Introduction

For most traders, the real battle isn’t finding a “perfect entry.” It’s staying consistent—day after day—without emotions hijacking the plan. That’s exactly why automated systems on MetaTrader 5 have become so popular. They don’t get scared, they don’t overtrade, and they don’t break rules just because the last trade was a loss.

Golden Hen EA V2.3 MT5 is built for traders who want structure in their execution. Instead of guessing, it follows a rule-based approach: it scans the market, waits for conditions that match its logic, and manages trades with predefined controls. But let’s be honest from the start—no EA is a guaranteed profit machine. The true value of an EA comes from how well you set it up, how responsibly you manage risk, and whether you treat it like a system, not a lottery ticket. In this blog, I’ll explain what Golden Hen EA is, how traders use it on MT5, and how to approach it with realistic expectations and professional discipline.

Golden Hen EA V2.3 MT5 Overview

If you trade on MetaTrader 5 and you’ve been hunting for an automated system that feels “simple on the surface but structured underneath,” Golden Hen EA V2.3 MT5 will catch your attention. The name sounds playful, but what matters is the logic: this EA is built to identify repeatable market conditions, enter based on a defined rule set, and manage positions with a risk model that aims to reduce emotional decision-making.

Now—let’s keep it real. No Expert Advisor is a magic money printer. Markets shift, spreads widen, liquidity changes during news, and even a great algorithm can hit a rough patch. The value of a well-designed EA is not “never losing.” It’s this:

- It follows rules even when you’re tired or distracted

- It helps you trade with consistency

- It can be tested, optimized, and controlled like a system

- It can reduce overtrading and revenge trading

In this review, I’ll break down how Golden Hen EA V2.3 MT5 typically fits into a professional workflow: what it’s designed to do, how traders use it, what settings matter, and how to run it responsibly on MT5.

What Is Golden Hen EA V2.3 MT5?

Golden Hen EA V2.3 MT5 is an automated trading robot made for MetaTrader 5, intended to scan the chart for conditions that match its internal model (entry trigger + confirmation + position management). The goal isn’t to “predict” the market; the goal is to react to probability zones—where price behavior tends to repeat more often than random.

Most MT5 EAs in this category are designed around:

- Trend continuation entries (when momentum confirms)

- Range-to-breakout logic (when consolidation ends)

- Mean reversion entries (when price deviates and snaps back)

- Time-session filtering (London/NY overlap often performs differently)

Golden Hen EA V2.3 usually appeals to traders who want a hands-off execution style but still want to control risk, filters, and trade frequency.

Who Should Use This EA?

This EA makes the most sense if you:

- Want automation but still believe in risk control

- Prefer a “system” approach instead of random trades

- Can run MT5 on a stable PC or VPS

- Understand that drawdown is part of trading and you size accordingly

This EA is not a good fit if:

- You expect guaranteed profits

- You want to double lots after losses (martingale addiction)

- You can’t tolerate normal drawdowns

- You don’t want to backtest or forward-test

Key Features of Golden Hen EA V2.3 MT5

- Fully Automated Trading for MT5

Runs trades automatically on MetaTrader 5, so you don’t need to sit on charts all day. - Rule-Based Entry Logic

Executes trades only when the market matches its pre-defined conditions (helps avoid emotional/random entries). - Built-in Risk Management Controls

Supports controlled exposure through settings like fixed lot or risk-based lots (depending on your configuration). - Stop Loss + Take Profit Management

Uses protective Stop Loss and target-based Take Profit to keep trades structured (no “hope trading”). - Trailing Stop / Break-Even Protection (if enabled in settings)

Helps protect profits by moving stop loss as price moves in your favor and reducing the chance of turning winners into losers. - Spread & Market Condition Filter

Can be configured to avoid trading when spreads are too high or market conditions are unstable (useful around low-liquidity hours). - Session / Time Filter (optional setup)

Allows traders to restrict trading to specific sessions like London or New York for better liquidity and cleaner movement. - Trade Frequency & Limit Controls

Options to limit the number of trades per day or the number of open trades at the same time—helps prevent overtrading. - Works Well with VPS for 24/5 Execution

Ideal for VPS usage so the EA stays online, executes fast, and avoids missed trades due to PC shutdowns or disconnects. - Beginner-Friendly Setup + Pro-Level Optimization Potential

Can be used with safer default settings for beginners, and also allows deeper tuning for advanced traders who backtest properly.

Best Timeframes and Pairs (Practical Guidance)

Because you didn’t specify the official pair/timeframe, here’s the most realistic way traders approach this:

Recommended Timeframes (Common Best Practice)

- M15 to H1 for balanced signals and less noise

- H1 to H4 for more stable filtering and fewer trades

If you want:

- More trades → M15/H1

- Cleaner trades → H1/H4

- Less stress → H1/H4 + stricter filters

Pairs That Usually Work Better for EAs

EAs generally perform better on:

- Major pairs (EURUSD, GBPUSD, USDJPY) due to liquidity

- Sometimes gold (XAUUSD) if the EA is designed for it and your broker has stable spreads

Avoid:

- Exotic pairs with crazy spreads

- Thin liquidity hours (late session gaps)

How to Set Up Golden Hen EA V2.3 MT5 Properly (Step-by-Step)

Step 1: Use a Reliable Broker + Low Spread Account

Automation needs tight execution. Look for:

- Low spread / RAW spread accounts

- Stable server execution

- Low slippage

Step 2: Run on VPS (Strongly Recommended)

If your PC sleeps, restarts, or MT5 disconnects—your EA will miss trades or mismanage open positions. VPS is the professional way.

Step 3: Start With Conservative Risk

If you’re new to automated trading:

- Start with 0.01–0.03 lots per $1,000 as a safe learning approach

- Or use the EA’s risk % setting at 0.5%–1% per trade (if supported)

Step 4: Avoid Over-Optimization

Don’t curve-fit. The market will change. Optimize lightly:

- Focus on risk controls and filters

- Keep settings stable

- Forward-test before scaling

Smart Risk Rules (My Real Advice)

If you want consistency, these rules matter more than any “secret setting”:

- Never risk more than you can emotionally handle

- Keep a max drawdown limit (example: 15%–25% equity, depending on style)

- Avoid running aggressive lot multipliers

- Don’t run multiple EAs on the same pair without a plan

- Track results weekly, not hourly

Automation is not set-and-forget. It’s set-and-manage like a business.

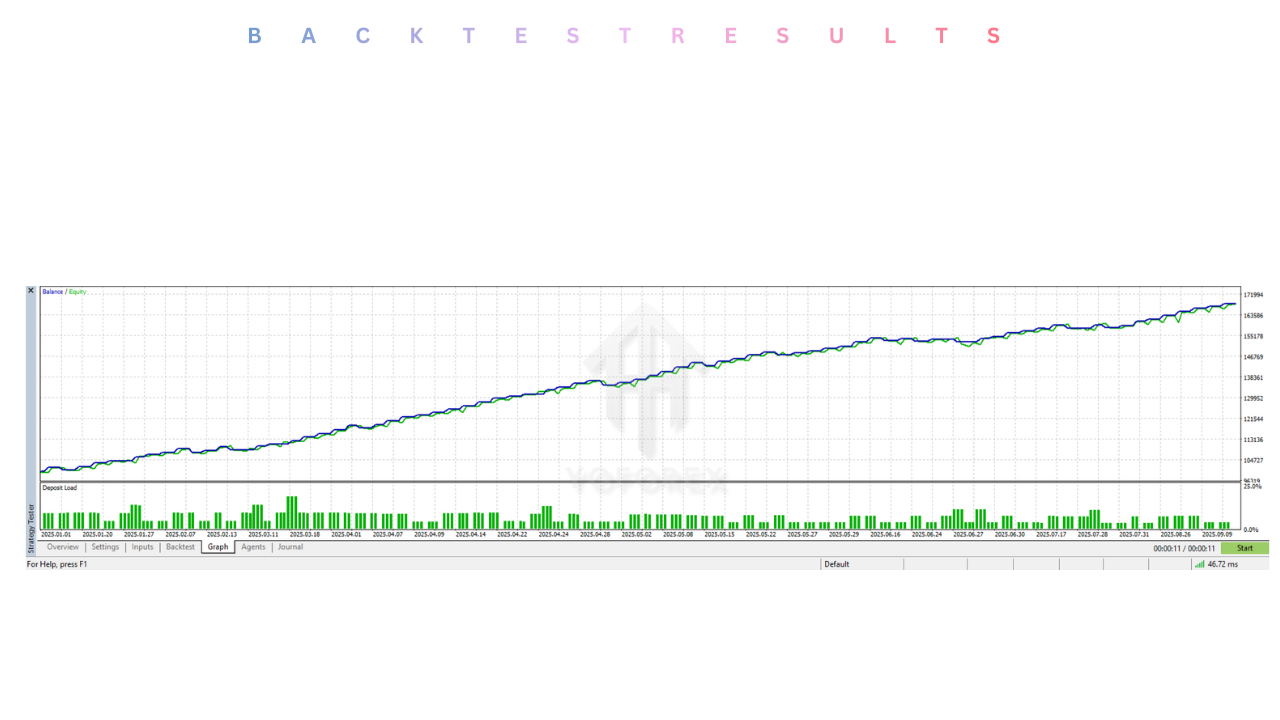

Performance Expectations (Honest Reality)

Let’s talk like a professional:

- Some months will be great

- Some weeks will be flat

- Some periods will draw down

- Execution quality matters (broker + VPS + spreads)

- The best traders scale slowly and protect capital

If anyone promises you “guaranteed monthly profit,” that’s marketing—not trading.

Add an Edge With an Assistant Tool (Optional but Powerful)

A smart move is pairing MT5 automation with an analysis assistant so you can understand the environment your EA is trading in.

Two helpful options:

- YoForex AI: Use it to evaluate market structure, volatility context, and whether conditions are trending or choppy before letting the EA run full-time.

- TradingView: Use simple structure tools (support/resistance, sessions, volatility) to decide when to use strict vs. aggressive EA settings.

This kind of workflow is what separates random EA users from disciplined system traders.

Pros and Cons

Pros

- Removes emotional trading decisions

- Can run 24/5 with consistent rules

- Risk controls help manage exposure

- Works well when paired with VPS + stable broker

Cons

- Still vulnerable to news spikes and spread widening

- Needs proper setup and monitoring

- Poor broker execution can ruin performance

- Over-optimization can lead to future failure

Conclusion

Golden Hen EA V2.3 MT5 should be seen as a tool—not a promise. If you run it with proper risk settings, a stable broker, and a clean MT5 setup (ideally on a VPS), it can help you trade with more discipline and less emotional interference. That’s the biggest advantage automation offers: consistency in execution.

However, your results will always depend on the market environment and how you control exposure. Avoid chasing “aggressive” settings, don’t over-optimize, and always forward-test before scaling. If you combine the EA with smart decision support—like checking volatility, avoiding risky news sessions, or using tools like TradingView and YoForex AI for market context—you’ll trade like a professional who respects the process, not like someone hunting shortcuts.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment