Funded X 99 EA V1.0 MT4 — Built for Prop-Firm Discipline, Tuned for Steady Gains

If you’re grinding through prop firm challenges or protecting a funded account, you already know the stress: tight daily drawdown limits, strict risk caps, and absolutely no room for reckless entries. Funded X 99 EA V1.0 steps in as a streamlined MT4 expert advisor that aims to keep you inside those rules while still looking for quality trade opportunities. It’s built for discipline first, profit second — which, funny enough, is exactly how you stay in the game long enough to actually make money.

This guide walks you through what the EA does, who it’s for, supported pairs and timeframes, suggested risk setups, and a clean step-by-step to get running fast.

What is Funded X 99 EA V1.0?

Funded X 99 EA V1.0 is an automated trading system for MetaTrader 4 designed with prop-firm-style risk discipline in mind. It uses deterministic logic and configurable risk controls to identify trade setups, size positions responsibly, and help you avoid rule-breaking spikes in exposure.

Core intent:

- Support traders managing funded or challenge accounts, where daily loss limits and max overall drawdown are non-negotiable.

- Provide consistent execution across specific liquid pairs: EUR/USD, GBP/USD, USD/JPY, AUD/CAD.

- Offer multi-timeframe operation — H1, M30, M15, M5, M1 — so you can calibrate speed vs. stability based on your prop firm’s rules and your own risk tolerance.

- Work reliably from a $500 minimum deposit (recommended to scale gradually from there).

Important note: Every prop firm has its own house rules (5% daily / 10% overall is common, but not universal). Always tune the EA’s risk to your firm’s exact limits.

Why it’s especially useful for funded and challenge accounts

Trade ideas are great, but most funded accounts fail on risk, not strategy. Funded X 99 focuses on the part many traders ignore:

- Position sizing respect: Encourage small, consistent risk per trade.

- Controlled exposure: Limit concurrent positions and cumulative risk so you don’t trip daily loss.

- Trade quality filters: Pre-trade checks (time-of-day, trend condition, and volatility thresholds) aim to avoid obvious noise pockets.

The result isn’t a “moonshot,” it’s a steady operator that helps you stick to plan, avoid emotional overrides, and maintain eligibility day after day.

Supported Markets & Timeframes

- Pairs: EUR/USD, GBP/USD, USD/JPY, AUD/CAD

- Timeframes: H1, M30, M15, M5, M1

- Minimum Deposit: $500

Practical guidance:

- H1 / M30 – Best for challenge/funded accounts seeking smoother equity and fewer trades.

- M15 – Balanced frequency vs. stability; ideal for diversifying entries across pairs.

- M5 / M1 – Higher frequency; consider only if spreads and execution are excellent and your daily loss buffer is large enough to absorb micro-noise.

Key Features (What traders love)

- Prop-firm friendly design: Built around drawdown discipline and exposure control.

- Multi-timeframe logic: Run H1 for calm, or M15/M5 for more opportunities.

- Pair selectivity: Optimized around EURUSD, GBPUSD, USDJPY, AUDCAD — all widely traded, cost-efficient pairs.

- Position sizing flexibility: Fixed lots or balance-based percentage (use % for funded rules).

- Session awareness: Option to avoid thin liquidity zones; focus on active sessions for tighter spreads (broker dependent).

- Stop-loss placement first: Entries are calculated with SL in mind, not added after the fact.

- Rule-compatible trade frequency: Helps avoid overtrading that often triggers daily loss limits.

- Scalable: Start small on $500 and scale with confidence as you gain data.

- Low maintenance: Set it, monitor it, and let the logic enforce discipline.

- VPS-ready: Works well on a stable, low-latency VPS for consistent execution.

Tip: Even if you’re tempted, avoid grid/martingale add-ons with funded accounts. The “slow and sane” path typically wins here.

Suggested Risk Templates (Tailor to your firm’s rules)

These are starting points — always adapt to your specific prop-firm thresholds and your personal risk tolerance.

Conservative (challenge phase)

- Risk per trade: 0.25% of balance

- Max open risk: 0.75% across all trades

- Daily soft loss cap: ~2% (EA stops trading for the day)

- Timeframes: H1 / M30

- Pairs active: 2 (e.g., EURUSD + USDJPY)

Balanced (after funded, building track record)

- Risk per trade: 0.35–0.5%

- Max open risk: 1–1.5%

- Daily soft loss cap: ~3%

- Timeframes: M30 / M15

- Pairs active: 2–3

Cautious Intraday (experienced, tight spread broker)

- Risk per trade: 0.2–0.3%

- Max open risk: 1%

- Daily soft loss cap: 2%

- Timeframes: M15 / M5

- Pairs active: up to 3 (avoid M1 unless you truly know your execution costs)

How to Install & Set Up (MT4)

- Download & copy files: Place the EA file into

MQL4/Experts/inside your MT4 data folder. - Restart MT4: Or right-click Expert Advisors and select Refresh.

- Enable algo trading: Make sure AutoTrading is green in MT4’s toolbar.

- Attach to chart: Open a new chart (e.g., EURUSD H1), drag Funded X 99 EA V1.0 onto it.

- Set inputs:

- Choose Risk Mode (fixed lot or % risk per trade).

- Configure Max Simultaneous Trades and Daily Loss Soft Cap (if available), or set your own “stop trading” rules via inputs.

- Confirm Stop-Loss and Take-Profit defaults — align with your firm’s daily loss and max drawdown math.

6. Broker checks:

- Use ECN/RAW account if possible, with tight spreads on your chosen pairs.

- Confirm hedging vs. netting requirements and FIFO (if applicable) before live use.

7. Run on VPS: For best uptime and consistent fills, use a reliable VPS close to your broker’s servers.

8. Demo first: Trade at least 10–20 trading days in demo or a tiny live sub-account to validate fill quality and slippage before scaling.

Strategy Notes (How it typically behaves)

- Selectivity over frequency: The logic prioritizes qualifying conditions (trend/volatility/structure) before entries.

- Risk-first execution: The EA sizes and places orders with stop-loss defined upfront to avoid sudden rule breaches.

- Session focus: Most brokers offer tighter spreads during London/NY overlap; that’s often where you’ll see cleaner execution.

- Multi-pair diversification: Running 2–3 uncorrelated pairs can smooth the equity curve compared to hammering a single symbol.

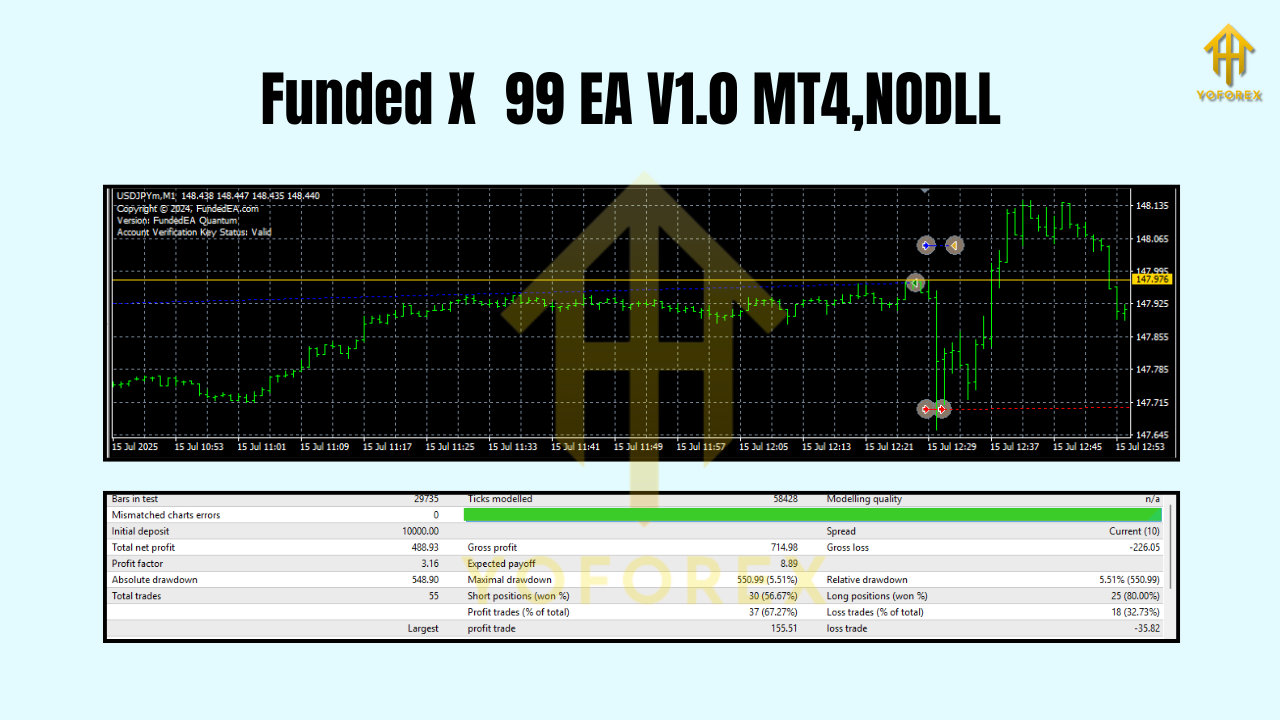

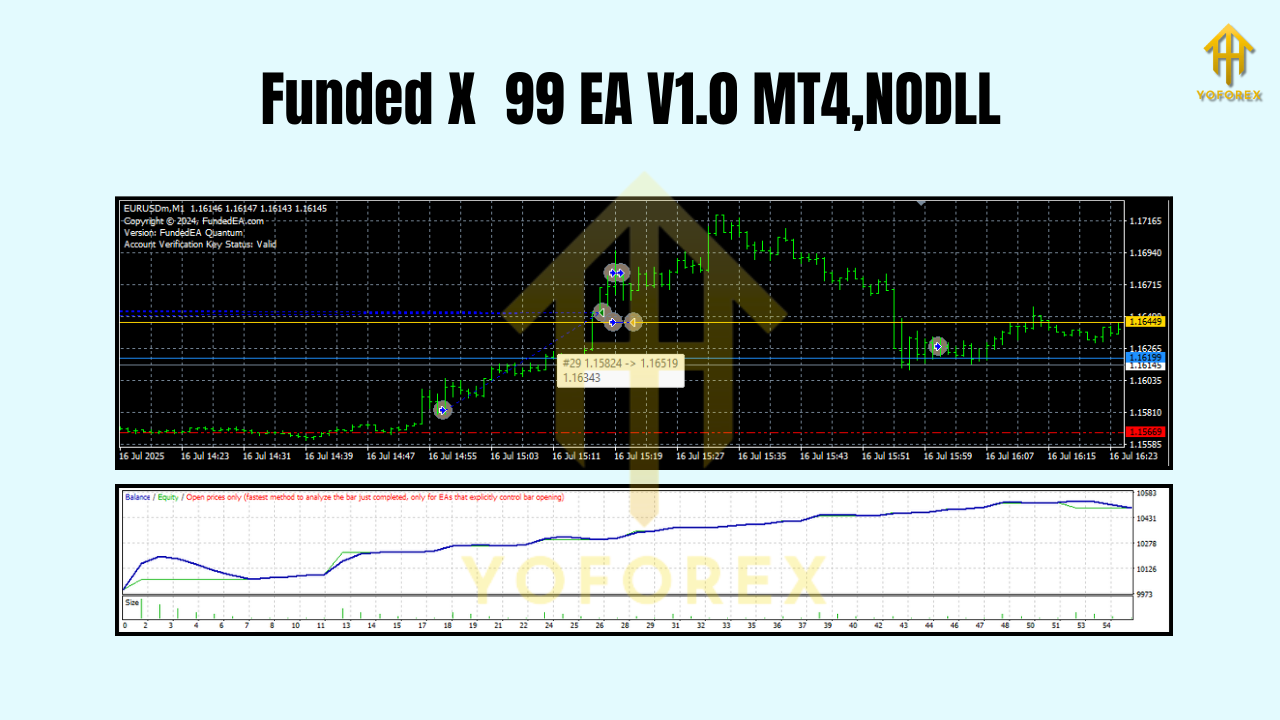

Backtesting & Forward Testing Guidance

While historical tests are useful for calibration, prop-firm suitability is best measured in forward conditions:

- Backtest for ranges: Validate SL/TP logic and overall expectancy over 3–5+ years if you can.

- Forward test for slippage: Run 4–8 weeks on a replica account type to capture real spreads and execution quirks.

- Journal outcomes: Track average R multiple, win rate, average adverse excursion, and number of trades per day.

- Tweak slowly: Adjust one variable at a time (risk %, max concurrent trades, or timeframe). Keep changes minimal to preserve data integrity.

Past performance never guarantees future results. Keep sample sizes meaningful before deciding to scale.

Tips to Stay Within Prop-Firm Rules

- Know your numbers: Many firms use ~5% daily and ~10% overall drawdown. Confirm yours.

- Bake in a buffer: If daily limit is 5%, cap your own at 3% so slip doesn’t disqualify you.

- Avoid stacking noise: Two or three correlated trades can behave like one big bet — manage correlation across pairs.

- Pause after a hit: If you take a 1.5–2% day, let the EA cool off. Preserving the account beats forcing a comeback.

- News awareness: If your rules or broker execution worsen around high-impact news, consider pausing entries for that window.

Who should use Funded X 99 EA?

- Challenge traders who need measured, rule-compliant automation.

- Funded account managers focused on longevity and steady compounding.

- Swing-to-intraday traders comfortable balancing H1/M30 stability with M15 opportunity.

If you want a “flip the account in a week” martingale gambler… this isn’t that bot (and prop firms would boot you anyway).

Final Word

Funded X 99 EA V1.0 MT4 is about precision, patience, and prop-firm longevity. It gives you a structured way to automate entries, keep position sizing sane, and avoid the classic “one bad day” that kills funded accounts. Start small, verify on demo, then scale responsibly as your data confirms the edge.

YoForex – empowering traders worldwide, one free tool at a time.

Join our Telegram for the latest updates and support

Comments

Leave a Comment