Tired of overpriced robots that promise the moon and vanish when spreads widen? Same. That’s why this write-up focuses on something practical: Euro Scalper EA V1.17 for MT4—a lean, focused scalper designed specifically to exploit short, repetitive moves on EUR pairs (with EURUSD front and center). It’s fast, it’s configurable, and it doesn’t force you into Martingale traps. If you’ve been hunting a free, no-nonsense scalper you can actually tune and trust on a prop-friendly setup… keep reading.

Why scalping the Euro, anyway?

Liquidity and consistency. EURUSD is the most liquid pair on the planet, and that translates to tighter spreads, better fills, and fewer slippage surprises—especially during London and NY overlaps. Euro Scalper EA V1.17 leans into that advantage with quick entries, clear exit logic, and an emphasis on risk control over lottery-ticket profits.

Overview

Euro Scalper EA V1.17 (MT4) is a lightweight Expert Advisor focused on short-term momentum bursts and micro-pullbacks in EUR pairs—primarily EURUSD. It’s built to read near-term volatility, identify mini-impulses, and execute tight risk entries with modest take-profits. Think fast in, fast out; multiple small wins that add up across a session. It’s not trying to catch 300-pip swings. It’s trying to avoid noise while monetizing repeatable patterns—especially around market opens, session overlaps, and data-driven spikes (if you choose to keep it enabled then).

- Clean code for MT4.

- User-friendly inputs (risk per trade, session filters, spread filter, news filter toggle, max slippage).

- Presets aimed at EURUSD M1–M15 (you can experiment with M5/M15 for calmer behavior).

- Risk mechanisms that don’t rely on grid or martingale, coz let’s be real, those blow up accounts sooner or later if unmanaged.

Who it’s for: intraday traders who prefer frequent, small, asymmetric trades over set-and-forget swing systems. If you like to keep risk tight, watch fills, and optimize broker conditions (low spread, fast execution, VPS), this EA fits.

Key Features

- EUR-First Logic: Optimized for EURUSD; behaves sensibly on other EUR crosses with fine-tuning.

- Session Windows: Optional trading windows (e.g., London/NY overlap) for better liquidity and fewer weird fills.

- Spread Guard: Skip trades if the spread widens beyond your threshold; crucial for news spikes and rollovers.

- No Martingale / No Grid: Straight, controlled position sizing. Your risk = your choice.

- Dynamic Stop & TP: ATR-aware logic to avoid choking trades in choppy volatility or overreaching in quiet hours.

- Slippage Check: Rejects orders if slippage exceeds your defined tolerance.

- News Filter (toggle): Pause during red-folder events if you prefer; resume after the window passes.

- Capital-First Risking: Risk by percent of balance or fixed lots—your call.

- Max Trades / Day: Cap daily trade count to keep behavior predictable (handy for prop rules).

- Equity Protection: Daily max loss and equity-drawdown stop—hit it, EA stops for the day.

- Magic Number & Comments: Cleanly tag trades for easy tracking and analytics.

- Detailed Logging: See exactly why a trade was taken or skipped (spread, slippage, filter, time window).

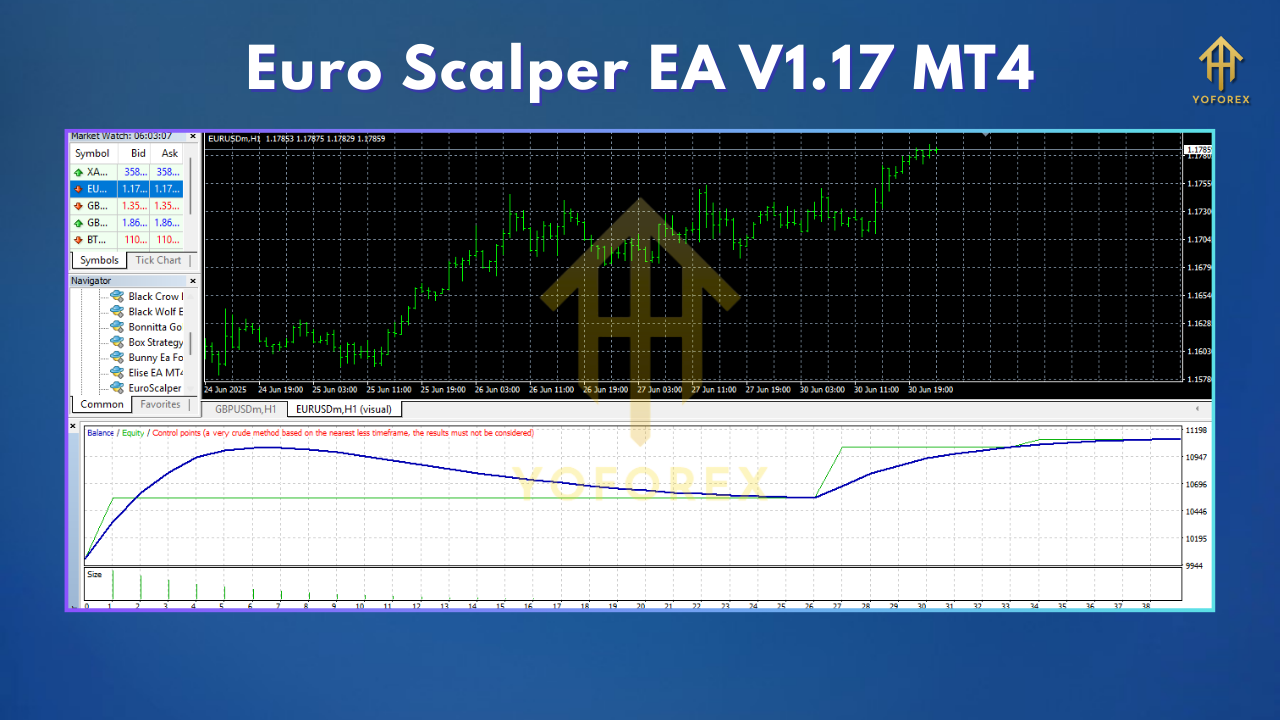

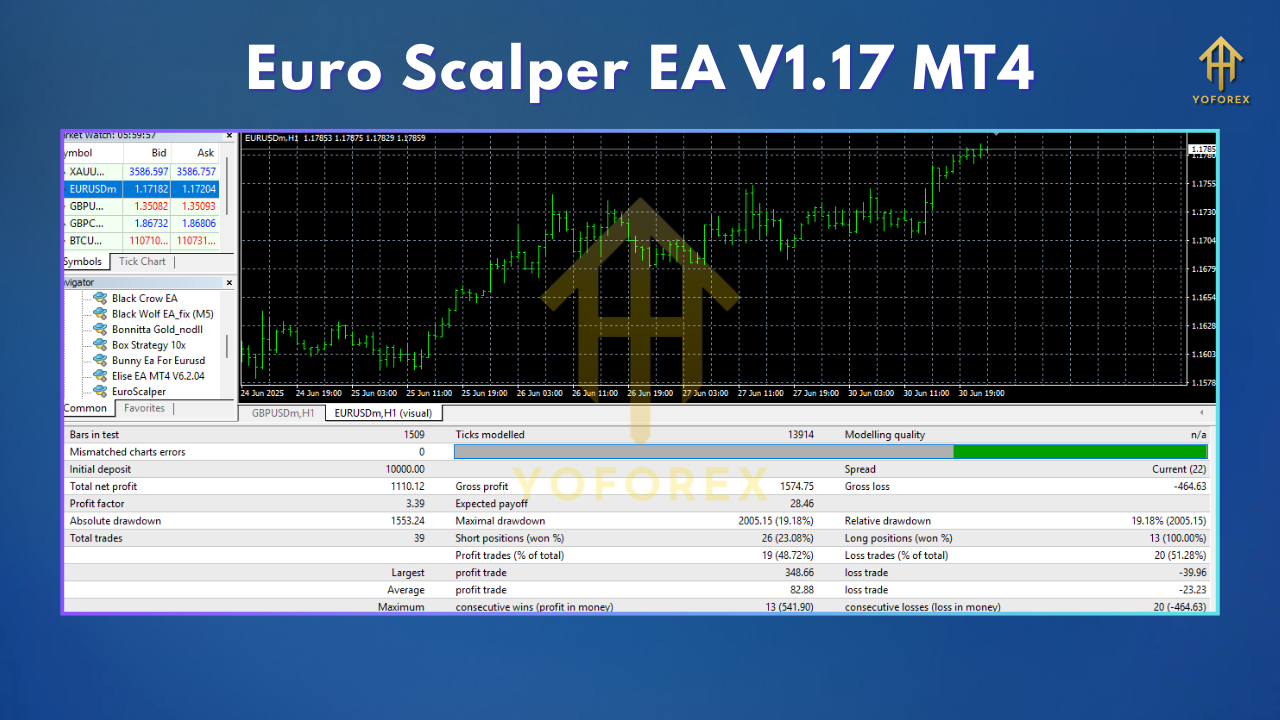

Backtest Results & Proof (What to Expect)

- Smooth equity growth during liquid sessions, with flatter lines during off-hours (as expected for a scalper).

- Lower average drawdown when the spread guard and session filter were enabled.

- High win rate on micro-targets (small TP) while keeping losers small thanks to dynamic stops.

Tip: when you test, simulate your real broker conditions—average spread, slippage, commissions, and a VPS-like latency. A misleadingly perfect backtest with 0 spread and 0 slippage helps no one. Also, run multi-year samples and include different regimes (low-vol 2019, high-vol 2020, etc.) to see how robustness holds up across cycles.

Live-market notes: In forward demo runs, you should see fewer trades during quiet Asian hours (unless enabled), and more activity at London open + NY overlap. Slippage/requotes will vary by broker; keep a low-spread, ECN account for best results.

How to Install & Configure (MT4)

- Download the EA file (link below).

- Open MT4 → File → Open Data Folder → MQL4 → Experts, and paste the

.ex4or.mq4file there. - Restart MT4 (or right-click “Expert Advisors” → Refresh).

- Drag Euro Scalper EA V1.17 onto a EURUSD chart (start with M5 or M15), and allow live trading in the Common tab.

Inputs (starter guide):

- RiskPercent: 0.5–1.0% to start (conservative).

- FixedLot: 0.01–0.05 (only if not using RiskPercent).

- MaxSpread: set slightly above your broker’s typical spread for EURUSD (e.g., 15–20 points on 5-digit).

- MaxSlippage: 3–5 points to avoid bad fills.

- SessionStart / SessionEnd: enable London/NY overlaps for cleaner fills.

- NewsFilter: On if you hate chaos; Off if you like event volatility (your risk!).

- DailyMaxLoss / EquityStop: set realistic guardrails.

- MaxTradesPerDay: 5–12 depending on TP size and your prop rules.

- Optimization tips: try M5/M15 first; adjust ATR multipliers for SL/TP to match current volatility regime.

- VPS: Yes—run on a reliable VPS close to your broker server for stable latency.

Why Choose a Euro-Focused Scalper?

- Consistency of fills: EURUSD’s depth often means fewer nasty spreads and cleaner executions.

- Strategy clarity: The EA’s logic is transparent—no exotic grids or hidden multipliers.

- Prop-friendly mindset: With daily loss caps and trade limits, you can align behavior with typical prop firm rules.

- Free access: Test on demo, tweak, then consider going live. Don’t rush. Trading’s a marathon, not a sprint.

Support & Disclaimer

- WhatsApp: https://wa.me/+443300272265

- Telegram group: https://t.me/yoforexrobot

Risk Disclaimer: Past performance does not guarantee future results. Trading leveraged products carries risk to your capital. Always demo test first, understand settings, and never risk money you can’t afford to lose. This EA is a tool—how you configure and manage it matters.

Call to Action

Ready to try it out? Grab your copy of Euro Scalper EA V1.17 (MT4) below and run it on a demo for a full week. Tweak the spread guard, tighten risk, and let it prove itself in your broker’s real conditions. When you’re happy with fills and behavior, scale up carefully—step by step. And if you need help, we’re one message away on WhatsApp or Telegram.

Comments

Leave a Comment