HORUS FX PRO EA V3.7 MT5 — Smart, Single-Shot Momentum Trading for US30, XAUUSD & Indices

Finding a reliable MT5 robot that doesn’t spam your account with dozens of risky positions can feel impossible. Too many EAs use grid/martingale tricks, blow up on news, or need constant babysitting. Horus FX PRO EA V3.7 aims to be different. It focuses on quality over quantity: reading trend strength, spotting breakout zones, and placing single, clean entries backed by tight risk control. If you’re trading US30, XAUUSD, or major indices and want a practical, disciplined execution partner, this one deserves a proper look.

Below, you’ll find a deep dive into how it works, recommended setups, risk templates, backtesting/forward-testing notes, FAQs, and best practices. No fluff. Just what you need to decide if Horus suits your style.

Overview: What Is Horus FX PRO EA V3.7 MT5?

Horus FX PRO is an automated trading system built for MetaTrader 5 (MT5). Its core idea is straightforward: detect trend direction, wait for a valid breakout confirmation, place one precise trade, and manage it with rules that protect downside and secure upside. That means fewer random entries, reduced overtrading, and a more readable equity curve.

Who it’s for

- Traders who prefer indices and gold (US30, NASDAQ, DAX, XAUUSD).

- People who dislike grids or martingale and want single-order logic.

- Those who appreciate clear risk controls and a user-friendly dashboard.

- Swing and intraday traders who are okay with selective signals; no FOMO.

Why it stands out

- Single trade per signal logic means less exposure stacking.

- Clean integration with MT5 risk parameters (fixed lot or % risk).

- Built-in tools for breakout validation, dynamic stops, and trailing.

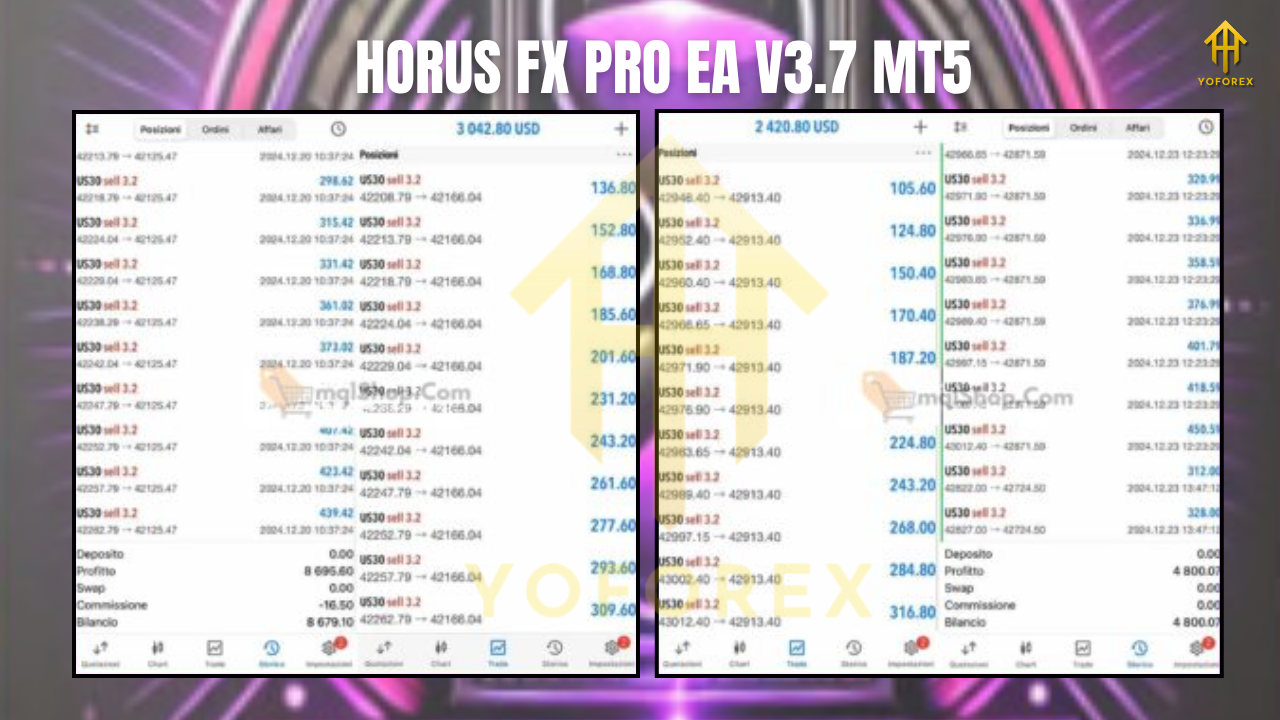

Real-world runs have shown stable growth on US30 when volatility is healthy. You’ll still face losing days (that’s markets), but the idea is structured consistency, not flashy over-leveraged wins that vanish on the next spike.

How Horus Finds & Trades Opportunities

1) Trend Detection (Context First)

Horus doesn’t just chase candles up and down. It builds a trend map using momentum filters, higher-timeframe bias, and volatility thresholds. If the market is choppy or mixed, it stands down. That “no trade” discipline can feel boring, but it’s often what preserves capital.

2) Breakout Confirmation (Precision Timing)

Once the bias is bullish or bearish, Horus looks for breakout structure—think price escaping a recent range, aligned with momentum and volume proxies. Only if multiple confirmations line up will the EA arm a single entry. No spray-and-pray.

3) Single-Order Execution (Clarity & Control)

One trade. One clear risk. That’s the design. You know exactly where your stop is, why the entry fired, and what the management plan is. Cleaner logs, easier audits, less stress.

