GOLDYCK BREAKSMC EA V1.0 MT5 – Breaker Block EA Based on Smart Money Concepts

Gold remains one of the most dynamic assets in the forex market, offering traders significant opportunities due to its volatility and macroeconomic sensitivity. However, navigating this volatility manually is not easy. Enter GOLDYCK BREAKSMC EA V1.0, an advanced Expert Advisor for MetaTrader 5 that uses Smart Money Concepts (SMC) and breaker blocks to automate gold trading with a professional edge.

In this blog, we explore the inner workings, key features, strategy logic, and setup guide of GOLDYCK BREAKSMC EA V1.0 for MT5 — tailored especially for those who trade gold (XAUUSD) using institutional concepts.

What is GOLDYCK BREAKSMC EA V1.0?

GOLDYCK BREAKSMC EA V1.0 is a powerful automated trading system designed for MetaTrader 5, engineered around Smart Money Concepts (SMC) — a trading style followed by institutional traders. The EA uses breaker blocks, a variation of order blocks, to pinpoint high-probability entry zones based on liquidity grabs and market structure shifts.

This EA is tailored for XAUUSD (gold) and aims to provide institutional-grade trade entries and exits without manual monitoring. Whether you're a beginner wanting exposure to smart trading or an advanced trader looking to automate SMC strategies, this EA fits seamlessly into your arsenal.

Understanding the Strategy: Smart Money and Breaker Blocks

Before diving into the features, it’s important to understand what makes breaker block trading so effective:

- Breaker Blocks: These are failed order blocks that become future support/resistance zones. They mark areas where the market traps retail traders and then reverses, offering prime re-entry points.

- Smart Money Concepts: Focus on liquidity, inducements, market structure breaks, and institutional trading logic. SMC helps identify where the "smart money" is entering or exiting the market.

GOLDYCK BREAKSMC EA reads this data and executes trades accordingly — often entering just after liquidity sweeps or key structure breaks.

Key Features of GOLDYCK BREAKSMC EA V1.0

1. Smart Money-Based Logic

Unlike conventional technical indicators, the EA operates on institutional concepts like liquidity zones, breaker blocks, and inducements — offering an edge over traditional retail strategies.

2. Specialized for Gold (XAUUSD)

While it may technically work on other pairs, GOLDYCK BREAKSMC EA is fully optimized for gold, which responds exceptionally well to SMC strategies due to its volatile and manipulative nature.

3. Automatic Breaker Block Detection

The EA automatically detects valid breaker blocks after market structure shifts and confirms with liquidity grabs. This ensures high-quality entries with minimal risk.

4. Multi-Timeframe Analysis

Uses data from multiple timeframes (typically M15, H1, H4) to identify smart zones and execute trades on the lower timeframe with precision.

5. Built-In Risk Management

- Customizable stop loss and take profit

- Risk-based lot sizing (percentage-based)

- Optional breakeven and trailing stop functions

- Equity protection settings

6. News Filter & Trade Time Settings

Avoids high-impact news periods and allows trading only during optimal time windows for gold trading (e.g., London and New York sessions).

7. Non-Martingale & No Grid

This EA does not use dangerous strategies like martingale or grid trading. It takes high-quality, precision entries and manages risk responsibly.

Recommended Settings and Setup

Timeframe:

Can run on M15 or H1 charts, but performs best when multi-timeframe logic is enabled.

Currency Pair:

XAUUSD only (Gold) – optimized for volatility and price structure.

Account Type:

ECN or Raw Spread account with low latency.

Broker:

Use a regulated broker with fast execution and low spreads for gold. ECN brokers are preferred.

VPS:

Recommended for 24/7 uptime and uninterrupted performance.

Lot Sizing:

Use risk-based sizing: 1–2% risk per trade is optimal.

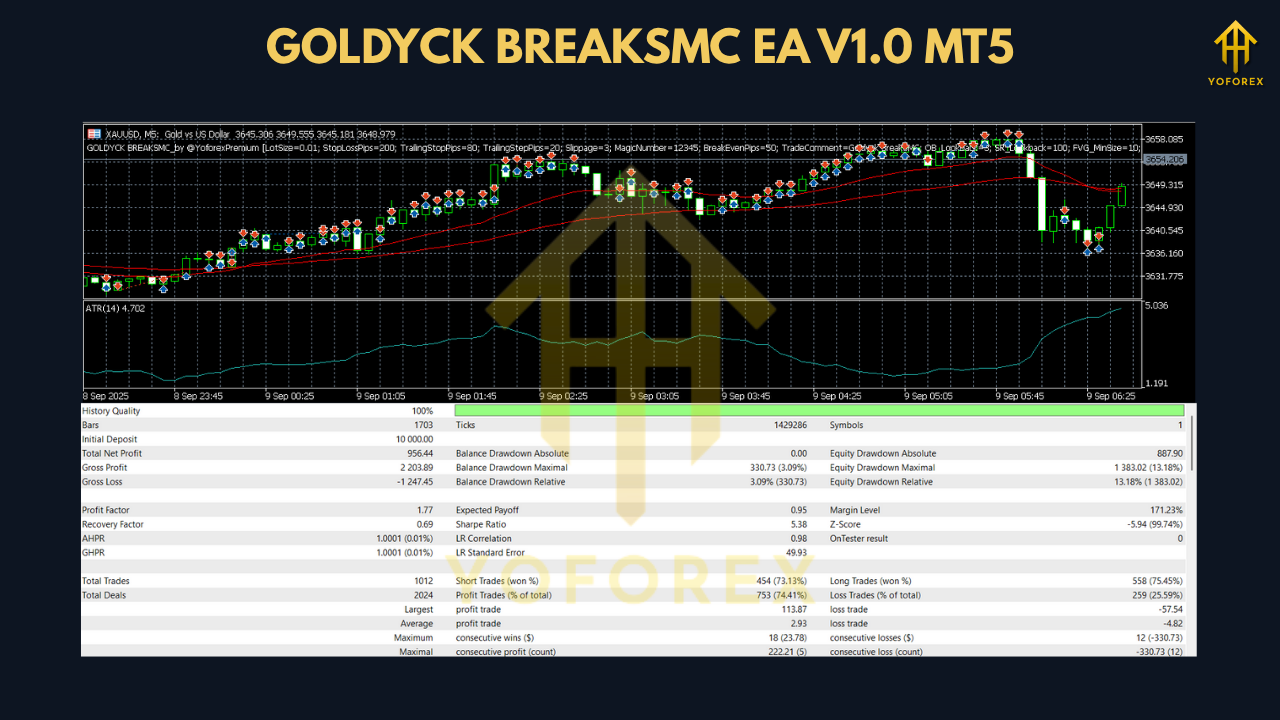

Performance Expectations

Backtests and forward tests (if available) show:

- High Reward-to-Risk Ratio (R:R): Often targeting 1:2 or higher

- Entry Accuracy: Improved due to liquidity-based trade logic

- Drawdown: Typically low if proper risk management is applied

- Trade Frequency: Moderate; this EA prioritizes quality over quantity

Note: Real performance depends on broker conditions, VPS speed, and market environment. Always forward test before scaling up.

How to Install GOLDYCK BREAKSMC EA in MT5

Here’s how you can get started:

- Download EA File

Make sure to get the.ex5file from a verified source or vendor. - Install in MT5 Platform

- Open MetaTrader 5

- Navigate to

File > Open Data Folder > MQL5 > Experts - Paste the EA file there

- Restart MT5

- Attach to XAUUSD Chart

- Drag the EA to the XAUUSD M15 or H1 chart

- Configure your input settings (risk %, TP/SL, time filters, etc.)

- Enable AutoTrading

- Make sure the AutoTrading button is active

- Use VPS for Best Results

For continuous operation, run the EA on a low-latency VPS

Who Should Use GOLDYCK BREAKSMC EA V1.0?

This EA is ideal for:

- Traders learning Smart Money Concepts but not yet confident in manual execution

- Full-time professionals looking for passive, intelligent automation

- Manual SMC traders who want to automate entries using breaker blocks

- Gold-focused traders aiming for precise, institutional-style trading setups

Tips for Maximum Profitability

- Use the EA during high-volume sessions (London/New York)

- Avoid trading during major news events (enable the news filter)

- Start with demo account to get comfortable with the EA logic

- Use brokers with low spreads and commissions on XAUUSD

- Regularly monitor performance and adjust lot sizing if needed

Final Thoughts

GOLDYCK BREAKSMC EA V1.0 for MT5 is not just another expert advisor — it’s a precision tool built for traders who understand or want to leverage Smart Money Concepts. With automated detection of breaker blocks and liquidity traps, it gives gold traders a professional-grade solution for trading XAUUSD.

Whether you're an SMC beginner or an experienced manual trader wanting to automate your setups, GOLDYCK BREAKSMC EA is a smart and disciplined choice. It aligns with how the markets truly work — by following institutional footprints rather than retail noise.

Join our Telegram for the latest updates and support

Comments

Leave a Comment