Navigating the gold trading landscape can be complex. Price action in the XAU/USD market often moves swiftly, and manual trading demands constant attention. Enter the Danesha XAUUSD EA V3.0 MT4 — an Expert Advisor (EA) designed for MetaTrader 4 that automates gold trades with a focused strategy built for the H1 timeframe. This blog dives into how it works, what the key settings are, and how you might deploy it effectively.

At its core, Danesha XAUUSD EA V3.0 MT4 is built to handle gold (XAU/USD) exclusively, on the 1-hour chart. The logic blends technical indicators (such as exponential moving averages and RSI) with pending order execution and a recovery mechanism to manage losing trades. While many EAs attempt multi-pair coverage, this one keeps its scope narrow, which allows specialisation. For traders seeking a robust gold trading bot, this specialisation can be a major benefit.

Let’s break down the major components:

Trading Strategy & Mechanics

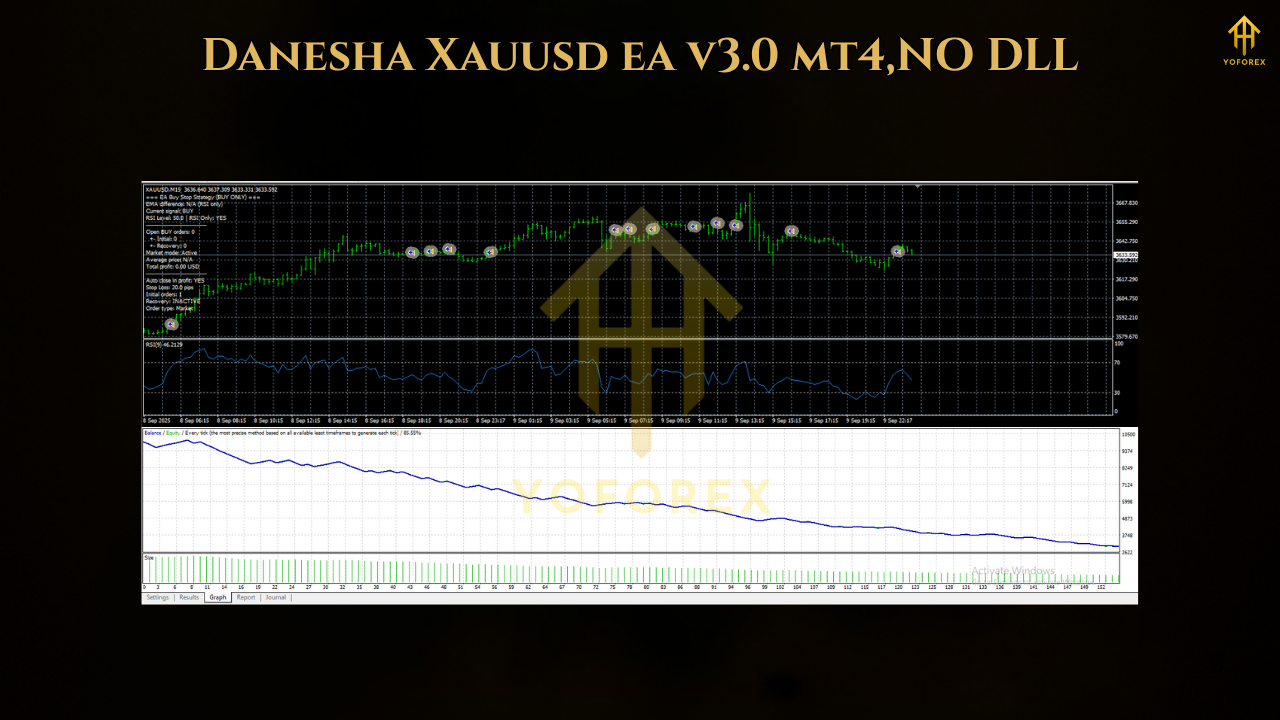

The EA monitors the H1 timeframe for XAU/USD. The strategy typically relies on fast and slow EMAs (for example, EMA 13 crossing EMA 21) combined with an RSI filter (e.g., period 3 crossing a defined threshold). Once the trend conditions align, the EA places two Buy Stop pending orders a certain distance above the market price (for example, 20 pips), spaced apart (e.g., 10 pips apart). If a pending order is not triggered within a preset period (for example, 2 hours), it may expire.

