Forex Quant EA V2.0 MT4 might be your kind of tool. It’s built around clean, quant-style checks—trend bias, volatility regime, spread quality, and time-of-day logic—so it trades when the probabilities look better, not just because a line crossed another line. In other words, fewer random clicks, more structured decisions. Nice, right?

Below you’ll find a practical, no-fluff walkthrough: what the EA does, core features, recommended pairs and timeframes, setup steps, backtesting tips, and some prop-friendly risk rules. I’ll also drop metadata at the end so you can publish this directly on your site without fiddling around… coz who’s got time for that.

What Is Forex Quant EA V2.0 MT4?

Forex Quant EA V2.0 MT4 is an automated trading system designed for MetaTrader 4 that blends a trend filter, volatility gates, and execution quality checks (spread, slippage, session windows). It aims to take entries only when conditions are decent—think “trade the right moments, not all moments.”

You can run it as a scalper (M5/M15), intraday (M15/M30), or swing (H1). It supports multi-chart, multi-pair deployments using unique Magic Numbers. No compulsory martingale or dense grids; risk is controlled via fixed-lot or %-risk per trade, with optional breakeven and partial-close logic to lock gains and reduce tail risk.

Who it’s for: traders who value consistency, cleaner execution, and risk discipline—especially those who need to follow prop-firm rules without drama.

Key Features (Why Traders Like It)

- Bias + Volatility Framework: Trades with a directional bias and only when volatility isn’t dead or unhinged.

- Session Awareness: Limit trading to London, New York, or custom windows to avoid dead zones.

- Strict Risk Controls: Fixed lot or %-risk per trade, ATR-aware stop placement, and realistic TPs.

- No Forced Martingale: Averaging off by default; if you toggle it on, you can cap steps and spacing.

- Equity Protection: Daily loss guard and global drawdown cut-off—prop-friendly and sanity-saving.

- Spread/Slippage Gate: Sits out when the market is “too expensive” to enter, e.g., news spikes.

- Breakeven & Partial Close: Lock early profits; scale out at smart milestones when momentum slows.

- Magic Number Isolation: Safely run multiple pairs/timeframes on the same account.

- Clean Order Comments: Easy auditing for prop reviews and your own journals.

- Preset Packs (.set): Plug-and-play starting points for Scalper, Intraday, and Swing profiles.

Supported Pairs & Timeframes

Pairs (start here):

- EURUSD, GBPUSD, USDJPY — liquid majors with cleaner structure.

- XAUUSD (Gold) — works best with conservative swing settings and wider stops.

Timeframes:

- Scalper: M5/M15 (needs tight spreads, low latency)

- Intraday: M15/M30 (balanced frequency vs. cost)

- Swing: H1 (fewer, higher-quality signals; lower execution stress)

Minimum deposit & leverage:

- Minimum: ~$100 (a cent account helps while learning)

- Recommended start: $300–$500+ for steadier sizing

- Leverage: 1:200 or higher is fine—size risk, not dreams.

How the Strategy Thinks (Plain English)

- Session Filter: Trades only during the windows you allow—skip the zombie hours.

- Market Quality Gate: Checks spread and slippage thresholds; if costs are nasty, it waits.

- Trend/Bias Scan: Aligns to a higher-timeframe bias so entries don’t fight every wave.

- Trigger Logic: Looks for price-action confirmation with ATR buffers to avoid micro-fakeouts.

- Risk & Targets: Places a stop (ATR-aware) and TP with fixed R or a dynamic trailing approach.

- Management: Breakeven activates after a defined move; partial close trims risk if momentum fades.

- Equity Guard: If the daily loss cap hits, the EA stops opening trades for the rest of the day.

Installation & First-Run Setup (Step-by-Step)

- Copy the file: Place

Forex_Quant_EA_V2.0.ex4into MQL4/Experts. - Restart MT4: Or right-click Experts in Navigator → Refresh.

- Enable AutoTrading: Make sure the green play icon is on.

- Attach to chart: Example: EURUSD M15 (Intraday) or M5 (Scalper) or H1 (Swing).

- Load a preset: Start with

FQ_Scalp_M15.set,FQ_Intraday_M15.set, orFQ_Swing_H1.set(if provided).

Configure risk:

- Risk %: begin at 0.5%–1.0% per trade.

- Fixed lot: 0.01 per $200–$300 equity for scalping; slightly higher on H1 swing if spreads are tight.

- Session hours: Choose London/NY or your own window; avoid 5–10 minutes around rollover.

- Spread/slippage gate: Keep defaults strict; loosen only if your broker is consistently clean.

- Magic Numbers: Unique per chart/pair to avoid conflicts.

