In forex trading, timing is everything—especially when it comes to spotting market reversals. One of the most respected signs of a possible reversal is the hammer candlestick. Recognising this setup in real-time, though, requires constant chart-watching, focus, and accuracy.

That’s exactly where Hammer Candle EA v2.40 for MetaTrader 5 steps in. This expert advisor is built to detect hammer-type candlesticks and automate your reversal trades without any emotional bias or overcomplication. It's not about chasing the market with risky strategies—it’s about structured, price-action-based trading with defined rules.

In this article, we’ll walk through the strategy behind the EA, how it works, key features, and who should consider using it.

What is Hammer Candle EA v2.40?

Hammer Candle EA is an MT5 Expert Advisor that’s designed to trade using one of the most classic candlestick patterns: the hammer and its inverted counterpart. These candles often show up at the end of a trend and can indicate that price is ready to reverse.

This EA doesn’t rely on any lagging indicators. Instead, it watches for specific candle formations and applies a defined set of logic to enter, manage, and exit trades. It gives traders full control over key trade parameters such as entry buffer, stop loss distance, take profit levels, and trade expiration.

What sets it apart is its clean execution—no Martingale, no grid systems, and no gambling-based logic. Just technical analysis and disciplined automation.

Understanding the Hammer Candle Strategy

A hammer candle has a small body and a long wick that sticks out in one direction. This formation occurs when price moves strongly in one direction, but by the time the candle closes, the move has been rejected.

- A bullish hammer forms at the bottom of a downtrend and may signal a move upward.

- A bearish inverted hammer shows up at the top of an uptrend and could suggest a downward shift.

These patterns can act as early warning signs that a trend is losing momentum. The EA monitors for these specific shapes and places trades when they appear at logical price zones, like local highs and lows.

Key Features of Hammer Candle EA v2.40

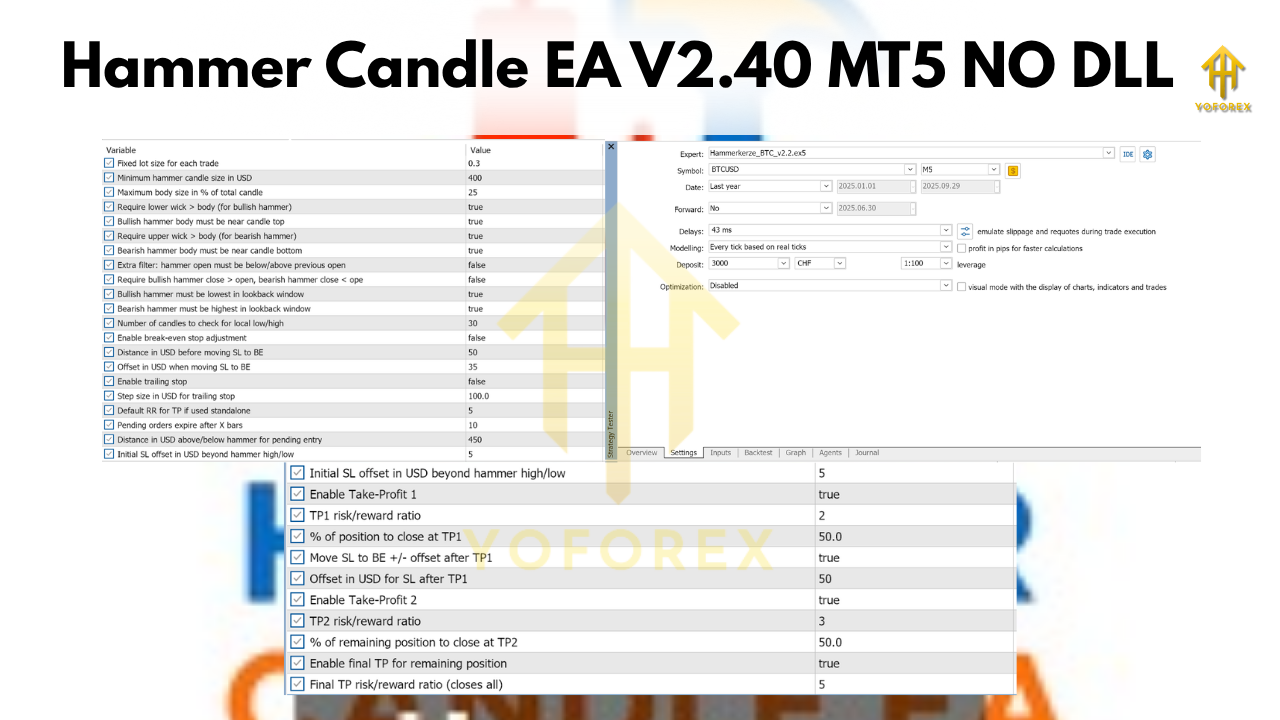

This EA goes beyond basic pattern recognition by allowing you to fine-tune exactly how hammer candles are defined and traded. Here’s a breakdown of its major capabilities:

1. Candle Structure Filters

You can set rules to determine what qualifies as a valid hammer, such as:

- Minimum size of the wick (in price units)

- Maximum allowed body size (as a percentage of total candle length)

- Body positioning at the top or bottom of the candle

- Option to filter trades based on candle direction (close above open or below)

This ensures that only strong and valid hammer patterns are used for trade decisions.

2. Entry and Order Settings

The EA allows pending orders rather than immediate market entries. You can define:

- Entry buffer above or below the candle wick

- How long the pending order remains active (measured in bars)

- Automatic cancellation of untriggered orders

This logic avoids early entries and waits for confirmation through price breakout.

3. Risk Management Tools

Controlling risk is central to the EA’s design. You can configure:

- Fixed stop loss based on price distance or account size

- Multiple take profit targets (TP1, TP2, Final TP)

- Percentage-based partial closes at each TP level

- Break-even logic to lock in profits

- Trailing stop options for trade protection

- Time-based exit if targets are not reached within a certain number of candles

With these tools, you stay in control while letting the EA manage trades based on market behavior.

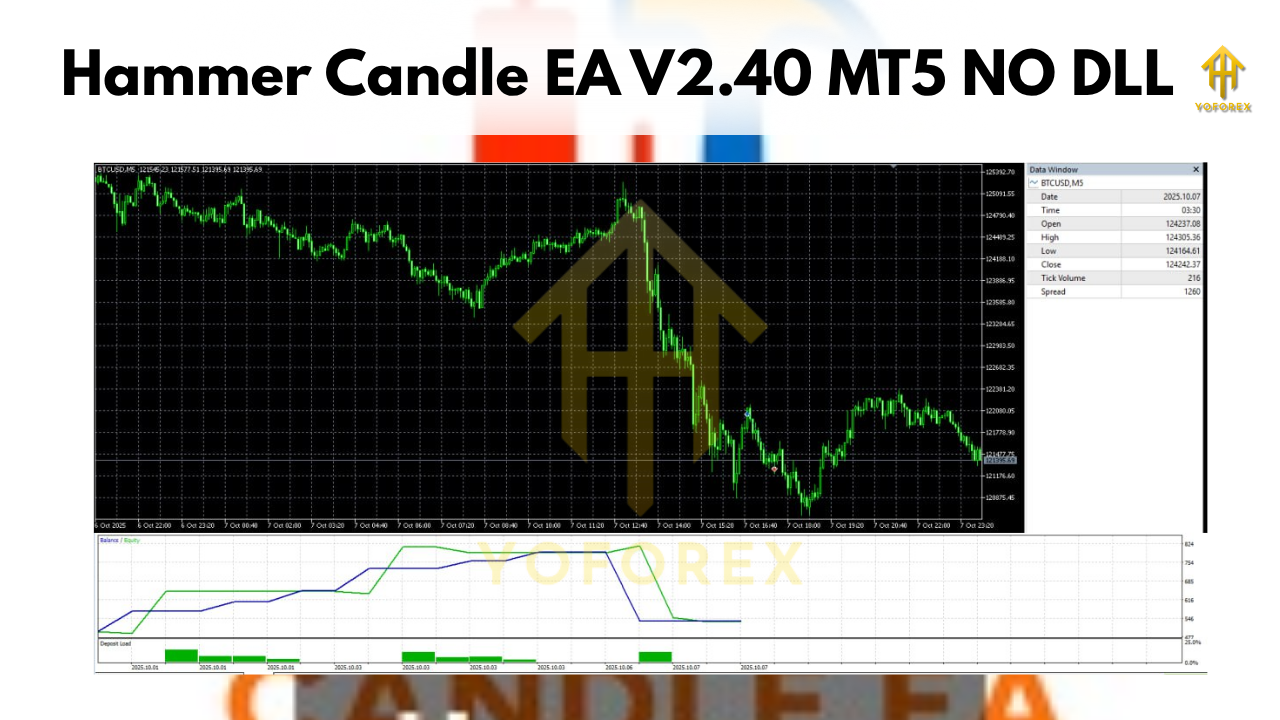

Best Timeframes and Pairs

Hammer Candle EA v2.40 is optimized for timeframes between M5 and H1, though it performs best on shorter charts where hammer formations appear more frequently. Suitable markets include:

- Forex majors like EURUSD, GBPUSD, USDJPY

- Cryptocurrency pairs such as BTCUSD and ETHUSD

- Metals like XAUUSD (with adjusted volatility filters)

The developer recommends adjusting settings for each instrument. What works on crypto may not be ideal for traditional currency pairs.

Who Should Use This EA?

Hammer Candle EA is ideal for traders who:

- Prefer price action over indicator-based systems

- Want to trade reversals with predefined rules

- Need an automated solution to handle execution and trade management

- Avoid high-risk strategies like Martingale or grid

- Are willing to optimise and test parameters per instrument

Even if you’re a beginner, the EA is user-friendly enough to set up with a little practice, and powerful enough for experienced traders who want a clean, logic-driven tool.

What Makes This EA Safe?

Unlike many EAs that chase profit with high drawdown risk, this tool avoids strategies that can blow your account. It uses:

- One trade per setup—no stacking of positions

- Fixed stop loss on every trade

- No doubling up of losing trades

- Partial profit-taking to secure gains along the way

- Break-even safety to protect capital if trades move favorably

This structure makes it suitable for traders looking for consistency and risk control, rather than explosive but unstable returns.

Limitations to Keep in Mind

While the Hammer Candle EA is built on solid logic, it’s not a magic solution. Here are a few things to remember:

- Hammer patterns aren’t always reliable; confirmation helps

- Trending markets may invalidate reversal signals

- Volatility and slippage can affect performance

- Each pair and timeframe needs its own optimization

- It's not 100% plug-and-play—you’ll need to monitor and adapt

Use it with realistic expectations, and you’ll be more likely to get consistent results.

How to Get Started

- Install the EA on your MT5 platform

- Load it onto the chart and select your desired timeframe

- Adjust the hammer candle filters according to your strategy

- Set your stop loss and take profit values

- Backtest and demo trade before going live

A good practice is to create multiple profiles for different pairs with tailored settings. This allows you to scale the strategy across markets with less risk.

Practical Tips for Traders

- Avoid running the EA during high-impact news events

- Pair it with simple confirmation tools like trendlines or support/resistance zones

- Use a VPS to keep the EA running without interruptions

- Monitor performance weekly and make small tweaks based on recent trades

- Consider using conservative lot sizing to manage risk effectively

Even though it's automated, trading with this EA should still be approached with the mindset of a professional.

Final Thoughts

Hammer Candle EA v2.40 is a well-structured Expert Advisor built for traders who value precision, risk management, and price action logic. It doesn’t promise unrealistic gains or flood your account with trades. Instead, it offers a straightforward, smart way to automate one of the most classic reversal patterns in trading.

If you’re looking for an EA that puts logic and safety first—and if you believe in the power of candle-based setups—this might be a tool worth adding to your MT5 system.

Just remember: even the best EA needs proper backtesting, careful setup, and realistic expectations. With that in place, Hammer Candle EA can be a reliable part of your trading strategy.

Comments

Leave a Comment