Funded Firm V1 VIP EA MT4 — Built to Pass Prop Challenges Without Breaking the Rules

Introduction

Prop-firm rules can feel… brutal. Daily drawdown caps, max total loss, strict news filters, and time limits that punish hesitation. If you’ve tried to pass a challenge manually, you already know how one impulsive click or a surprise news spike can ruin a whole month’s effort. That’s exactly where Funded Firm V1 VIP EA (MT4) comes in. It’s designed for disciplined, rules-compliant trading on MetaTrader 4, with guardrails that help you keep the account alive first and grow it second. Think of it as a “co-pilot” that automates the boring parts—risk sizing, timing windows, spread checks—so you can stick to a plan and stop chasing noise.

This EA isn’t about wild 20% weeks. It’s about methodical, low-stress advancement through the phases, then a smooth hand-off into a sustainable funded account. You’ll still need common sense and realistic expectations (no magic wands here), but the logic and guardrails inside Funded Firm V1 VIP EA are tuned for prop rules: steady exposure, low slippage, and drawdown protection. If you’ve been burned by martingale monsters or over-hyped grid bots, you’ll appreciate the calmer approach here.

What Is Funded Firm V1 VIP EA (MT4)?

Funded Firm V1 VIP EA is a rules-aware automated trading system tailored for prop-firm challenges and funded accounts on MetaTrader 4. It prioritizes risk controls (daily equity guard, max loss kill-switch, session filters) and trades during specific market conditions that align with typical prop requirements. The EA prefers high-liquidity sessions, avoids erratic conditions, and can optionally pause around scheduled news.

Under the hood, it combines a trend-bias filter with a momentum confirmation layer to avoid trading against primary structure. Entries are only placed when spread is reasonable, slippage is acceptable, and the risk budget for the day is still available. The goal: keep your account safe, meet the daily/overall drawdown rules, and build profit targets gradually. It’s not trying to be flashy—it’s trying to be fundable.

Typical environment

- Pairs: EURUSD, GBPUSD, XAUUSD, US30 (configure per broker);

- Timeframes: M5–M15 for scalps and tactical swings; H1 for calmer pace;

- Account type: ECN/raw spreads recommended;

- Execution: Low-latency VPS advised.

Key Features (You’ll Actually Use)

- Daily Equity Guard: Stops trading after a daily loss threshold is reached; optional “hard cut” to close all trades if necessary.

- Max Overall Loss Protection: A master cap that disables trading if total drawdown nears account limits.

- News Pause (Optional): Auto-skip high-volatility windows to avoid unexpected spikes.

- Session Filters: Trade only during London/NY overlap or your preferred sessions; avoid dead liquidity.

- Spread/Slippage Checks: No entry if conditions are too expensive; protects scalps from hidden costs.

- Position Sizing by Risk %: Every trade sized from equity, not vibes; compound safely.

- Adaptive Take-Profit/Stop-Loss: ATR-aware levels; optional trailing logic for smoother exits.

- One-Trade-Per-Signal Discipline: No martingale, no “revenge add-ons.”

- Prop Templates: Pre-sets for common rule profiles (daily loss, total loss, soft targets).

- Equity-Based Cooldown: After a win/loss, pause briefly to prevent over-trading.

- Time-of-Day Bias: Prioritize periods with cleaner micro-structure and lower slippage.

- Broker Safety: Checks execution requirements and cancels orders if your broker widens spreads.

Strategy Logic in Plain English

Funded Firm V1 VIP EA tracks short-term structure within a higher-timeframe bias. That means: if the H1 trend is bullish, the EA tries to take long setups on M5–M15 when momentum confirms (e.g., pullback + breakout alignment). It doesn’t double-down or average into losers; losers are cut early relative to target size. A typical profile targets R multiples (e.g., 1R–1.5R) where R is the risk per trade. Because it’s built for prop rules, it pressures the loss side more than the profit side—accept the small scratch now, survive to trade the next session.

Recommended Setup

- Broker: ECN/Raw spread with tight commissions.

- VPS: 24/7, low latency (<10ms to broker if possible).

- Pairs: Start with EURUSD and XAUUSD, then diversify.

- Timeframes: M5 or M15 for the base profile.

- Risk: 0.25%–0.5% per trade for challenges; 0.25% or less for funded stages.

- Daily Loss Cap: 2%–3% (align with your prop’s rules).

- Max Overall Loss: 4%–6% depending on firm; keep margin for string of losers.

Pro tip: Don’t crank risk just coz a day starts green. Funded accounts die when traders “celebrate” too early. Stay boring.

Installation & Quick Start

- Copy to MT4: Open MT4 → File → Open Data Folder → MQL4 → Experts → paste the EA

.ex4. - Enable AutoTrading: Restart MT4, click the “AutoTrading” button on top.

- Attach to Chart: Open EURUSD M15 (as a start), drag the EA onto the chart, enable “Allow live trading.”

- Load a Template: Choose a prop-friendly preset (Daily Loss, Max Loss, Risk %, Sessions).

- Broker Conditions: Set a max spread in pips and acceptable slippage.

- News Pause (Optional): Configure news windows or manual disable around major events.

- Run on VPS: Keep MT4 and your EA always on; never close during trading windows.

Passing the Challenge: Practical Playbook

- Phase 1 (Challenge): Use 0.25% risk per trade. Keep the daily loss cap at 2% or below. Target small, recurring gains; stop after 1–3 qualified trades/day.

- Phase 2 (Verification): Same risk or slightly lower. Don’t “prove” anything—consistency > speed.

- Live Funded: Dial down risk to 0.10%–0.25%. Spread your trades across days; extract slowly. Remember, payout > gamer score.

Keep logs. If a day is messy (high spreads, wicked wicks), stand aside. Prop rules reward patience; the EA helps, but you decide when not to play.

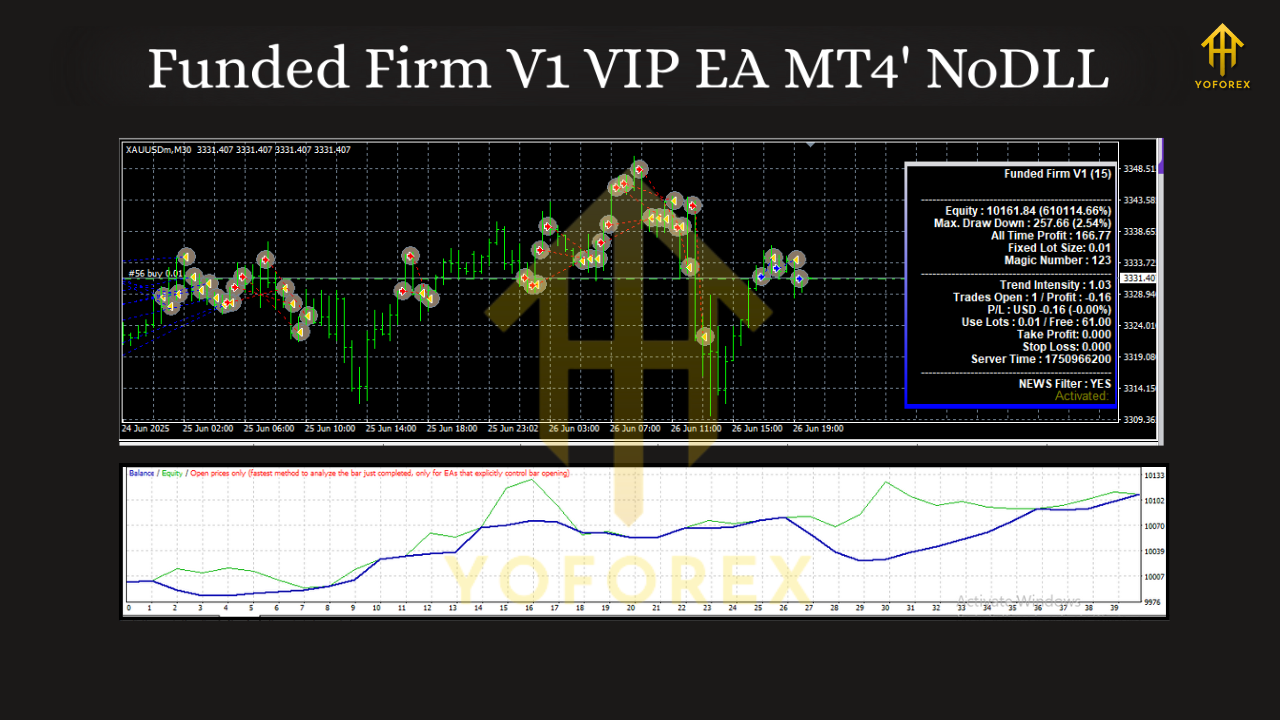

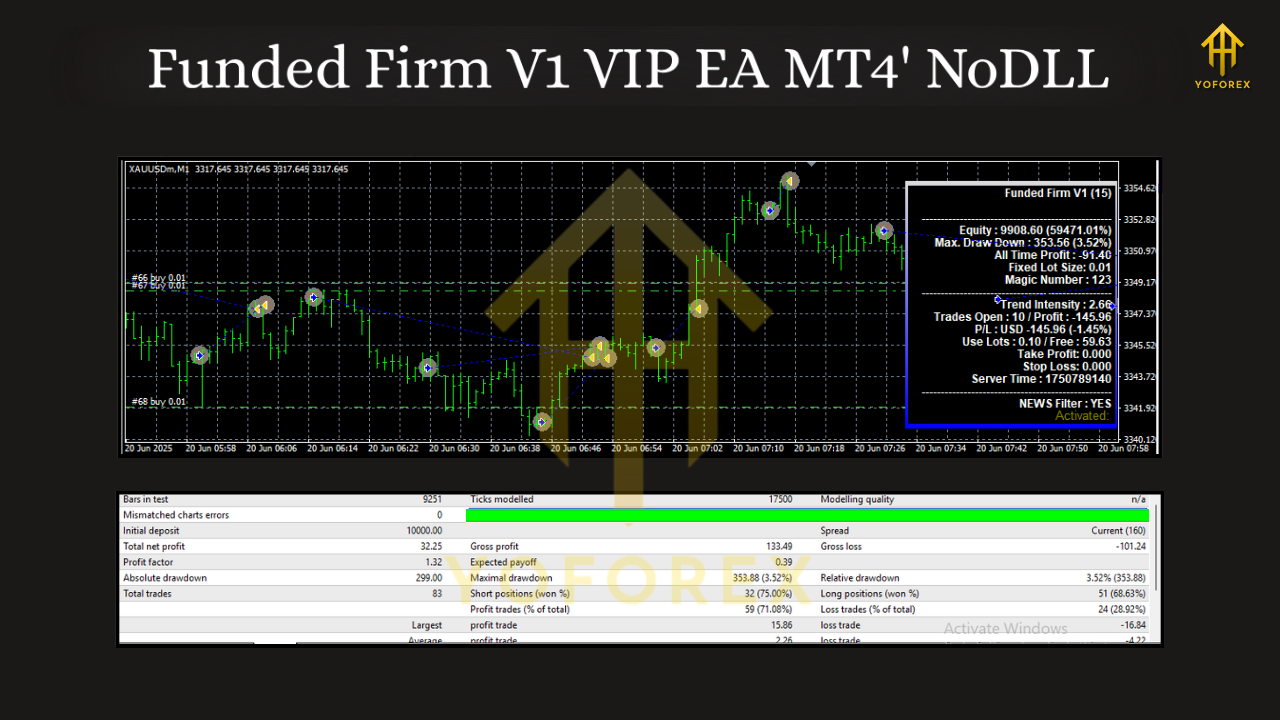

Backtesting & Forward Testing Tips

Backtests can mislead if you allow unrealistic spreads or instant fills. When you test:

- Use tick-by-tick data with realistic spreads/commissions.

- Add slippage assumptions; 0.5–1.0 pip for majors, more for gold/indices.

- Match session hours to your real plan.

- Run multi-year samples to see behavior across regimes (trends, ranges, shock events).

- Forward test on a demo that mirrors your prop broker’s feed before going live.

Expect a smoother equity line than grid/martingale systems—drawdowns should be shallower but still present. The EA’s job is to cap the downside while giving your edges room to play out.

Risk Management: The Real Edge

The “edge” isn’t a magic entry. It’s limiting damage while giving decent setups a chance. Funded Firm V1 VIP EA enforces:

- Hard daily stop (quit while you’re behind).

- Trade frequency limits (no revenge trading loops).

- No martingale (ever).

- Session discipline (quality over quantity).

You’ll be shocked how far a simple, repeatable routine can take you when risk is truly capped.

Common Mistakes to Avoid

- Cranking risk after a win. Keep it flat; compounding works over weeks, not hours.

- Forcing trades on low-liquidity Fridays or holidays. Just don’t.

- Ignoring spread/commission math. Scalps die on “hidden friction.”

- Changing five settings at once. Tweak slowly and track results.

- Letting news invalidate your edge. Pause; there’ll be another session.

Final Thoughts & Call-to-Action

If you’re tired of “all or nothing” bots that nuke accounts, Funded Firm V1 VIP EA is a breath of fresh air. It’s methodical, rules-aware, and built for the exact environment prop traders operate in. Start small, respect the caps, and let consistency do the heavy lifting. When you’re ready, set it up on a stable VPS, begin with EURUSD M15, and track each week. You’ll see why disciplined automation beats seat-of-the-pants trading, every time.

Comments

музыка mailsco мотивирует человека при творчество и выражение внутренних мыслей.

Leave a Comment