Content The evolution of algorithmic trading has brought us to a point where retail traders can now access institutional grade tools directly on their MetaTrader 5 terminals. Among the latest wave of sophisticated automated systems, the Gem Pro EA V1.1 MT5 has emerged as a specialized solution for those focusing on two of the most liquid assets in the financial world: Gold and the S&P 500. This version represents a significant refinement in how Expert Advisors handle market volatility, moving away from high risk gambling techniques toward a disciplined, multi strategy portfolio approach.

In this guide, we will break down the mechanics of Gem Pro EA V1.1, analyze its core trading logic, and explain why it is becoming a preferred choice for traders navigating the 2025 market landscape.

Understanding the Multi Strategy Framework

Most Expert Advisors fail because they are designed for a specific market condition, such as a strong trend or a tight range. When the market regime changes, these single strategy bots often suffer catastrophic drawdowns. The Gem Pro EA V1.1 addresses this by implementing a portfolio of twenty distinct sub strategies.

Ten of these strategies are dedicated to Gold, which is known for its sharp, volatile swings and safe haven status. The other ten focus on the S&P 500, an index that reflects the health of the US economy and generally maintains a long term bullish bias. By running multiple algorithms simultaneously, the EA ensures that if one specific logic underperforms during a choppy market, the other nineteen can provide a buffer, leading to a more stable and predictable equity curve.

Technical Logic and Market Entry

The Gem Pro EA V1.1 does not rely on "black box" secrets. Instead, it utilizes a robust combination of classic technical indicators refined by modern filtering techniques. The primary entry engine uses the Simple Moving Average to identify the primary trend direction. It then cross references this with the Commodity Channel Index and Williams %R to find optimal entry points within that trend.

For the S&P 500, the EA is specifically tuned to recognize institutional buying patterns. It often focuses on "buying the dip" during minor retracements in an uptrend, ensuring it aligns with the long term momentum of the index. On the Gold side, the system is more aggressive with trend following, attempting to capture large price expansions that occur during geopolitical shifts or inflation data releases.

Risk Management Without Toxic Logic

A major concern for any automated trader is the use of Martingale or Grid systems. These methods involve increasing lot sizes after a loss, which can lead to a total account wipeout during an extended trend. The Gem Pro EA V1.1 explicitly avoids these toxic money management styles.

Every trade executed by the EA comes with a mandatory hard Stop Loss and Take Profit. This "fixed risk" approach is vital for several reasons. First, it ensures that your maximum possible loss on any single trade is known before the position is even opened. Second, it makes the EA compatible with the strict rules of modern prop firms. Most proprietary trading firms will disqualify a trader for using hidden stops or aggressive recovery grids, making Gem Pro a safer alternative for those trading funded accounts.

