Giant Heist Bot EA V2.2 MT5 — Precision Entries from M1 to H4

If you’ve been hunting for a MetaTrader 5 Expert Advisor that can adapt to different market moods—scalping fast moves on M1 or holding structured trends on H4—Giant Heist Bot EA V2.2 (MT5) deserves a serious look. Built to operate across EUR/USD, GBP/USD, and USD/JPY with clean risk controls and flexible logic, it’s a practical “daily driver” bot for traders who want automation without babysitting charts all day.

Pairs: EUR/USD, GBP/USD, USD/JPY

Timeframes: M1, M5, M15, M30, H1, H4

What Makes Giant Heist Bot V2.2 Different?

Most EAs specialize in either scalping or swing trading. Giant Heist Bot V2.2 is designed to do both, intelligently. On lower timeframes (M1–M15) it seeks short, high-probability bursts; on higher timeframes (H1–H4) it leans into structured trends and mean-reversion pullbacks. The core logic blends:

- Multi-timeframe confirmation: The entry timeframe looks for micro structure while higher timeframes confirm trend bias or filter chop.

- Volatility-aware risk: ATR-based stops and targets expand or contract as the market “breathes,” which helps keep stops meaningful even on noisy pairs like GBP/USD.

- Session filters: Optional filters help you avoid dead liquidity periods or reckless spreads during rollover.

- Spread and slippage checks: The EA will stand down if conditions get hostile—because the best trade can be the one you skip.

Under the hood, V2.2 introduces cleaner execution, snappier signal confirmation, and safer default risk controls versus earlier builds. It’s not just about entries; it’s about intelligent pass-or-play decisions that compound over weeks.

Strategy Snapshot (Simple, Practical, and Robust)

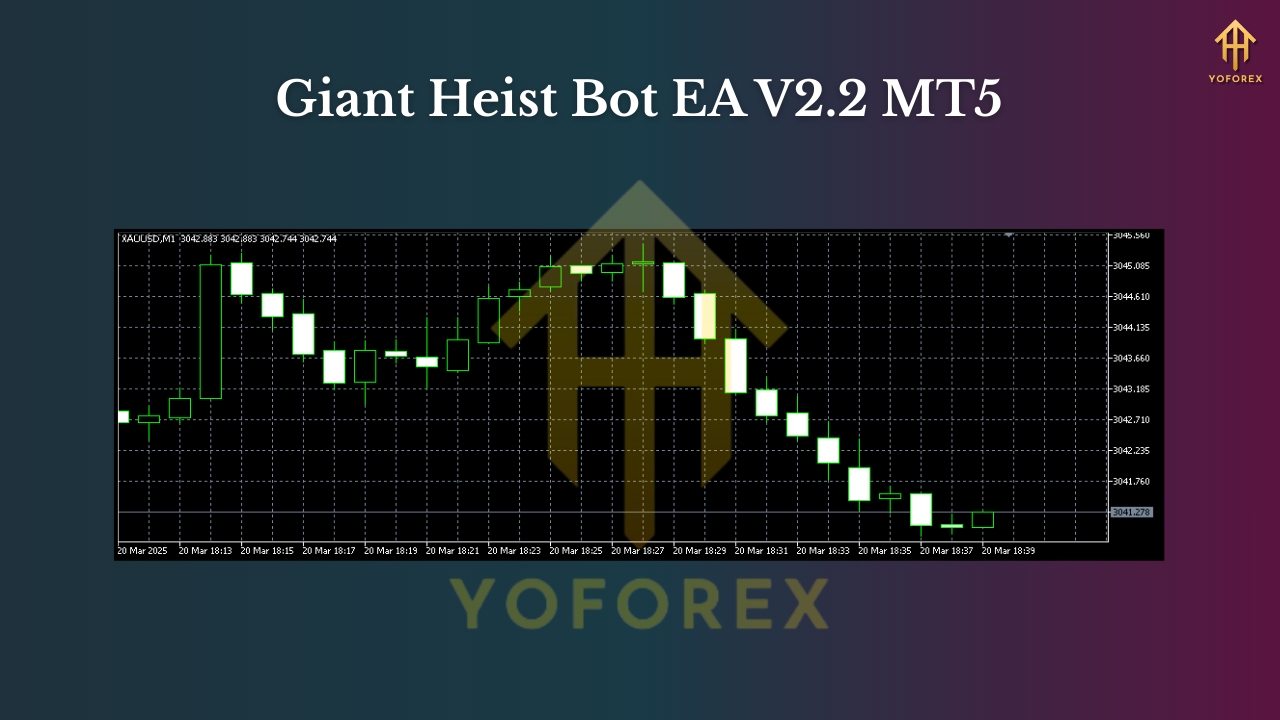

- Lower TF Scalper (M1–M15): Looks for quick momentum breaks following micro consolidations. Tight stops, small targets, multiple bites. Great when EUR/USD is trending intraday.

- Mid TF Hybrid (M30–H1): Balances pullback entries with trend continuation logic. Often the sweet spot for GBP/USD to avoid M1 noise but still capture daily moves.

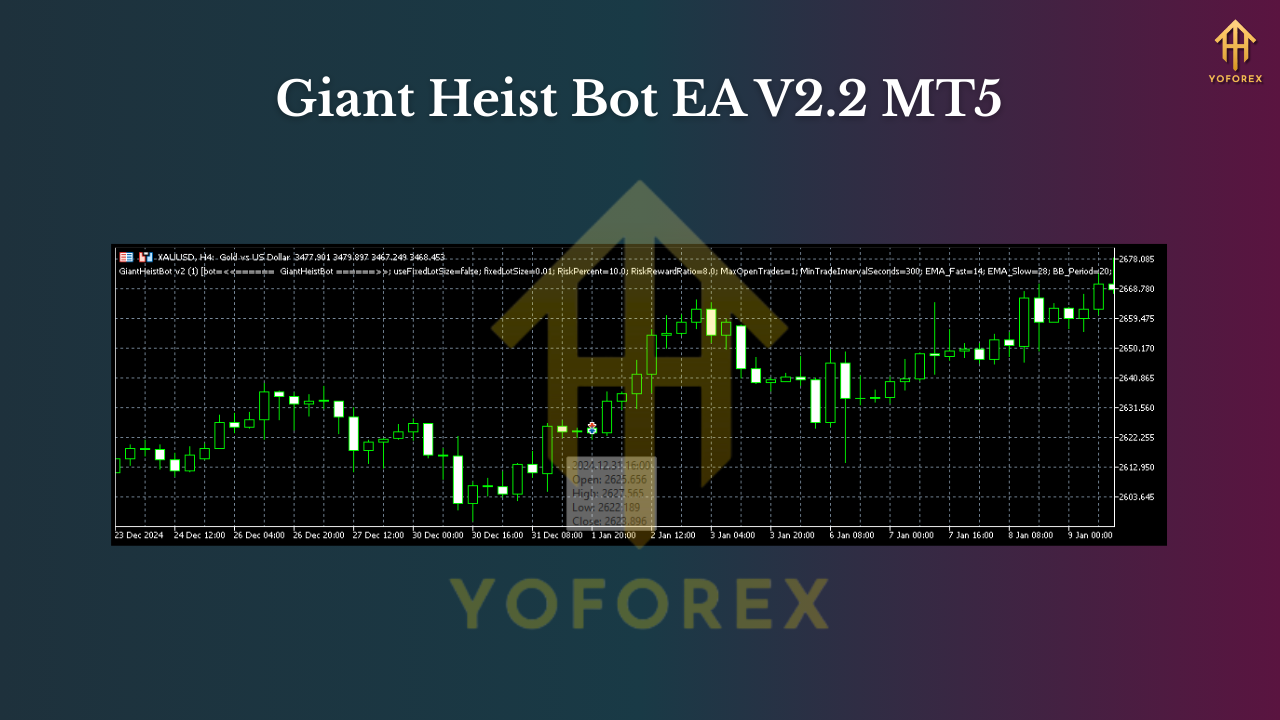

- Higher TF Bias (H4): Uses structural pivots and volatility bands to frame swing entries. Particularly useful on USD/JPY, where trend legs can run for days.

No martingale, no reckless averaging down. The bot will scale out partial profits when available and trail intelligently when momentum persists.

Key Features at a Glance

- Multi-timeframe logic: Entry on the chosen chart TF with higher-TF confirmation.

- Pairs optimized: EUR/USD, GBP/USD, USD/JPY—three of the most liquid majors.

- Timeframe flexibility: Works from M1 to H4 without rewriting your playbook.

- ATR-based stops & targets: Dynamic protection that adapts to real volatility.

- Smart filters: Session, news-pause toggle, spread/slippage guardrails.

- Partial take-profit: Locks in gains early; lets a runner trail if momentum holds.

- Equity protection: Daily loss cap and max-drawdown guard to keep your account intact.

- Prop-firm friendly modes: Conservative presets to respect max daily loss rules.

- No martingale, no grid sprawl: Clean risk per trade, position limits enforced.

- Detailed logs & alerts: Understand what it’s doing and why, in real time.

Recommended Settings (Start Here, Then Tweak)

Risk

- Start with 0.5%–1% per trade. If you’re new or using a prop challenge, lean closer to 0.25%–0.5%.

- Daily loss cap at 2%–3% with an emergency stop-trading switch.

Timeframes & Pairs

- Scalping: M1 or M5 on EUR/USD; try M5/M15 on GBP/USD due to volatility.

- Intraday/Swing: M30–H1 on EUR/USD / GBP/USD; H1–H4 shines on USD/JPY.

Execution

- Use a low-spread, ECN-style broker, fast VPS (≈ <10–20 ms latency), and raw pricing if possible.

- Keep Max Spread threshold tight. If spreads blow out at rollover, let the EA sit flat.

News Handling

- For high-impact macro events, either enable the EA’s news-pause setting (if available) or disable trading 15–30 minutes before/after releases. Clean charts > lottery trades.

Risk Management (The Part That Actually Grows Accounts)

The EA’s risk controls are there to stop “one bad day” from nuking a month of gains. A few non-negotiables:

- Hard stop on every trade. No exceptions.

- Daily loss limit: When hit, the EA goes flat till the next session.

- Max concurrent positions: Keep this sensible—especially for prop rules.

- No martingale: Position sizing remains consistent; compounding comes from edge, not averaging down.

As a trader, your edge isn’t just the algo—it’s the discipline you wrap around it. The best setup in the world can’t beat uncontrolled risk.

Backtest & Forward-Test Tips

While results vary by broker, data quality, and settings, here’s how to run useful tests:

- Use tick-by-tick data with real spread and commissions. Garbage data = garbage conclusions.

- Test per pair, per timeframe. EUR/USD M5 ≠ GBP/USD M5. Let the data show you where the bot sings.

- Walk-forward approach: Optimize modestly, then roll forward without re-tuning to avoid curve-fit illusions.

- Forward demo for 2–4 weeks. Confirm slippage behavior and session nuances before going live.

- Journal deviations. If you adjust a parameter, note why—and check if it actually helped.

You’re not chasing the “perfect” equity curve. You’re stress-testing stability and drawdown behavior across time.

Installation & Setup (MT5)

- Copy the EA to

MQL5/Experts/in your MT5 data folder. - Restart MT5 and confirm the EA shows under the Navigator > Experts.

- Open a chart for your chosen pair (e.g., EUR/USD), select timeframe (M1–H4).

- Drag the EA onto the chart; enable Algo Trading.

- Load a preset (conservative/standard) or set your own risk, spread limits, session filters.

- Check the journal for confirmations: spread, slippage, and session windows recognized.

- Start on demo. After you’re comfortable with performance and broker conditions, go live with conservative risk.

Who Is This EA For?

- Busy intraday traders who want consistent logic handling entries and exits while they focus on planning.

- Prop-firm challengers needing disciplined risk, low drawdown modes, and strict daily loss limits.

- Swing traders who want H1–H4 structure with clean, rules-based execution.

If you’re looking for a “get rich fast” martingale grinder—this ain’t it (thankfully). Giant Heist Bot V2.2 is about scalable, sustainable trading with rules you can explain to yourself on a bad day.

Pro Tips to Get the Most Out of V2.2

- One change at a time. When tweaking risk or filters, isolate variables so you know what actually helped.

- Respect the rollover. Spreads widen; skip those minutes instead of feeding the broker.

- Keep charts clean. Less visual noise helps you evaluate when to sit out (yes, flat is a position).

- VPS matters. Execution latency can be the difference between a clean fill and slippage wasteland—especially on M1/M5.

Final Word

Giant Heist Bot EA V2.2 for MT5 is a versatile workhorse across EUR/USD, GBP/USD, and USD/JPY from M1 to H4. It’s not flashy for the sake of it; it’s thoughtful—dynamic stops, session awareness, and no-nonsense risk controls. Start conservative, let the data guide you, and scale only after you’ve seen stability through different market conditions.

Join our Telegram for the latest updates and support

Comments

file is not working

Leave a Comment