Introduction

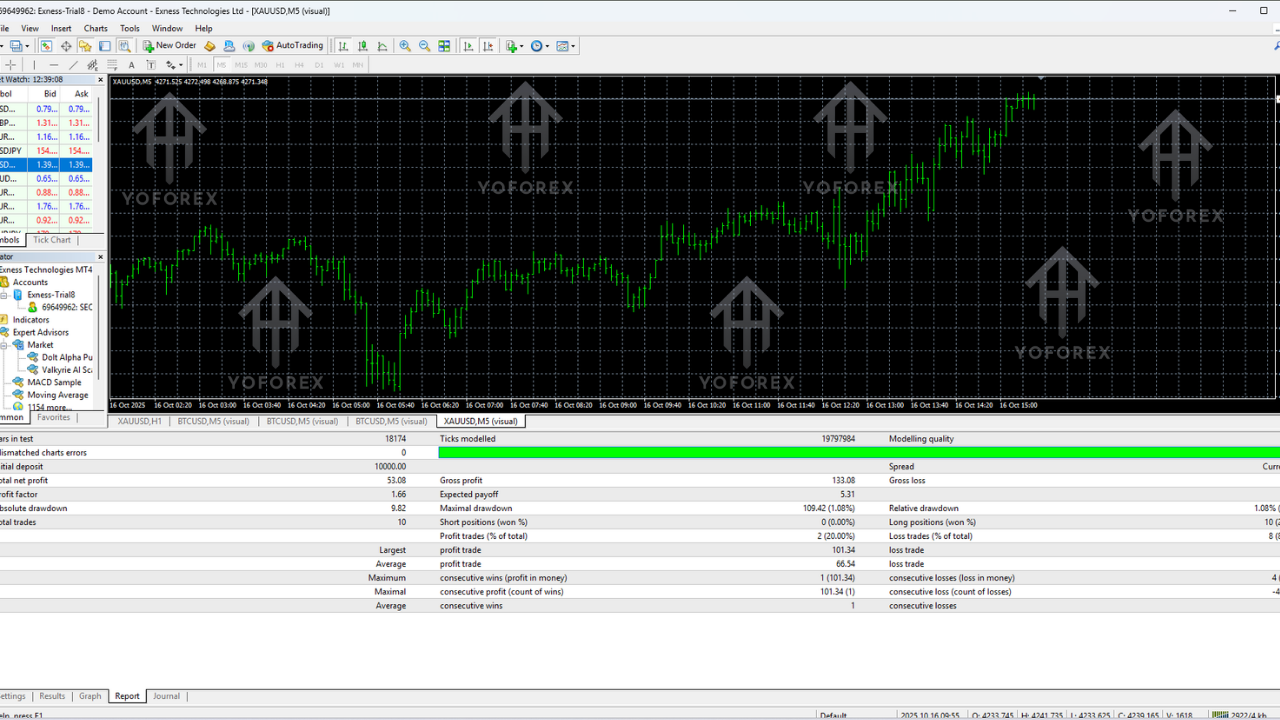

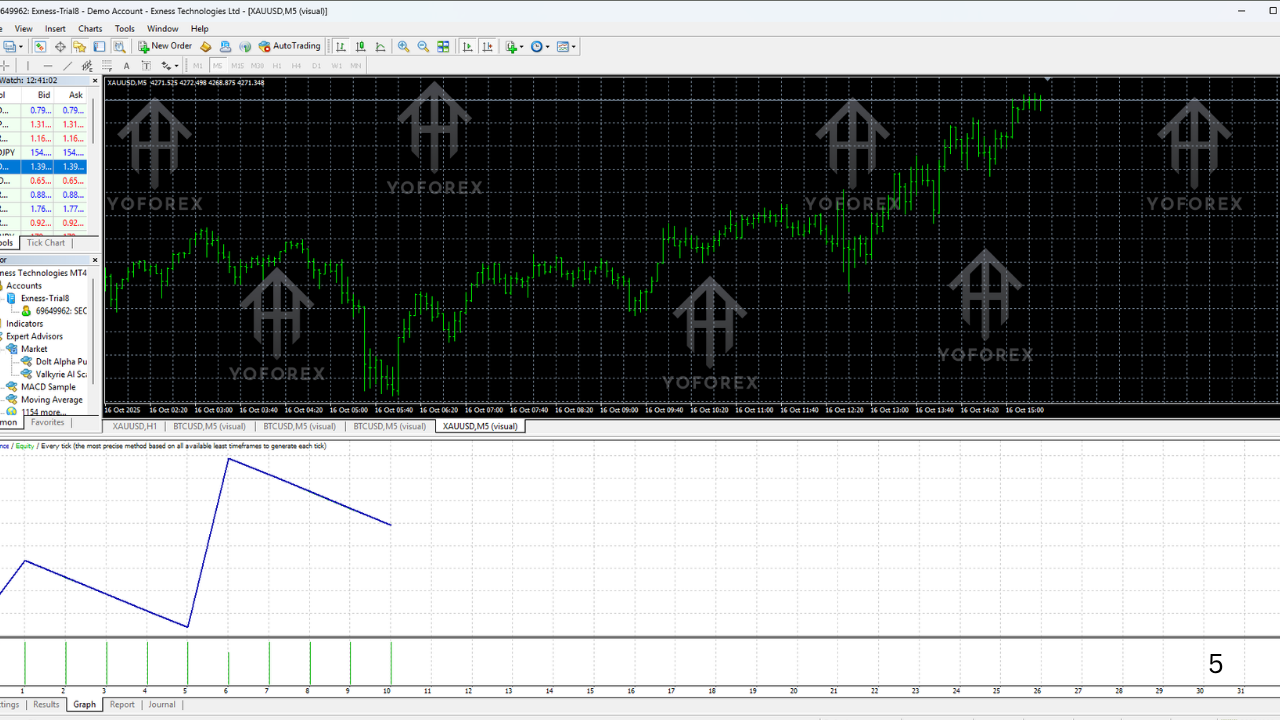

If you’ve been jumping from one “holy grail” forex robot to another and still not finding something stable enough for daily use, you’re not alone. Most bots either over-risk, over-optimize, or just fail in real markets after a few weeks. DoIt Alpha Pulse AI EA V2.32 MT4 is built to avoid exactly that situation. It combines AI-style logic with classic market structure rules, giving you a tool that actually respects risk while still hunting for solid trade setups.

In this guide, you’ll see what makes DoIt Alpha Pulse AI EA V2.32 MT4 interesting, how it works, what kind of trader it suits, and how to install and start using it on your MetaTrader 4 platform. No hype, just clear, human style explanation you can actually use.

What Is DoIt Alpha Pulse AI EA V2.32 MT4?

DoIt Alpha Pulse AI EA V2.32 MT4 is an automated trading system (Expert Advisor) created for the MetaTrader 4 platform. It’s designed to read the “market pulse” in real time — volatility, direction, and order-flow style behavior — and then execute trades based on a strict algorithmic rule set.

Instead of firing random scalping trades or gambling with aggressive grids, this EA focuses on:

- Identifying the active market regime (trending vs. ranging).

- Adjusting entries and exits according to current volatility.

- Limiting exposure through smart position sizing and built-in protections.

You can run DoIt Alpha Pulse AI EA on major forex pairs like EURUSD, GBPUSD, USDJPY and others, and you’re free to optimize it for your preferred broker conditions. It’s especially suitable for traders who want a “semi-hands-off” approach — set it up, monitor it once or twice a day, tweak risk, and let it work.

Because this is the V2.32 release, you also benefit from refined logic, bug fixes, and upgraded filters compared to earlier builds. Think of it as a more mature, battle-tested version rather than a brand-new experiment that might break anytime.

Key Features of DoIt Alpha Pulse AI EA

- AI-Driven Market Pulse Detection: The EA reads price action, volatility, and recent swings to understand if the market is trending or choppy, then adapts entries and exits to match that behavior.

- Multi-Timeframe Confirmation: You can configure higher timeframe confirmation (for example H1 or H4) so entries on M15 or M30 follow the broader directional bias instead of fighting the trend.

- Risk-Based Position Sizing: Lot size can be calculated as a percentage of account balance or equity, so your risk stays proportional instead of using blind fixed lots. This is crucial for long-term survival.

- No Martingale, No Crazy Grids: DoIt Alpha Pulse AI EA V2.32 MT4 doesn’t rely on doubling lot sizes after losses. There’s no extreme grid stacking that can blow accounts in one bad week.

- Built-In Equity Protection: Daily loss limits, maximum drawdown thresholds, and emergency close-all logic can be configured to protect your capital when markets become too unstable.

- Adaptive Take-Profit & Stop-Loss: TP and SL levels can be adjusted according to current volatility, instead of using the exact same static level in all conditions. In quiet markets stops can be tighter, in strong trends they can breathe.

- News & Volatility Filters (Optional): You can choose to reduce or pause trading around high-impact news if your style is more conservative. This helps avoid sudden spikes that can hit stops.

- Clear and Editable Input Settings: All main parameters — risk percentage, max open trades, magic numbers, trading sessions, spread filters — are available as inputs so even non-coders can fine-tune behavior.

- Compatible with Most MT4 Brokers: Any standard MT4 broker with decent spreads and execution should work. The EA is not locked to any specific provider.

- Scalable For Personal and Prop Accounts: With the right risk settings, the logic can be used on both smaller personal accounts and larger, more conservative capital like prop firm evaluations, tho you should always test first.

How DoIt Alpha Pulse AI EA V2.32 MT4 Trades the Market

Let’s break down how this EA “thinks” about trades in simple terms so you don’t feel lost in technical jargon.

1. Market Regime Detection

First, DoIt Alpha Pulse AI EA checks recent price action to decide what kind of market you’re in:

- Are we making higher highs and higher lows? (Possible uptrend.)

- Are we making lower highs and lower lows? (Possible downtrend.)

- Or are we stuck in a tight sideways range with no clean direction?

Depending on this market “pulse check,” the EA decides whether to trade with the trend, fade levels inside a range, or stand aside if conditions are too messy or unstable.

2. Signal Confirmation

When a potential setup appears, DoIt Alpha Pulse AI EA V2.32 MT4 looks for confirmation. This may include:

- Moving average direction or slope.

- Break of recent support or resistance zones.

- Volatility filters to avoid entries when the market is either too dead or too explosive.

Only when enough conditions line up does the EA trigger a buy or sell order. This way, it’s not just guessing; it’s reacting to a structured checklist.

3. Smart Entry & Exit Logic

Entries are placed with a predefined stop loss and take profit, tuned to current volatility. The EA may:

- Use tighter stops in low-volatility, calmer markets.

- Allow slightly wider stops in strong, directional trends.

- Trail stop loss when trades move strongly in your favor, locking in profits.

You can also limit the total number of open positions and the maximum risk across all trades, so the system doesn’t over-stack in dangerous conditions.

4. Risk & Equity Management

Risk handling is where many robots fail, but this is a core focus for DoIt Alpha Pulse AI EA:

- Per-trade risk: You define how much of your account you’re willing to risk per trade (for example, 0.5% or 1%).

- Daily loss cap: If your daily loss limit is hit, the EA can stop opening new trades for that day.

- Total exposure limit: There’s an option to restrict how much risk can be open across all pairs at once.

If any of these limits are triggered, the EA can either stop trading or close open positions, depending on your chosen settings. This is not magic, but it does enforce discipline even when you personally feel tempted to over-risk.

Recommended Usage & Basic Setup

You can adjust this to your own style, but here’s a simple, realistic starting point for running DoIt Alpha Pulse AI EA V2.32 MT4.

1. Recommended Pairs & Timeframes

- Pairs: EURUSD, GBPUSD, USDJPY as core majors. Optionally XAUUSD (Gold) if your broker offers tight spreads.

- Timeframes: M15 or H1 for a balance between signal frequency and quality.

You can always optimize pair-by-pair later, but don’t overload your platform with too many charts from the start.

2. Starting Deposit & Leverage

- Minimum practical deposit: Around $200–$300 to see meaningful percentage-based results.

- Leverage: 1:100 or higher is fine, but use it for flexibility, not for gambling huge positions.

Even the best EA cannot eliminate risk; it can only structure it. Treat leverage as a tool, not a shortcut to get rich overnight.

3. Installation Steps

- Download the EA file (

DoIt Alpha Pulse AI EA V2.32.ex4or similar) from your trusted source. - Open MetaTrader 4, then click File > Open Data Folder.

- Navigate to MQL4 > Experts and paste the EA file into this folder.

- Close and restart MT4 so the EA is loaded properly.

- Open your chosen chart, for example EURUSD M15 or H1.

- In the Navigator panel, find DoIt Alpha Pulse AI EA V2.32 MT4 under Expert Advisors.

- Drag and drop the EA onto the chart, then allow live trading in the settings window.

- Click the AutoTrading button at the top of MT4 to enable expert trading.

- Set your inputs: risk percentage, max open trades, magic number, spread filter, trading hours, etc.

- Run it on a demo account first for at least 1–2 weeks to understand behavior before going live.

Who Is DoIt Alpha Pulse AI EA V2.32 MT4 For?

This EA is a solid fit if:

- You’re tired of over-promised “100% win rate” robots.

- You want rules-based automation but still like to supervise risk and review results.

- You don’t have time to stare at charts all day but still want systematic participation in the forex market.

- You’re okay with realistic, steady growth instead of dream-level overnight doubling of accounts.

It may not be for you if:

- You expect 50% returns every single week no matter what.

- You’re not willing to read basic instructions or test on demo.

- You treat EAs like lottery tickets rather than tools that need proper risk control.

Tips to Get the Best Out of DoIt Alpha Pulse AI EA

A few practical suggestions, coz small tweaks can make a big difference:

- Always start on demo. Watch the EA across different weeks, including trending and ranging conditions, and during news.

- Use 1–3 pairs initially. Don’t attach the EA to every chart in your terminal on day one. Build up slowly.

- Keep risk moderate. For most traders, 0.5%–1% risk per trade is enough. High risk feels exciting but usually ends badly.

- Track performance. Export trading history regularly or use tracking tools so you can measure drawdown, win rate, and profit factor instead of guessing.

- Stay updated. When new versions release, check the changelog and consider upgrading after testing — V2.32 already represents a more polished build.

Final Thoughts

DoIt Alpha Pulse AI EA V2.32 MT4 sits nicely between “too basic” and “over-complicated.” It doesn’t promise magic, but it does offer:

- AI-style logic to read the current market pulse.

- Rules-based entries and exits instead of random trades.

- Strong emphasis on risk and equity protection.

- Enough flexibility to adapt to your preferred pairs, timeframe, and broker settings.

Used correctly — with demo testing, responsible risk, and regular monitoring — DoIt Alpha Pulse AI EA V2.32 MT4 can become a reliable part of your automated trading toolbox instead of just another file gathering dust in your MT4 experts folder.

Comments

Leave a Comment