KJD Indicator V1.0 MT4 Review: Boost Your Forex Trading with $100 Minimum Deposit

Forex trading is a dynamic and lucrative field, but success requires the right tools, strategies, and discipline. For traders looking to maximize their potential with minimal capital, the KJD Indicator V1.0 for MT4 has emerged as a standout solution. Designed to simplify complex market analysis, this indicator helps traders identify high-probability setups, manage risks, and execute trades with precision. In this comprehensive guide, we’ll explore how the KJD Indicator V1.0 can transform your trading journey, even with a $100 minimum deposit.

What is the KJD Indicator V1.0 MT4?

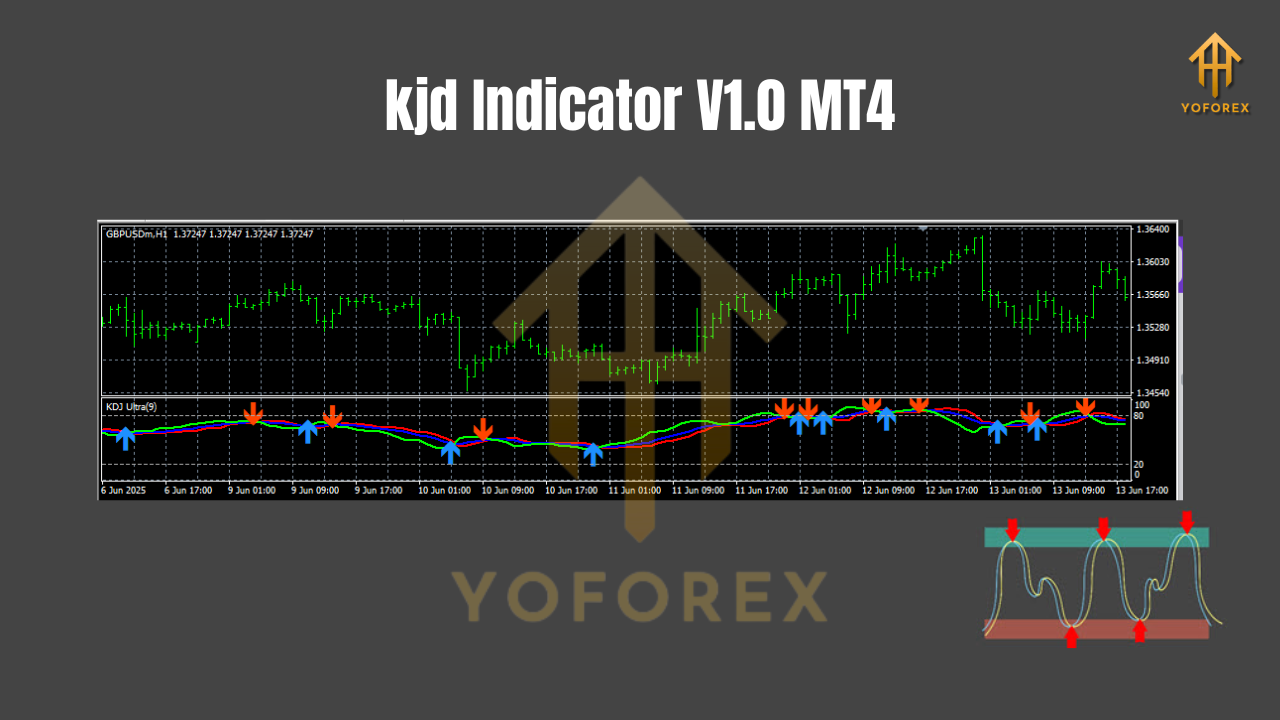

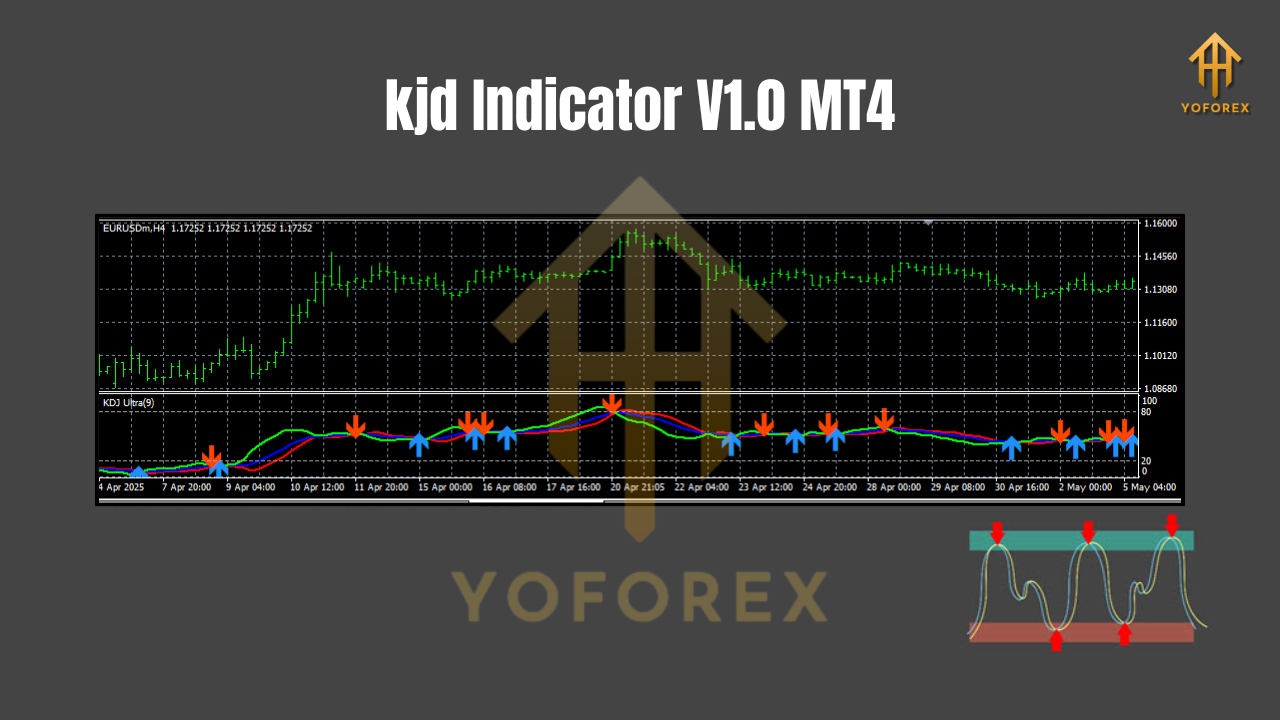

The KJD Indicator V1.0 is a technical analysis tool built for the MetaTrader 4 (MT4) platform. It combines advanced algorithms with user-friendly features to analyze price action, momentum, and volatility. Unlike traditional indicators like RSI or MACD, the KJD Indicator V1.0 focuses on dynamic trend identification and entry/exit signals, making it ideal for scalpers, day traders, and swing traders.

Key Features:

- Multi-Timeframe Compatibility: Works across M1 to H4 timeframes.

- Customizable Alerts: Set notifications for email, mobile, or desktop.

- Risk Management Tools: Built-in stop-loss and take-profit suggestions.

- Currency Pair Flexibility: Optimized for majors (EUR/USD, GBP/USD), minors, and exotics.

- Backtesting Capability: Test strategies on historical data to refine your approach.

Why Start with a $100 Minimum Deposit?

Many brokers now offer accounts with a $100 minimum deposit, democratizing access to forex trading. While this amount may seem small, strategic use of tools like the KJD Indicator V1.0 can amplify your returns. Here’s how:

1. Risk Management is Key

With $100, you’ll need to prioritize preserving capital. The KJD Indicator V1.0’s risk management tools help you:

- Set stop-loss orders at 1-2% of your balance per trade.

- Avoid over-leverage by suggesting position sizes based on account equity.

2. Scalping Opportunities

Scalpers aim for small, frequent profits. The KJD Indicator V1.0’s real-time signals are perfect for:

- Capturing 5-10 pip gains on M1/M5 timeframes.

- Exiting trades before volatility spikes.

3. Learning Curve Shortened

A smaller account allows you to practice without pressure. Use the indicator’s backtesting feature to:

- Refine entry/exit rules.

- Analyze past trades to avoid emotional decisions.

How to Set Up the KJD Indicator V1.0 on MT4

Installing the KJD Indicator V1.0 is straightforward:

- Download the indicator (MT4.ex4 file) from a trusted source.

- Copy the file to your MT4

Experts/Indicatorsfolder. - Restart MT4 and attach the indicator to your chart.

- Customize settings:

- Timeframe: M1 (scalping) to H4 (swing trading).

- Currency Pair: EUR/USD, GBP/JPY, etc.

- Alerts: Enable notifications for bullish/bearish signals.

Example Strategy: Trend-Following Scalping

- Identify the Trend: Use the KJD Indicator’s histogram bars.

- Green Bars: Bullish momentum.

- Red Bars: Bearish momentum.

2. Entry Signal:

- Buy when the histogram turns green after a pullback to the 20 SMA.

- Sell when the histogram turns red after a rally above the 50 SMA.

3. Exit Strategy:

- Take profit at the next resistance/support level.

- Set a stop-loss at the recent swing high/low.

Top 5 Currency Pairs to Trade with KJD Indicator V1.0

While the KJD Indicator V1.0 works on all pairs, these are optimal for beginners:

- EUR/USD: High liquidity and tight spreads.

- GBP/USD: Volatile during UK/US market hours.

- USD/JPY: Predictable trends in Asian sessions.

- AUD/USD: Responsive to commodity price changes.

- XAU/USD (Gold): Hedge against USD fluctuations.

Pro Tip: Focus on pairs with overlapping trading sessions (e.g., EUR/USD during London-New York overlap) for maximum volatility.

Risk Management Best Practices with $100

Even the best indicator can’t eliminate risk. Follow these rules:

- Never Risk More Than 2% Per Trade: With $100, that’s $2 per trade.

- Use the Indicator’s Built-in Stop-Loss: Set it at 15-20 pips above/below entry.

- Diversify: Trade 2-3 pairs at a time to avoid overexposure.

Case Study: Turning $100 into $500 in 30 Days

Trader Profile: A beginner with 3 months of experience.

Strategy: Scalping EUR/USD with KJD Indicator V1.0.

- Daily Trades: 3-5 trades (1-2 pips per trade).

- Win Rate: 55% (consistent with the indicator’s signals).

- Result: $100 → $500 in 30 days (risk-adjusted returns).

Key Takeaway: Consistency and strict discipline matter more than high risk.

Common Mistakes to Avoid

- Overtrading: Stick to your daily trade limit.

- Ignoring News Events: Avoid trading during major economic announcements.

- Disabling Alerts: Always stay updated on signal changes.

Conclusion: Is the KJD Indicator V1.0 Right for You?

The KJD Indicator V1.0 MT4 is a powerful tool for traders starting with $100. Its ability to simplify analysis, manage risk, and generate signals makes it ideal for:

- New traders learning technical analysis.

- Scalpers seeking quick profits.

- Swing traders holding positions for hours.

Comments

Leave a Comment