Hedge Guard Ultra EA V1.0 MT4 is an innovative Expert Advisor built for traders who want to balance performance and protection in automated forex trading. Instead of relying on random signal entries or aggressive martingale systems, this EA uses strategic volatility-based decision-making combined with an advanced hedging mechanism. The goal is simple — consistent growth with controlled exposure.

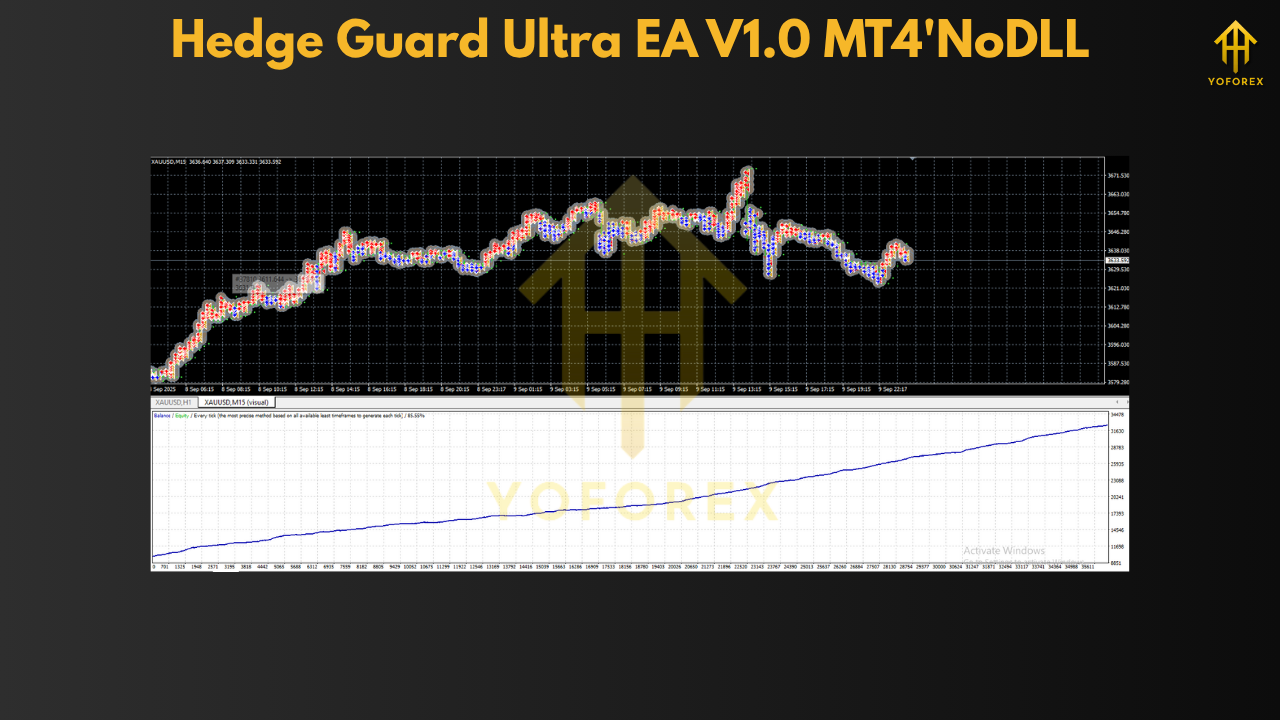

This Expert Advisor operates on the MetaTrader 4 platform and focuses on intelligent trade management. It observes market behavior, detects price patterns, and calculates volatility changes before executing trades. Whether the market is trending or ranging, Hedge Guard Ultra EA adapts its strategy to suit the environment. The system opens buy and sell positions based on market momentum and activates a hedge when price movement conflicts with the initial direction.