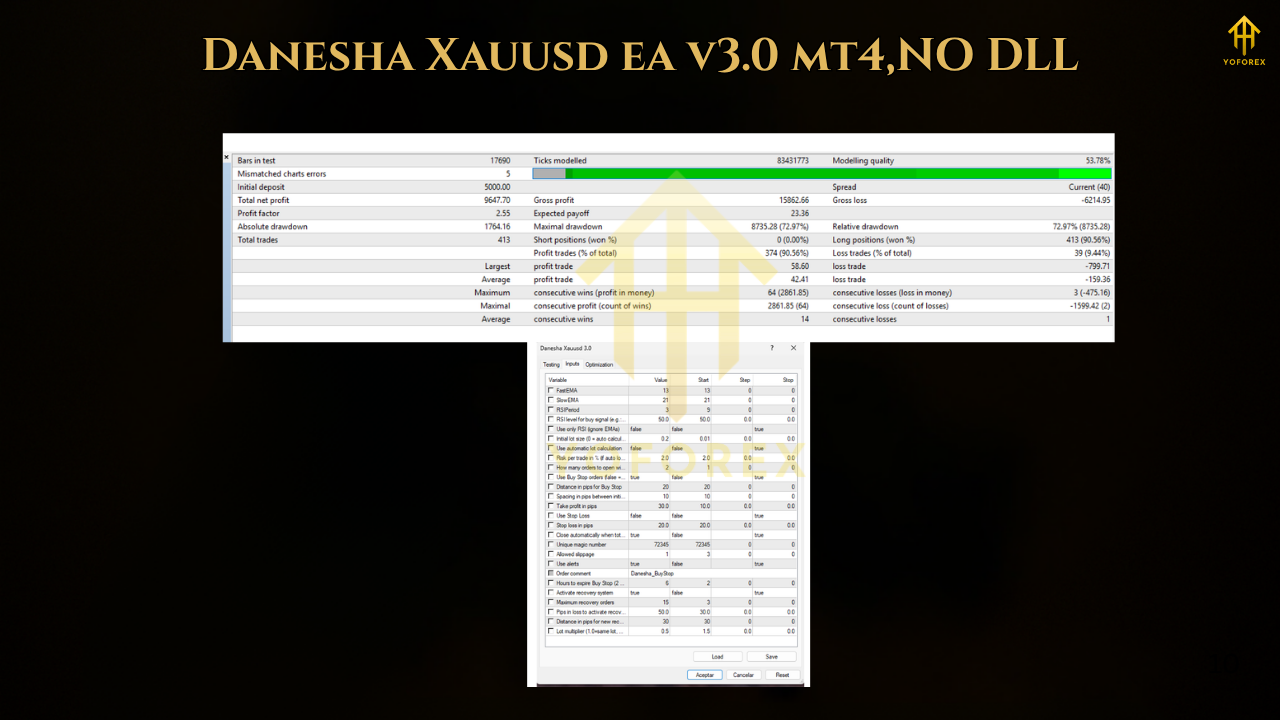

Once a trade triggers, the take-profit may be set at a fixed level (for example, 30 pips). Stop-loss is optional or set via user parameters. Crucially, the EA includes a recovery/averaging system: if a trade drifts into a predefined loss threshold (e.g., 50 pips), the recovery logic may open additional positions (up to a maximum number, for example 15), each with a reduced lot size multiplier (such as 0.5×) and spaced by a “RecoveryDistance” (such as 30 pips). This hybrid approach blends trend entries with controlled averaging, rather than a full grid or pure martingale.

Key Settings & Requirements

To deploy this EA successfully, you’ll want to consider several pivotal settings and requirements:

- Broker & Symbol: Use a broker with tight spreads on XAU/USD and ensure the symbol name matches (some brokers label gold differently).

- Timeframe: H1 chart only. Running on lower/higher timeframes may change performance significantly.

- Minimum Capital: Because gold’s volatility and the EA’s lot sizing and recovery logic can require a capital cushion, a recommended baseline deposit is advisable (e.g., $5,000 or more, depending on lot size settings).

- Lot / Risk Configuration: You might choose a fixed lot size (e.g., 0.20 lots) or auto-lot via percentage risk (e.g., 2%). Always align with your account size and risk appetite.

- Spread / Slippage Consideration: Since gold trades often come with wider spreads and may be sensitive to slippage, select an ECN-style broker or a low-spread environment.

- VPS / Execution: Trade execution quality matters. Use a VPS close to your broker’s servers and keep your system stable and latency low.

- Parameter Calibration: While the default settings provide a baseline, robust results depend on calibrating the EA to your broker’s feed, spread, and volatility behaviour. Back-testing and forward live testing are critical.

Benefits of Using Danesha XAUUSD EA V3.0 MT4

There are several compelling advantages this EA offers:

- Gold-only Focus: Many EAs are spread across dozens of pairs. Here, the focus on XAU/USD means the logic can be optimised specifically for gold’s behaviour.

- Trend-based entries: The use of EMAs + RSI ensures entries are aligned with momentum and trend confirmation rather than random signals.

- Controlled recovery mechanism: Unlike many aggressive grid/martingale systems, the recovery logic here uses a multiplier less than 1 and a cap on the number of recovery orders — helping manage risk in drawdown situations.

- Suitable for prop-firm or funded account strategies: For traders aiming at prop-firm challenges or funded accounts, this type of focused, disciplined EA can be part of a strategic toolset.

- Reduced monitoring burden: Executing on H1 rather than M1–M5 means fewer trades, less screen time, and a more hands-off structure once properly set up.

Potential Drawbacks & What to Watch

No system is flawless, and this EA comes with caveats you must be aware of:

- Gold’s inherent volatility: XAU/USD is subject to large, sometimes sudden moves (due to macro-economic events, central bank announcements, geopolitical tensions). When movement is strong and against the EA’s position, the recovery module may still face large drawdowns.

- Pending order approach risk: The strategy uses Buy Stops above the price, anticipating a breakout. If the market reverses before the trigger, you may face no entry or trigger at poor levels.

- Broker feed dependency: Performance will differ significantly based on broker spreads, order execution latency, slippage, broker fees, and symbol tick size. A test on one broker does not guarantee similar results on another.

- Risk of averaging downside: While recovery is controlled, adding positions in losing trades inherently increases exposure. If many recovery trades accumulate and price moves significantly against you, the risk can escalate.

- Need for discipline and oversight: Automation does not eliminate risk. You must monitor your account, check that the EA continues to behave, ensure there are no trade issues, and respect drawdown limits.

Implementation Workflow for Traders

Here’s a suggested roadmap for integrating Danesha XAUUSD EA V3.0 MT4 into your trading approach:

- Demo testing: Start with a demo account on the broker you intend to use. Run the EA with default settings for 4-8 weeks, track key performance metrics (win rate, profit factor, max drawdown, number of recovery trades, average hold time).

- Broker feed review: While testing, pay specific attention to how your broker treats XAU/USD — spread evolution during key hours, requotes, overnight swap/rollover, and slippage behaviour.

- Parameter adjustment: Based on demo results, you may adjust lot size, risk per cent, recovery multiplier, distance spacing, pending order distance, and stop loss settings. Document those changes and the rationale behind each.

- Live small-capital deployment: Once comfortable, deploy the EA on a live account with modest capital (for example, aligning with your risk tolerance). Monitor live trades, evaluate the impact of live execution versus demo results.

- Risk management & diversification: Ensure this EA’s capital allocation is part of your overall trading portfolio, not your entire capital. Set drawdown limits, possibly stop trading (or disable EA) when results diverge significantly from expectations.

- Ongoing monitoring & maintenance: Regularly check the EA’s trades, especially recovery chains, drawdown progression, and correlation with market hours. In the event of major fundamental events (e.g., central bank announcements impacting gold), consider disabling the EA temporarily or using a news filter.

- Reporting and readiness: If you are using this EA for a prop-firm account or funded challenge, keep detailed logs, maintain transparency of trade comments, track performance and ensure you meet the firm’s rules (max drawdown, minimum trading days, style constraints).

- Review and iteration: Over time, you may refine your settings, pause the EA when market conditions become unfavourable (e.g., low volatility gold phases), or combine this EA with other systems for diversification.

Conclusion

The Danesha XAUUSD EA V3.0 MT4 offers a targeted, well-designed automation solution for gold trading on the MT4 platform. Its strength lies in its dedicated focus on XAU/USD, trend-based entries via EMAs and RSI, and a controlled recovery mechanism to manage drawdowns. For traders serious about gold and looking for an EA they can fine-tune and integrate into a disciplined trading plan, this system holds definite appeal.

However, the performance is not automatic nor guaranteed. Success depends heavily on choosing the right broker, verifying execution, managing capital appropriately, and continuously monitoring the system’s live behaviour. As part of a broader trading portfolio, and once properly configured and tested, Danesha XAUUSD EA V3.0 MT4 can become a valuable component in your automated trading toolbox.

If you are ready to unlock gold trading automation with precision and structure, this EA is worth exploring — but treat it like any trading system: test, monitor, manage risk, and refine.

Comments

Leave a Comment