4) Risk Management & Trade Management

- Stop-Loss (SL): Placed beyond invalidation (range low/high, structure edge).

- Take-Profit (TP): Adaptive, with optional partial profits and trail.

- Trailing: Can kick in once price reaches an “unlock” level, shifting SL to breakeven or step-trailing behind structure.

- Time Filters: Avoids illiquid sessions or known whipsaw windows if you enable them.

Key Features You’ll Actually Use

- • Single-Trade Logic: No grid. No martingale. Cleaner risk.

- • Trend + Breakout Confluence: Fewer but higher-quality setups.

- • Dynamic SL & TP: Structure-aware stops; optional ATR-style sizing.

- • Trailing Options: Breakeven shift, step trail, or structure trail.

- • Session Filters: Trade only when volatility is meaningful.

- • News Buffer (optional): Sit out minutes around major events.

- • Position Sizing: Fixed lots or balance-based risk %.

- • Pair Versatility: Tuned for US30 & XAUUSD; works on major indices.

- • Clean UI: Parameters grouped logically; quick to configure.

- • Alerts & Logs: Know exactly when/why entries happen.

- • Robust Error Handling: Auto checks to avoid duplicate orders.

- • Preset Profiles: Load conservative / moderate / aggressive templates fast.

Recommended Markets, Timeframes & Settings

These are practical, battle-tested starting points. Tweak for your broker’s spreads, execution, and your risk tolerance.

Markets

- US30 (Dow Jones) — Great for momentum breakouts and strong NY volatility.

- XAUUSD (Gold) — Loves clean trend days; be mindful around high-impact news.

- Other Indices (NAS100, DAX40) — Similar behavior; adjust volatility filters.

Timeframes

- M15 or M30 for US30 and NAS100 (balance between signals & clarity).

- M30 or H1 for XAUUSD to reduce noise and false breaks.

Risk Templates (pick one and stick to it)

- Conservative: 0.5% risk per trade, trailing only after +1R; fewer but calmer moves.

- Moderate: 1.0% risk per trade; partial take-profit at +1R, trail remainder.

- Aggressive: 1.5–2.0% risk; wider unlock level; keep this for funded-account pros who understand drawdowns.

Lot Sizing Tip

- If your broker’s index symbols use unusual contract sizes, test fixed lots on demo first. Once you’re confident, switch to % risk for consistency.

Installation & Setup (MT5)

- Install MT5 from your broker (updated build recommended).

- Copy the EA into

MQL5/Experts/(File → Open Data Folder). - Restart MT5 so it recognizes Horus.

- Open a Chart (US30 or XAUUSD), select your timeframe (M15–H1).

- Attach the EA and enable algo trading (green “Algo” button lit).

- Set Inputs:

- Choose risk mode (fixed lot vs. % risk).

- Configure session times and news buffer (if you use it).

- Pick trailing behavior and partial TP plan.

- Run on Demo for 1–2 weeks to validate fills and settings with your broker.

- Go Live only when you’re satisfied with execution and slippage.

Small but crucial: keep your VPS latency low for indices; spreads/commissions vary a lot across brokers.

Backtest & Forward-Test Notes

Backtests help you compare settings quickly, but forward results reflect your broker’s spreads, slippage, and live conditions. For a useful backtest:

- Use high-quality tick data with variable spreads.

- Test M15 on US30 across multiple years (bull, bear, and range conditions).

- Include NY session filters; indices can be sleepy outside.

- For XAUUSD, try M30/H1 with a news buffer to skip CPI/FOMC spikes if you dislike whipsaw.

What we typically see

- A smoother equity curve than multi-order systems (coz single-trade logic).

- Drawdowns tied to fakeouts and range break failures—managed by strict SLs.

- Streaks on trending weeks (especially when US30 runs). That’s where Horus shines.

Reality check

- No EA wins daily. Expect sequences of small losses during range chop.

- The edge appears over sets of trades, not a single day. Patience pays, tho.

Best Practices for Running Horus

- One symbol per chart; one EA instance per chart.

- Avoid mixing Horus with aggressive scalpers on the same symbol (signal clashes).

- If you’re new, stick to one or two markets first (US30 + XAUUSD).

- Start with Conservative risk; grade up only after 4–6 weeks of stable execution.

- Keep a trade journal: symbol, session, spread, slippage, news context.

- Update presets when volatility regime changes (summer vs. Q4, etc.).

Limitations & Risks (Read This)

- Whipsaw Hazard: Breakout systems can get tagged during fakeouts. SLs are your friend.

- News Spikes: If you disable the buffer and trade through news, expect sporadic slippage.

- Broker Differences: Contract specs and execution speed matter a lot for indices.

- Psychology: Selective EAs feel “slow.” Don’t crank risk out of boredom.

Disclaimer: Past results don’t guarantee future returns. Always test on demo first and risk capital responsibly.

Who Will Love Horus (And Who Won’t)

You’ll likely love it if…

- You want disciplined, single-shot entries on US30/XAUUSD.

- You prefer trend/momentum markets and can wait for clean setups.

- You value simple logs and transparent risk.

You might not love it if…

- You want constant action and dozens of trades daily.

- You rely on martingale recovery to feel “safe” (it’s not).

- You dislike tweaking to match your broker’s fills/spreads.

Verdict

Horus FX PRO EA V3.7 MT5 is a pragmatic, no-nonsense choice for traders who want single entries with tight risk, focused on US30, XAUUSD, and top indices. It’s not a magic wand; it’s a sensible execution engine that does less… so your results can do more. If you align it with the right sessions, keep risk sane, and let it pass on low-quality conditions, it can be that steady co-pilot many traders try to build by hand—and often fail.

Comments

Leave a Comment