If you’ve been looking for a MetaTrader 5 expert advisor that respects risk and still hunts for quality entries, Elise EA V6.2.04 MT5 is a solid pick. It blends a higher-timeframe trend bias with local price-action signals, filters out poor liquidity with spread/latency gates, and manages trades with breakeven and partial-close logic to smooth your equity curve. No forced martingale, no dense grids. Just an adaptive engine that aims for consistency.

Below you’ll find a full, practical walkthrough—how Elise EA thinks, what pairs/timeframes to use, starter risk settings, step-by-step installation, backtest workflow, prop-friendly guidance, troubleshooting tips, and a ready-to-paste metadata block for your CMS.

What Is Elise EA V6.2.04 MT5? (Overview)

Elise EA V6.2.04 is an automated trading system for MT5 that focuses on trading in the direction of a multi-timeframe trend while using an ATR-aware entry/exit framework. The idea is simple: avoid fighting the bigger move, wait for robust local confirmation, keep costs in check, and manage risk like an adult.

Core design pillars:

- Directional bias first: A higher-TF filter keeps the EA aligned with the dominant move.

- Signal confirmation second: A combination of candle structure and volatility buffers reduces fakeouts.

- Execution discipline: Spread/slippage gates, session windows, and optional news pause.

- Risk first, profit second: Stops and targets are baked in; breakeven and partial TP help reduce variance.

Key Features (At a Glance)

- Multi-Timeframe Trend Filter

Trades with the higher-TF bias to avoid constant counter-trend chops. - ATR-Aware Stops & Targets

Stop-loss and take-profit adapt to prevailing volatility so settings don’t go stale as conditions shift. - Session Windows

Restrict trading to London/NY or your custom window to avoid dead or erratic hours. - Spread & Slippage Gates

Skips poor-quality conditions (rollover spikes, thin liquidity) that ruin otherwise good ideas.

- Breakeven & Partial Close

Secure early gains; scale out at a first target to smooth the equity curve when momentum fades. - Optional Trailing Stop

Trail modestly when trends extend; avoid over-tight trails that cut winners. - Equity & Daily Loss Guard

Halt new entries if a daily cap or overall equity drawdown is hit—prop-friendly and sanity-saving. - No Forced Martingale/Grid

Averaging is off by default; if you enable safety adds, steps/spacing are capped. - Magic Number Isolation

Run multiple pairs/timeframes on the same account without conflicts. - Readable Logging

Clear order comments and logs for audits, journals, and prop reviews.

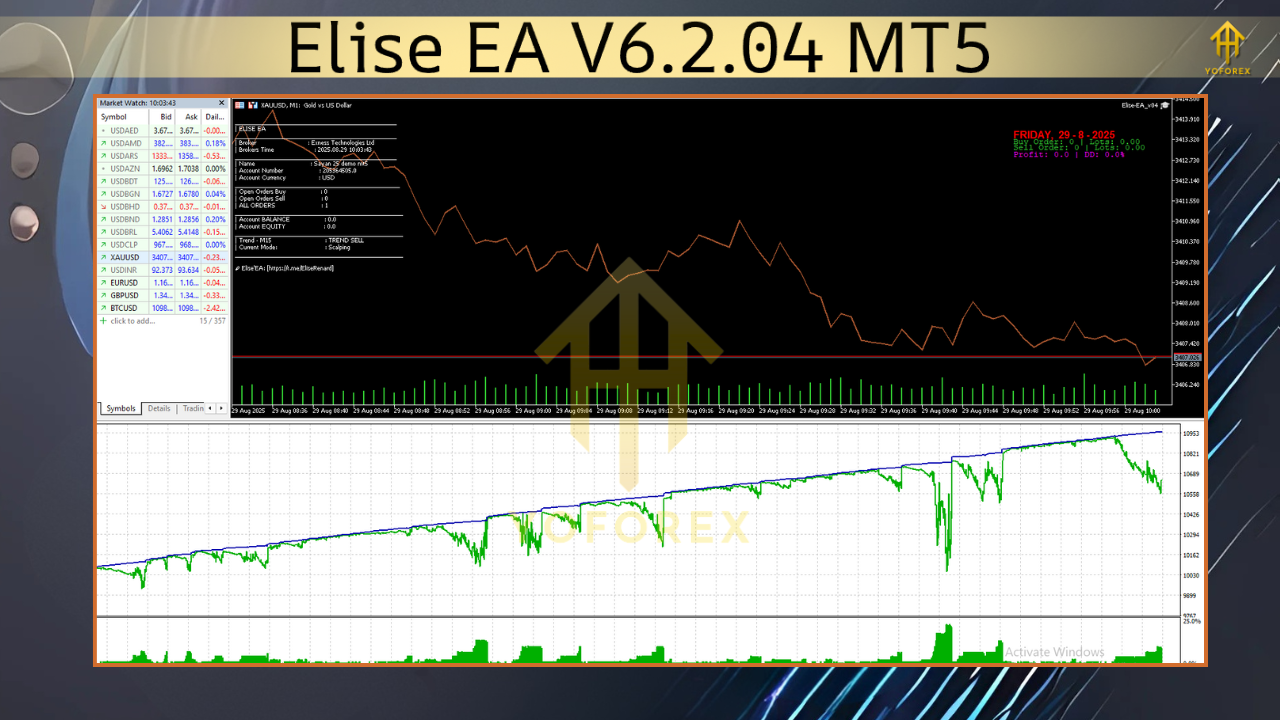

Supported Pairs, Timeframes & Capital

Pairs (start here): EURUSD, GBPUSD, USDJPY (tight spreads, strong liquidity).

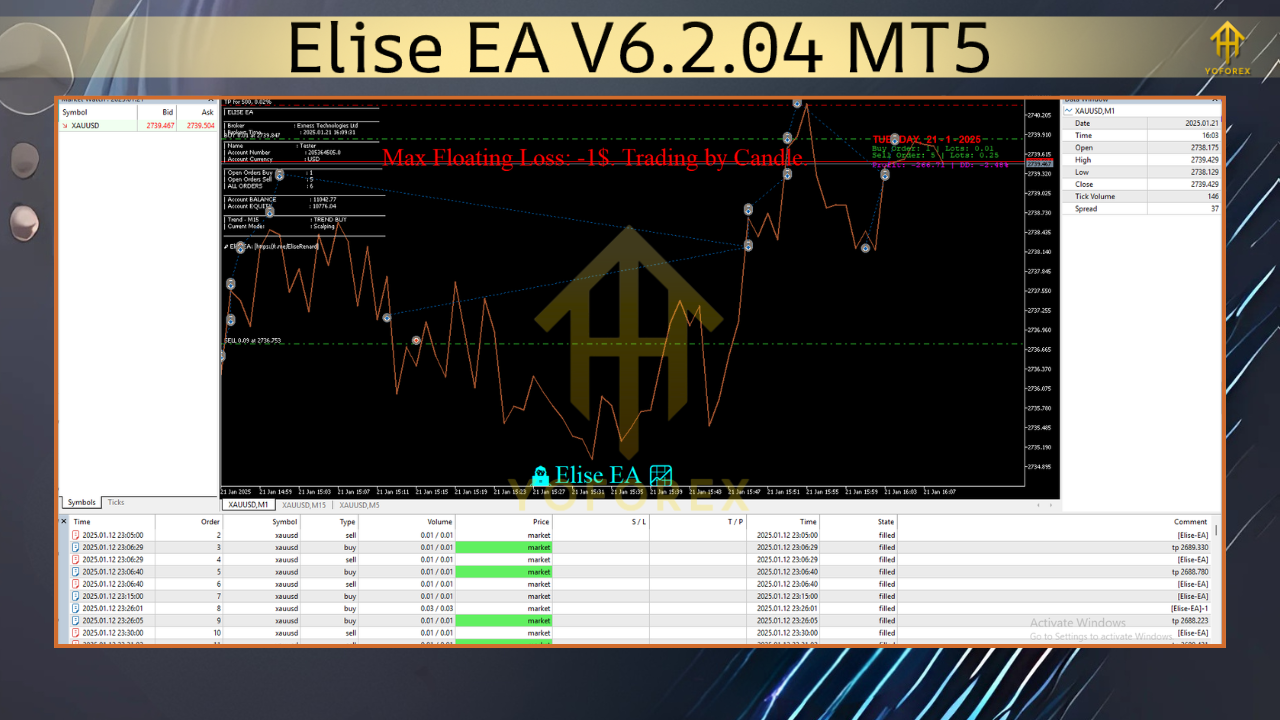

Add XAUUSD (Gold) on H1 once comfortable—use conservative risk and wider stops.

Timeframes:

- Scalper: M5/M15 (requires raw spreads and low latency)

- Intraday: M15/M30 (balanced frequency and costs)

- Swing: H1 (fewer trades, higher average quality)

Minimum & Recommended Deposit:

- Minimum: ~$100 (a cent account is handy for learning)

- Recommended: $300–$500+ for steadier sizing and risk control

Leverage: 1:200 or higher is fine—size risk, not dreams.

Environment: ECN broker, fast execution. For scalping, target <20ms VPS latency.

How Elise EA “Thinks” (Plain English)

- Session + Cost Check: Trades only during your defined hours and only if spread/slippage are below thresholds.

- Bias Filter: Confirms the higher-TF direction (e.g., H1/H4) to avoid constant counter-trend fighting.

- Trigger Logic: Looks for local price-action confirmation and applies ATR buffers to reduce micro-noise.

- Order Placement: Sets stop and target with either fixed-R or dynamic/ATR math.

- Management: Breakeven engages after a defined move; partial TP can bank a portion at the first target.

- Safety: Equity guard and daily loss cap can pause new entries when limits are reached.

Installation & First-Run Setup (Step-By-Step)

- Copy the file

PlaceElise_EA_v6.2.04.ex5into MQL5/Experts in your MT5 data folder. - Restart MT5 / Refresh

Restart, or right-click Experts in Navigator → Refresh. - Enable Algo Trading

Ensure the “Algo Trading” button is active in MT5. - Attach to Chart

Start with EURUSD M15 (Intraday) or H1 (Swing). Drag Elise EA onto the chart. - Load a Preset (.set)

If provided, useElise_Intraday_M15.setorElise_Swing_H1.setas a baseline.

Risk Settings

- Risk % per trade: begin at 0.5%–1.0%.

- Fixed lot: ~0.01 per $200–$300 equity for lower TFs; slightly higher for H1.

- Session Hours

London/NY overlap often works best. Avoid 5–10 minutes around daily rollover. - Quality Gates

Keep spread/slippage gates strict until your broker proves consistently clean. - Magic Numbers

Use a unique Magic Number per chart/pair to prevent conflicts. - VPS (recommended)

Especially for M5/M15—latency and stability matter.

Sensible Baselines (Safe Starters)

- Risk per trade: 0.5% to start; increase to 1% after stable forward results.

- Daily loss cap (EA): 3%–4% (below most prop daily max).

- Max concurrent trades: 1–2 while you learn the EA’s behavior.

- Breakeven trigger: around +0.8R–1.0R on scalper/intraday; later on swing.

- Partial TP: 50% at first target if you prefer smoother curves.

- Trailing: Modest ATR-trail only when trends extend; don’t strangle winners.

- News pause: Off for swing; on (or manual pause) for scalping around top-tier releases.

Backtest & Forward-Test Workflow (Don’t Skip)

- Data: High-quality tick data with variable spreads, realistic commission.

- Period: 12–24 months that include both trends and range chop.

- Session match: Test the same hours you’ll trade live.

- Costs: Use your broker’s typical spread/commission—no sugarcoating.

- Risk constant: Fix 1% risk/trade to compare pairs/timeframes fairly.

Metrics that matter:

- Max drawdown (relative) and consecutive losses—can you stomach it?

- Profit Factor > 1.3 on realistic costs is a decent baseline.

- Expectancy per trade stable across sub-periods.

- Time in market—lower exposure helps reduce tail risks.

Prop-Firm-Friendly Notes

- Daily cap: Keep EA cap below the firm’s daily limit (e.g., 3%–4% vs 5%).

- Risk per trade: 0.5%–0.8% during busy sessions.

- Correlation control: Avoid stacking highly correlated pairs at once.

- Event risk: Pause new entries 15–30 minutes pre/post CPI, NFP, FOMC if you scalp.

Troubleshooting (Quick Wins)

- “No trades today?” Check session hours, spread/volatility filters—skipping bad conditions is a feature.

- “Too many scratches?” Delay breakeven or enable partial TP; consider slightly wider ATR stops.

- “Whipsawed by news?” Lengthen the pre/post news pause for lower timeframes.

- “Conflicts with another EA?” Assign unique Magic Numbers and, if needed, use comment filters.

- “Hit the daily guard?” Lower per-trade risk and reduce concurrent exposure.

FAQ

Does Elise EA use martingale or grid?

Not by default. Any averaging is optional and capped—most users keep it off.

Can I run multiple pairs?

Yes. Use unique Magic Numbers per chart and respect total exposure.

Is a VPS required?

Strongly recommended for M5/M15. H1 swing still benefits from stability.

Will it work on Gold?

Yes, on H1 with conservative risk and wider ATR-aware stops. Test first.

Risk Disclaimer

Trading Forex/CFDs involves substantial risk. Past performance does not guarantee future results. Only trade capital you can afford to lose. Always validate settings on demo or a small live account before scaling.

Call to Action

Ready to trade with structure instead of stress? Download Elise EA V6.2.04 MT5, start with a preset (Intraday or Swing), and run disciplined tests for a couple of weeks. Keep risk tight, review results honestly, and scale when the data—not emotion—says go.

Download: (Insert your fxcracked.org download link here—match the slug below for clean SEO.)

Support: Add questions in your blog comments or contact your usual support channel.

Comments

Leave a Comment