If you’ve been searching for a forex expert advisor that blends smart grid tactics with structured risk rules, you’ve probably stumbled across Fish n Grid EA MT4. And honestly, for traders who want a semi-aggressive but still controlled trading approach, this EA can feel surprisingly refreshing. Many grid EAs out there blow accounts coz they don’t handle volatility well… but this one tries to deal with that in a more realistic, less reckless way.

In today’s blog, let’s break down what Fish n Grid EA MT4 actually does, how it works, who it’s ideal for, its pros and cons, and why traders are still drawn toward grid-based systems even after years of market evolution.

This article is written in a simple, human-style tone with slight imperfections—kinda like how we talk naturally. Let’s dive in!

What Is Fish n Grid EA MT4?

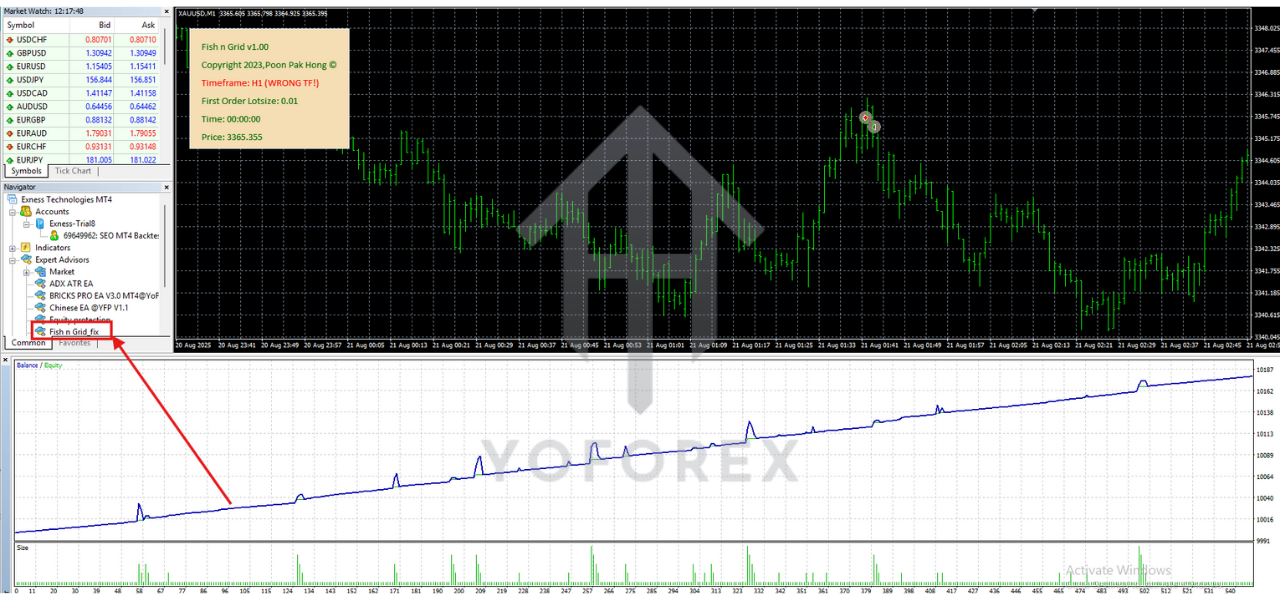

Fish n Grid EA MT4 is an automated trading robot designed for the MetaTrader 4 platform. As the name suggests, it uses a grid trading strategy, which means it opens multiple positions at predefined intervals as price moves in either direction. Traders who like this method usually want to catch reversals, retracements, or smooth trends without manually entering multiple trades.

The unique thing about this EA is that it combines:

- A structured grid layering model,

- A volatility-aware entry system,

- Adjustable maximum orders,

- And customizable distance between trades.

Unlike some grid robots that keep adding orders blindly, Fish n Grid EA MT4 tries to identify favorable price zones before expanding the grid. That alone makes it a bit safer compared to classical martingale-style bots.

It works on almost all major FX pairs, tho traders often prefer EURUSD, GBPUSD, AUDUSD, USDJPY, or GOLD depending on their risk appetite.

How Fish n Grid EA MT4 Works

It identifies the initial entry (Starter Trade).

This is usually based on its internal trend conditions or reversal conditions.

If the market moves opposite, it opens additional trades (Grid Expansion).

The spacing between trades (Grid Step) is configurable.

It aims for a target take profit for the entire basket.

Once overall profit reaches the target, it closes all positions.

If volatility spikes, distance adjusts (optional).

This prevents sudden over-stacking.

Key Features of Fish n Grid EA MT4

- Fully Automated Trading – no manual intervention needed.

- Customizable Grid Step – widen or tighten distance based on volatility.

- Supports All Major FX Pairs – works on EURUSD, GBPUSD, USDJPY, GOLD, etc.

- Dynamic Profit Target – closes overall basket, not individual trades.

- Risk Control Parameters – max orders, lot sizing, stop-trading filters.

- Smart Reversal Catching – designed to catch market pullbacks.

- No Coding Required – simply load onto MT4 and start trading.

- Handles Sideways Markets Beautifully – grid thrives in ranging conditions.

- Spread Filter – avoids trading when spreads widen unexpectedly.

- Beginner-Friendly Settings – default settings work fine for micro accounts too.

- News Filter Option (in some setups) – prevents grid stacking during news.

- Supports Low Deposits – many traders start with $100–$300.

Recommended Timeframes & Pairs

- M15

- M30

- H1

Best pairs:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- NZDUSD

- GOLD (XAUUSD) for experienced traders only

Advantages of Fish n Grid EA MT4

1. Perfect for Ranging Markets

Grid bots shine when price bounces between support & resistance levels. Fish n Grid EA MT4 handles this nicely.

2. Aims for Consistent Daily/Weekly Profits

Instead of chasing big targets, it usually aims for 1–3% basket closures depending on your risk setup.

3. Easy to Use

Even beginners can run it since it doesn’t need complicated inputs.

4. Adjustable Risk

You can set:

- Lot multiplier,

- Max number of grid orders,

- Equity protection,

- And profit targets.

5. Works on Small Accounts

You don’t need a huge balance to test or run it. Many traders start small and scale up.

Disadvantages of Fish n Grid EA MT4

1. High Trend Markets Can Be Risky

Long one-direction trends may cause deeper drawdowns.

2. Requires Strong Risk Management

If you increase grid sizes too fast, account risk rises sharply.

3. Not Ideal for News-Driven Sessions

NFP, CPI, FOMC, or major high-impact news can break grid logic.

4. Needs a Good Broker

Low-spread ECN brokers are essential; otherwise spacing becomes tight.

5. Not a Set-and-Forget EA

Although automated, you should monitor the market conditions at least once a day.

Performance Expectations (Generalized)

- Low-risk mode: 5–15% monthly

- Medium-risk mode: 15–35% monthly

- High-risk mode: 40–70% monthly (not recommended without experience)

Best Settings for Fish n Grid EA MT4 (General Advice)

- Starting lot: 0.01 per $100–$200

- Grid Step: 20–35 pips on majors

- Max Orders: 6–10

- Take Profit (basket): 5–15 pips equivalent

- Stop Trading During High Spread: Enabled

- News Filter: Optional but recommended

- Magic Number: Unique if running multiple EAs

Who Should Use Fish n Grid EA MT4?

- Traders who like grid/scaling strategies

- People with basic forex understanding

- Those who monitor markets once per day

- Anyone wanting passive but controlled trading

- Traders comfortable with small floating drawdowns

Risk Warning

Grid EAs can grow equity fast—but can also draw down heavily if misconfigured. Always test on demo first and avoid using unnecessarily high multipliers.

Conclusion: Is Fish n Grid EA MT4 Worth Trying?

If you’re someone who understands the risk and logic of grid systems, Fish n Grid EA MT4 can be a surprisingly balanced and profitable bot. It’s flexible, customizable, beginner-friendly, and capable of steady month-to-month gains when handled responsibly.

It’s not a miracle EA, but it’s definitely a capable tool for traders willing to manage it smartly.

Comments

Надёжная водоочистная система играет ключевую роль в повседневной жизни. Такая система помогает нейтрализовать вредные вещества из питьевой воды. При качественной фильтрации, тем здоровее становится питьевая вода. Большинство домовладельцев понимают необходимость использования надёжных очистительных систем. Новые фильтрационные решения позволяют добиться максимальной степени очистки. https://teplo-info.com/roboty-pylesosy-dlya-chistki-bassejnov-innovaczionnoe-reshenie.html Правильно выбранная система помогает защитить здоровье для организма. Регулярная замена фильтров продлевает срок службы водоочистной системы. Таким образом, качественная система очистки воды — это важный элемент для безопасного быта.

Leave a Comment