Gold trading is considered one of the most aggressive and opportunity-rich markets available in Forex. The XAUUSD pair moves with strong volatility, reacts instantly to global events, and offers clear directional trends when the market aligns with liquidity shifts. For this reason, many traders search for automated tools that can help them manage gold’s unpredictable behaviour. One of the latest and most refined gold-focused robots is the Guran xauusd EA V6.20 MT4. This expert advisor is designed exclusively for XAUUSD, built with a logic engine that reacts to momentum shifts, heat levels, and reversal conditions.

This detailed review explores how the EA works, what makes the 6.20 version special, and why gold traders are showing interest in this system. The objective is to help traders understand whether this EA suits their trading style and risk profile, especially for those operating on MT4.

Understanding the Concept Behind Guran xauusd EA

The Guran xauusd EA was created for one purpose: trading gold with precision. Instead of working across multiple currency pairs, indexes, or synthetics, the developer shaped the algorithm around a single instrument. This allows the EA to follow the rhythm of XAUUSD specifically, which behaves differently from traditional forex pairs.

Gold typically produces:

- Strong spikes around the US session

- Sudden liquidity sweeps

- High influence from economic news

- Layered movements with quick reversals

The EA is designed to track these behaviours through timing, heat signals, and predefined reversal logic.

What’s New in Guran xauusd EA V6.20 MT4

The 6.20 update introduces several improvements that make the EA more stable and easier to customise. These upgrades enhance the EA’s decision-making ability and offer more flexibility to traders.

1. Improved Market Heat Calculation

One of the standout enhancements is the recalibrated heat signal. When heat levels drop to zero, the EA enters an observation phase. This prevents unnecessary trades during uncertain market conditions. For fast-moving assets like gold, avoiding misfires is a significant advantage.

2. Directional Waiting Logic

The EA includes a waiting indicator and reversal indicator. When both align, the EA identifies a potential opportunity. This mechanism helps the EA prepare for an upcoming trade rather than reacting blindly.

3. Adjustable Cycle Parameter

You can modify cycle values to control how frequently the EA trades.

Lower Cycle

More trades with smaller profit targets

Best for high-volume fast strategies

Higher Cycle

Fewer trades with larger reward potential

Best for swing-oriented setups

This allows the EA to adapt to both conservative and aggressive traders.

4. Enhanced Trade Management

The 6.20 version introduces smoother trade management, including two operational modes:

Mode 0

Closes the trade immediately once the internal profit condition is reached.

Mode 1

Modifies stop-loss levels instead of instant closing, useful for securing extended movements.

5. Partial Close Function

Traders can set a percentage for partial exit. This is extremely helpful during volatile market runs when the price may not follow through fully. With a partially closed active, the EA locks in partial gains while allowing the remaining lot to move with the trend.

Why a Gold-Only EA Makes Sense

Most retail traders struggle with gold because of its unpredictable behaviour. A general EA built for forex pairs can rarely handle XAUUSD efficiently. Guran xauusd EA solves this by adopting a gold-centric logic.

Here are the primary advantages:

Specialisation

The EA is optimised solely for gold, which avoids conflicts in multi-pair algorithms.

Volatility Utilisation

Gold volatility can either destroy accounts or rapidly grow them. A specialised EA helps navigate this with controlled entries and exits.

Low Optimisation Requirements

Instead of managing numerous pairs, traders only need to optimise one symbol.

Predictive Behaviour

Gold respects reversal zones and momentum impulses more than currency pairs.

The EA uses this characteristic to identify clean setups.

Setting Up Guran xauusd EA on MT4

Traders can install the EA on MT4 within minutes. However, proper setup is essential for stable performance.

Recommended Steps

- Attach the EA to an XAUUSD chart, preferably on timeframes like M15 or H1.

- Set initial lot size based on account balance.

- Adjust cycle value depending on preferred trade frequency.

- Decide whether to use mode 0 or mode 1 for trade closures.

- Enable partial close if you prefer step-by-step profit securing.

- Keep automated trading enabled at all times.

VPS Usage

Running the EA on a VPS ensures uninterrupted trading during volatile market hours.

Gold often moves aggressively during late US sessions, and VPS stability is crucial to avoid missed trades.

Optimising the EA for Performance

To maximise the EA’s potential, traders must refine its input parameters. Here’s how to optimise safely:

Balance Your Lot Size

Small accounts should use micro lots to avoid margin pressure.

Larger accounts can gradually increase risk after reviewing performance results.

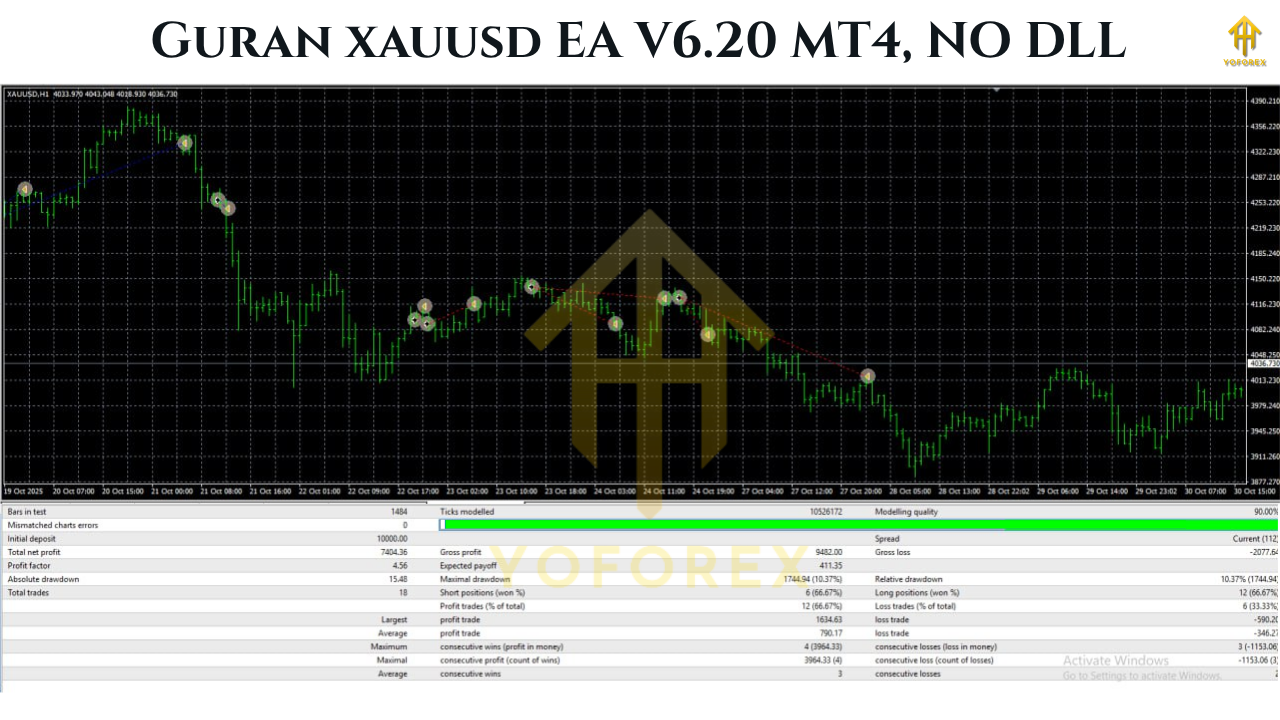

Backtesting and Forward Testing

Always run detailed backtests for:

- Win rate

- Equity curve shape

- Maximum drawdown

- Recovery time

After successful backtesting, traders should forward test on a demo before deploying live.

Avoid Using the EA During Major News

Gold reacts strongly to:

- Non-Farm Payrolls

- CPI releases

- FOMC meetings

During such news, the EA may produce unpredictable results unless cycle settings are optimised for volatility.

Advantages of Guran xauusd EA V6.20 MT4

1. Focused Algorithm

Specialising in XAUUSD gives the EA a strong edge over multi-pair robots.

2. Adjustable Trading Frequency

Using the cycle parameter, traders can scale up or down easily.

3. Intelligent Entry System

The EA prepares for trades rather than jumping into random signals.

4. Low CPU Consumption

It runs smoothly on MT4 without loading the system.

5. Good for Both Beginners and Professionals

Easy-to-understand inputs make it suitable for newer traders, while advanced modification options suit professional users.

6. Risk-Management Tools

Partial close, adjustable stop-loss modification, and entry validation help prevent unnecessary losses.

Limitations and Considerations

Single Instrument

It only trades XAUUSD.

Traders who want a multi-pair EA may find this limiting.

Spread Sensitivity

High spreads during low liquidity sessions can affect profitability.

Requires Monitoring

Automated trading doesn’t mean you can ignore your account.

Monitoring performance weekly is recommended.

Market Conditions Affect Results

Like all EAs, performance varies during ranging, trending, or news-heavy phases.

Who Should Use Guran xauusd EA V6.20 MT4?

This EA is ideal for:

- Traders who prefer gold-only strategies

- MT4 users seeking automation

- Those with medium to high trading frequency preferences

- Traders who want an adjustable strategy depth

- Users who understand risk and want structured automated assistance

It may not be suitable for traders looking for extremely low-risk, multi-pair diversification, or long-term swing-only systems.

Final Verdict

Guran xauusd EA V6.20 MT4 is a refined, powerful, and structured trading robot that suits gold traders who want dedicated automation. The EA’s blend of heat analysis, cycle-based direction recognition, partial close control, and flexible trade management makes it one of the more adaptable gold-focused models.

Its ability to synchronise with gold’s fast movements while still allowing users to personalise the strategy is exactly why traders are paying attention to this EA. Whether used by intermediate traders looking to upgrade their trading approach or experienced traders searching for consistency, Guran xauusd EA delivers a well-rounded framework.

As with all automated systems, risk management is crucial. Traders should test the EA thoroughly, use VPS hosting, and adjust parameters according to account size and volatility.

Comments

Leave a Comment