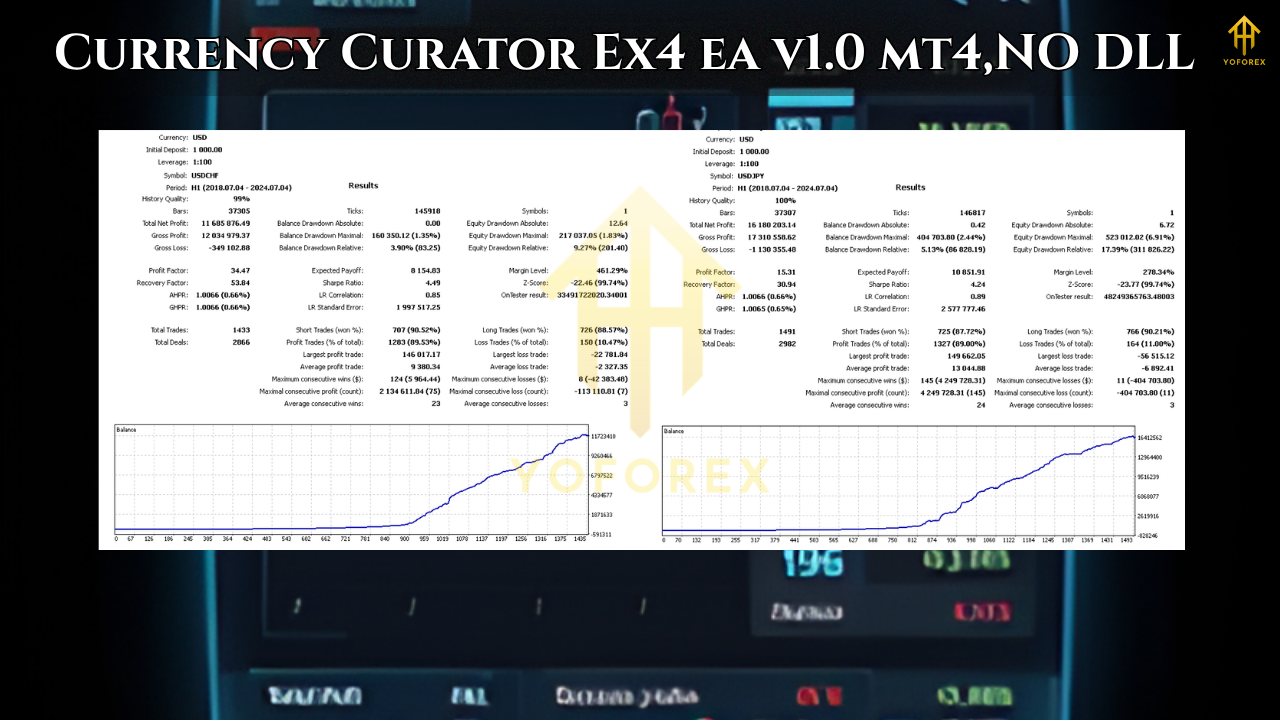

One of the key advantages of Currency Curator is its multi‑currency pair capability. Rather than being restricted to just a single pair, this EA allows you to trade across several currencies at once. This helps diversify exposure and capture opportunities in different markets. Next, it offers a high degree of customisation: you can set parameters for lot size or risk percentage, stop‑loss and take‑profit levels, trailing behaviour, series order limits, and other signal‑generation filters. Because market conditions differ between brokers, account types, time zones and currency pairs, that flexibility is valuable.

The automation of trade execution is another major feature. When the configured conditions are met—based on technical filters the EA has been programmed to evaluate—the EA opens the trade without manual input. This removes the need to constantly monitor charts or wait for alerts. Further, the system incorporates risk‑management safeguards. In addition to traditional stop‑loss and take‑profit, there may be series limits (how many trades in a sequence), maximum drawdown caps, and trailing stop adjustments to protect profits as positions move favourably.

How to Set Up and Deploy

To begin with, you need to purchase and download the EA file. After locating the .ex4 file, launch your MetaTrader 4 platform and go to File > Open Data Folder. Navigate to the MQL4 folder, then Experts, and copy the EA file there. Restart MT4 so that the EA appears in the Navigator pane. Next, open the chart for each currency pair you intend to trade. Drag the EA from the Navigator and drop it onto the chart. In the settings interface, adjust the risk‑level, lot size or percentage, enable/disable pairs, set stop loss/take profit/trailing stops, define series limits and any other available filters. Finally, ensure Auto‑Trading is turned on (check that the green “play” button is enabled). Once that is done, the EA is live and will begin monitoring and executing trades.

Advantages of Using Currency Curator Ex4

This EA is particularly useful for traders who want to reduce manual effort. By automating the entire process from signal to execution, you avoid fatigue, missed opportunities, and the emotional swings of manual trading. Diversification across multiple currency pairs means you are not reliant on a single market moving. The customisation options permit you to align the EA with your personal risk appetite and account size—from conservative low‑risk setups to more aggressive strategies. Moreover, putting the EA on a VPS (virtual private server) means you can maintain 24/5 operation with minimal downtime, regardless of your local machine or internet.

Important Considerations & Risk Factors

It is essential to recognise that no EA guarantees profits. The currency markets are subject to sudden shifts in volatility, liquidity drops, broker server issues, news events, or changes in spread/slippage conditions. Because of that, even an automated system must be carefully monitored. Broker conditions matter: high spreads, poor execution, or frequent requotes will impair results. It is strongly recommended to run the EA initially in a demo environment or a small live account to validate performance under your broker’s conditions. Also, you need to maintain good money management. Automation can sometimes lead to overconfidence: ensure you set realistic targets, cap maximum drawdown, and avoid overleveraging.

Best Practices for Users

- Choose a low‑spread, reliable broker with fast execution and preferably an ECN/STP model to reduce slippage.

- Use a VPS located physically near your broker’s server for minimal latency.

- Verify that your broker allows running Expert Advisors and that account settings (hedging, margin, etc) are compatible with multi‑pair EAs.

- Start with default settings or conservative parameters and monitor performance for a few weeks before increasing risk/lots.

- Keep a log of performance: track drawdown, maximum single loss, average trade duration, profit factor, etc.

- After major news events, review any positions opened by the EA and ensure that risk filters remain appropriate.

- Regularly update the EA if the vendor releases new builds, and ensure compatibility with your MT4 build version.

Conclusion

If you’re searching for an automated solution to trade multiple currency pairs while reducing manual workload, the Currency Curator Ex4 EA v1.0 MT4 offers a strong option. With its flexible settings, ability to handle several pairs, and risk management features, it is suitable for traders who are willing to configure and monitor an EA rather than trade manually all day. Like any automation tool, it is not a “set‑and‑forget” guarantee—but when used responsibly, it can become a valuable part of your trading toolkit. For those ready to integrate automation into their strategy, this EA is worth evaluating and testing within a controlled live or demo environment.

Comments

Leave a Comment