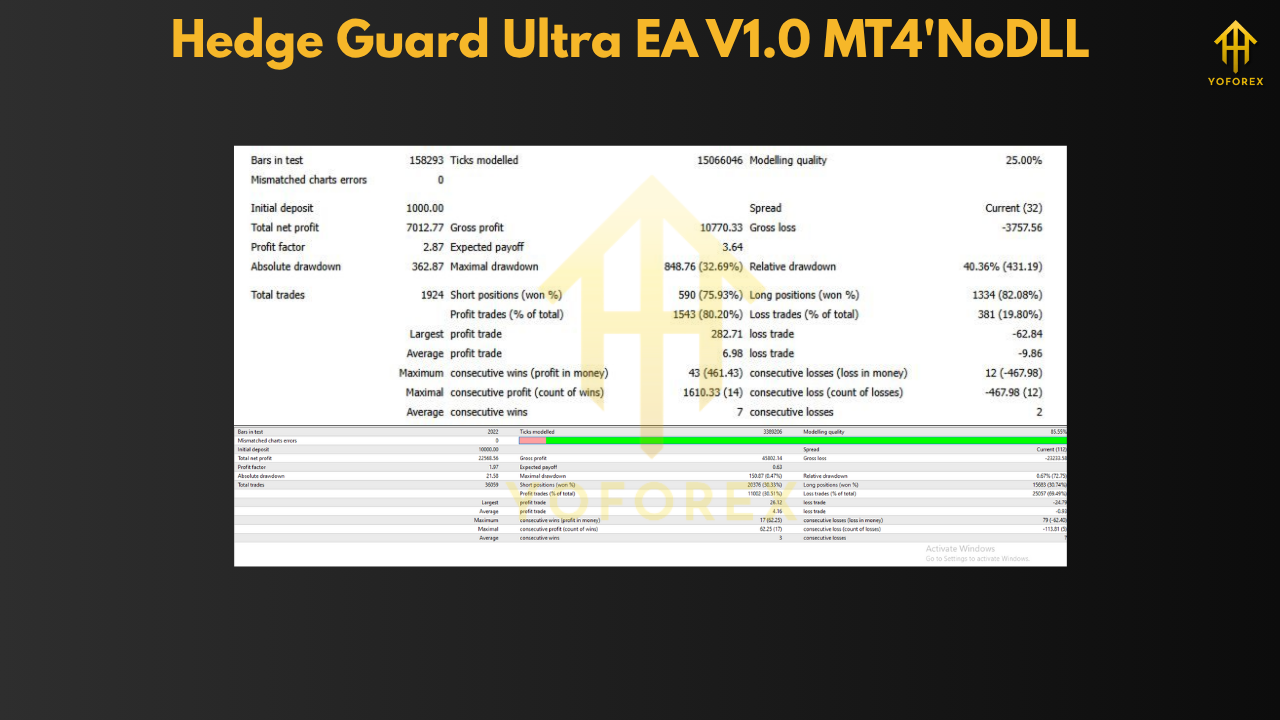

Through continuous analysis of market volatility, the EA maintains a stable risk profile and avoids unnecessary exposure. It does not chase every market signal but waits for high-probability opportunities aligned with its volatility framework. This makes it especially effective for traders looking to grow their accounts while keeping drawdowns low.

How Hedge Guard Ultra EA Works

The EA operates through a calculated process:

- Volatility Recognition: It analyses the market to determine when volatility reaches a range suitable for trading. This helps identify the ideal timing for entry and prevents random order placement.

- Strategic Entry: Trades are placed when momentum confirms a directional bias. If the market begins to move against that position, the EA prepares a controlled hedge order to offset potential losses.

- Hedging Mechanism: The system maintains a balance by opening an offsetting trade with a proportional volume. This approach helps maintain equity stability even during sudden reversals.

- Trade Management: Once equilibrium is restored or profit targets are achieved, positions are automatically closed.

This structure enables Hedge Guard Ultra EA to operate efficiently across various market conditions without requiring manual intervention.

Core Features

1. Adaptive Hedging Logic

The EA is designed with a dynamic hedging algorithm that responds to real-time price action. Instead of closing losing trades, it counters them with offsetting positions, reducing the pressure on equity while preserving growth potential.

2. ATR-Based Volatility System

By measuring volatility using the Average True Range (ATR), the system adapts its trade spacing and lot sizing. This ensures that each trade is aligned with current market strength, preventing overexposure during extreme volatility.

3. Risk Control & Lot Management

The EA automatically adjusts lot sizes according to account balance and trade conditions. Users can set custom limits to define the maximum number of open positions, ensuring safety under different market environments.

4. Multi-Pair Compatibility

Hedge Guard Ultra EA supports major and minor currency pairs, including gold (XAUUSD), EURUSD, GBPUSD, and indices like NAS100. It performs well on low timeframes (M1–M15) where volatility creates more trading opportunities.

5. Fully Automated Execution

Once configured, the EA works autonomously, continuously scanning market data to decide when to enter, hedge, or close trades. It also uses a built-in trailing stop to secure profits as the market moves favourably.

Trading Advantages

- Consistent equity growth with balanced exposure

- Protection during unexpected volatility

- Reliable execution on MetaTrader 4

- Optimised for low-drawdown performance

- Effective under both trending and sideways conditions

These benefits make it appealing for traders who prefer a technical, data-driven approach to automation.

Recommended Setup

To get the best performance, it is advised to:

- Use a hedging-enabled MT4 account

- Start with at least $100–$200 capital and 1:500 leverage

- Run it on a VPS for uninterrupted 24/7 operation

By maintaining a stable connection and constant monitoring, users can let the EA execute trades without intervention while still controlling their overall risk exposure.

Why It Stands Apart

Most EAs focus on either trend-following or grid-based logic, often ignoring the importance of volatility adaptation. Hedge Guard Ultra EA bridges that gap by incorporating volatility filters with a risk-controlled hedge strategy. This combination ensures that even during unpredictable market movements, your account remains stable and your trades stay managed.

Another distinction lies in its ability to recover during prolonged drawdowns. Many robots fail when markets reverse sharply, but this EA’s offsetting system allows it to manage floating losses efficiently and gradually restore profit levels without high-risk doubling or martingale sequences.

Performance Reliability

The reliability of Hedge Guard Ultra EA lies in its precision-coded structure and practical logic. It doesn’t overtrade, and it prioritises capital safety. Instead of relying on backtest results with perfect historical conditions, it performs well in live market scenarios where spread and slippage affect results.

Its low CPU usage also means you can run multiple pairs simultaneously on a single terminal without slowing performance. Traders with experience in algorithmic systems will appreciate how it integrates stability and adaptability without complexity.

For Whom Is This EA Suitable?

Hedge Guard Ultra EA V1.0 MT4 is ideal for:

- Beginners who want an easy-to-use, preconfigured trading robot

- Intermediate traders seeking consistent results with limited manual control

- Professionals who need a low-maintenance, hedged trading strategy for portfolio diversification

It fits both short-term traders who prefer daily action and long-term investors who seek steady performance over months of market data.

Long-Term Outlook

In the long run, Hedge Guard Ultra EA is engineered for sustainability rather than short-lived gains. It emphasises account preservation, disciplined risk management, and systematic decision-making. By avoiding random entries and using a structured trade logic, it delivers more predictable outcomes.

When combined with sound money management and proper risk allocation, it can serve as a strong foundation for any automated trading portfolio.

Comments

Leave a Comment