- VPS (recommended): Especially for scalping—aim for <20ms latency to your broker.

Recommended Settings (Safe Baselines)

- Risk per trade: 0.5% (prop-friendly), scale to 1% after a stable month.

- Max daily loss (EA): 3%–4% (keep below prop’s 5% if applicable).

- Max open trades: Start with 1–2 to avoid correlation shocks.

- Breakeven trigger: Around 0.8R–1.0R on scalper/intraday; later for swing.

- Partial take-profit: 50% at first target if you prefer smoothing; otherwise let full R run.

- News pause: Off by default for swing; on (or manual pause) for scalping around high-impact events.

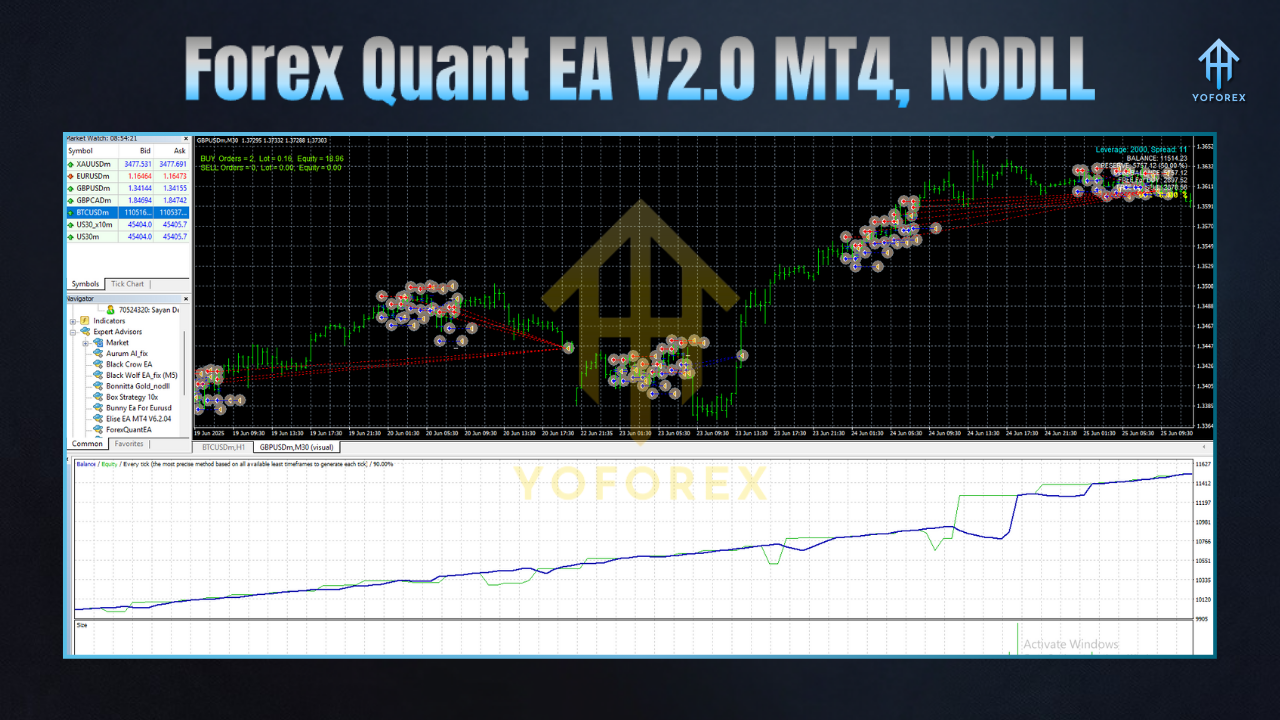

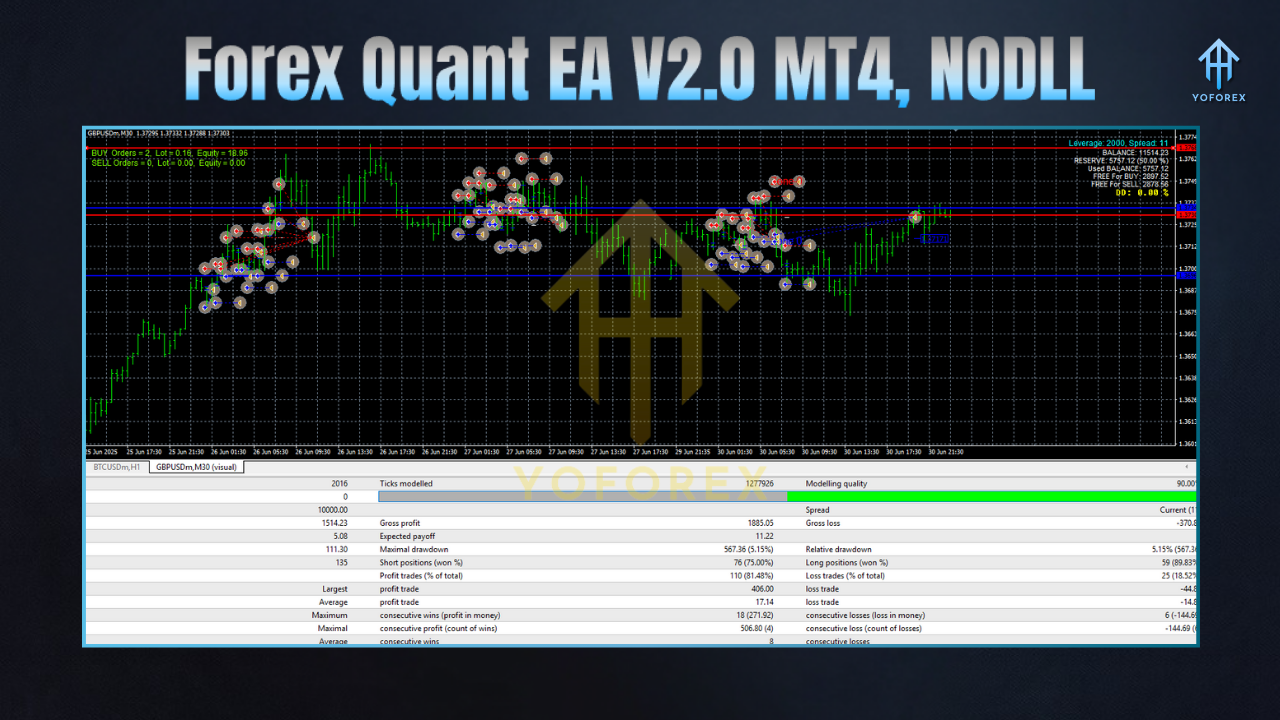

Backtest & Forward-Test Workflow (What to Check)

Backtest like a pro:

- Data Quality: Use tick data with variable spread and realistic commission.

- Period: 12–24 months covering both trends and range chop.

- Costs: Match your broker’s typical spread/commission—be honest.

- Session Match: If you trade NY only, test NY only. Don’t fool yourself.

- Consistency: Fix risk at 1% per trade to compare pairs and templates fairly.

Key metrics to watch:

- Max Drawdown (relative) and consecutive losses — can you stomach it?

- Profit Factor > 1.3 under realistic costs is generally workable.

- Expectancy per trade (keep it positive across sub-periods).

- Exposure/Time in Market — less exposure often equals fewer nasty surprises.

Forward test for 2–3 weeks on micro lots or a small live account. Confirm that live spreads & slippage don’t wreck the math. If they do, tighten filters or shift to Intraday/Swing.

Prop-Firm Notes (Stay Funded)

- Daily cap: Set EA daily loss below the firm’s threshold.

- Risk per trade: 0.5%–0.8% during scalping windows; avoid stacking correlated pairs.

- Avoid big news whipsaws: Pause new entries 15–30 minutes before/after top-tier US releases (CPI, NFP, FOMC).

- Keep it boring: Consistency beats thrill—especially through evaluations.

Troubleshooting Quick Wins

- No trades today? Check your session hours, spread gates, and volatility thresholds. It’s better to skip than force.

- Too many scratches? Delay breakeven slightly or use partial TP to bank something.

- Whipsaws around news? Activate (or lengthen) the news pause window for scalper templates.

- Duplicate orders? Assign unique Magic Numbers per chart.

- Equity guard tripping? Lower risk per trade and reduce concurrent positions.

FAQ

- Does it use martingale/grid?

Not by default. Any averaging is optional and capped—most traders keep it off. - Does it work on gold?

Yes, with Swing (H1) and conservative risk. Backtest and forward-test first. - Do I need a VPS?

Highly recommended for scalping; helpful for stability even on swing. - Is it plug-and-play?

Presets make it close, but broker conditions vary. Always test, then scale.

Risk Disclaimer

Trading Forex/CFDs involves substantial risk. Past performance does not guarantee future results. Only trade capital you can afford to lose. Always validate settings on demo or a small live account before scaling up.

Call to Action

Ready to trade with structure instead of stress? Download Forex Quant EA V2.0 MT4, load a preset that fits your style (Scalper/Intraday/Swing), and run disciplined tests for two solid weeks. Keep risk tight, track results, and scale only when the data says “go.” Simple as that—no heroics, just process.

Comments

Leave a Comment