Dark Gold EA V1.0 MT4 — High-Frequency Scalping for Gold, Bitcoin & Majors

If you’ve ever watched XAUUSD or BTCUSD rip through levels in seconds and thought, “there’s no way I can catch that move manually,” Dark Gold EA V1.0 for MT4 is built exactly for those moments. This expert advisor automates high-frequency scalping on volatile instruments—Gold (XAUUSD), Bitcoin (BTCUSD), plus EURUSD and GBPUSD—using precise support-and-resistance logic with both trend-following and counter-trend entries. It’s designed for traders who want disciplined execution, consistent trade logic, and the freedom from second-guessing entries on fast charts like M5, M15, and even H1 when conditions call for it.

What Is Dark Gold EA V1.0 MT4?

Dark Gold EA is a fully automated scalping system that specializes in momentum bursts around intraday levels. It combines two complementary approaches:

- Trend-following module: hunts for breakouts and continuation setups once price confirms through a key level.

- Counter-trend module: fades sharp spikes back into mean zones when volatility overshoots, but with strict filters to avoid standing in front of steamrollers.

The EA’s edge comes from its support & resistance engine, which continuously recalculates micro-levels, recent session highs/lows, and volatility bands to decide whether a pullback is a dip to buy (trend-following) or an exhaustion pop to fade (counter-trend). Execution is nimble, risk is rule-based, and the entire process is hands-off once you’ve configured the input parameters.

Timeframes: M5, M15, H1

Pairs: XAUUSD, BTCUSD, EURUSD, GBPUSD

Minimum/Recommended Deposit: $100 (with micro/cent account or small fixed lots)

Who Is It For?

- Intraday scalpers who like multiple opportunities per session without manual clicking.

- Volatility chasers focusing on Gold and Bitcoin, where quick, repeatable edges matter.

- Disciplined traders who prefer rules over gut feel and want consistent risk per trade.

- Prop-firm aspirants needing a rules-first, low-drawdown approach (assuming sensible risk settings).

Core Strategy Logic (In Simple Words)

- Level Mapping: The EA identifies fresh S/R levels using recent swing points, session extremes, and dynamic ranges.

- Signal Confirmation:

- Trend-following: looks for price acceptance beyond a level with volume/volatility confirmation and minimal pullback failure risk.

- Counter-trend: looks for exhaustion patterns (wicks, velocity slowdown) at stretched extremes.

3. Risk Framing: Stop loss and take profit are set relative to volatility (ATR-driven) and level distance, not arbitrary pips.

4. Trade Management: Optional trailing, breakeven rules, and partial exits help lock gains and cap tail risk.

5. Filters: Spread filter, max slippage, and time filters reduce bad fills during illiquid windows or news spikes.

Key Features You’ll Actually Use

- Dual-mode engine (trend + counter-trend) that you can enable/disable independently.

- Volatility-aware stops/targets so risk adapts to market conditions (especially crucial on BTC & XAU).

- Spread & slippage filters to avoid trading during spikes or poor liquidity.

- Session/time filter to control when the EA is active (e.g., London/NY focus).

- News-avoidance buffer (optional manual time blocks) to step aside near scheduled releases.

- Elastic lot sizing—fixed, per-$ risk, or proportional (with equity protection).

- Smart trailing with breakeven shift after initial RR is reached.

- Failsafe equity guard to pause new trades if a daily loss threshold is hit.

- Multi-pair handling with separate magic numbers for clean trade tracking.

- Low resource footprint so you can run it on a modest VPS.

Recommended Settings (Starting Point)

Always forward-test on demo for a couple of weeks before going live. Fine-tune per broker conditions.

- Timeframes: M15 (balanced), M5 (more signals), H1 (fewer but cleaner swings).

- Pairs: Start with XAUUSD and EURUSD to get familiar; add BTCUSD once you’re comfortable with crypto volatility.

- Risk: 0.5% per trade (new users), max 1% per trade (experienced).

- Stops/Targets: ATR-based (e.g., SL = 1.2×ATR, TP = 1.6–2.0×ATR).

- Trailing: Enable breakeven at 1.0×R, light trail thereafter.

- Filters: Max spread (XAU: 30–40 points depending on broker quoting; FX majors: 15–20 points); slippage 3–5.

- Session Window: London open → early New York for best liquidity on XAUUSD/EURUSD.

- Equity Protection: Daily loss cap 3–5% to prevent “bad day” spirals.

Installation & Setup (MT4)

- Copy Files: Place the EA file (

.ex4) intoMQL4/Expertsin your MT4 data folder. - Restart MT4: Or right-click Navigator → Refresh.

- Enable Algo Trading: In MT4, allow “AutoTrading” and check “Allow live trading” in EA properties.

- Attach to Chart: Open charts for XAUUSD, BTCUSD, EURUSD, and GBPUSD on your chosen timeframe(s) and attach the EA.

- Input Parameters:

- Magic number (unique per pair)

- Risk mode & percent per trade

- ATR multiplier for SL/TP

- Spread/slippage caps

- Trading sessions & days

- Trailing and breakeven toggles

6. Run on VPS: For 24/5 uptime and consistent execution, especially if you’re trading BTCUSD.

Risk Management (Don’t Skip This)

High-frequency scalping shines when you control the downside. Three rules:

- Small risk per trade: 0.25–0.5% is fine for starters; scale only after a statistically meaningful sample.

- Daily loss stop: If the system hits your daily cap, let it rest—don’t change settings mid-storm.

- Broker hygiene: Low spreads, fast execution, and a stable VPS matter more to scalpers than any indicator tweak.

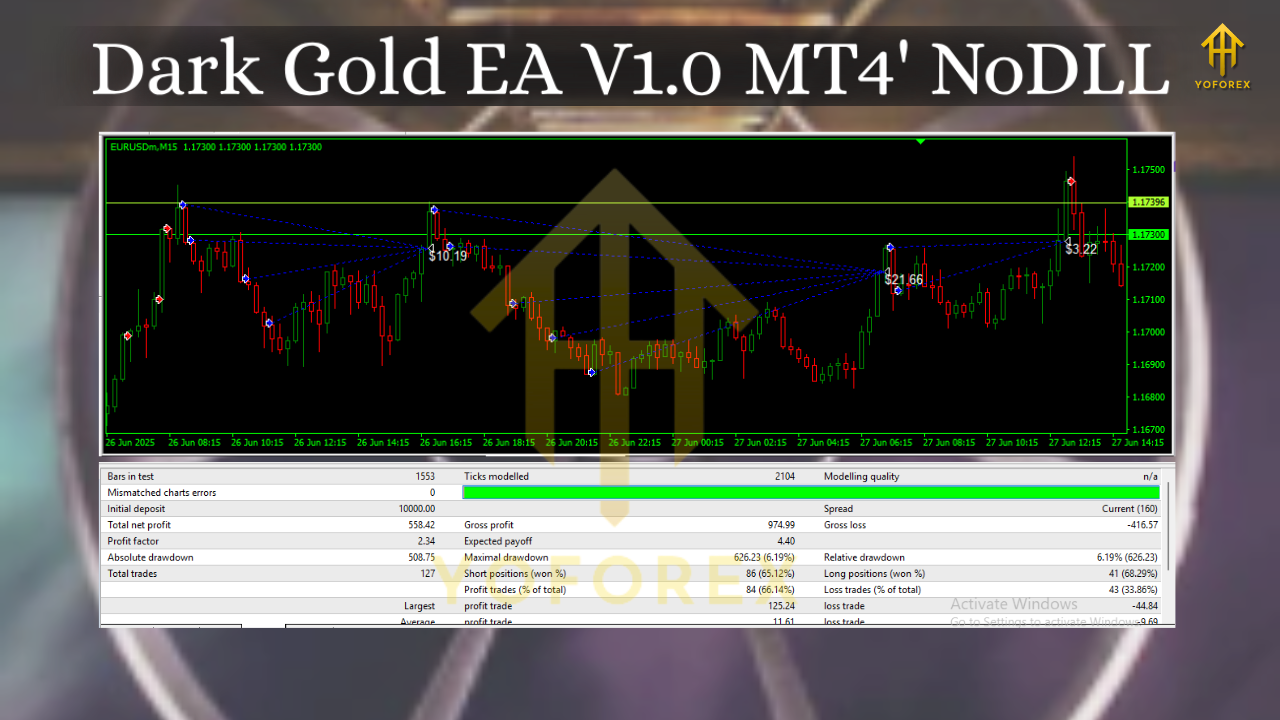

Performance Expectations & Testing

No EA wins every trade, and crypto/gold spikes can be wild. What you should aim for:

- High sample size on M5/M15 for realistic stats (hundreds of trades).

- Stable equity slope rather than moonshot curves. A steady 1.2–1.6 average R with ~45–55% win rate can outperform thrill-seeking systems.

- Pair-by-pair calibration: BTCUSD may need wider ATR multipliers; EURUSD often tolerates tighter stops.

Backtesting is useful for parameter discovery, but forward testing reveals real-world frictions like slippage and spread widening at odd hours. Keep logs; iterate gradually.

Tips for Each Market

- XAUUSD (Gold): Loves London/NY. Use stricter spread filter. News days (CPI, NFP, FOMC) are tricky—consider pausing.

- BTCUSD: 24/7 vibe; volatility comes in waves. Wider ATR multipliers, and watch weekend liquidity.

- EURUSD: Cleaner structure; great for learning the EA’s rhythm before tackling gold/crypto.

- GBPUSD: Punchier than EURUSD; modestly widen stops vs. EUR standards.

Final Word

Dark Gold EA V1.0 MT4 turns fast markets into a rules-driven playground. It won’t “fix” impatience or over-risking—but it will execute your plan flawlessly, every time. Start small, forward-test, keep clean logs, and adapt parameters per pair. Do that, and you’ll see why disciplined scalping beats adrenaline trading—especially on Gold and Bitcoin.

Comments

Leave a Comment