Gold trading has always attracted traders because of its volatility, liquidity, and global demand. However, trading XAUUSD manually on lower timeframes can be mentally exhausting and technically demanding, especially for beginners. This is where automated trading systems, commonly known as Expert Advisors (EAs), step in to bridge the gap between opportunity and execution.

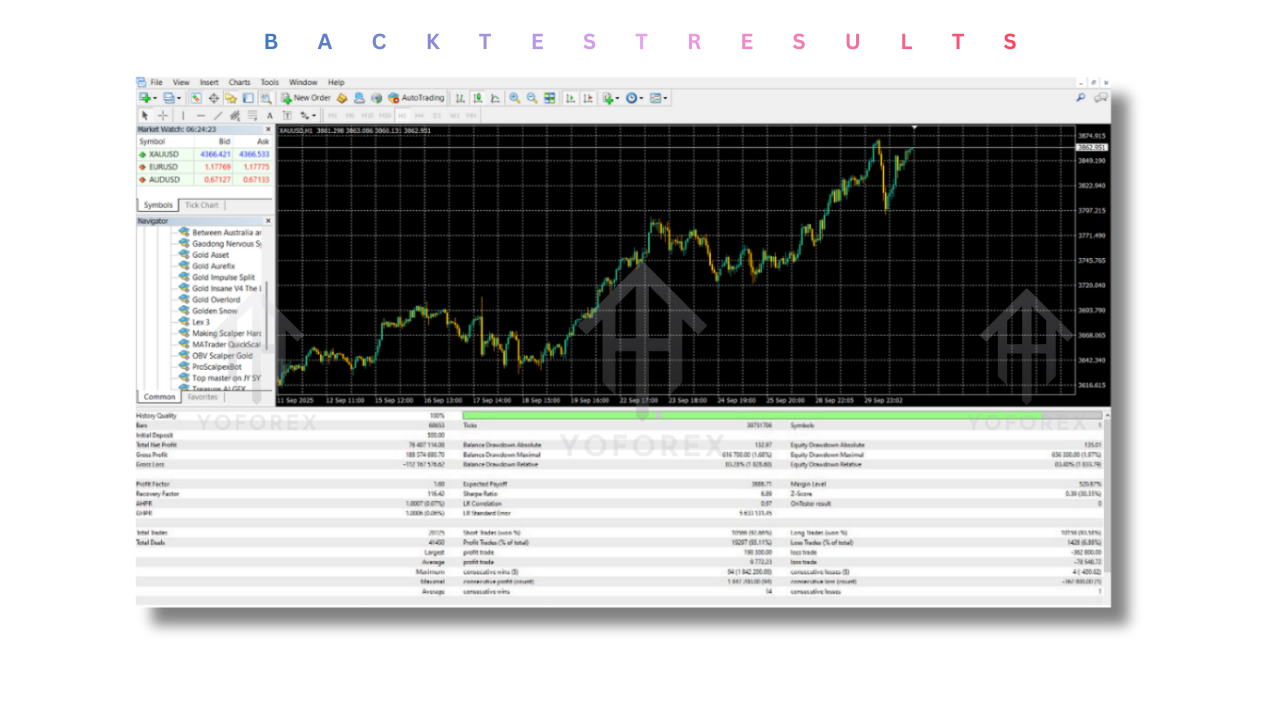

Golden Snow EA V12.25 MT4 is an automated trading solution designed specifically for gold traders who want a structured, rule-based approach without spending hours in front of charts. Built for the MetaTrader 4 platform, this EA aims to combine technical confirmation, volatility-based risk management, and adaptive trade recovery logic to navigate the fast-moving gold market.

This in-depth review explores how Golden Snow EA V12.25 works, who it is suitable for, its trading logic, risk profile, installation process, and whether it can realistically fit into a beginner-friendly trading plan.

What Is Golden Snow EA V12.25 MT4?

Golden Snow EA V12.25 is an automated trading robot developed for MT4 that focuses exclusively on the XAUUSD (gold) currency pair. Rather than attempting to trade multiple instruments, the EA concentrates on one asset class, allowing it to optimize behavior around gold’s volatility, price reactions, and session-based movements.

The EA is designed to operate on the M5 timeframe, where short-term price inefficiencies, momentum bursts, and retracements are more frequent. This approach makes it attractive for traders who want active trading exposure without manually scalping the market.

Golden Snow EA emphasizes structured trade execution, dynamic stop loss and take profit placement, and optional recovery logic to adapt to unfavorable market conditions.

Core Trading Logic Explained

Golden Snow EA V12.25 does not rely on a single indicator or simplistic entry rule. Instead, it applies a layered decision-making process designed to filter low-quality trades.

The EA primarily evaluates price action behavior across multiple timeframes to identify short-term momentum aligned with broader directional bias. Candlestick structures are analyzed to detect rejection zones, momentum continuation, or temporary exhaustion in price movement.

Volatility plays a central role in trade management. By incorporating Average True Range calculations, the EA dynamically adjusts stop loss and take profit levels based on current market conditions. This helps prevent stops from being too tight during high volatility or too wide during low-volatility periods.

An optional recovery mechanism allows the EA to adapt after a losing trade. Instead of immediately repeating the same logic, the system adjusts its aggressiveness based on predefined parameters. This feature is intended to improve trade recovery but must be used cautiously due to its impact on drawdown.

Focus on XAUUSD Only

One of the defining characteristics of Golden Snow EA V12.25 is its exclusive focus on gold. This specialization matters because XAUUSD behaves differently from major forex pairs.

Gold is influenced by macroeconomic news, interest rate expectations, geopolitical events, and session-based liquidity. A generic EA often struggles to adapt to these conditions. By focusing only on gold, Golden Snow EA is structured to handle sudden volatility spikes, retracements, and momentum bursts common in the gold market.

This specialization makes the EA easier to configure for beginners, as there is no need to adjust parameters for different currency pairs.

Risk Management Approach

Risk management is a critical factor in evaluating any automated trading system, especially one operating on a lower timeframe.

Golden Snow EA V12.25 uses ATR-based stop loss and take profit logic, which means trade exits are scaled according to real-time market volatility. This adaptive approach is generally safer than fixed pip targets in fast-moving instruments like gold.

The EA supports both fixed lot sizing and automatic lot calculation based on account balance. While automatic lot sizing can simplify risk control, beginners are advised to start with conservative values to avoid overexposure.

The recovery feature should be approached with caution. While it can help offset losses in ranging or choppy markets, it can also increase drawdown if market conditions remain unfavorable for an extended period. Proper testing and strict limits are essential when enabling this feature.

Account Requirements and Trading Environment

Golden Snow EA V12.25 is optimized for ECN or RAW spread accounts. Gold spreads can widen significantly during volatile periods, and lower spreads help maintain trade accuracy and reduce execution costs.

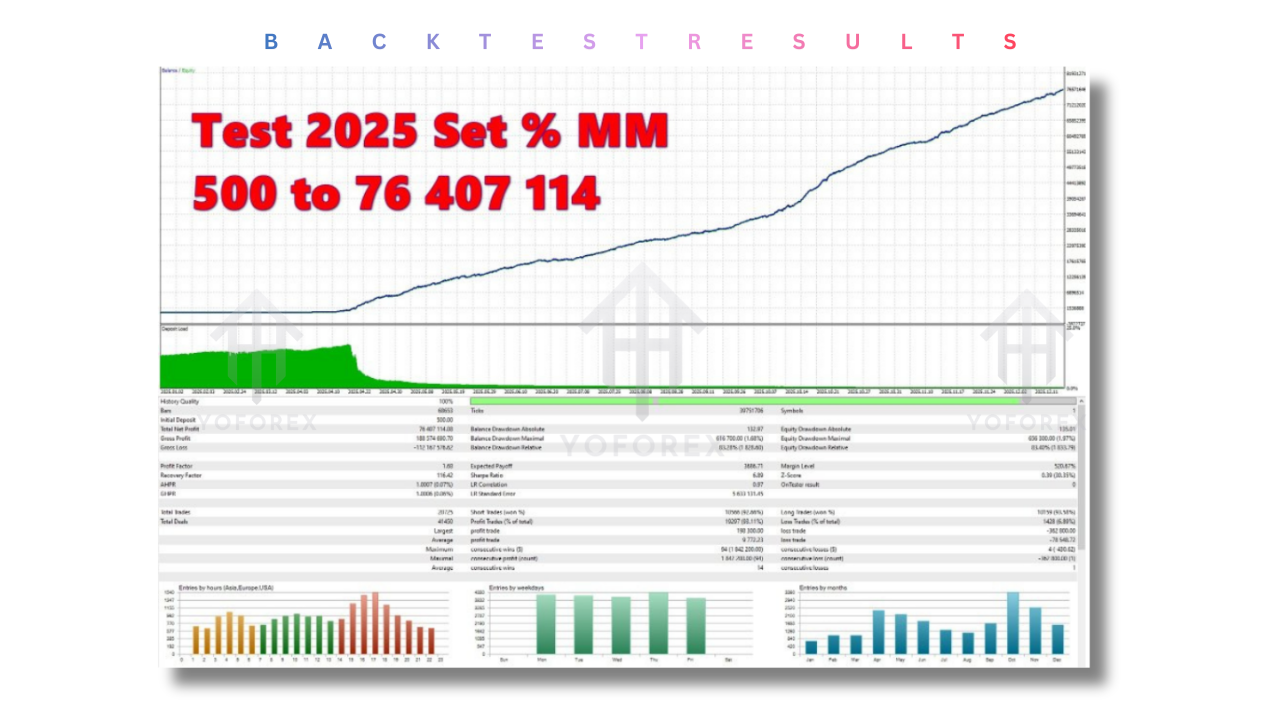

A minimum deposit of $500 is often mentioned, but a balance of $1,000 or more is more practical for maintaining stability during drawdowns. Higher balances allow the EA to operate without excessive lot scaling.

Leverage of at least 1:50 is required, though higher leverage should not be confused with higher risk exposure if lot sizing is managed properly.

Using a VPS is strongly recommended to ensure uninterrupted operation, stable execution, and consistent performance during all trading sessions.

Installation and Setup Guide

Installing Golden Snow EA V12.25 on MT4 is a straightforward process, even for beginners.

First, download the EA file and open your MetaTrader 4 platform. Navigate to the Experts folder through the data directory and place the EA file there. Restart MT4 to ensure the EA appears in the Navigator panel.

Attach the EA to an XAUUSD chart set to the M5 timeframe. Enable automated trading and allow DLL imports if required.

Before going live, review the input parameters carefully. Beginners should avoid aggressive recovery or lot scaling settings during initial testing. Starting with default or conservative settings on a demo account is highly recommended.

Once configured, the EA operates fully automatically, opening, managing, and closing trades without manual intervention.

Performance Expectations and Realistic Outlook

Golden Snow EA V12.25 is designed to capture frequent trading opportunities rather than relying on long-term position holding. As a result, users can expect a higher number of trades compared to swing-based systems.

Profitability depends heavily on broker conditions, spread stability, execution speed, and proper configuration. Like all automated systems, the EA is not immune to drawdowns, especially during high-impact news events or abnormal market conditions.

It is important to approach this EA as a tool rather than a guaranteed income source. Consistent performance requires disciplined risk control, realistic expectations, and continuous monitoring.

Who Should Use Golden Snow EA V12.25?

This EA is best suited for beginners and intermediate traders who want structured exposure to gold trading without manual chart analysis.

Traders who prefer short-term strategies and understand the risks of lower timeframe trading will find this EA more aligned with their goals. It may not be ideal for those seeking ultra-low drawdown or long-term position trading.

Users who are willing to test, optimize, and manage risk responsibly are more likely to benefit from this system.

Advantages of Golden Snow EA V12.25

The EA is fully automated, eliminating emotional decision-making.

It focuses exclusively on gold, allowing optimized behavior for one asset.

Dynamic stop loss and take profit adapt to market volatility.

Beginner-friendly installation and setup process.

Supports both fixed and automatic lot sizing.

Limitations and Risk Considerations

Lower timeframe trading increases exposure to noise and spread fluctuations.

Recovery features can amplify drawdowns if misused.

Performance is highly dependent on broker quality and execution speed.

Not suitable for traders expecting passive, zero-risk returns.

Final Verdict

Golden Snow EA V12.25 MT4 presents itself as a specialized automated solution for gold traders who want an active yet structured approach. Its focus on XAUUSD, volatility-based trade management, and adaptable logic make it appealing for traders looking to automate short-term strategies.

However, like any Expert Advisor, success depends on responsible use, proper testing, and disciplined risk management. Beginners should treat Golden Snow EA as a learning and automation tool rather than a guaranteed profit machine.

When used correctly, it can serve as a valuable component in a diversified automated trading approach.

Upgrade

If you are looking to automate your gold trading strategy and reduce manual workload, Golden Snow EA V12.25 offers a structured starting point. Always begin with demo testing and gradually scale based on performance and comfort level.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment