Forex Robotron EA V29 MT4 — Automated Trading On Majors & Minors With $100 Start

If you’ve been hunting for a straightforward MT4 trading robot that doesn’t drown you in jargon, Forex Robotron EA V29 for MetaTrader 4 ticks a lot of boxes. It’s a fully automated Expert Advisor designed to scan charts, pick out high-probability setups, place trades, and manage positions with rules-based precision. Whether you’re brand-new to EAs or you’ve been testing bots for years, Robotron aims to deliver consistency by cutting out emotional decision-making and sticking to an algorithm that executes the same way, every time.

Below, you’ll find a practical walkthrough of what the EA does, how to install it, recommended baseline settings, and risk controls. You’ll also see guidance on how to backtest and run it on a VPS for best uptime. The goal: get you up and running safely with a sane approach to automation—because the fastest way to learn an EA is to set it up correctly and let the data speak.

What Is Forex Robotron EA V29 MT4?

Forex Robotron EA V29 is a MetaTrader 4 Expert Advisor built to analyze market structure, momentum, and volatility conditions, then execute entries and exits without human intervention. It’s compatible with all major and minor currency pairs, and it can be attached to any timeframe. The trade logic operates on price action rules and indicator filters to look for repeatable patterns. You’ll typically set your risk per trade, lot sizing method, and a few logic toggles—then let the EA handle the rest.

At a glance

- Platform: MetaTrader 4 (MT4)

- Working Pairs: All majors & minors

- Timeframes: Any (attach on your preferred chart)

- Minimum Deposit: $100 (conservative risk recommended)

- Mode: Fully automated (entry, exit, and position management)

Why Traders Consider Robotron

The real value of any EA is consistency. Robotron’s proposition is simple: if a setup meets the algorithm’s criteria, it gets traded—no hesitation, no “what if,” and no revenge trading. In day-to-day practice, that means:

- Rule-based entries: Eliminates the cognitive bias that leads to overtrading.

- Risk controls: Stop-loss, take-profit, break-even, and trailing logic (if configured).

- 24/5 monitoring: The EA can watch charts while you sleep—just be sure your MT4 stays online via a VPS or a machine that runs continuously.

Automation is not magic; it’s discipline. If you approach Robotron as a rules engine that must be paired with risk limits and broker reliability, you’ll have a healthier relationship with it from day one.

Core Features You’ll Use Daily

- One-click deployment: Attach to a chart, load settings, hit “OK,” and you’re done.

- Multi-pair flexibility: Works with majors (EURUSD, GBPUSD, USDJPY, etc.) and minors (EURGBP, AUDNZD, etc.).

- Any timeframe compatibility: M1 to H4 or higher; your risk and frequency will vary.

- Position sizing: Fixed lot or balance-based proportional lot sizing for steady scaling.

- Stops & targets: Configure hard SL/TP, optional trailing stop, and break-even shift.

- News-aware trading (optional via filters): If you use an external news filter/EA companion, you can pause during high-impact releases.

- Robust logging: MT4 Experts and Journal logs for quick diagnostics.

- VPS-friendly: Lightweight and stable for 24/5 execution.

Quick Start: Installation & Setup (MT4)

- Copy files: Place the EA file (

.ex4or.mq4) intoFile → Open Data Folder → MQL4 → Experts. - Restart MT4: Close and reopen MT4 so it recognizes the EA.

- Enable algo trading: Click the Algo Trading button (it should show green).

- Attach to chart: Open your chosen symbol (e.g., EURUSD M15), drag Forex Robotron EA V29 from the Navigator → Expert Advisors panel onto the chart.

- Allow live trading: In the EA’s Common tab, check “Allow live trading.”

- Load set file (if provided): In the Inputs tab, load a preset or configure your risk, SL/TP, and logic filters manually.

- Check smiley face: A smiling face in the chart’s top-right corner confirms the EA is active.

- Test in demo first: Run it on demo for at least 2–4 weeks to validate execution and slippage with your broker.

Baseline Settings (A Sensible Starting Point)

These are generic, conservative ideas to help you start clean. Always adapt to your broker’s spreads, commissions, and execution quality.

- Account balance: From $100 minimum; more balance increases survivability.

- Risk per trade: 0.5% to 1% is conservative. Newer traders: start at 0.5%.

- Lot sizing: Use balance-based (e.g., 0.01 lots per $1,000 balance) for smooth scaling.

- Stop-loss: 15–60 pips depending on pair volatility; tighter for low-spread majors.

- Take-profit: 1:1 to 1.5:1 RR for frequent-win profiles; 2:1 if strategy logic supports it.

- Trailing stop (optional): Use a modest trail only if your tests show improved net outcomes.

- Trading hours: If your broker’s spreads widen at rollover, consider pausing 5–15 minutes around server midnight.

- Pairs to prioritize: Start with EURUSD, GBPUSD, USDJPY, AUDUSD, EURJPY—tight spreads, ample liquidity.

Timeframes & Pairs: How To Choose

Robotron can sit on any timeframe, but your experience will differ:

- Lower timeframes (M1–M5): More trades, more noise. Great for testing execution; be careful with spreads and slippage.

- Mid timeframes (M15–H1): Balanced frequency and quality of signals; often a sweet spot for many EAs.

- Higher timeframes (H4+): Fewer signals, potentially stronger trend alignment; patience required.

On pairs, start with majors for lowest friction costs. Add minors once you’ve seen stable behavior, and only if spreads are acceptable for the logic you run.

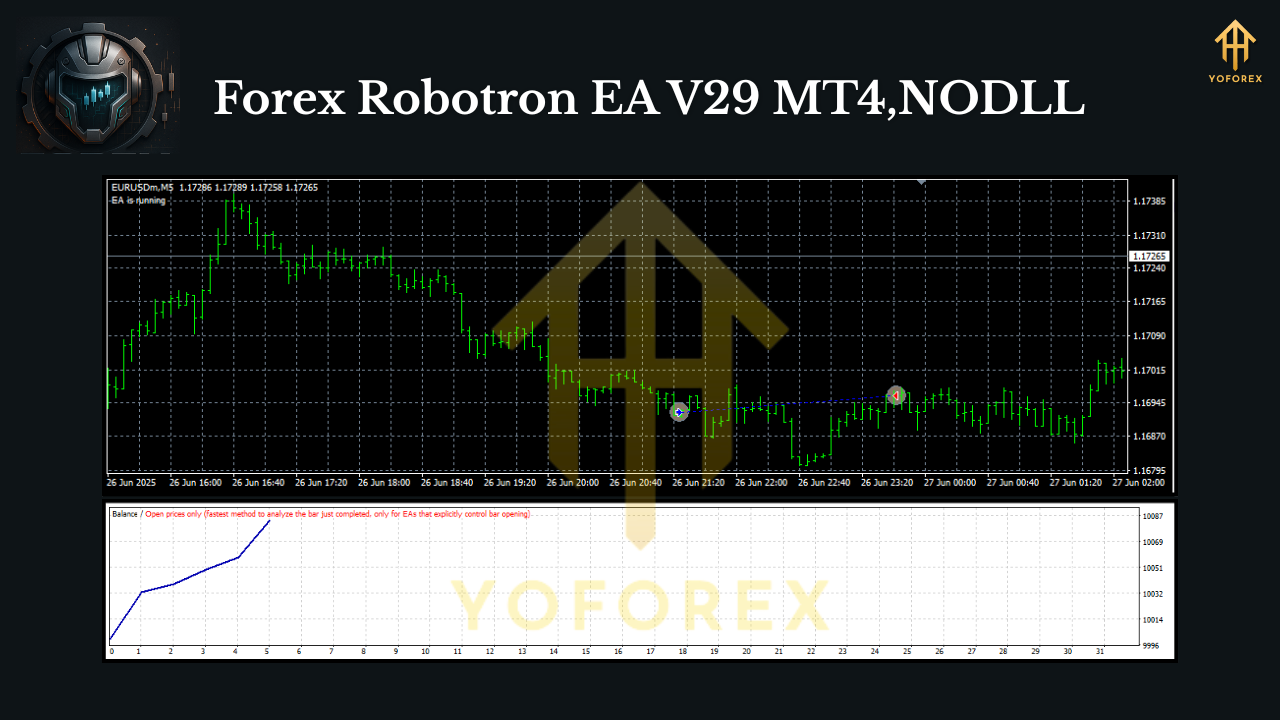

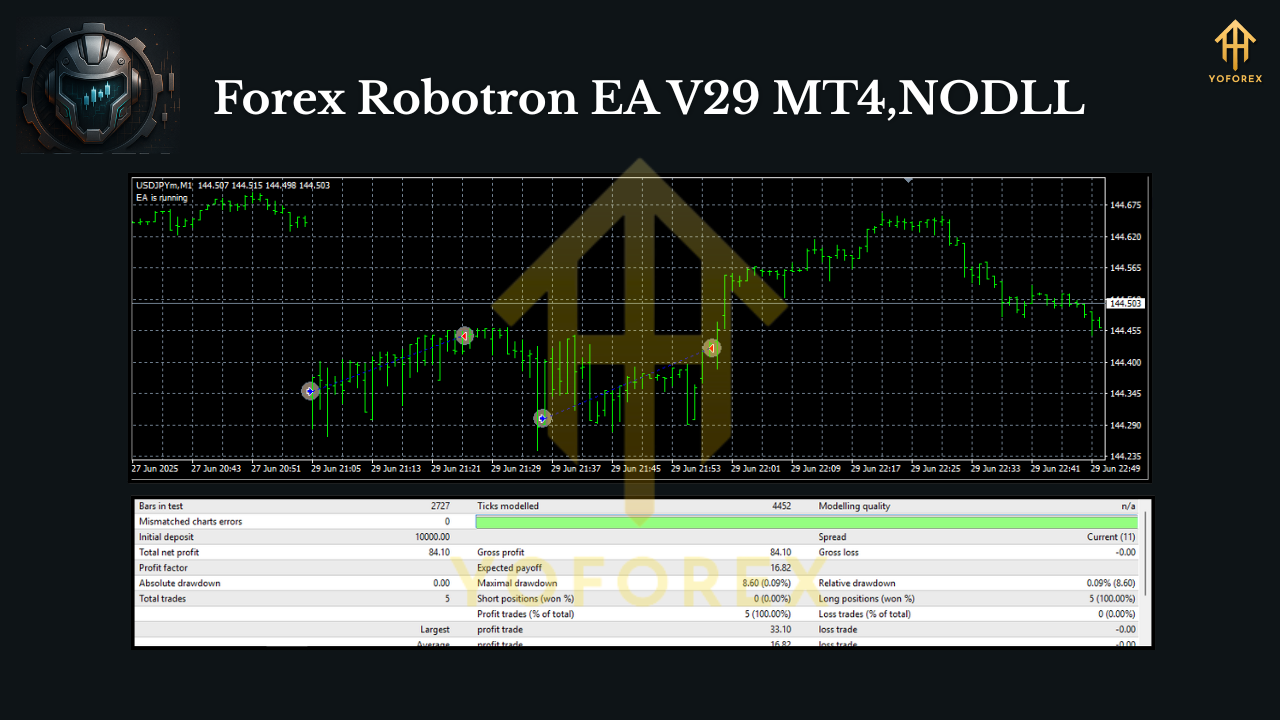

Backtesting & Optimization Tips

Before risking real money, you should always backtest. Here’s a clean process:

- Use high-quality data: Model with as much tick accuracy as your tester/data provider allows.

- Test multiple years: At least 2–3 years across mixed regimes (trending, ranging, volatile).

- Parameter sweeps: Don’t overfit; look for stable regions where small input changes still produce acceptable results.

- Walk-forward validation: Split your history (in-sample vs out-of-sample) to see if performance generalizes.

- Broker mirroring: If possible, test with your broker’s historical feed to mirror live spreads/commissions.

What to look for in results:

- Smooth-ish equity curve: Small dips are normal; avoid “straight lines up” (usually overfit).

- Max drawdown within tolerance: Keep it below your personal pain threshold (e.g., 10–20%).

- Trade count: Enough trades to be statistically meaningful (hundreds, not dozens).

- Profit factor & Sharpe: PF above ~1.3 is workable; higher is better if it’s consistent.

Live Trading Checklist

- VPS: Use a reputable VPS near your broker’s server for stable uptime and lower latency.

- Leverage & margin: Keep free margin healthy; avoid stacking risk across too many pairs at once.

- Broker selection: Tight spreads, fast execution, honest slippage—test before scaling.

- Position sizing: Resist the urge to “juice” the profits by doubling risk. Scale only after 4–8 weeks of stable outcomes.

- Logging & review: Check MT4 logs weekly. If something looks off, pause and investigate before resuming.

Risk Management That Actually Helps

No EA is bulletproof. Markets gap, spreads widen, and news can shock price. Practical guardrails:

- Daily loss cap: Stop trading for the day if equity drops a fixed % (e.g., 2%–3%).

- News hygiene: Consider pausing during high-impact news (CPI, NFP, central bank rates).

- Diversification: If you enable multiple pairs, keep per-pair risk small so total portfolio risk stays controlled.

- Withdrawal plan: Set milestones (e.g., withdraw 25% of profits after +10% equity growth).

Who Is Robotron Best For?

- Hands-off traders who want rules-based trading without screen time.

- Beginners who will commit to demo testing and start with tiny risk.

- Busy professionals who can’t watch markets 24/5 but want systematic exposure.

- Systematic traders who enjoy backtesting and gradual optimization.

Final Notes & Disclaimer

Forex Robotron EA V29 MT4 can trade any major or minor pair and run on any timeframe with a minimum deposit from $100. That said, past performance does not guarantee future results. Always test on demo first, deploy risk you can afford to lose, and treat automation as a professional tool—not a promise.

Comments

Leave a Comment