Gold (XAUUSD) is one of the most dynamic assets in forex trading. Its constant volatility offers incredible opportunities for scalpers, but managing trades manually in such a fast-moving market can be overwhelming. This is where Gold Scalping EA V2.5 MT4 comes into play—a specialized Expert Advisor designed to automate short-term breakout strategies exclusively for gold trading.

In this article, we will take a deep dive into how Gold Scalping EA V2.5 works, its trading approach, core features, recommended configurations, and practical tips for traders who want to integrate this EA into their strategy.

Understanding Gold Scalping EA V2.5 MT4

Unlike general-purpose EAs, Gold Scalping EA V2.5 is built only for XAUUSD on MetaTrader 4. By narrowing its focus, the EA is able to optimize trade entries and exits around gold’s unique behavior, making it a highly targeted scalping tool.

Snapshot of Gold Scalping EA V2.5 MT4:

- Platform: MetaTrader 4

- Version: 2.5

- Instrument: Gold (XAUUSD)

- Method: Breakout scalping with pending orders

- Risk Model: Dynamic stop loss and trailing stop, no martingale or grid

Trading Logic Behind the EA

Breakout Identification

The EA uses ZigZag-based price levels to detect turning points. Pending buy or sell stop orders are placed above or below these levels, ensuring trades only trigger during actual breakouts.

Pending Orders for Accuracy

By waiting for price confirmation, the EA avoids false signals that often occur in sideways markets. This pending order method improves entry quality compared to instant market execution.

Risk Management at the Core

- Dynamic Stop Loss adjusts with volatility.

- Trailing Stop protects floating profits.

- Order Limits prevent overexposure by capping simultaneous trades.

Session Timing Control

The EA allows you to set trading hours, aligning scalping activities with high-liquidity sessions like London and New York.

Key Features of Gold Scalping EA V2.5 MT4

- XAUUSD Focused – Optimized solely for gold scalping.

- M15 Scalping Compatibility – Works best on the 15-minute chart.

- Automatic Lot Sizing – Adjusts based on equity growth.

- Customizable Inputs – Includes take profit levels, trailing stop values, and session filters.

- VPS Friendly – Runs smoothly with low latency hosting.

- Safe Money Management – No grid, no martingale, lower risk profile.

Why This EA Appeals to Traders

- High Volatility Utilization: Takes advantage of gold’s natural price spikes.

- Complete Automation: Executes trades without manual intervention.

- Risk Control Built In: Protects traders from large drawdowns.

- Beginner Ready: Straightforward configuration makes it accessible.

- Advanced Friendly: Offers customization for traders who like tweaking strategies.

Recommended Trading Environment

To get the best out of Gold Scalping EA V2.5 MT4, traders should prepare the right setup:

- Broker: ECN or Raw Spread broker with fast execution

- Leverage: 1:500 recommended

- Deposit Requirement: $100–$500 minimum capital

- Timeframe: M15 (suggested by most tests)

- Hosting: VPS for stable connectivity

- Risk Settings: 0.5%–1% per trade for conservative trading

Performance Expectations

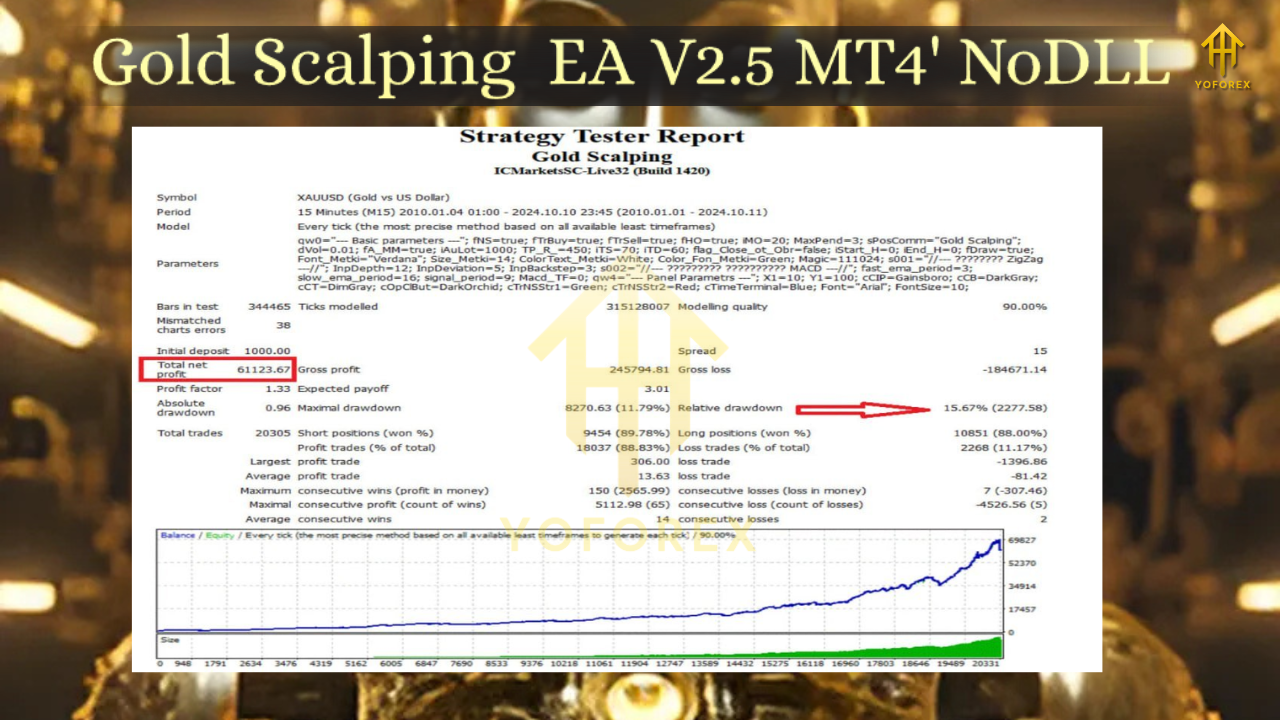

Backtesting Results

Historical simulations from 2019–2024 indicate strong breakout capture during trending phases. Risk remains under control with the trailing stop mechanism.

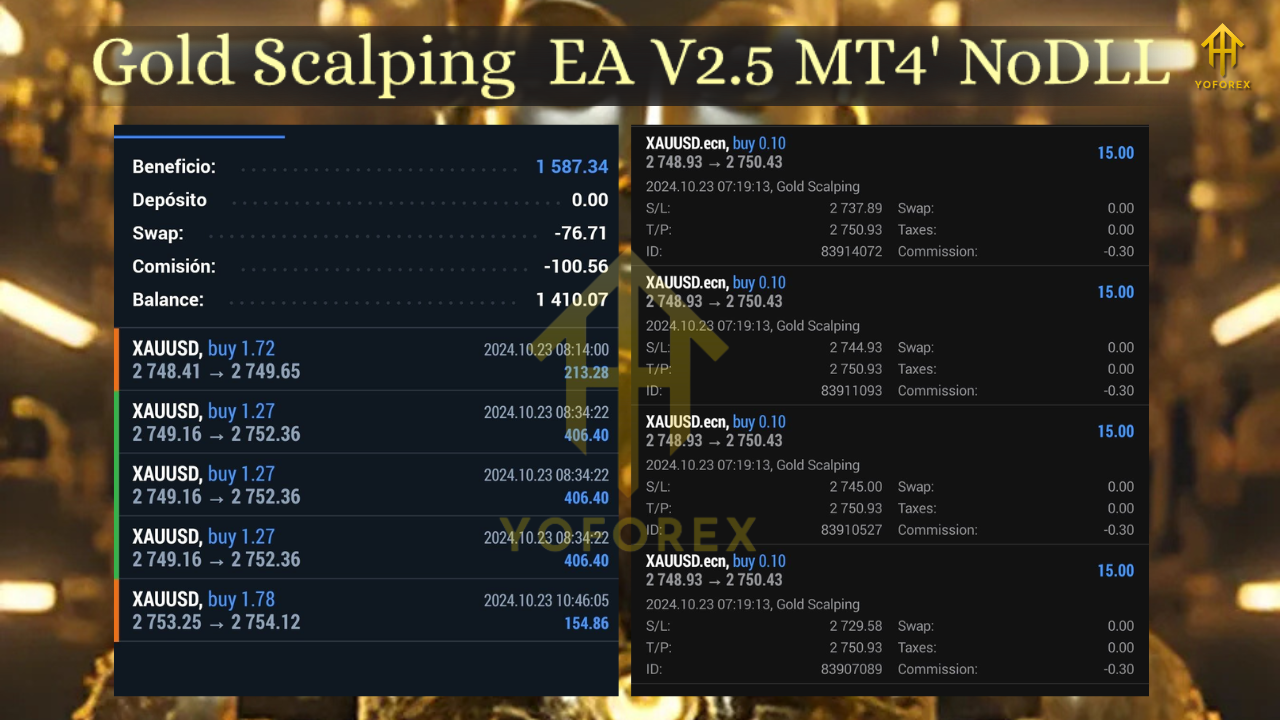

Forward Testing Results

Live demo forward tests show profitability when used with low-spread brokers and VPS hosting. Execution speed plays a significant role in real-world results.

Advantages and Drawbacks

Advantages:

- Designed exclusively for gold

- Uses pending orders for cleaner entries

- Dynamic stop loss prevents runaway losses

- Scalable to different account sizes

- Session filters for smarter trading windows

Drawbacks:

- Dependent on broker execution and spreads

- Performance may drop during news spikes

- Requires reliable VPS hosting

- Scalping generates frequent trades, leading to higher commission costs

Practical Tips for Success

- Always Test on Demo: Run the EA on demo before going live.

- Stick to Conservative Risk: Avoid over-leveraging; keep risks small.

- Check the Economic Calendar: Gold reacts sharply to events like NFP, CPI, and Fed announcements.

- Diversify Strategies: Use alongside other EAs or manual strategies.

- Keep Updated: Use the latest version for improved stability and features.

Final Thoughts

The Gold Scalping EA V2.5 MT4 is a specialized trading robot that takes full advantage of gold’s breakout opportunities. With pending orders, dynamic stop loss, trailing stop, and session filters, it delivers a balanced mix of precision and safety.

While no EA is risk-free, traders who configure this tool properly—with conservative risk settings and reliable broker conditions—can turn gold’s volatility into consistent opportunities. It’s not just an automation tool but a structured framework to approach scalping in the gold market.

Comments

Leave a Comment