The evolution of automated trading has brought forth numerous tools designed to simplify the complexities of the financial markets. Among these, the Forex Yields EA V1.02 MT4 has gained significant attention for its specialized approach to currency and gold trading. This expert advisor is not merely a signal generator but a comprehensive algorithmic system engineered to operate within the MetaTrader 4 environment. By removing the emotional hurdles that often lead to retail trader failure, this software aims to provide a structured, data-driven methodology for market engagement.

Understanding the Architecture of Forex Yields EA V1.02

At its core, version 1.02 of the Forex Yields EA is built on a hybrid logic that combines price action analysis with a sophisticated grid-averaging mechanism. Unlike traditional robots that rely solely on lagging indicators like moving averages or the Relative Strength Index, this system focuses on market structure and volatility. It identifies key liquidity zones where price is likely to react and initiates positions based on high-probability setups.

The system is particularly well-known for its performance on the XAUUSD pair, commonly known as Gold. Because Gold exhibits high volatility and strong trending characteristics, the EA's internal logic is tuned to capitalize on these swings. However, it is also adaptable to major currency pairs such as EURUSD and GBPUSD, where it utilizes a tighter scalping frequency to accumulate small gains over time.

Core Strategy and Trade Execution

The Forex Yields EA V1.02 employs a multi-staged entry process. It does not enter the market at random intervals. Instead, it waits for a confluence of factors, including volume spikes and trend exhaustion. When a trade is initiated, the system monitors the price movement in real-time. If the market moves in favor of the position, the EA applies a trailing stop or a fixed take profit to secure the gains.

If the market moves against the initial entry, the version 1.02 logic activates its recovery mode. This is where the grid component comes into play. It opens secondary positions at calculated distances to lower the average break-even point. This allows the system to exit the entire basket of trades in profit even if the market only retraces a fraction of the initial move. This "mean reversion" philosophy is the engine behind its high win rate.

Technical Requirements for Optimal Performance

To run the Forex Yields EA V1.02 effectively, certain technical standards must be met. This is not a software intended for unstable environments.

MetaTrader 4 Terminal: The EA is exclusively coded for the MT4 platform. It will not function on MT5 or other proprietary trading interfaces.

Virtual Private Server (VPS): Continuous uptime is mandatory. A grid-based system requires 24/7 connectivity to manage open baskets of trades. A lag in execution or a power outage at home can lead to unmanaged trades and potential capital loss.

Low Spread Broker: Since the EA often executes multiple trades, the cost of trading (spreads and commissions) can impact the net yield. Using an ECN account with raw spreads is highly recommended.

Capital Allocation: While the EA can technically run on smaller balances, the use of a Cent account is advised for deposits under 1000 dollars. This provides the necessary margin to withstand the drawdowns inherent in grid strategies.

Risk Management Protocols

No expert advisor is without risk, and the Forex Yields EA V1.02 is no exception. The primary risk associated with this software is a "runaway trend" where the market moves hundreds of pips without a significant pullback. To mitigate this, the developer has included several safety features in the V1.02 update.

The Equity Protector is a critical setting that allows the user to define a maximum percentage of the account that can be at risk. For example, if set to 20 percent, the EA will automatically close all open positions if the floating drawdown reaches that threshold. This prevents a total account wipeout during extraordinary market events. Additionally, the EA includes a News Filter. This module pauses the robot during high-impact economic releases such as Non-Farm Payrolls or central bank interest rate decisions, protecting the account from slippage and extreme volatility.

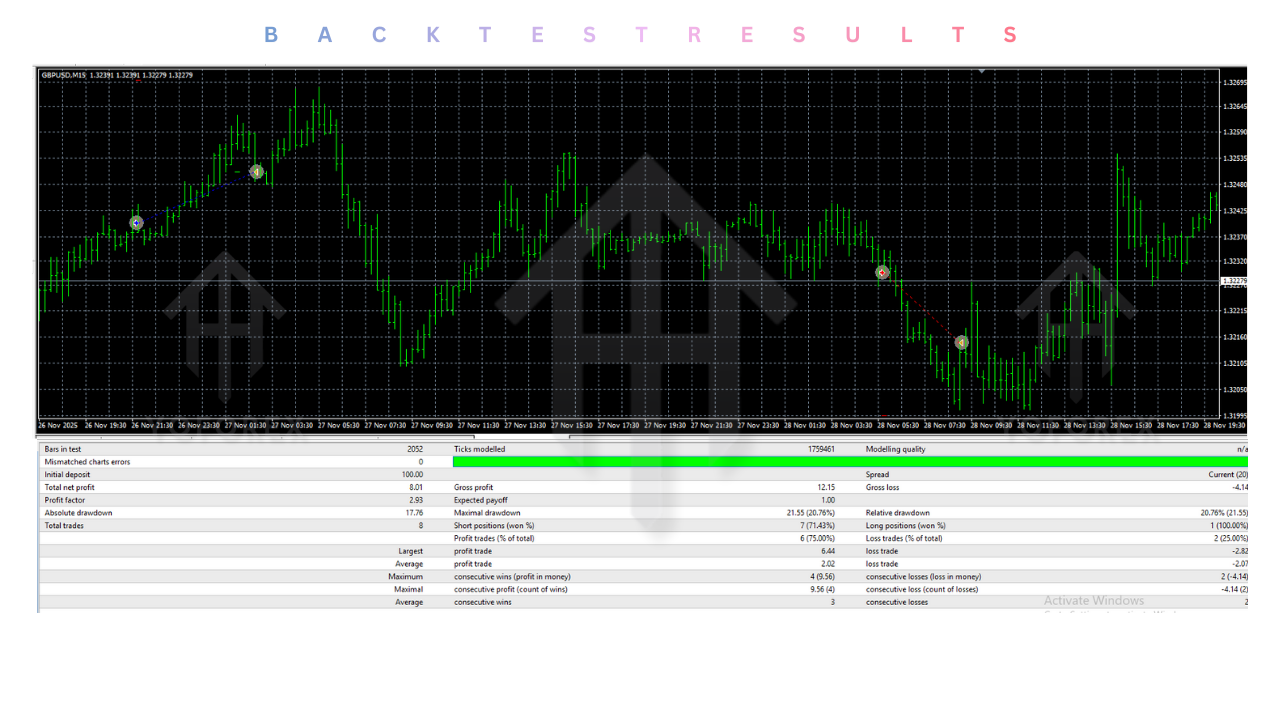

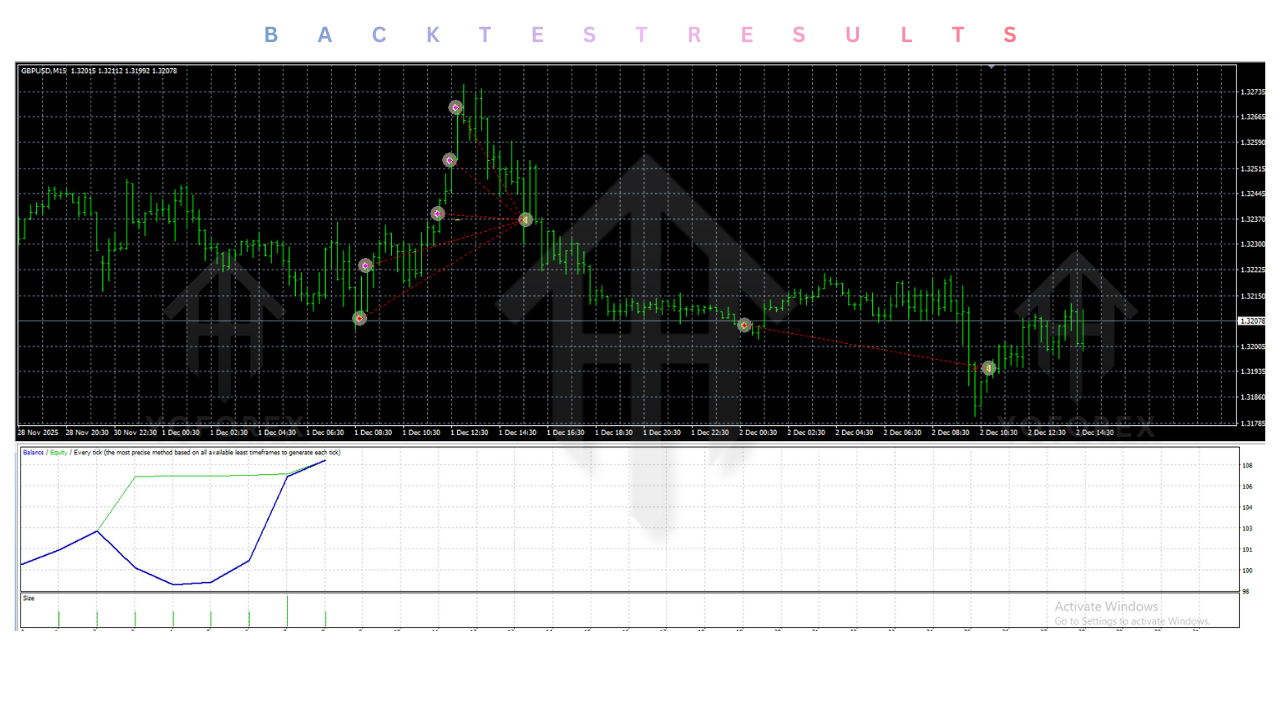

The Importance of Backtesting and Optimization

Before deploying the Forex Yields EA V1.02 on a live account, rigorous testing is required. Traders should utilize the MT4 Strategy Tester to run historical simulations. However, it is important to remember that past performance does not guarantee future results. When backtesting, ensure you are using high-quality tick data to simulate real market conditions as accurately as possible.

Optimization involves adjusting the input parameters—such as the grid distance, lot multiplier, and take profit levels—to suit current market volatility. A setting that worked perfectly in a low-volatility environment may need to be tightened during periods of geopolitical uncertainty.

Conclusion

The Forex Yields EA V1.02 MT4 represents a sophisticated tool for traders looking to automate their market participation. Its blend of price action filters and recovery logic offers a balanced approach to the high-risk world of algorithmic trading. While the potential for consistent yields is present, the responsibility of risk management remains with the trader. By utilizing a reliable VPS, choosing the right broker, and strictly adhering to equity protection settings, users can leverage this EA to enhance their trading portfolio.

Comments

Leave a Comment