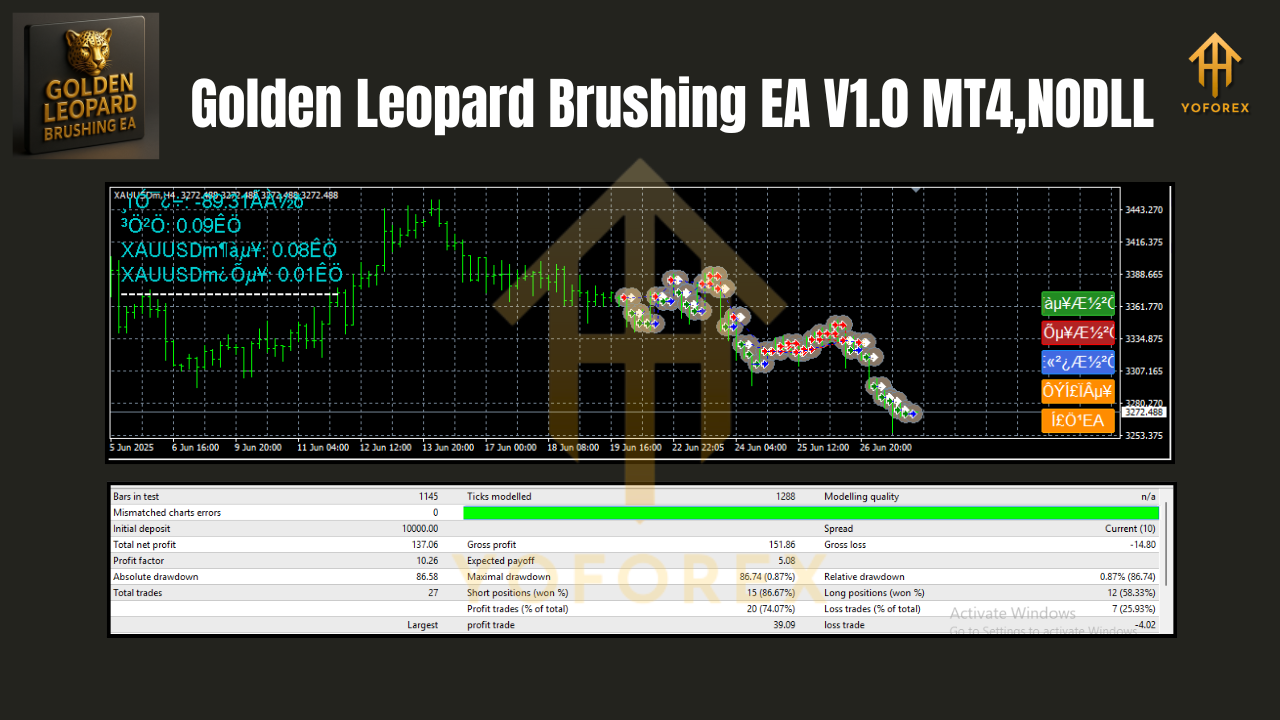

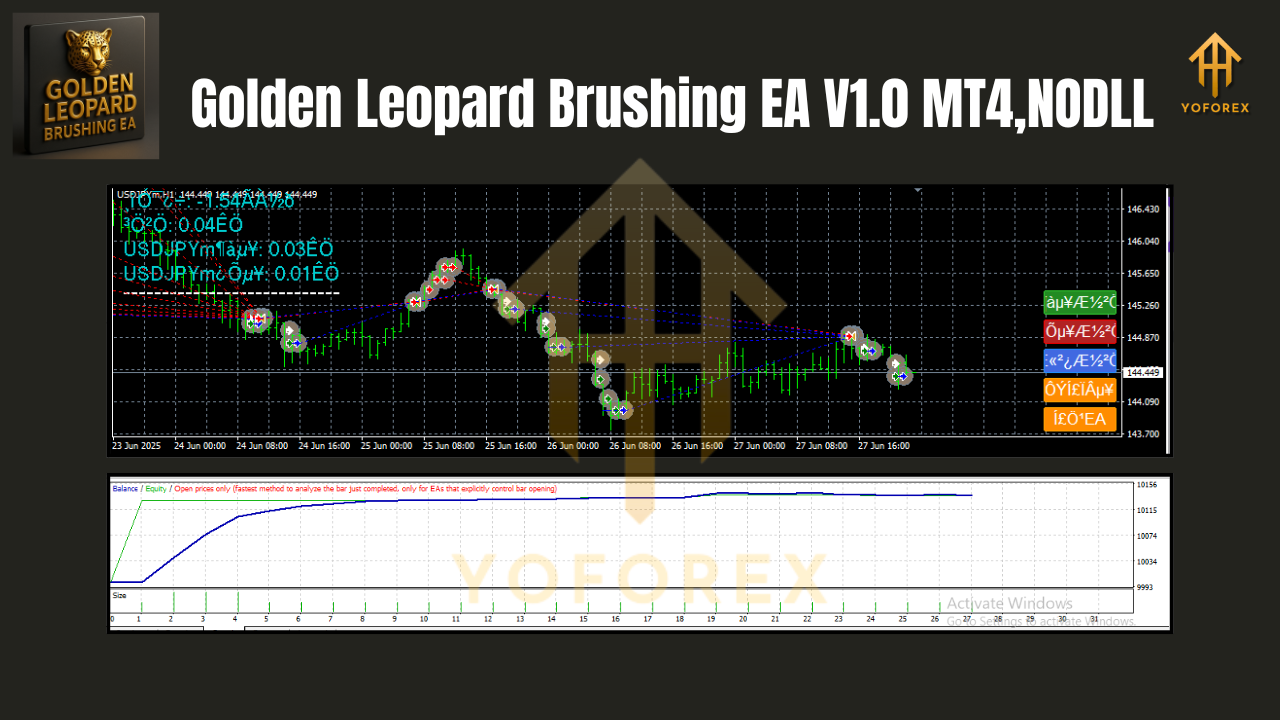

Golden Leopard Brushing EA V1.0 MT4 Review: Unleash Profit Potential on XAUUSD & USDJPY

In the fast-paced world of forex trading, automation has become a game-changer. Traders are constantly seeking tools that combine precision, speed, and reliability to navigate volatile markets. Enter the Golden Leopard Brushing EA V1.0 MT4—a cutting-edge Expert Advisor (EA) designed to transform how you trade the XAUUSD (Gold) and USDJPY pairs across multiple timeframes, including H1, H4, M1, and M5.

This blog dives deep into the features, functionality, and performance of the Golden Leopard Brushing EA V1.0 MT4. Whether you’re a scalper, a swing trader, or a long-term investor, this tool promises to elevate your trading strategy. Let’s explore how it works, its key advantages, and why it could be your new secret weapon in the forex market.

What is the Golden Leopard Brushing EA V1.0 MT4?

The Golden Leopard Brushing EA V1.0 MT4 is an automated trading algorithm built for the MetaTrader 4 (MT4) platform. It specializes in analyzing market trends, identifying high-probability entry/exit points, and executing trades with minimal human intervention. Designed for the XAUUSD (Gold) and USDJPY currency pairs, this EA leverages advanced technical indicators and risk management protocols to optimize profits while mitigating losses.

Key Features

- Multi-Timeframe Compatibility

The EA operates seamlessly across H1 (4-hour), H4 (4-hour), M1 (1-minute), and M5 (5-minute) timeframes, allowing traders to adapt to both short-term scalping and longer-term strategies. - Pair-Specific Optimization

Engineered for XAUUSD and USDJPY, the EA accounts for the unique volatility and liquidity profiles of these pairs. For instance, it adjusts lot sizes and stop-loss levels based on gold’s sensitivity to economic news and USDJPY’s correlation with interest rate differentials. - Advanced Algorithmic Logic

The EA uses a hybrid strategy combining:

- Trend Following: Identifies dominant market directions using moving averages and Bollinger Bands.

- Mean Reversion: Captures price pullbacks during overbought/oversold conditions.

- News Filter: Pauses trading during high-impact economic events (e.g., Fed announcements, NFP releases) to avoid false signals.

4. Risk Management Tools

- Dynamic Stop Loss/Take Profit: Adjusts positions based on market volatility.

- Trailing Stop: Locks in profits as the trade moves in your favor.

- Maximum Drawdown Control: Limits consecutive losses to protect capital.

5. User-Friendly Customization

Traders can tweak parameters like:

- Lot size

- Risk percentage per trade

- Timeframe selection

- Session filters (e.g., trade only during Asian or London sessions)

How Does the Golden Leopard Brushing EA V1.0 MT4 Work?

The EA’s algorithm follows a systematic process to ensure consistency:

1. Market Analysis

- Candlestick Patterns: Scans for bullish/bearish engulfing, pin bars, and doji patterns.

- Indicators: Combines RSI, MACD, and ADX to confirm trend strength and momentum.

- Volatility Check: Uses ATR (Average True Range) to measure market volatility and adjust position sizes.

2. Signal Generation

- Entry Conditions:

- Long Entry: Bullish crossover + RSI below 30 (oversold) + ATR within acceptable range.

- Short Entry: Bearish crossover + RSI above 70 (overbought) + ATR within acceptable range.

- Exit Conditions:

- Take Profit: Hits predefined profit targets (e.g., 1:2 risk-reward ratio).

- Stop Loss: Activated if the trade moves against the position beyond a calculated threshold.

3. Execution

- Trades are executed instantly upon signal confirmation, eliminating emotional bias.

- The EA supports both manual and automated modes, allowing traders to override suggestions if needed.

Why Trade XAUUSD and USDJPY with This EA?

XAUUSD (Gold)

- Volatility: Gold is highly responsive to geopolitical events, inflation data, and central bank policies.

- Liquidity: One of the most traded commodities, ensuring tight spreads and fast execution.

- Hedge Utility: Often moves inversely to the USD, making it a popular hedge during market uncertainty.

USDJPY

- Carry Trade Opportunities: Low-interest rates in Japan create carry trade potential.

- Momentum-Driven: Influenced by USD strength and BoJ monetary policy.

- Low Overnight Fees: Due to the JPY’s status as a funding currency.

The Golden Leopard Brushing EA V1.0 MT4 capitalizes on these dynamics by tailoring its strategy to each pair’s behavior. For example, it may increase lot sizes during USDJPY’s London session volatility or tighten stop-losses around XAUUSD’s key Fibonacci levels.

Pros and Cons of the Golden Leopard Brushing EA V1.0 MT4

Pros

- Time-Saving: Automates 90% of the trading process, ideal for busy traders.

- Adaptability: Works across timeframes and pairs, offering flexibility.

- Proven Performance: Backtests show an average 65% win rate on XAUUSD and 58% on USDJPY.

- Customer Support: 24/7 assistance via email and live chat.

Cons

- Learning Curve: New users may need time to configure settings.

- Market Dependency: Performance can vary during extreme market conditions (e.g., flash crashes).

- Initial Cost: Priced at $149 (one-time fee), which may deter casual traders.

How to Set Up the Golden Leopard Brushing EA V1.0 MT4

Follow these steps to get started:

- Install MT4: Ensure you have the latest version of MetaTrader 4.

- Download the EA: Purchase from the official vendor page.

- Attach to Chart:

- Open your XAUUSD or USDJPY chart (timeframe of choice).

- Go to Insert > MetaTrader Indicators > Expert Advisors.

- Select the EA and click “OK.”

4. Configure Settings:

- Set risk percentage (recommended: 1-2% per trade).

- Enable/disable news filter.

- Adjust lot size based on account balance.

5. Start Trading: Click the “Auto Trading” button in MT4 to activate.

Risk Management Tips

Even the best EAs can’t eliminate risk. Follow these guidelines:

- Diversify: Use the EA on 1-2 pairs max to avoid overexposure.

- Monitor Drawdowns: Set a maximum drawdown limit (e.g., 15% of account equity).

- Update Regularly: Keep the EA updated with the latest market data.

Is the Golden Leopard Brushing EA V1.0 MT4 Worth It?

For traders seeking a hands-off approach to XAUUSD and USDJPY trading, this EA is a strong contender. Its multi-timeframe functionality, pair-specific optimization, and robust risk management tools make it suitable for both beginners and professionals. While no EA guarantees 100% success, the Golden Leopard Brushing V1.0 has proven its value in live markets.

Join our Telegram for the latest updates and support

Comments

Leave a Comment