The Importance of MetaTrader 5 for Gem Pro

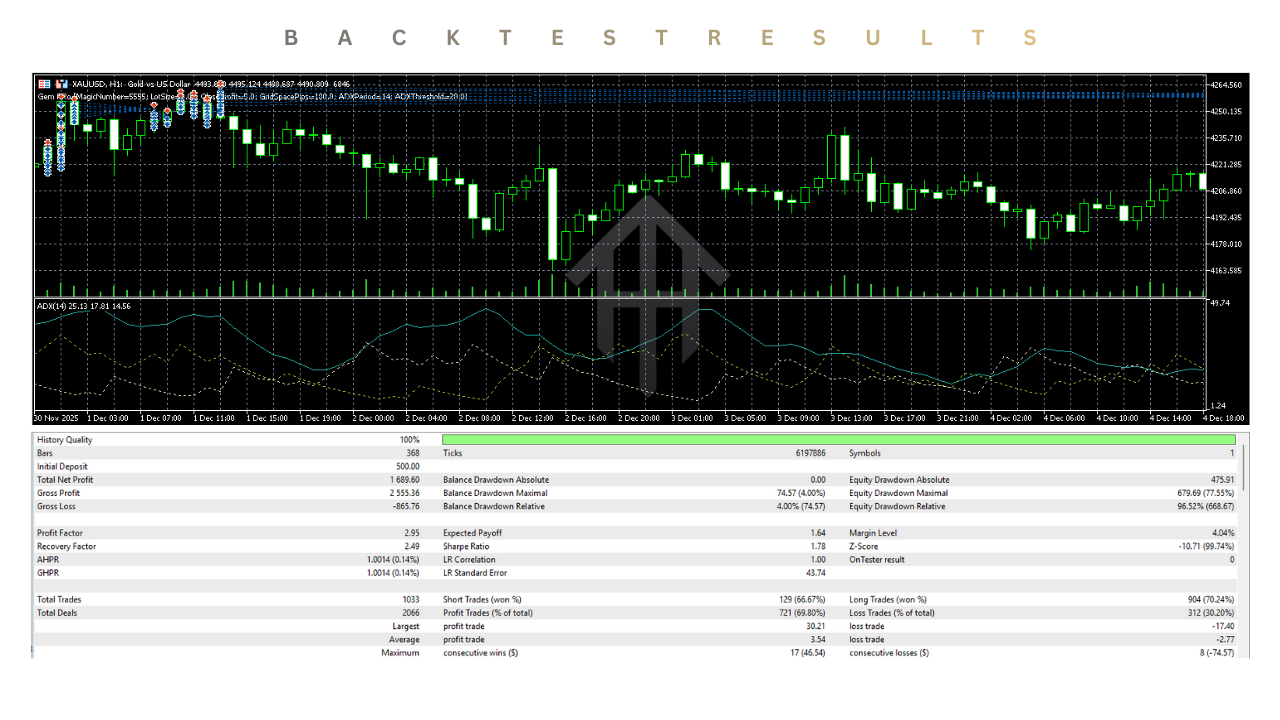

While many traders still use MT4, the Gem Pro EA V1.1 is built specifically for the MetaTrader 5 platform. This is not just a cosmetic choice. MT5 allows for multi threaded backtesting, meaning the system can test all twenty strategies across Gold and SPX500 simultaneously using real tick data.

Furthermore, MT5 handles pending orders and execution speeds more efficiently than its predecessor. For a trend following system like Gem Pro, getting filled at the right price is essential to maintaining the high reward to risk ratio that the strategy promises.

Optimizing for 2025 Market Conditions

The markets in 2025 have shown increased sensitivity to central bank policies and global economic shifts. The V1.1 update includes specific filters designed to handle these environments.

One of the key improvements in this version is the refined exit logic. Instead of just waiting for a Take Profit hit, the EA utilizes trailing stops and time based exits. This means that if a trade is not moving in the expected direction within a certain timeframe, the EA will close the position to free up margin and reduce exposure, even if the Stop Loss hasn't been hit. This proactive management is a hallmark of institutional grade software.

Setting Up for Success

To get the most out of the Gem Pro EA V1.1, your technical setup is just as important as the bot itself. Because the EA trades Gold, spread sensitivity is a major factor. You should always use a Raw Spread or ECN account where the spread on XAUUSD is as close to zero as possible during peak London and New York sessions.

Additionally, a Virtual Private Server is mandatory. An EA cannot manage a trade if your home internet disconnects or your computer goes into sleep mode. Running Gem Pro on a low latency VPS ensures that the signals are executed instantly and that your trailing stops are always active on the server side.

Final Thoughts on Gem Pro EA V1.1

The Gem Pro EA V1.1 MT5 represents a mature approach to automated trading. It is not a "get rich quick" scheme that promises 100% returns in a month. Instead, it is a professional tool designed for capital preservation and steady growth. By diversifying across two major asset classes and twenty different strategies, it offers a level of resilience that is rare in the retail EA market.

Whether you are looking to diversify your manual trading or seeking a robust system for a prop firm challenge, the Gem Pro V1.1 provides the technical foundation needed to compete in today's high speed markets.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment