Prop firm trading has changed the way retail traders approach capital growth. Instead of slowly compounding small accounts, traders now attempt structured evaluation challenges where strict rules must be respected. In this environment, automation has become extremely popular, especially Expert Advisors designed specifically to target prop firm rules. One such system is HFT Pass Prop Firm EA V1.1 MT4, an automated trading solution created with the goal of passing prop firm challenges efficiently while respecting predefined drawdown limits.

This article provides a detailed, professional, and unbiased analysis of HFT Pass Prop Firm EA V1.1 MT4. The focus is on understanding how the EA works, what type of traders it is designed for, the strategy logic behind it, execution requirements, advantages, limitations, and realistic expectations. The content is written to help beginners and intermediate traders decide whether this EA fits their prop firm goals.

What Is HFT Pass Prop Firm EA V1.1 MT4

HFT Pass Prop Firm EA V1.1 MT4 is an automated trading robot developed for the MetaTrader 4 platform. The EA is positioned as a challenge-focused trading tool rather than a long-term portfolio manager. Its primary objective is to generate controlled short-term profits that align with prop firm evaluation rules, particularly profit targets, daily loss limits, and overall drawdown restrictions.

The term “HFT” in the name does not necessarily imply institutional-level high-frequency trading. Instead, it refers to fast-execution scalping logic where trades are opened and closed quickly, often during periods of heightened market volatility.

Core Trading Philosophy

The philosophy behind HFT Pass Prop Firm EA V1.1 MT4 is simple: exploit short-lived price movements while keeping risk tightly controlled. Prop firm challenges usually reward consistency and discipline more than aggressive risk-taking. This EA is designed to:

- Focus on a limited number of high-quality trade setups

- Avoid overtrading that could trigger rule violations

- Close positions quickly to reduce market exposure

- Maintain a structured risk model aligned with evaluation criteria

Instead of holding trades for hours or days, the EA aims to capture small but repeatable market inefficiencies.

Strategy Logic and Market Behavior

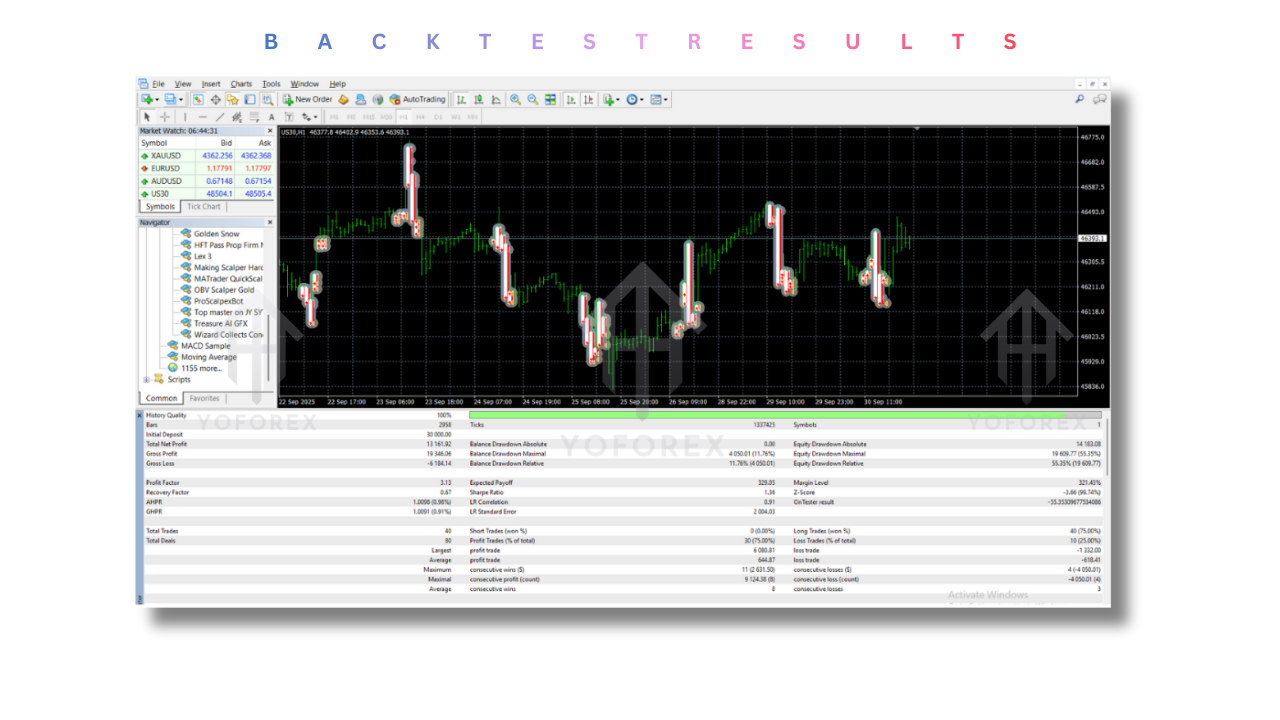

HFT Pass Prop Firm EA V1.1 MT4 is optimized for volatile market instruments, particularly indices like US30. Such instruments often experience sharp price movements during specific trading sessions, especially around session opens and liquidity transitions.

The EA analyzes price action behavior, short-term momentum shifts, and volatility expansion. Trades are executed when predefined internal conditions align, allowing the system to enter and exit the market within a short time window. This approach minimizes prolonged drawdowns and reduces exposure to unexpected macro events.

Importantly, the EA is designed to avoid random entries. Its logic emphasizes confirmation and structured execution rather than blind scalping.

Risk Management Framework

Risk management is one of the most critical components of any prop firm EA. HFT Pass Prop Firm EA V1.1 MT4 places strong emphasis on capital preservation. The EA typically operates with:

- Controlled lot sizing relative to account balance

- Limited exposure per trade

- Strict internal loss controls

- Session-based trade filtering

The system is designed to stop trading once certain internal thresholds are reached. This behavior is essential for traders attempting to comply with daily loss limits and maximum drawdown rules imposed by prop firms.

Why This EA Targets Prop Firm Challenges

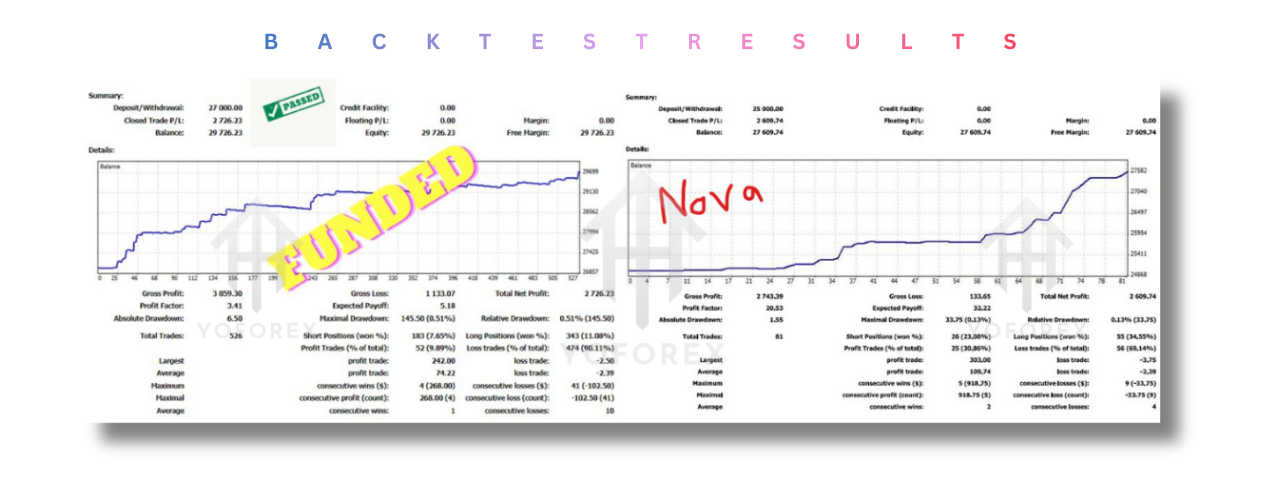

Traditional retail trading EAs are usually designed for long-term account growth. In contrast, prop firm challenge EAs like HFT Pass Prop Firm EA V1.1 MT4 are engineered for a very specific objective: passing an evaluation phase.

Prop firm challenges typically require traders to reach a fixed profit target within a certain period while respecting strict drawdown rules. This EA’s fast-exit approach and controlled exposure model make it suitable for such conditions, provided it is used correctly and under compatible rules.

Platform Compatibility and Execution Requirements

HFT Pass Prop Firm EA V1.1 MT4 runs exclusively on MetaTrader 4. Execution speed plays a crucial role in its performance. Because the EA relies on short-term price movements, latency, spreads, and slippage can significantly affect results.

For optimal operation, traders should consider:

- Low-latency VPS hosting

- Stable broker execution

- Competitive spreads and commissions

- Consistent trading conditions

Without proper execution infrastructure, even the best strategy can underperform.

Installation and Setup Overview

Installing HFT Pass Prop Firm EA V1.1 MT4 follows the standard MT4 Expert Advisor process. After installation, traders should carefully review all input parameters and ensure the EA is attached to the correct chart and timeframe recommended by the developer.

It is strongly advised to test the EA on a demo account that closely mirrors the prop firm’s trading conditions before using it in a live challenge environment. This allows traders to understand trade frequency, drawdown behavior, and overall system rhythm.

Advantages of HFT Pass Prop Firm EA V1.1 MT4

One of the key strengths of this EA is its purpose-built nature. It does not attempt to be a universal trading robot. Instead, it focuses on a narrow objective and executes it with discipline.

Key advantages include:

- Designed specifically for prop firm evaluations

- Fast trade execution with limited market exposure

- Structured risk management approach

- Reduced emotional trading influence

- Suitable for traders with limited manual trading experience

Limitations and Considerations

Despite its strengths, HFT Pass Prop Firm EA V1.1 MT4 is not a guaranteed solution. Like all automated systems, it has limitations that traders must understand.

Potential limitations include:

- Sensitivity to broker conditions

- Dependence on low latency execution

- Not suitable for all prop firm rules

- Performance may vary across market conditions

- Requires active monitoring during evaluations

Traders should also be aware that prop firms frequently update their rules, especially regarding automated and high-speed trading strategies.

Who Should Use This EA

HFT Pass Prop Firm EA V1.1 MT4 is best suited for traders who:

- Are attempting prop firm challenges

- Prefer automated execution over manual trading

- Understand the importance of rule compliance

- Can provide proper execution infrastructure

- Are willing to test and optimize responsibly

It may not be ideal for traders seeking long-term passive income or those unwilling to monitor automated systems.

Realistic Expectations

One of the most important aspects of using any trading EA is setting realistic expectations. HFT Pass Prop Firm EA V1.1 MT4 should be viewed as a structured trading tool, not a shortcut to guaranteed profits.

Market conditions change, execution varies, and no EA can eliminate risk entirely. Success with this system depends on discipline, proper setup, and alignment with the prop firm’s evaluation environment.

Best Practices for Using the EA

To improve the probability of success, traders should:

- Carefully read prop firm rules before deployment

- Avoid modifying risk parameters excessively

- Use demo testing before live challenges

- Monitor trades during high-impact sessions

- Stop trading manually if abnormal behavior is observed

These practices help reduce the chance of unexpected losses or rule violations.

Conclusion

HFT Pass Prop Firm EA V1.1 MT4 is a specialized automated trading solution designed for traders aiming to pass prop firm challenges. Its fast-execution logic, structured risk management, and focus on short-term opportunities make it a compelling option for evaluation-focused trading.

However, success with this EA depends heavily on execution quality, rule compatibility, and responsible usage. Traders who approach it with realistic expectations and disciplined risk control are more likely to benefit from its design philosophy.

Upgrade

If you are looking to streamline your prop firm evaluation process and explore structured automation, HFT Pass Prop Firm EA V1.1 MT4 can be a valuable addition when used correctly.

Comments

Leave a Comment