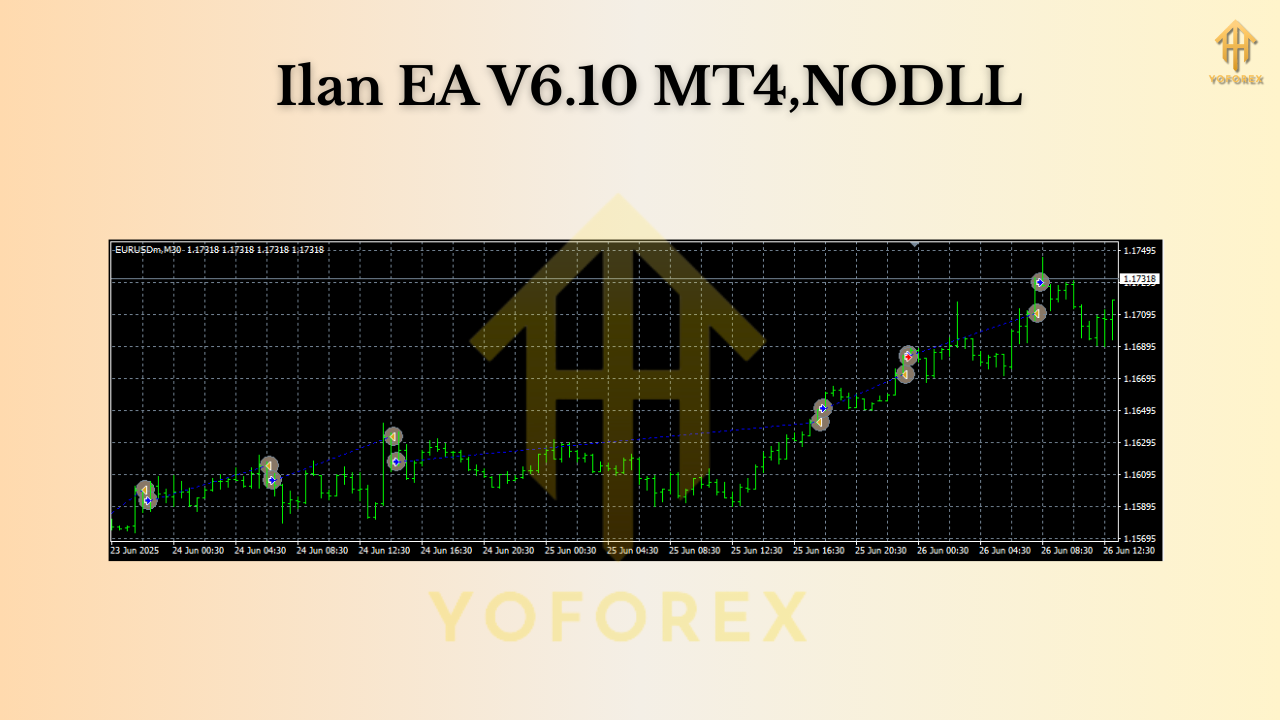

Ilan EA V6.10 MT4 – A Practical Guide for Smarter Averaging on EURUSD, EURGBP & CADCHF

If you’ve ever stared at a ranging market and thought, “there’s got to be a better way to harvest these swings,” Ilan EA V6.10 MT4 might be your new best friend. This version of the classic Ilan line focuses on controlled, rules-based exposure with flexible averaging logic—great for pairs that frequently rotate between micro-trends and consolidation. In this review-style guide, you’ll get a clear rundown of how Ilan EA V6.10 works on EURUSD, EURGBP, and CADCHF, why the M15 and H1 timeframes are chosen, what the minimum $1,000 balance means in real-world terms, and how to install it (with SetFiles included). No fluff; just actionable detail so you can test properly and trade responsibly.

What Makes Ilan EA V6.10 Different?

Ilan has a reputation for using cost-averaging and grid-style logic—but V6.10 emphasizes tighter risk parameters and adaptive entries to handle today’s faster markets. The EA watches for short-term exhaustion and retracement opportunities, scales into positions with measured steps, and aims to close baskets at realistic profit targets rather than chasing home-run moves. You’re not betting on massive trends; you’re surfing the ebb and flow.

Who it’s for:

- Traders who prefer consistent, smaller gains over moonshots.

- Those comfortable with basket management and dynamic position sizing.

- Users who can monitor risk and are happy to run an EA on a VPS for stable connectivity.

Who it’s not for:

- Anyone allergic to drawdowns—cost-averaging strategies can and do hold floating loss during adverse moves.

- Traders seeking set-and-forget with no oversight. You’ll want periodic checks (even if brief).

Strategy Snapshot (Plain English)

Ilan EA V6.10 typically looks for a mean-reversion edge. When price stretches away from a recent equilibrium, the EA opens a position (or starts a basket) targeting a snap-back. If price continues further, it can deploy incremental entries (per settings) to improve average price, then exit the basket at a pre-defined net profit. The key is configuration—your step size, lot progression, and take-profit must be aligned with volatility on the target pair and chosen timeframe.

Important: This is not a martingale free-for-all. With the provided SetFiles, exposure is moderated, step distances are sensible, and safety features can limit how far the basket extends—reducing tail risk compared to older, looser Ilan variants.

Supported Pairs & Timeframes

- EURUSD, EURGBP, CADCHF

These three pairs are chosen for their generally orderly liquidity and frequent range-bound phases (especially in quieter sessions). - M15 and H1

The M15 chart captures more signals and shorter baskets; H1 tends to be calmer, with fewer but often cleaner opportunities. If you’re new to averaging systems, start on H1 to keep noise lower.

Minimum Balance & Risk Framing

- Minimum Balance: $1,000 USD

This baseline is designed for conservative lot sizing with the included SetFiles. If you’re using more than one pair at once, consider increasing capital or reducing lots further. - Leverage & Broker

Higher leverage doesn’t mean you should max exposure—treat it as breathing room. Use a reputable, low-spread broker with stable execution. - VPS Recommended

Cost-averaging strategies benefit from continuous uptime. A VPS minimizes slippage and missed closes.

Key Features You’ll Actually Use

- SetFiles Included: Pre-tuned profiles for EURUSD, EURGBP, and CADCHF on M15/H1—plug in and forward test right away.

- Adaptive Averaging: Adds positions at configurable step distances rather than blindly doubling risk.

- Basket Take-Profit: Closes multiple positions at a net profit target, not just single trades.

- Equity Protection: Optional max spread filters, daily loss caps, and equity guards to cap downside.

- Session Filters: Focus activity on liquid trading hours to avoid spread spikes.

- News Awareness (Optional): Pause around high-impact events to dodge outsized candles.

- Lot Progression Controls: Linear or modest progression—avoid runaway multipliers.

- Magic Number Management: Cleanly separates charts/pairs for easy monitoring.

- Drawdown Smoothing: Sensible step sizes to resist over-concentration.

- Detailed Logging: Transparent trade notes for backtracking and improvement.

Setup: From Download to First Trade

Install the EA

- Copy

Ilan EA V6.10.ex4(or.mq4) into MT4 → File → Open Data Folder → MQL4 → Experts. - Restart MT4 or refresh the Navigator panel.

2. Attach to Chart

- Open EURUSD M15 (start here if you want more signals) or H1 (if you prefer calmer pacing).

- Drag the EA from Navigator → Experts onto the chart.

- Enable Algo Trading.

3. Load the SetFile

- In the EA inputs, click Load and select the appropriate SetFile (e.g.,

Ilan_V610_EURUSD_M15.set). - Double-check lot size, max orders, step distance, and TP.

4. Safety Check

- Set a daily drawdown limit (if available).

- Keep Max Orders realistic for your equity.

- Confirm spread filter is active for your broker’s typical spread.

5. Forward Test

- Start on demo or a small live account to feel the rhythm.

- Monitor the first week—note average basket duration and typical profit/float.

Pair-Specific Notes (Quick Wins)

- EURUSD:

Tight spreads, steady liquidity. The provided SetFile usually handles Asia/London overlap well. If baskets linger, widen step by ~10–15% and trim lots slightly. - EURGBP:

Often range-y but can drift during UK data. Consider enabling news pause around high-impact GBP events. H1 is very chill here. - CADCHF:

Can be slower; baskets may take longer. Patience helps. If spreads widen during rollover, use session filters to avoid late entries.

Risk Management That Actually Matters

- Reduce Lot Size When in Doubt:

A small lot keeps your head clear. You can always scale later. - Limit Concurrent Pairs:

Running all three pairs at once on $1,000 can be tight. Start with one pair, then add a second only after a calm forward-test period. - Respect News:

Averaging into a post-news trend is a quick way to stress your equity. Use the EA’s news/session protections if provided in your SetFiles. - Set a Weekly Review:

Check total pips harvested, average basket size, and the longest basket hold time. If max hold time creeps up, increase step size or lower max orders.

Backtesting vs. Forward Testing (Reality Check)

Backtests are great for parameter sanity—they show that the logic can survive multiple market regimes. But averaging systems can look stellar in the tester and still feel very different live because of spreads, slippage, and news spikes. Treat your backtest as your baseline, and let forward results (on the same SetFile) guide final tweaks. You’ll likely find that the included SetFiles are a solid starting point, but nudging step distance or TP by small increments—based on your broker’s live behavior—can improve stability.

Final Thoughts & Next Steps

Ilan EA V6.10 MT4 is a disciplined take on a classic averaging style. With the provided SetFiles, sensible lot sizing, and patience, it can steadily clip profits from mean-reverting moves on EURUSD, EURGBP, and CADCHF. The real edge isn’t magic—it’s your risk discipline. Start on demo, watch a week of baskets, and then go live only when the numbers (and your nerves) line up.

Comments

Leave a Comment