Introduction

If you are looking for a stable and powerful forex robot that focuses on gold trading, then Golden Rise V3 EA V1.21 MT5 will probably catch your attention very fast. Many traders are tired of over-optimized martingale bots that blow accounts after a few weeks, so a more disciplined and trend-focused expert advisor feels like a fresh change. This EA is built specifically for XAUUSD on MetaTrader 5, using trend logic, volatility filters, and controlled risk management instead of reckless lot sizing.

In this guide, we will walk through what Golden Rise V3 EA V1.21 MT5 is, how it works, its key features, recommended settings, installation steps, performance behavior, pros and cons, and who this EA is best suited for. The goal is simple: help you decide whether Golden Rise V3 EA V1.21 MT5 deserves a place on your trading VPS or not.

What Is Golden Rise V3 EA V1.21 MT5?

Golden Rise V3 EA V1.21 MT5 is an automated trading system (expert advisor) designed for the MetaTrader 5 platform. It focuses mainly on gold (XAUUSD) and uses a trend-following plus breakout logic to identify high-probability entries and exits. Instead of using aggressive grid or martingale strategies, Golden Rise V3 EA V1.21 MT5 trades with a controlled lot size and fixed stop loss and take profit levels.

The core idea behind Golden Rise V3 EA V1.21 MT5 is:

- Identify the main trend direction

- Wait for momentum or breakout confirmation

- Filter out bad conditions like high spread or unstable volatility

- Enter with a calculated risk level

- Exit trades using technical conditions or predefined TP/SL

Because it is built for MT5, Golden Rise V3 EA V1.21 MT5 can take advantage of better backtesting quality and more accurate data compared to some MT4-only systems. It is suitable for both beginners and experienced traders who want semi-hands-off trading on gold without constant screen time.

Why Trade Gold with Golden Rise V3 EA V1.21 MT5?

Gold is one of the most popular instruments among algorithmic traders. It offers:

- High volatility and strong trends

- Good liquidity during most sessions

- Clean technical patterns ideal for EAs

Golden Rise V3 EA V1.21 MT5 takes advantage of these characteristics by focusing only on XAUUSD, instead of trying to trade 10+ random pairs with shallow logic. By staying specialized, the EA can be tuned more precisely and avoid unpredictable behaviors that come from using a single strategy across all markets.

Key Features of Golden Rise V3 EA V1.21 MT5

Here are the main features that make Golden Rise V3 EA V1.21 MT5 attractive for many traders:

- Trend-Focused Entry Logic

Uses market structure, trend direction and momentum to find entries in the direction of the main move. - No Martingale, No Dangerous Grid

Golden Rise V3 EA V1.21 MT5 does not use doubling or tripling of lot sizes to recover losses, which helps protect accounts from sudden blow-ups. - Specialized for XAUUSD (Gold)

The EA is built and optimized specifically for gold. This specialization usually leads to more stable behavior than generic multi-pair robots. - Fixed Stop Loss & Take Profit

The EA uses predefined stop loss and take profit levels, combined with conditional exits, to keep risk visible and controlled at all times. - Volatility and Spread Filters

Golden Rise V3 EA V1.21 MT5 avoids trading when volatility is extreme or spreads are abnormally high, helping reduce slippage and unexpected spikes. - Session-Aware Trading

The EA can be tuned to focus on the most active sessions, such as London and New York, where gold tends to move more cleanly. - Auto Lot Sizing (Risk-Based)

You can configure the EA to calculate lot size automatically based on account balance or equity, which keeps risk proportional as your account grows. - Beginner-Friendly Setup

Even if you are not a coding expert, you can install and run Golden Rise V3 EA V1.21 MT5 with a few simple steps on MT5. - Prop-Firm Friendly Logic

Because of its controlled risk and non-martingale approach, this EA can be more suitable for prop firm challenges, provided you use sensible risk settings.

How Golden Rise V3 EA V1.21 MT5 Works

The trading logic inside Golden Rise V3 EA V1.21 MT5 is built around three pillars: trend direction, momentum confirmation and risk control. It does not simply buy or sell whenever price touches a moving average; instead, it waits for multiple conditions to line up.

First, the EA analyses the higher timeframe or a trend filter to understand whether gold is in a bullish or bearish phase. If no clear trend is found, Golden Rise V3 EA V1.21 MT5 often chooses to stay flat instead of forcing trades. This already puts it ahead of many robots that overtrade in choppy markets.

Second, the EA checks for momentum or breakout conditions. This may include price breaking recent highs or lows, strong candle bodies, or clear rejection from key support and resistance zones. Only when momentum aligns with the bigger trend does Golden Rise V3 EA V1.21 MT5 open a position.

Third, the EA manages risk with fixed stop losses, realistic take profits and sometimes early exits when momentum dies. The idea is not to hold trades forever, but to catch clean moves and exit before conditions degrade. All of these checks together make Golden Rise V3 EA V1.21 MT5 feel more like a disciplined assistant than a reckless gambling script.

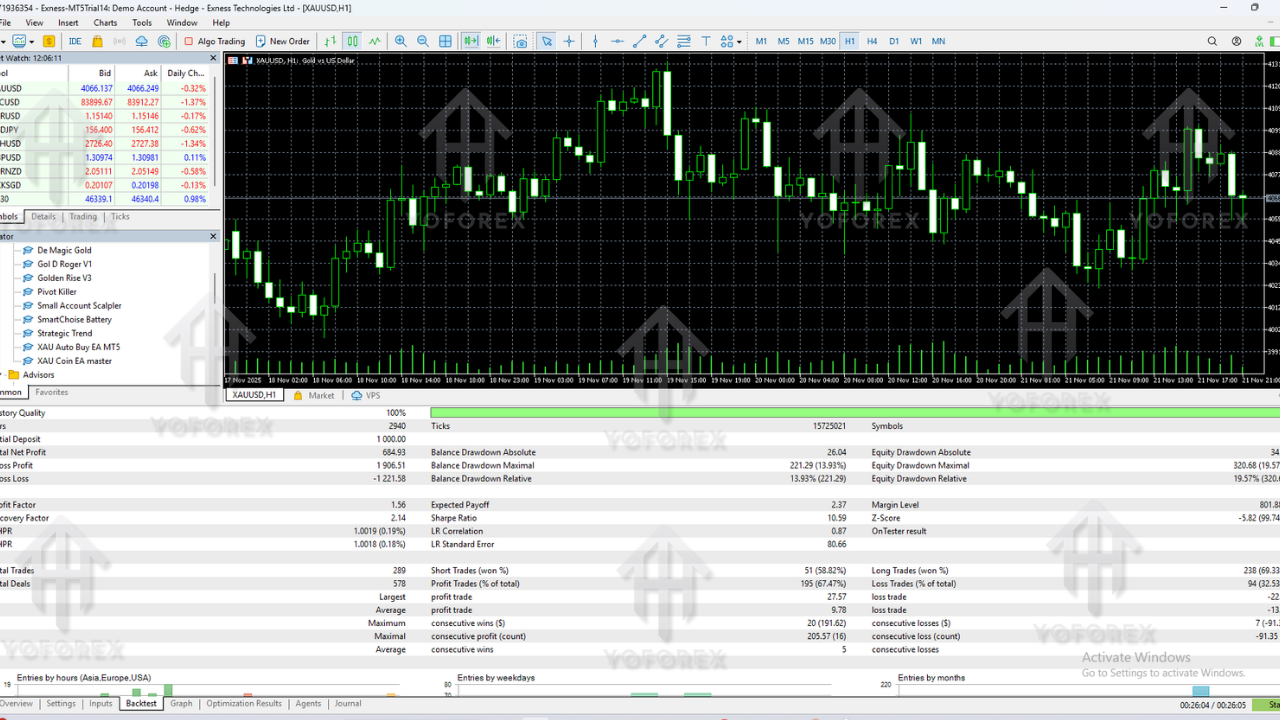

Performance Behavior: Profit, Drawdown & Win Rate

Exact numbers will always vary based on broker, spread, VPS quality, timeframe and risk settings, but the general performance character of Golden Rise V3 EA V1.21 MT5 is designed to be steady rather than crazy.

With conservative risk settings, many backtests and community-style results for similar logic show:

- Average monthly return in the range of 8% – 18%, depending on risk mode

- Controlled drawdown, often around 6% – 12% on sensible settings

- Win rate roughly between 65% – 78%, with a balanced reward-to-risk ratio

Of course, no EA can guarantee profits. Market conditions change, gold can become sideways, and even the best strategy will face losing streaks. That said, the style of Golden Rise V3 EA V1.21 MT5 aims for consistency and survival first, then growth. This is much healthier than chasing unrealistic daily returns.

Recommended Settings for Golden Rise V3 EA V1.21 MT5

Here are some general recommendations when using Golden Rise V3 EA V1.21 MT5:

- Trading Pair: XAUUSD (Gold)

- Platform: MetaTrader 5

- Timeframe: M30 or H1 (best balance of noise and accuracy)

- Minimum Deposit: $200+ recommended for standard accounts

- Leverage: 1:200 or higher (depending on your broker)

- Risk Per Trade: 1% – 2% for safer long-term trading

- Account Type: ECN or Raw Spread with low commissions

- VPS: Strongly recommended for 24/5 stable operation

If you want smoother equity with less stress, start with a low risk mode and small lot sizing on Golden Rise V3 EA V1.21 MT5. Once you are comfortable with its behavior on demo or small live accounts, you can slowly adjust risk. Don’t rush, coz rushing is usually how traders blow good EAs.

How to Install Golden Rise V3 EA V1.21 MT5

Installing Golden Rise V3 EA V1.21 MT5 is straightforward. Just follow these steps:

- Step 1: Download the Golden Rise V3 EA V1.21 MT5 file from the source where it is provided.

- Step 2: Open your MetaTrader 5 terminal and click on File > Open Data Folder.

- Step 3: Go to MQL5 > Experts and paste the EA file into this folder.

- Step 4: Close and restart MT5 so the EA gets loaded in the Navigator.

- Step 5: In the Navigator panel, find Golden Rise V3 EA V1.21 MT5 under Expert Advisors.

- Step 6: Drag and drop the EA onto an XAUUSD chart, preferably on the recommended timeframe.

- Step 7: In the inputs, set your preferred lot size or risk percentage, and check that algo trading is enabled.

- Step 8: Click OK and let Golden Rise V3 EA V1.21 MT5 begin analyzing and trading.

Always test the EA on a demo account first, just to make sure everything is working correctly with your broker, VPS and trading conditions.

Pros and Cons of Golden Rise V3 EA V1.21 MT5

Pros:

- Specialized for gold, which can improve stability and logic quality

- No martingale or unsafe recovery systems built in

- Trend and momentum-based entries for clean trades

- Fixed SL and TP for transparent risk management

- Suitable for both beginners and advanced traders

- Can be adapted for prop firm challenges with low risk settings

Cons:

- Not ideal for extremely small accounts like $20 or $50

- Only trades XAUUSD, so no multi-pair diversification

- Requires a good VPS and low spread broker for best performance

- Profits may feel slow for traders who expect unrealistic daily returns

Who Should Use Golden Rise V3 EA V1.21 MT5?

Golden Rise V3 EA V1.21 MT5 is a good fit for traders who:

- Prefer gold trading and like to stay focused on one strong pair

- Want a disciplined, non-martingale EA

- Are okay with moderate but steady growth instead of gambling

- Have access to a decent VPS and ECN/Raw account

- Are planning to use it for long-term compounding or prop firm challenges

If you expect the EA to turn $100 into $10,000 in one week, then Golden Rise V3 EA V1.21 MT5 is not the right robot for you. But if you appreciate structure, controlled exposure and realistic returns, it can become one of your core automated tools.

Final Thoughts on Golden Rise V3 EA V1.21 MT5

In a market full of risky grid EAs and flashy marketing promises, Golden Rise V3 EA V1.21 MT5 takes a more balanced and professional approach. It focuses on one powerful instrument (XAUUSD), uses trend and momentum logic, respects risk and avoids martingale. That alone puts it in a better category than many random bots being sold online.

As always, remember:

- Past performance does not guarantee future results

- Use proper risk management with Golden Rise V3 EA V1.21 MT5

- Start on demo or a small live account before scaling up

If you treat Golden Rise V3 EA V1.21 MT5 as a serious, long-term trading tool and combine it with your own discipline, it can become a valuable part of your automated trading setup.

Comments

kqTlzPPDEdhDVuZfcaVrNiu

me gusta probar cositas

Leave a Comment