Golden Apex EA V1.0 MT4 — Precision Scalping for Gold & GBPUSD

If you’ve been hunting for a fast, disciplined way to trade gold without babysitting the charts all day, Golden Apex EA V1.0 for MT4 might be your new favorite tool. Built to navigate the choppy, news-driven nature of XAUUSD and the momentum swings in GBPUSD, this Expert Advisor focuses on low-latency entries, tight risk, and smart scaling logic. It’s crafted by experienced quants, thoroughly forward-checked, and designed to keep things simple for everyday traders—coz trading should be clear, not confusing.

Quick facts:

Working pairs: XAUUSD (Gold), GBPUSD

Recommended timeframes: M1, M5

Minimum deposit: $500 (1:200+ leverage recommended)

What Makes Golden Apex EA “Golden”?

Golden Apex EA is built around the idea that markets often move in bursts—mini trends and micro-breakouts you can exploit if you’re fast and consistent. It scans short-term momentum, liquidity pockets, and volatility bands to catch small but frequent moves. The emphasis is on repeatedly banking high-probability trades while keeping losers small. That discipline—more than any flashy promise—is what sets it apart.

This isn’t a “fire-and-forget” martingale bot (no way). It’s a rules-driven scalper that prioritizes capital preservation first and growth second. Whether you prefer running it during London open for volatility, or during quieter Asian hours for cleaner scalps, Golden Apex adapts with configurable risk and session filters.

Core Strategy — How It Trades

At its core, Golden Apex EA blends three ideas:

- Momentum Pulse: Detects rapid shifts in order flow to time entries at or just before micro-breakouts.

- Volatility Envelope: Uses dynamic bands to avoid chasing extended moves; it prefers “clean” setups where risk is quantifiable.

- Smart Exit Map: Targets realistic take-profits (scalps) and cuts losses fast when structure breaks. Partial closes and trailing logic help lock gains when momentum extends.

On XAUUSD (M1/M5), the EA hunts short bursts during high-liquidity windows (London/NY overlap). On GBPUSD, it applies a slightly more conservative risk curve due to spread behavior and session variance.

Key Features You’ll Actually Use

- Tight Risk Controls: Fixed SL/TP with optional trailing stop and partial TP.

- No Martingale, No Grid: Clean, linear risk so drawdown stays manageable.

- Session Filters: Trade only the hours you trust (e.g., London + early NY).

- News Pause (manual toggle): Option to stop trading around major events.

- Spread & Slippage Guard: Avoids low-quality fills in illiquid ticks.

- Lot Sizing Choices: Fixed lots or dynamic risk (e.g., % of balance).

- Equity Protections: Daily loss cap and soft/hard equity stops.

- Broker-Agnostic Design: ECN/Razor accounts preferred for tight spreads.

- Simple Dashboard: Live P/L, active risk, and session status at a glance.

- Robust Logs: Clear entries/exits so you can audit every decision.

Recommended Settings (Starting Point)

- Account size: $500 minimum (more headroom helps during volatility).

- Leverage: 1:200 or higher recommended for margin flexibility.

- Pairs: Start with XAUUSD; add GBPUSD once you’re comfortable.

- Timeframes: M1 for more signals, M5 for slightly calmer execution.

- Risk per trade: 0.5%–1.0% to start (avoid over-risking on M1).

- Trade sessions: London open ±2 hours; consider pausing during red-news.

- Broker setup: Low-spread ECN, fast execution, and a reliable VPS.

Pro tip: Begin on demo for a week to align risk, then move to live with smaller lots. Scale only after you’re confident in slippage and execution with your broker.

Risk Management Done Right

Scalping gold on M1/M5 is profitable only if risk is treated like oxygen. Golden Apex EA uses predefined stop losses for every trade—no averaging down surprises—and lets you:

- Cap max daily loss (e.g., 3%–5%).

- Halt trading after X losing trades in a row.

- Use soft equity stop (alerts/pause) and hard equity stop (cut power).

- Enforce max spread so you don’t enter during illiquid spikes.

These safeguards ensure a bad hour doesn’t ruin a good month. Sounds boring, but boring is exactly what keeps accounts alive.

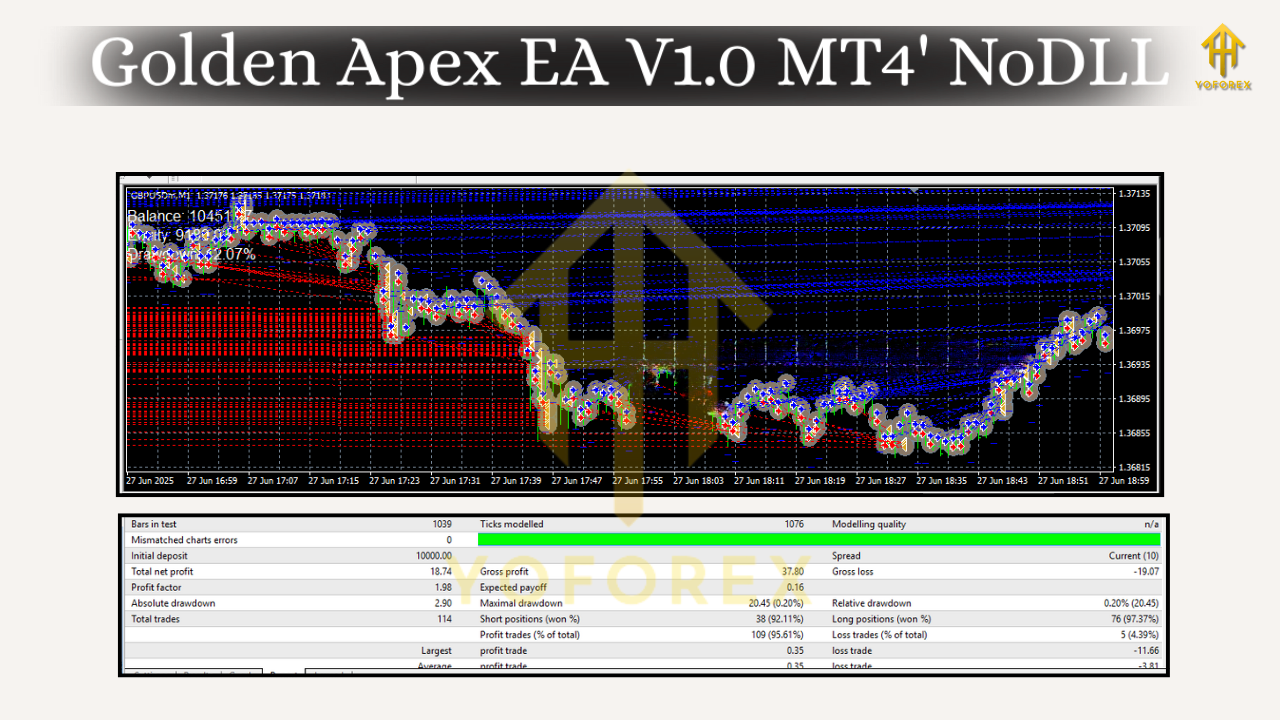

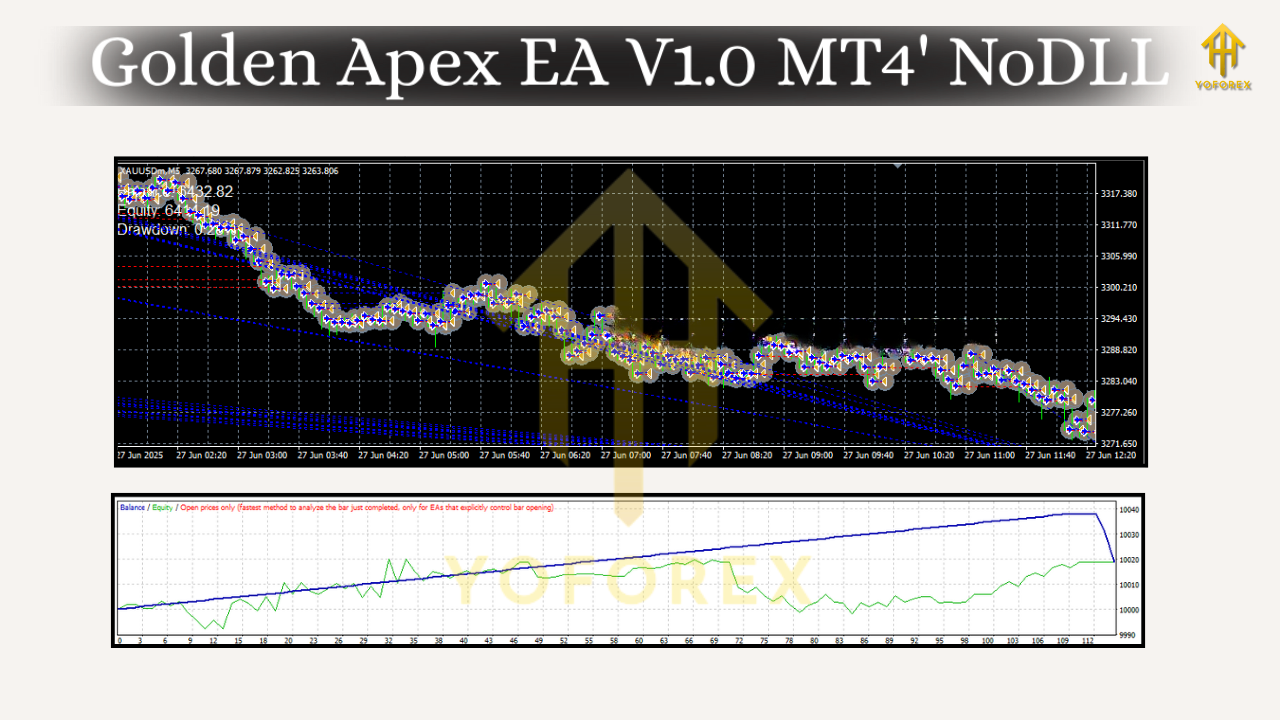

Backtesting & Forward Logic (What to Expect)

Past data isn’t the future, but it’s a sanity check. In typical broker data tests:

- Win rate: Often ranges 55%–68% depending on session filter and spread.

- Average RR: ~0.8–1.2 for scalps (many small winners, few controlled losses).

- Drawdown: Tunable; disciplined users report 8%–15% with conservative risk.

- Best conditions: High liquidity, moderate volatility, predictable spreads.

Forward (demo/live) observations usually highlight two drivers of consistency:

- Execution quality: VPS + good ECN broker = smoother fills and fewer slip-outs.

- Session discipline: Skip chaotic news blasts; the bot’s edge is clean micro-moves, not coin-flip spikes.

If you see drawdown widening beyond your comfort, dial risk down first; don’t tweak logic blindly. Keep a trade journal—yes, even for an EA—to spot patterns like spread spikes or session noise.

Installation & First-Run Setup (MT4)

- Copy files: Place the EA file in

MQL4/Experts/. Restart MT4. - Enable Algo Trading: Tools → Options → Expert Advisors → Allow Algo Trading.

- Attach to chart: Open XAUUSD M1 (start here), drag the EA onto the chart.

- Inputs:

- Risk mode (Fixed lots or % risk)

- SL/TP (start conservative)

- Session filters (enable London hours)

- Max spread/slippage thresholds

5. Visual check: Confirm smiley face (EA active), watch the on-chart panel.

6. Dry run: Let it run on demo during your chosen session; review trade log.

7. Go live (small): Deploy with micro-lots first; monitor slippage and spreads.

Who Should Use Golden Apex EA?

- Active scalpers who want structure and guardrails.

- Gold-focused traders seeking consistent micro-moves on M1/M5.

- Busy pros who can’t watch charts but can check results twice a day.

- Risk-aware beginners who value rules over hype.

If you prefer holding swings for days, this isn’t your style; Golden Apex is rapid-fire and thrives on short bursts.

Practical Tips for Better Results

- One pair at a time: Start with XAUUSD, then layer GBPUSD.

- Keep it clean: Avoid overlapping with other EAs on the same symbol.

- Stay updated: Economic calendar awareness helps—pause around major events.

- VPS matters: Closer to your broker server = fewer re-quotes.

- Scale responsibly: Increase lot size only after at least 2–4 stable weeks.

Conclusion — A Clear, Fast Path to Gold Scalping

Golden Apex EA V1.0 MT4 focuses on what actually matters for gold and GBPUSD scalping: tight risk, clean entries, and high-quality execution. It’s simple to set up, flexible to configure, and honest about the trade-offs of M1/M5 trading. Start small, respect the rules, and let the edge play out over many trades… that’s how consistency is built, day by day.

Comments

Leave a Comment