In the realm of forex trading, gold (XAU/USD) has consistently been a favoured asset due to its volatility and safe-haven status. With the advent of automated trading systems, traders now have the opportunity to capitalise on gold's price movements without constant manual intervention. One such system making waves is the ECNture Raging Gold EA V1.0 for MetaTrader 4 (MT4). Developed by Dimitri Nepomniachtchi, this Expert Advisor (EA) promises to revolutionise gold trading by offering a blend of advanced algorithms, multi-asset compatibility, and robust risk management features.

What Is ECNture Raging Gold EA V1.0?

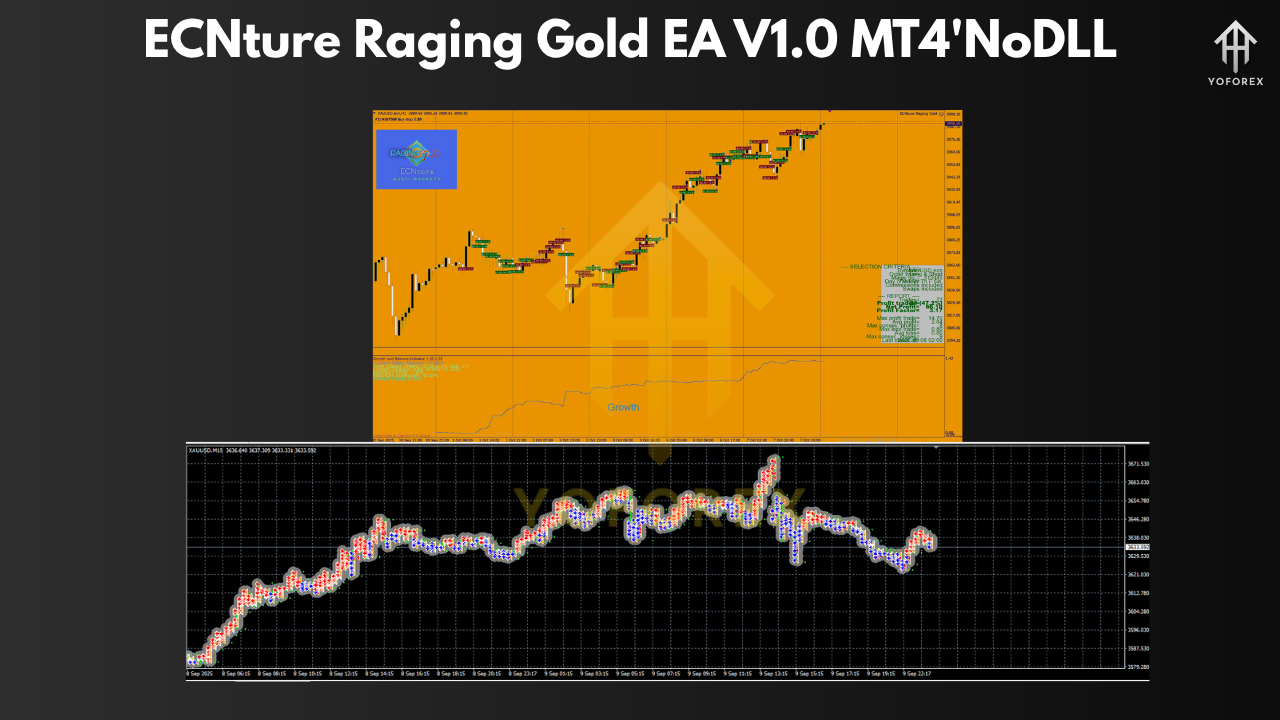

The ECNture Raging Gold EA is an automated trading system designed specifically for the MT4 platform. Its primary focus is on trading gold, but it also extends its capabilities to other assets such as major currency pairs and stocks. The EA operates by analysing market data and executing trades based on predefined strategies, aiming to maximise profits while minimising risks.

Core Features of ECNture Raging Gold EA V1.0

1. Multi-Asset Trading Capabilities

While optimised for gold trading, the ECNture Raging Gold EA also supports trading in other financial instruments:

- Currencies: The EA has demonstrated effective trading strategies on major currency pairs like EURUSD and GBPUSD, showcasing its adaptability across different markets.

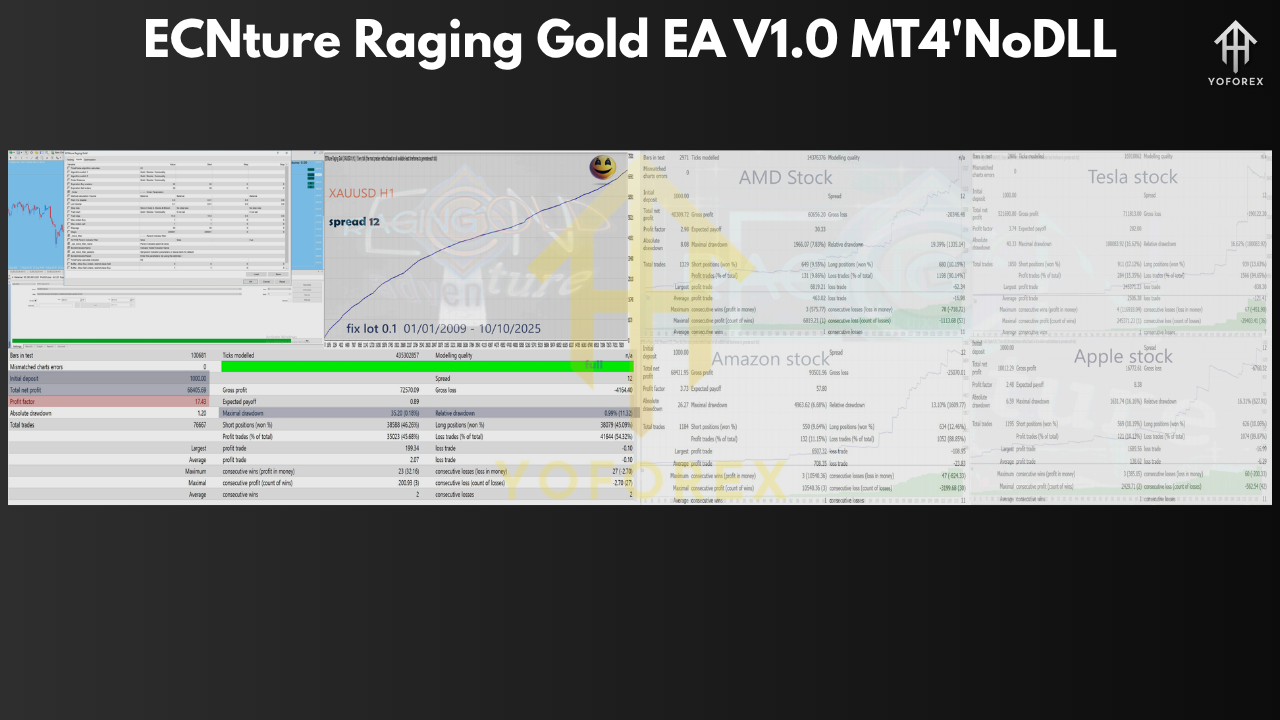

- Stocks: It can generate entry and exit signals for stocks, making it appealing for traders interested in stock market automation. However, it's essential to note that stock trading is subject to market hours, and the EA's performance may vary during off-hours.

- Cryptocurrencies: The EA is also capable of trading cryptocurrencies, offering versatility in asset selection.

2. Advanced Algorithmic Strategy

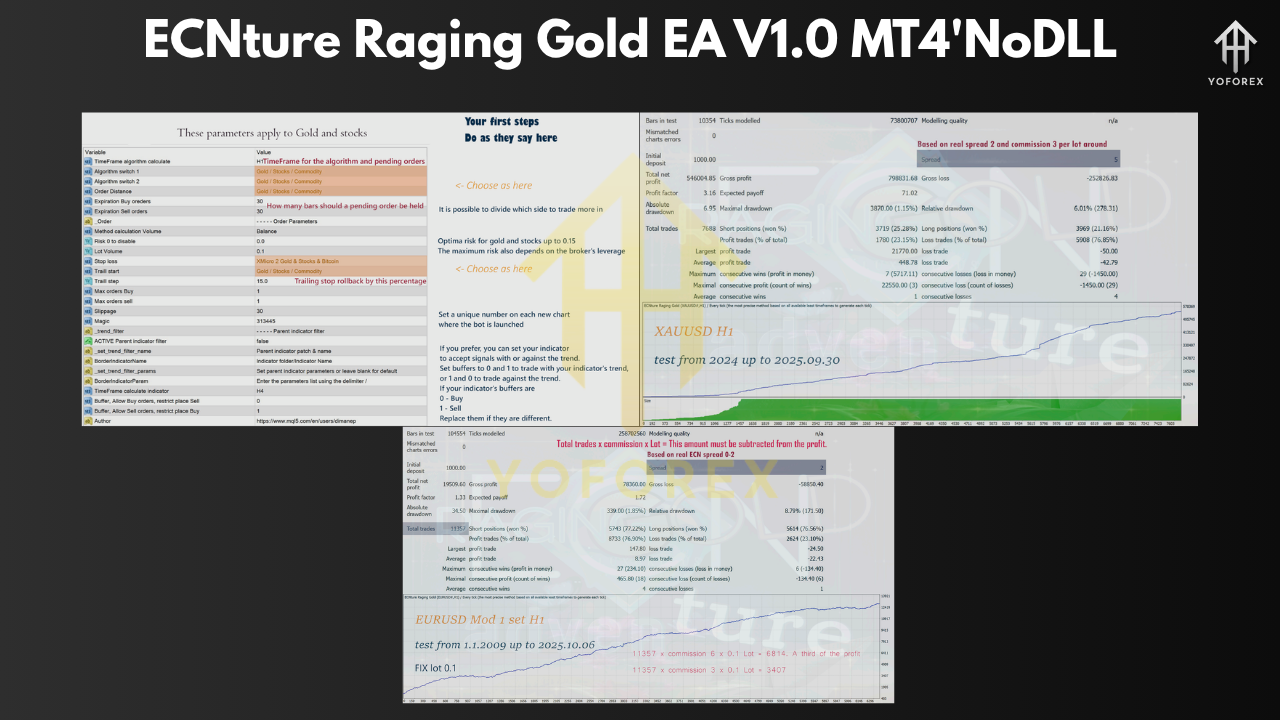

At the heart of the ECNture Raging Gold EA lies a sophisticated algorithm that has undergone extensive backtesting over several years. The developer emphasises that the system's reliability is not based on simple backtests but on comprehensive, long-term evaluations across various market conditions. This approach aims to ensure consistent performance and risk management.

3. Risk Management and Drawdown Control

Effective risk management is crucial in trading, and the ECNture Raging Gold EA incorporates several features to mitigate potential losses:

- Drawdown Monitoring: The EA includes mechanisms to monitor and control drawdowns, helping traders preserve capital during adverse market conditions.

- Spread and Commission Considerations: The developer advises that the EA performs optimally with brokers offering low spreads and commissions, as higher costs can erode profits.

Performance and Backtesting Insights

The developer shares insights into the EA's performance based on extensive backtesting:

- Currency Trading: The EA's parameters have been tested on EURUSD and GBPUSD, demonstrating good growth. However, it's noted that a spread of 2x without commissions is unrealistic, and lower spreads are preferred for optimal performance.

- Gold Trading: In gold trading scenarios, the EA has shown promising results, though it's acknowledged that periods of drawdown may occur, particularly during market lulls. The developer suggests that starting an account and allowing it to run for two years or more could yield favourable outcomes.

- Stock Trading: While the EA has shown potential in stock trading, it's important to consider that stock markets have specific trading hours, and the EA's performance may be affected during gaps when stock trading is closed.

Compatibility and Broker Recommendations

For optimal performance, the ECNture Raging Gold EA is recommended to be used with brokers that offer:

- Low Spreads and Commissions: To maximise profitability, it's crucial to choose brokers with competitive pricing structures.

- MT4 Platform Support: Since the EA is designed for the MT4 platform, brokers that support this platform are essential.

- 24/7 Market Access: Especially for trading cryptocurrencies, brokers that provide continuous market access can be beneficial.

Conclusion

The ECNture Raging Gold EA V1.0 for MT4 presents a promising option for traders looking to automate their gold trading strategies. With its multi-asset trading capabilities, advanced algorithmic strategy, and emphasis on risk management, it caters to a broad spectrum of trading preferences. However, as with any trading system, traders need to conduct thorough research, consider broker compatibility, and test the EA in various market conditions to ensure it aligns with their trading objectives.

Comments

Leave a Comment