Overview

Dragons Risk Shield EA V1.0 MT4 is a risk-centric automated trading system for MetaTrader 4. The EA’s core job is simple: protect capital first and let trades play out only when the conditions are aligned. It focuses on single-trade exposure (per symbol), uses a measured position-sizing engine (risk-percent model), and enforces daily/weekly loss halts. If you’ve been burned by martingale or grid blowups, this one’s a breath of fresh air.

Who it’s for

- Prop firm challengers who must respect daily drawdown rules.

- Retail traders who want structure and strong guardrails.

- Cautious investors who value steady growth over lottery-ticket wins.

How it trades (high level)

- Uses a trend-plus-volatility filter (e.g., EMA alignment and ATR thresholds) to pick a bias.

- Enters on breakout or pullback confirmations; avoids random chops.

- Applies fixed SL/TP measured in ATR and activates break-even + trailing when price moves in your favor.

- Limits max open trades and blocks new entries after a defined daily loss cap or equity drawdown is hit.

- Optional news/session filters to sit out chaotic windows.

Pairs & timeframe

- Works well on EURUSD, GBPUSD, XAUUSD; start on M15–H1 for cleaner signal-to-noise.

- Use a reliable ECN account and a VPS (latency < 50 ms) for consistent execution.

Key Features

- No Martingale, No Grid — one position at a time per symbol; sizing via risk percent.

- Equity Guard — hard equity stop in USD and/or %; protects the overall account.

- Daily/Weekly Loss Halt — automatically pauses new trades after a configured loss threshold.

- Risk-Percent Position Sizing — lot size derives from your chosen RiskPercent and actual stop distance.

- ATR-Based SL/TP — volatility-aware risk so stops aren’t too tight in fast markets.

- Break-Even & Trailing — lock gains once price moves your way; configurable activation points.

- Session Filter — trade only during liquid sessions (e.g., London/NY overlap).

- News Filter (optional) — skip high-impact events; reduce slippage traps.

- Max Open Trades — global cap to prevent exposure stacking across pairs.

- Pause-After-Loss — cool-off timer to avoid revenge trading logic.

- Magic Number & Comment Tags — clean separation if you run multiple EAs.

- FIFO/No-Hedge Mode — optional settings to align with prop/broker rules.

- Lightweight & Stable — designed to be VPS-friendly and consistent.

How the Strategy Approaches Entries

Trend Filter

- Looks for alignment of a fast and slow EMA (e.g., EMA 50 over EMA 200) to establish bias.

- Counter-trend trades off limits by default; can be allowed with stricter risk if you really want (not advised).

Volatility Filter

- Uses ATR to confirm there’s enough range to justify a trade.

- If the market’s sleepy or insanely volatile, it steps aside.

Entry Models

- Breakout: triggers on structure breaks with a clean impulse.

- Pullback: joins the trend after a measured retracement and rejection.

Exit Logic

- Hard SL/TP: always present and respected.

- Break-Even: activates after X ATR in profit.

- Trailing Stop: ratchets behind price; you choose step and distance.

- Time-Based Exit (optional): close before session end to avoid overnight risk.

Recommended Settings (Good Starting Point)

- RiskPercent: 0.5%–1.0% per trade (prop firms often prefer ≤0.5%)

- MaxDailyLossPercent: 3%–4% (halts new entries when reached)

- MaxWeeklyLossPercent: 7%–10% (optional additional guard)

- EquityStopPercent: 15% (global equity guard)

- MaxOpenTrades: 1 per symbol (start conservative)

- ATRPeriod: 14 | SL_ATR: 1.8–2.5 | TP_RR: 1.5–2.0

- BreakEvenTrigger: +1.0 ATR | BreakEvenOffset: +0.2 ATR

- TrailingStart: +1.5 ATR | TrailingStep: 0.5 ATR

- Session Filter: On (London+NY overlap)

- News Filter: On (skip high-impact)

- Symbols: Start with EURUSD; add XAUUSD once stable

- Timeframe: M15 (or H1 if you prefer fewer signals)

- Leverage: 1:100–1:500 (don’t let leverage tempt you into bigger risk)

- VPS: Strongly recommended

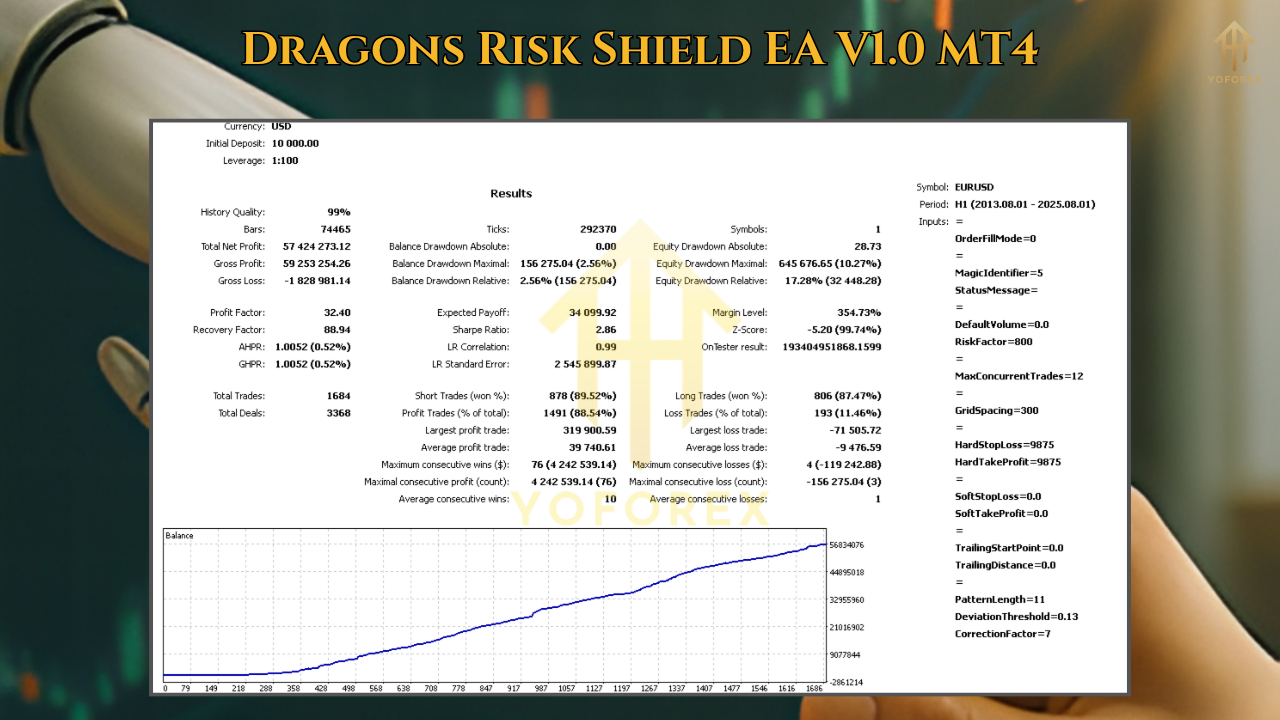

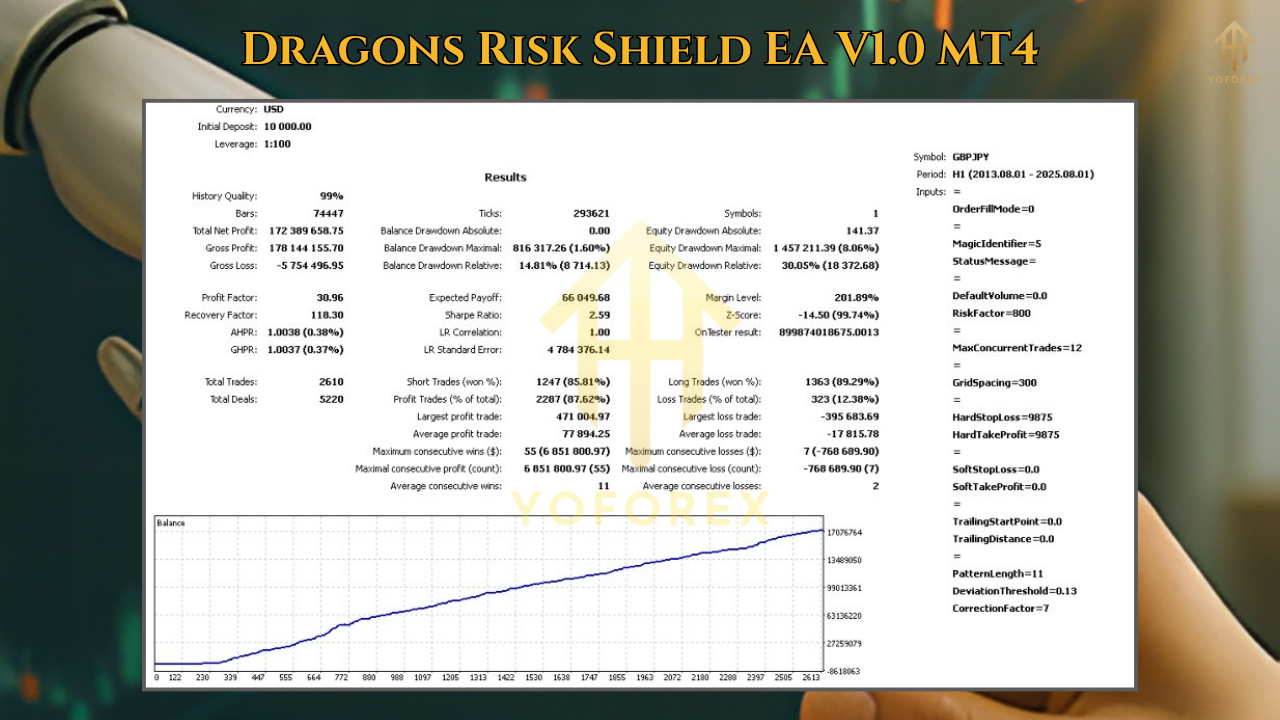

Backtest Results & How to Test Properly

Instead of tossing out wild “% per month” claims, Dragons Risk Shield EA V1.0 MT4 encourages evidence-based testing:

How to run a meaningful backtest

Data quality: Use tick data with proper spreads/commission modeling.

5-year span (or more): Include bull, bear, and choppy phases.

Robustness checks:

- Monte Carlo: randomize spread/slippage/order delay.

- Walk-Forward: optimize on one period, validate on the next.

Key metrics to watch:

- Max Drawdown (realistic) and underwater duration

- Trade count (enough samples to matter)

- Win rate × average R (expect realistic variance)

- Stability (no single month driving the equity curve)

What a healthy equity curve looks like

- Gradual stair-step with shallow dips, not vertical spikes.

- DD under control (your settings drive this; risk small).

- Low sensitivity to minor parameter changes (robustness).

How to Install & Configure (MT4)

- Copy files: Place the EA file into

MQL4/Expertsinside your MT4 data folder. - Restart MT4: Or right-click “Expert Advisors” and choose Refresh.

- Allow algo trading: Enable Algo Trading in MT4 top toolbar.

- Attach to chart: Open EURUSD M15 (starter symbol/timeframe) and attach the EA.

- Check common settings: Allow DLL imports if the news/session filters require it.

- Input parameters: Set RiskPercent, SL/TP, ATR, Daily/Weekly Loss caps, Session and News filters.

- Run on a VPS: Keep MT4 live 24/5 to avoid missed signals and reboots.

Risk Management Playbook (Use This Daily)

- Never raise RiskPercent to “win it back.” Keep it constant.

- Daily stop means stop. When the EA halts, you halt.

- Diversify across pairs cautiously. Correlated pairs can double your risk.

- Withdraw profits periodically. Protect gains outside the trading account.

- Journal weekly. Note slippage during news, spread spikes, and broker quirks.

Prop-Firm & Broker Compliance

- FIFO / No-Hedge Mode: Enable if your broker/firm requires it.

- Avoid HFT-like configs: Over-tuned trailing or ultra-tight SLs can trigger slippage flags.

- News trading: Many firms dislike event-spike exploitation — keep News Filter ON.

- Lot sizing: Keep risk small (≤0.5% per trade) to respect daily DD limits.

Troubleshooting

- “Trade disabled” or no entries? =>Session or news filter may be blocking. Check the Experts tab logs.

- Frequent small losses? =>Widen SL via ATR or use H1 timeframe to reduce noise.

- Large slippage on gold? =>Use a faster VPS, or switch to a lower-spread broker at liquid hours.

FAQs

Is Dragons Risk Shield EA V1.0 MT4 a martingale or grid bot?

No. It’s strictly non-martingale and non-grid by design.

What’s the minimum deposit?

Start from $200–$300 for FX pairs with 0.5% risk; gold typically needs more margin.

Can it pass a prop challenge?

It’s designed to respect risk, which helps — but no EA can guarantee passing. Use conservative settings.

Do I need a VPS?

Strongly recommended for stability and execution speed.

Can I run multiple pairs?

Yes, but start with one pair, then scale cautiously; set MaxOpenTrades conservatively.

Support & Disclaimer

If you need help with installation, optimization, or settings hygiene, reach out to your usual channel/community. Remember: past performance is not indicative of future results. Always forward-test on demo first and never risk money you can’t afford to lose.

Call to Action

Want a safer, rules-first approach to automation? Set up Dragons Risk Shield EA V1.0 MT4 on demo today, run it through your routine, and feel the difference of capital-first trading. When you’re comfortable with the flow, go live with conservative risk — let the guardrails do their job while you focus on consistency.

Comments

Leave a Comment