Automated trading has evolved far beyond simple buy-and-sell algorithms. Modern traders now demand systems that can adapt to market cycles, manage drawdowns intelligently, and provide flexibility in both automatic and manual trading environments. One such system that has gained attention among MT4 users is DCA CycleMax EA V2.53 MT4.

This guide is written specifically for beginners and intermediate traders who want a clear, professional understanding of how this Expert Advisor works, what type of trading logic it uses, and how it should be approached from a risk-management perspective. The focus is not on unrealistic profit promises, but on practical usage, strategy logic, and long-term survivability.

Upgrade

Version 2.53 of DCA CycleMax EA introduces refinements aimed at improving trade management and execution stability. The most notable upgrade is the correction of trailing stop behavior, which ensures that partial basket profits are protected more accurately once the market moves in favor of open positions.

This upgrade is important because DCA-based systems rely heavily on basket-level management rather than single-trade outcomes. Any improvement in how exits are handled can significantly affect overall performance consistency.

What Is DCA CycleMax EA V2.53 MT4

DCA CycleMax EA V2.53 MT4 is a semi-automated Expert Advisor designed around the Dollar Cost Averaging (DCA) concept combined with cyclical price movement logic. Instead of relying on a single entry and fixed stop loss, the EA builds a series of positions at predefined price intervals.

The core idea is simple: markets move in cycles, and strong assets often retrace before continuing in their primary direction. By spacing entries and managing them as a basket, the EA aims to close all trades collectively at a profit once the price returns to a favorable zone.

Unlike many fully automated grid systems, this EA allows traders to retain a level of manual control. This makes it suitable for traders who want automation assistance without completely removing human decision-making from the process.

How the Strategy Works

The trading logic of DCA CycleMax EA revolves around four key components:

First, the EA identifies a starting trade direction, either automatically or manually, depending on user preference. Once the initial trade is placed, the EA monitors price movement relative to the entry.

Second, if the market moves against the initial position, the EA opens additional trades at predefined price gaps. These gaps are adjustable, allowing traders to control how aggressively or conservatively the system averages positions.

Third, all open trades are treated as a basket. Instead of closing each trade individually, the EA calculates a combined profit target. Once the overall basket reaches this target, all positions are closed together.

Finally, optional features such as hedging and trailing stop management can be enabled to reduce exposure during extended adverse market conditions.

This structure makes the EA particularly effective in markets that exhibit strong directional movement with temporary pullbacks.

Semi-Automatic Trading Explained

One of the most important characteristics of DCA CycleMax EA V2.53 MT4 is its semi-automatic nature.

Traders can choose to:

- Let the EA handle entries automatically

- Manually open the first trade and allow the EA to manage averaging and exits

- Use manual take-profit levels while still benefiting from automated basket management

This flexibility is especially useful for traders who prefer to analyze the market themselves but want automation support during trade management and execution.

For beginners, this hybrid approach provides an excellent learning opportunity. It allows users to observe how DCA strategies behave in real market conditions while maintaining control over risk exposure.

Recommended Markets and Timeframes

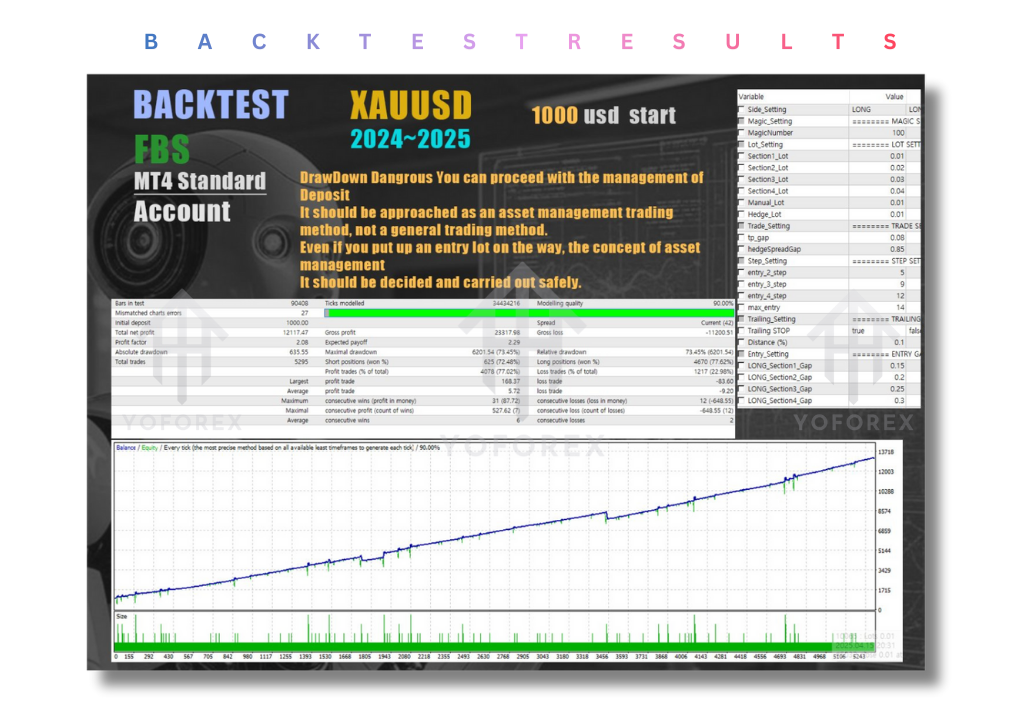

DCA CycleMax EA is designed for assets that demonstrate long-term trending behavior. Common use cases include:

- Gold (XAUUSD)

- Major indices

- High-liquidity crypto pairs

The recommended timeframe is M5, which allows the EA to respond quickly to price fluctuations while still capturing broader intraday trends.

Lower timeframes increase trade frequency and responsiveness but also require careful attention to spread, slippage, and broker execution quality.

Risk Management Philosophy

It is critical to understand that DCA-based systems manage risk differently from traditional stop-loss strategies.

Instead of cutting losses early, the EA attempts to recover drawdown through structured averaging and basket exits. This approach requires:

- Conservative lot sizing

- Adequate account balance

- Strict control over maximum number of entries

The EA includes parameters to limit how many positions can be opened in a single cycle. This is one of the most important safety features and should never be ignored.

Traders should also maintain sufficient free margin. DCA systems are not suitable for small, over-leveraged accounts. Proper buffer capital is essential to survive prolonged adverse movements.

Hedging and Trade Protection

DCA CycleMax EA offers optional hedging functionality. When enabled, the EA can open counter-directional positions after a certain number of averaging trades.

This feature is designed to reduce net exposure during extreme market moves. However, hedging should be used carefully, as it adds complexity and can increase swap or commission costs depending on the broker.

The trailing stop improvements in version 2.53 further enhance trade protection by allowing profitable baskets to lock in gains during favorable price movement.

Broker and Account Considerations

The EA performs best on accounts with:

- Low spreads

- Stable execution

- Minimal or zero swap costs

Micro or cent accounts are often preferred for beginners, as they allow traders to test the system with lower monetary risk while maintaining realistic execution behavior.

Using excessive leverage is strongly discouraged. The EA relies on margin availability to manage multiple open positions safely.

Who Should Use This EA

DCA CycleMax EA V2.53 MT4 is suitable for:

- Beginners learning how DCA strategies work

- Traders who prefer basket-based trade management

- Users who want semi-automated control rather than full automation

- Traders focusing on trending instruments

It is not suitable for:

- Traders expecting instant profits

- Small accounts with high leverage

- Users unwilling to monitor drawdown

- Traders who do not understand grid or averaging risks

Installation and Setup Overview

Installation follows standard MT4 procedures. After attaching the EA to the chart:

- Select the correct symbol and timeframe

- Adjust lot size according to account balance

- Define maximum number of averaging trades

- Configure entry gap settings conservatively

- Test on demo before live deployment

Proper setup is more important than optimization. Over-optimization often increases risk rather than reducing it.

Performance Expectations

Performance should be evaluated over long periods rather than short bursts of profitability. The true measure of a DCA system is its ability to survive difficult market conditions while maintaining controlled drawdowns.

Traders should focus on:

- Maximum drawdown

- Margin usage stability

- Recovery time after adverse moves

- Consistency rather than peak profit

Final Verdict

DCA CycleMax EA V2.53 MT4 is a thoughtfully designed DCA-based trading system that prioritizes flexibility, basket management, and trader involvement. Its semi-automatic structure makes it particularly appealing to beginners who want to understand how averaging strategies operate in real markets.

While it offers powerful tools for managing trades, success ultimately depends on responsible configuration, disciplined risk management, and realistic expectations. Used correctly, it can serve as a valuable component in a diversified automated trading approach.

For support and community discussion:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment